(MENAFN- PR Newswire)

VANCOUVER, BC, Sept. 28, 2022 /PRNewswire/ - Copper Mountain mining Corporation (TSX: CMMC) (ASX: C6C) (the 'Company' or 'Copper Mountain') is pleased to announce an updated Mineral Reserves and Mineral Resources estimate and revised life of mine plan for its 75% owned Copper Mountain Mine, located in southern British Columbia. The new life of mine plan, based only on Mineral Reserves, supports an updated mill expansion scenario to 65,000 tpd ('65ktpd Expansion'), producing a total of 4.1 billion pounds of copper equivalent(1) over a mine life of 32 years with robust economics including an after-tax net present value ('NPV') at an 8% discount rate of $1.24 billion(1).

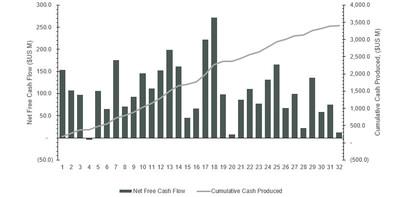

Figure 1: Projected Net Free Cash Flow (CNW Group/Copper Mountain Mining Corporation)

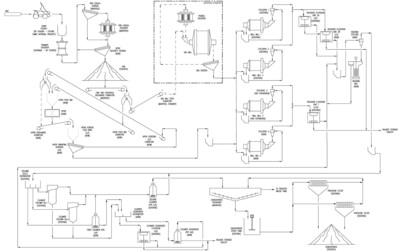

Appendix 2: Flowsheet for 65ktpd Mill Expansion (CNW Group/Copper Mountain Mining Corporation)

All metrics are on a 100% basis and all amounts are in U.S. dollars unless otherwise indicated.

Highlights: - Measured and Indicated Mineral Resources (inclusive of Mineral Reserves) estimate of 1.1 billion tonnes increased by(2):

- 70% to 5.5 billion pounds of copper at average grades of 0.22% Cu.

- 68% to 3.4 million ounces of gold at average grades of 0.09 g/t Au.

- 62% to 23.4 million ounces of silver at average grades of 0.64 g/t Ag.

- Proven and probable Mineral Reserves estimate of 702 million tonnes increased by(2):

- 57% to 3.7 billion pounds of copper at average grades of 0.24% Cu.

- 54% to 2.3 million ounces of gold at average grades of 0.10 g/t Au.

- 49% to 16.0 million ounces of silver at average grades of 0.71 g/t Ag.

- Total mine life has been extended to 32 years with the 65ktpd Expansion commencing in 2028.

- Annual average production(3) of 138 million pounds of copper equivalent (114 million pounds of copper, 54,000 ounces of gold and 367,000 ounces of silver).

- After-tax NPV (8%)(1) of $1.24 billion.

- All-in cost ('AIC')(3) of $1.76 per pound of copper, net of by-product credits.

| 1. | Based on a C$1.30 to US$1.00 exchange rate and consensus metal prices for years 1, 2, 3 and long-term, respectively, of: $3.73, $3.86, $3.94 and $3.60 per pound copper; $1,796, $1,762, $1,749 and $1,650 per ounce of gold; and $21.86, $22.30, $22.24 and $21.35 per ounce of silver. |

| 2. | Compared to the prior technical report titled 'Copper Mountain Mine 65 kt/d Expansion Study and Life-of-Mine Plan NI 43-101 Technical Report' with an effective date of September 1, 2020 and dated November 30, 2020. |

| 3. | For the first 20 years, starting in 2023. The Company reports the non-GAAP financial measure of AIC per pound of copper produced to manage and evaluate its operating performance. See 'Cautionary Note Regarding Non-GAAP Performance Measures' in this press release. |

'These results illustrate the size and scale of the Copper Mountain Mine,' stated Gil Clausen, Copper Mountain's President and CEO. 'Our large Mineral Reserves base underpins our updated 65ktpd Expansion study, which estimates total production of over 4.1 billion pounds of copper equivalent over a mine life that will extend beyond 30 years. Increasing plant capacity to 65ktpd requires only modest initial development capital, which is self funded with mine cash flow. In fact, not only is the Copper Mountain Mine able to fund capital required over the life of mine, but it is also expected to generate significant free cash flow beyond these requirements. In addition, higher-grade exploration upside remains, particularly at depth, providing further reserve expansion potential. With Mineral Reserves at the Copper Mountain Mine continuing to grow, the Company's total Mineral Reserves estimate, including at the Eva Copper Project, is now at 5.4 billion pounds of copper and over 2.6 million ounces of gold. We have two large, scalable assets in two of the best mining jurisdictions in the world.'

