Black Swan Turns White On US Debt Default Probability

That is unless we're talking about Asia's view of the battle underway on Capitol Hill over the US deficit .

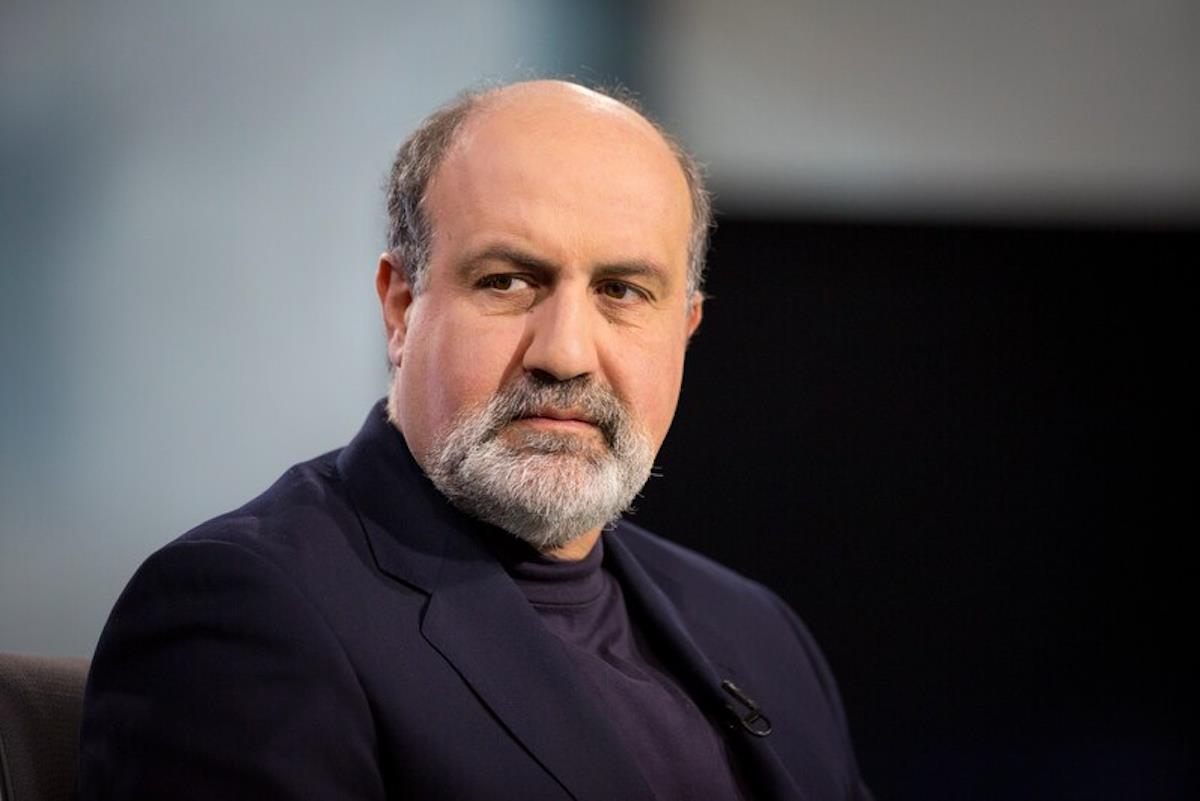

Taleb, famous for his 2007 bestseller

“The Black Swan: The Impact of the Highly Improbable”, argues this threat is hiding in plain sight. The“white swan” about which Taleb warns is a“spiral” as the US debt tops US$34 trillion and lawmakers gamble with Washington's last AAA credit rating.

In November, Moody's Investors Service warned it might yank away America's only remaining top rating . That followed three months after Fitch Ratings downgraded the US to AA+ as Republicans and Democrats brawled over funding the government.

“The risk is right in front of us,” Taleb told an investment forum last week.“If you see a fragile bridge, you know it's going to collapse at some point.” Taleb adds that“we need something to come in from the outside, or maybe some kind of miracle.”

Yet miracles seem in short supply as US fiscal priorities favor continued expansion. On Wednesday (February 7), the US Congressional Budget Office (CBO)

said the deficit will continue to climb over the next decade, ensuring that interest payments, already a record share of government spending, become an even bigger challenge for lawmakers and burden to America's bottom line.

The CBO sees deficits jumping to $2.6 trillion in 2034 from US$1.6 trillion this year. Today, the gap is 5.6% of gross domestic product (GDP); by 2025, it's seen increasing to 6.1%.“The primary deficits in the CBO's projections are especially large given the relatively low unemployment rates that the agency is forecasting,” the agency says.

Hence Taleb's concerns that the globe's biggest economy is courting a debt reckoning in ways everyone can see coming, as white not black swan.

“So long as you have Congress keep extending the debt limit and doing deals because they're afraid of the consequences of doing the right thing, that's the political structure of the political system, eventually you're going to have a debt spiral,” Taleb said.

Nassim Nicholas Taleb isn't the only one who sees a possible US debt default. Image: X Screengrab

Granted, the black swan scenario that the 2008 Lehman Brothers crisis proved to be has been invoked early and often since then. Wrongly, too.

In late 2021, many feared the fallout from China Evergrande Group's default might be a systemic shock that very few had built into their investment portfolios. Not so much. The resulting chaos remained a mostly mainland phenomenon.

In recent years, hedge fund bigwig Michael Burry, who played a central role in the film

“The Big Short”, declared it was time to sell US Treasuries. Then the market went on to boom despite tight US Federal Reserve policies.

Now, though, as US political polarization hits a fever pitch, there's little scope for a pivot toward fiscal sobriety. As US President Joe Biden runs for reelection on

November 5, his Democratic Party has zero plans for debt reduction. Ditto for Republicans loyal to ex-president and rival candidate Donald Trump.

“This makes me kind of gloomy about the entire political system in the Western world,” Taleb said.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment