(MENAFN- Frost & Sullivan)

Increasing Electric vehicles Sales Create Pressure to Fast-Track Charging Infrastructure Development across Latin America

Increasing Electric Vehicles Sales Create Pressure to Fast-Track Charging Infrastructure Development across Latin America Standardization and strategic partnerships across the ecosystem will be key even as energy companies like Raizen, Enel and Copel take the lead in building public and semi-public charging infrastructure. By Ingrid Schumann, industry Analyst – Mobility Rising battery EV (BEV) and [...]

Increasing Electric Vehicles Sales Create Pressure to Fast-Track Charging Infrastructure Development across Latin America

Standardization and strategic partnerships across the ecosystem will be key even as energy companies like Raizen, Enel and Copel take the lead in building public and semi-public charging infrastructure.

By Ingrid Schumann, Industry Analyst – Mobility

Rising battery EV (BEV) and plug-in hybrid EV (PHEV) sales, the strengthening of regulatory frameworks, decarbonization imperatives, and public and private initiatives will underpin the development of robust charging infrastructure across major Latin American countries.

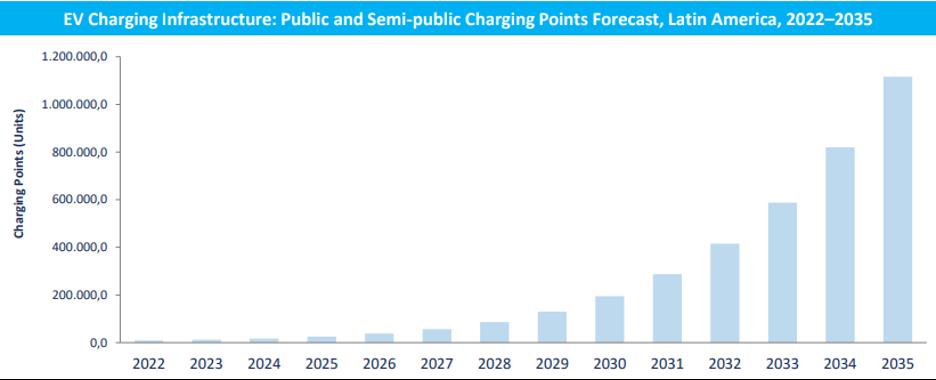

Frost & Sullivan research reveals that electric vehicle (EV) parc across Argentina, Brazil, Chile, Colombia, Ecuador, Mexico, Peru, and Uruguay is projected to collectively increase from around 89,195 units in 2022 to 9.9 million units by 2035. Over the same period, the region's public and semi-public charging points (or connectors) are set to grow from 8,486 to more than 1.1 million, clocking a CAGR of 45.5%.

With two EVs for every charging point, Argentina has the best ratio of EV parc to number of connectors, while Colombia has the most skewed ratio with 32 EVs for each charging point. Nevertheless, it is worth noting that Argentina's ratio can be attributed to its limited EV parc, whereas Colombia's ratio is due to the country's EV parc having grown faster than its charging infrastructure.

As the EV market grows, both public and private charging infrastructure will need to be rapidly developed. Public and semi-public stations will need to expand availability and improve quality. OEMs are already investing in direct current (DC) ultrafast charging that address challenges related to lengthy charging times. In parallel, the number of residential charging points will need to be increased.

To learn more, please access Latin American Electric Vehicle Charging Infrastructure Growth Opportunities and Latin American Hybrid and Electric Vehicles Growth Opportunities or contact ... for information on a private briefing.

Challenges Notwithstanding, Market is Primed for Growth

While the market holds much promise, several challenges remain. These include the lack of standardization vis a vis charging connectors, implying that an EV connector will not necessarily work across all charging points. This has been exacerbated by uneven distribution of charging points wherein some areas, particularly important urban centers, have several charging points, whereas others have either very few or none.

Limited charging points apart, EV owners also have to contend with issues like broken chargers, inactive charging points, and extended waiting times. Nascent public and semi-public charging infrastructure in the region, moreover, dampen EV sales, pushing consumers towards hybrid vehicles.

Despite such challenges, the market is primed for growth. Sensing its revenue generating potential, leading energy companies in the region such as Raizen, Copel, and Enel – many of whom already have electric mobility focused business arms – have been at the forefront of developing public and semi-public charging infrastructure. The promotion of seamless interoperability among differing charging systems, irrespective of the service provider or operator, is set to boost usage of charging points.

Concerted efforts are ongoing to fast-track the development of charging infrastructure. For example, private initiatives have resulted in the installation of large EV charging stations. This represents a virtuous cycle, spurring mutual growth in EVs and related charging infrastructure. For instance, in January 2022, Enel X Way introduced a 24/7 service station in Chile meant exclusively for EVs, with 23 chargers. In October 2022, the Mexican municipality of Hermosillo launched a charging station with 120 connectors, targeted towards electric patrols.

Currently, the region has around 21 charging providers, who compete on factors like cost, technology, and contractor relationships. Partnerships among energy providers, OEMs, and charging point manufacturers participants across the charging ecosystem are emerging as a key strategy to enhance charging network volumes, coverage, and quality. Recent examples include Enel X Way's partnerships with Uber and Petrobras in Chile, with Estapar in Brazil, and with ALD Automotive in Chile, Colombia, and Peru (this includes ALD's commercial partner AutoCorp, in Argentina and Uruguay).

Our Perspective

To begin with, automakers and charging infrastructure providers and operators should work in tandem with their respective governments to create an enabling environment for EV uptake. In parallel, they should focus on raising awareness among consumers about the long-term RoI linked to EV usage.

Partnerships between OEMs and EV charging companies should be aimed at installing chargers at dealerships for customer use in emergencies. Another strategy would be for OEMs to offer portable chargers along with EV purchases to customers for use either at home or at work. Such value-added products and services will boost market prospects, while ensuring a superior customer experience both in terms of service and ownership.

At the same time, OEMs and charging companies should deepen their partnerships to both increase sales and strengthen charging infrastructure. For instance, BMW is partnering with charging infrastructure company Evergo which offers BMW owners a certain number of kWs for free. Partnerships between automotive companies (such as OEMs and rental companies) with energy companies could also yield mutually beneficial results.

Standardization of chargers will catalyze market development. Accordingly, EV ecosystem participants should work with government regulatory authorities to establish standard connectors for AC and DC systems that work across the entire region.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility

About Ingrid Schumann

Ingrid Schumann is an experienced consultant with Frost & Sullivan's Mobility team. As an Industry Analyst, she authors research studies for leading companies from this market. With over six years in the mobility sector, her main study topics are related to electric vehicles, commercial vehicles, fleet & leasing and new mobility business models.

View all posts by Ingrid Schumann

MENAFN19012024005545012248ID1107741970

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.