The Executive Summary of the NI 43-101 technical report (the '2022 Technical Report') for the new life of mine plan for the Copper Mountain Mine is available on the Copper Mountain website at . The Company will file the full 2022 Technical Report on SEDAR ( ) within the next seven days and such report will be available at that time on the Company's website.

Mining & Processing The 65ktpd Expansion includes a new primary crusher feed hopper, modifications to the primary gyratory crusher, the installation of a High-Pressure Grinding Roll (HPGR) circuit, the addition of a fourth ball mill, a regrind verti-mill, additional rougher and cleaner flotation circuit capacity, and electrical system upgrades. The existing SAG mill will be retired. The fourth ball mill, a 22 ft by 38 ft mill, will be installed adjacent to the third ball mill within the existing building. With the addition of the fourth ball mill, the ball milling line will comprise four mills operating in parallel: two identical 24 ft x 30 ft mills, and two identical 22 ft x 38 ft mills (see Appendix 2 for the proposed 65ktpd process flowsheet). This work will allow for increased throughput with a slightly coarser grind size P80 of 165 µm as compared to the current grind size of 150 µm.

The 65ktpd Expansion is a planned plant-wide improvement that increases throughput in addition to:

- Reducing operating costs using newer but proven technologies and equipment;

- Reducing energy consumption through more efficient grinding unit operations; and

- Improving flotation performance with substantially more capacity at the rougher and cleaner stages.

The mine plan is based only on Proven and Probable Mineral Reserves at the Copper Mountain Mine, and indicates a 32-year life of mine, which comprises 30 years of mining and milling followed by 2 years of processing the low-grade stockpiles. The plan indicates average copper equivalent production of 138 million pounds per annum for the first 20 years starting in 2023. The increased milling rate to 65,000 tonnes per day is planned to commence in 2028. The additional mining equipment required includes one additional shovel, 21 haul trucks and one additional drill for a total of five shovels, 49 220-t haul trucks and six blasthole drills. The 65ktpd Expansion also includes Trolley Assist on the East haul road.

Significant exploration potential remains at the Copper Mountain Mine with mineralization open both laterally and at depth. Multiple historical drillholes end in copper mineralization and geophysical data suggests the copper deposit extends below the current known resource.

Total ore mined is expected to be 652 million tonnes and total waste mined is expected to be 1,356 million tonnes, with a strip ratio of 2.08:1. Using average recoveries of 87.9% for copper, 66.8% for gold and 68.2% for silver, total production is expected to be 4.1 billion pounds of copper equivalent composed of 3.4 billion pounds of copper, 1.6 million ounces of gold and 11.6 million ounces of silver. A summary of mining, processing and production metrics is provided below. A more detailed life of mine production schedule will be available in the 2022 Technical Report on SEDAR.

| Parameter(1) | Unit | Value |

| Total Ore Mined | kt | 652,015 |

| Total Waste | kt | 1,356,381 |

| Strip Ratio | w:o | 2.08 |

| Processing Rate (after year 2028) | t/d | 65,000 |

| Total Copper Equivalent Produced | Mlb | 4,116 |

| Total Copper Produced | Mlb | 3,402 |

| Total Gold Produced | koz | 1,557 |

| Total Silver Produced | koz | 11,629 |

| Average Annual Copper Equivalent(2) | Mlb | 138.4 |

| Average Annual Copper Produced(2) | Mlb | 113.6 |

| Average Annual Gold Produced(2) | koz | 54.0 |

| Average Annual Silver Produced(2) | koz | 367.0 |

| Average Cu Head Grade | % | 0.25 % |

| Average Au Head Grade | g/t | 0.10 |

| Average Ag Head Grade | g/t | 0.8 |

| Cu Recoveries | % | 87.9 |

| Au Recoveries | % | 66.8 |

| Ag Recoveries | % | 68.2 |

| Mine Life (including stockpile years) | years | 32 |

| (1) | All parameters do not include 2022. |

| (2) | For years 1-20, starting in 2023. |

Capital Costs The initial capital cost required to increase throughput to 65,000 tonnes per day is estimated to be approximately $237 million. This includes the installation of the HPGR circuit, buildings, fourth ball mill, regrind circuit, verti-mill, additional rougher and cleaner flotation circuits, and electrical system upgrades. Other development capital requirements estimated at $223 million subsequently required over the remaining mine life, include additional mobile mining equipment, the East haul road Trolley Assist and water management related expenditures.

Total sustaining capital for the life of mine is estimated to be $828 million. With the 65ktpd Expansion's significant increase in Mineral Reserves and mine life, an additional replacement cycle for the mining fleet has been factored into the sustaining capital estimate which contributes to most of the total estimate.

| Initial 65ktpd Expansion CAPEX Breakdown | $M |

| Direct Costs | |

| Site Water Management | $4.3 |

| Process Plant Ancilliaries | $1.9 |

| Crushing, HPGR, Ore Storage and Conveying | $67.6 |

| Grinding | $20.1 |

| Flotation and Regrind | $24.7 |

| Reagents | $0.1 |

| Buildings | $14.7 |

| Site Development & Plant Roads | $2.4 |

| New Ingerbelle Bridge | $12.9 |

| Transformers and Substations | $8.6 |

| Freight & Logistics | $3.5 |

| Direct Costs Subtotal | $160.7 |

| | |

| Indirect Costs | |

| EPCM | $14.5 |

| Project Indirects | $16.6 |

| Engineering Support for Permitting | $1.2 |

| Contingency | $43.9 |

| Indirect Costs Total | $76.2 |

| | |

| Total Initial 65ktpd Expansion CAPEX | $236.9 |

| LOM Capital Costs | $M |

| Sustaining Capital | |

| Mine (Includes Capital Leases on Fleet Replacement) | $715.5 |

| Mill & Site | $112.0 |

| Total Sustaining Capital | $827.5 |

| | |

| Other Development Capital | $222.8 |

Operating Costs AIC per pound of copper produced is a non-GAAP financial measure. See 'Cautionary Note Regarding Non-GAAP Performance Measures' in this press release.

Total LOM operating unit costs are estimated to be $10.14 per tonne milled, which includes mining cost per tonne milled of $5.75, milling cost per tonne milled of $3.87 and G&A cost per tonne milled of $0.51. Mining cost per tonne mined is estimated to be $1.70. A unit cost breakdown is provided below.

| Unit Operating Costs | $ per tonne milled |

| Mine Cost per Tonne Milled | $5.75 |

| Mill Cost per Tonne Milled | $3.87 |

| G&A Cost per Tonne Milled | $0.51 |

| Total Operating Cost per Tonne Milled | $10.14 |

| Notes: Mining costs are inclusive of costs to rehandle the existing ore stockpiles. |

The above costs result in an average AIC per pound of copper of $1.76 for the first 20 years of mine life.

Economics The after-tax NPV for the 65ktpd Expansion at the Copper Mountain Mine assuming an 8% discount rate is estimated to be $1.24 billion. The economics are calculated assuming a Canadian Dollar to U.S. Dollar exchange rate of 1.30 to 1 and long-term metal prices of $3.60 per pound copper, $1,650 per ounce of gold and $21.35 per ounce of silver. Metal price assumptions are based on consensus forecasts. A sensitivity analysis on varying copper prices was completed on the after-tax NPV (8%) and the results are summarized below.

| Copper prices | After-tax NPV (8%) |

| -10 % | $956 million |

| $3.60 | $1,245 million |

| +10 % | $1,532 million |

Mineral Reserve and Mineral Resource A summary of the Mineral Reserves and Mineral Resources estimates is provided below as of August 1, 2022. The Mineral Resources are inclusive of Mineral Reserves.

| Copper Mountain Mine Mineral Reserves Estimate (as of August 1, 2022) |

| Category | Tonnes(kt) | Cu Grade(% Cu) | Au Grade(g/t) | Ag Grade(g/t) | Cu Pounds(Mlb) | Au Ounces(koz) | Ag Ounces(koz) |

| Proven | | | | | | | |

| CM M&N Total Pit | 232,512 | 0.28 | 0.09 | 1.10 | 1,454 | 665 | 8,208 |

| New Ingerbelle Pit | 183,003 | 0.23 | 0.14 | 0.41 | 928 | 824 | 2,412 |

| Subtotal Pit Only | 415,515 | 0.26 | 0.11 | 0.79 | 2,382 | 1,488 | 10,620 |

| Stockpile | 51,765 | 0.15 | 0.04 | 0.45 | 176 | 67 | 749 |

| Total Proven | 467,280 | 0.25 | 0.10 | 0.76 | 2,557 | 1,555 | 11,369 |

| Probable | | | | | | | |

| CM M&N Total Pit | 155,011 | 0.23 | 0.09 | 0.74 | 786 | 449 | 3,688 |

| New Ingerbelle Pit | 80,154 | 0.22 | 0.12 | 0.37 | 389 | 309 | 953 |

| Total Probable | 235,165 | 0.23 | 0.10 | 0.61 | 1,175 | 758 | 4,641 |

| Proven + Probable | | | | | | | |

| CM M&N Total Pit | 387,522 | 0.26 | 0.09 | 0.95 | 2,240 | 1,113 | 11,895 |

| New Ingerbelle Pit | 263,157 | 0.23 | 0.13 | 0.40 | 1,317 | 1,133 | 3,366 |

| Subtotal Pit Only | 650,679 | 0.25 | 0.11 | 0.73 | 3,556 | 2,246 | 15,261 |

| Stockpile | 51,765 | 0.15 | 0.04 | 0.45 | 176 | 67 | 749 |

| Total | 702,444 | 0.24 | 0.10 | 0.71 | 3,732 | 2,313 | 16,010 |

| 1. | Mineral Reserves estimate was prepared in accordance with the Australian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves prepared by the Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia, as amended (the 'JORC Code') and Canadian Institute of Mining, Metallurgy and Petroleum ('CIM') Definition Standards on Mineral Reserves and Mineral Resources (the 'CIM Standards') adopted by the CIM Council on May 10, 2014. |

| 2. | Mineral Reserves estimate was generated using the August 1, 2022 mining surface. |

| 3. | Mineral Reserves estimate is reported at 0.10% and 0.13% Cu cut-off grade for New Ingerbelle and Copper Mountain Mine ('CMM') respectively. |

| 4. | Mineral Reserves estimate is reported using long-term copper, gold, and silver prices of $2.75/lb, $1,500/oz, and $18.50/oz, respectively. |

| 5. | An average CMM copper process recovery of 80%, gold process recovery of 65%, and silver process recovery of 70% is based on geo-metallurgical domains and actual plant values. |

| 6. | An average New Ingerbelle copper process recovery of 88.5%, gold process recovery of 71%, and silver process recovery of 65% is based on geo-metallurgical domains, historical recoveries, and recent testwork. |

| 7. | Average bulk density is 2.78 t/m3. |

| 8. | Stockpile tonnes and grade are based on production grade control process. |

| 9. | Totals may not add due to rounding. |

| Copper Mountain Mine Mineral Resources Estimate (as of August 1, 2022) |

| Category | Tonnes(kt) | Cu Grade(% Cu) | Au Grade (g/t) | Ag Grade (g/t) | Cu Pounds(Mlb) | Au Ounces(koz) | Ag Ounces(koz) |

| Measured | | | | | | | |

| CM M&N Total Pit | 346,989 | 0.24 | 0.08 | 0.92 | 1,862 | 877 | 10,294 |

| New Ingerbelle Pit | 198,241 | 0.24 | 0.14 | 0.41 | 1,027 | 905 | 2,588 |

| Subtotal Pit Only | 545,230 | 0.24 | 0.10 | 0.73 | 2,889 | 1.78 | 12.88 |

| Stockpile | 51,765 | 0.15 | 0.04 | 0.45 | 176 | 67 | 749 |

| Total Measured | 596,995 | 0.23 | 0.10 | 0.71 | 3,064 | 1,848 | 13,631 |

| Indicated | | | | | | | |

| CM M&N Total Pit | 369,786 | 0.19 | 0.07 | 0.65 | 1,558 | 838 | 7,759 |

| New Ingerbelle Pit | 165,210 | 0.23 | 0.13 | 0.37 | 845 | 680 | 1,987 |

| Total Indicated | 534,995 | 0.20 | 0.09 | 0.57 | 2,402 | 1,518 | 9,745 |

| Measured and Indicated | | | | | | | |

| CM M&N Total Pit | 716,775 | 0.22 | 0.07 | 0.78 | 3,420 | 1,714 | 18,053 |

| New Ingerbelle Pit | 363,451 | 0.23 | 0.14 | 0.39 | 1,872 | 1,585 | 4,574 |

| Subtotal Pit Only | 1,080,226 | 0.22 | 0.09 | 0.65 | 5,291 | 3,299 | 22,627 |

| Stockpile | 51,765 | 0.15 | 0.04 | 0.45 | 176 | 67 | 749 |

| Total Measured and Indicated | 1,131,991 | 0.22 | 0.09 | 0.64 | 5,467 | 3,366 | 23,376 |

| Inferred | | | | | | | |

| CM M&N Total Pit | 290,841 | 0.19 | 0.08 | 0.65 | 1,216 | 710 | 6,072 |

| New Ingerbelle Pit | 154,800 | 0.20 | 0.11 | 0.32 | 696 | 567 | 1,603 |

| Total Inferred | 445,641 | 0.19 | 0.09 | 0.54 | 1,912 | 1,278 | 7,674 |

| 1. | Mineral Resources estimate was prepared in accordance with the JORC Code and the CIM Standards. |

| 2. | Mineral Resources were estimated using the August 1, 2022 mining surface for the Copper Mountain Mine. |

| 3. | Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Due to the uncertainty that may be attached to Inferred Mineral Resources, it cannot be assumed that all or any part of the Inferred Mineral Resource will be upgraded to an Indicated or Measured Mineral Resource as a result of continued exploration. |

| 4. | Mineral Resources estimate is constrained by a $3.50/lb Cu pit shell. |

| 5. | Cut-off grade is based on copper grade only. |

| 6. | Mineral Resources are inclusive of Mineral Reserves. |

| 7. | Cut-off grades applied at 0.10% Cu. |

| 8. | Totals may not add due to rounding. |

Competent Persons Statement The information in this report that relates to Exploration Targets, Exploration Results, Mineral Resources or Ore Reserves is based on information compiled by Patrick Redmond, Ph.D., P.Geo. Dr. Redmond is a full-time employee of the Company and has sufficient experience which is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code. Dr. Redmond does consent to the inclusion in this news release of the matters based on their information in the form and context in which it appears.

Qualified Persons The Mineral Resources estimate for the Copper Mountain Mine was prepared by Patrick Redmond, Ph.D., P.Geo. who is the Senior Vice President, Exploration and Geoscience at Copper Mountain. Dr. Redmond serves as the qualified person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects ('NI 43-101') for the Mineral Resources estimate at the Copper Mountain Mine. Dr. Redmond consents to the inclusion of the Mineral Resources estimate in this news release and has approved the Mineral Resources information included in this news release.

Mr. Alberto Chang, P.Eng., serves as the qualified person as defined by NI 43-101 for information regarding the Copper Mountain Mine's technical information and Mineral Reserves estimate. Mr. Chang is the Vice President, Mining of Copper Mountain and has reviewed and approved the contents of this news release.

The qualified persons have verified the information disclosed herein, including the sampling, preparation, security and analytical procedures underlying such information, and are not aware of any significant risks and uncertainties that could be expected to affect the reliability or confidence in the information discussed herein.

About Copper Mountain Mining Corporation Copper Mountain's flagship asset is the 75% owned Copper Mountain Mine located in southern British Columbia near the town of Princeton. The Copper Mountain Mine currently produces approximately 90 million pounds of copper equivalent. Copper Mountain also has the development-stage Eva Copper Project in Queensland, Australia and an extensive 2,100 km2 highly prospective land package in the Mount Isa area. Copper Mountain trades on the Toronto Stock Exchange under the symbol 'CMMC' and Australian Stock Exchange under the symbol 'C6C'.

Additional information is available on the Company's web page at .

On behalf of the Board of

COPPER MOUNTAIN MINING CORPORATION 'Gil Clausen'

Gil Clausen, P.Eng.President and Chief Executive Officer

Cautionary Note Regarding Forward-Looking Statements This news release may contain 'forward looking information' within the meaning of Canadian securities legislation and 'forward-looking statements' within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, 'forward-looking statements'). These forward-looking statements are made as of the date of this news release and Copper Mountain does not intend, and does not assume any obligation, to update these forward-looking statements, whether as a result of new information, future events or otherwise, except as required under applicable securities legislation. All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements relate to future events or future performance and reflect the Company's expectations or beliefs regarding future events.

In certain circumstances, forward-looking statements can be identified, but are not limited to, statements which use terminology such as 'plans', 'expects', 'estimates', 'intends', 'anticipates', 'believes', 'forecasts', 'guidance', scheduled', 'target' or variations of such words, or statements that certain actions, events or results 'may', 'could', 'would', 'might', 'occur' or 'be achieved' or the negative of these terms or comparable terminology. In this news release, certain forward-looking statements are identified, including but not limited to: information with respect to the Company's strategy, plan or future financial or operating performance with respect to the 65ktpd Expansion life of mine plan; forecast or estimated copper production, including annual copper production, and the increase or timing thereof; projected or estimated costs, including AIC; projected, estimated or assumed prices, including the price of copper, gold and silver; exploration potential; Mineral Resources and Mineral Reserves; Mineral Resources and exploration existing beyond the currently defined Mineral Reserves; projected or estimated capital expenditures; mine life; the duration of mining operations; estimated or projected mine operating figures, including mining and processing rates, the amount of ore mined and waste removed, strip ratios, copper, gold and silver grades and copper, gold and silver recovery rates; and certain financial measures, including estimated cash flows. Forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual results, performance and opportunities to differ materially from those implied by such forward-looking statements. Factors that could cause actual results to differ materially from these forward-looking statements include the successful exploration of the Company's properties in Canada and Australia, market price, continued availability of capital and financing and general economic, market or business conditions, extreme weather events, material and labour shortages, the reliability of the historical data referenced in this press release and risks set out in Copper Mountain's public documents, including in each management discussion and analysis, filed on SEDAR at . Although Copper Mountain has attempted to identify important factors that could cause the Company's actual results, performance, achievements and opportunities to differ materially from those described in its forward-looking statements, there may be other factors that cause the Company's results, performance, achievements and opportunities not to be as anticipated, estimated or intended. While the Company believes that the information and assumptions used in preparing the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Accordingly, readers should not place undue reliance on the Company's forward-looking statements.

Cautionary Note Regarding Non-GAAP Performance Measures This news release includes certain non-GAAP performance measures that do not have a standardized meaning prescribed by International Financial Reporting Standards ('IFRS'). These measures may differ from those used and may not be comparable to such measures as reported by other issuers. The Company believes that these measures are commonly used by certain investors, in conjunction with conventional IFRS measures, to enhance their understanding of the Company's performance. These performance measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These measures have been derived from the Company's financial statements and applied on a consistent basis. The calculation and an explanation of these measures is provided in the Company's management's discussion and analysis and such measures should be read in conjunction with the Company's financial statements.

APPENDIX 1: LIFE OF MINE PRODUCTION PLAN (Excluding Stockpile Years)

| | Units | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 | 2036 | 2037 | 2038 |

| Ore mined | kt | 14,286 | 13,822 | 12,620 | 14,589 | 15,090 | 21,289 | 27,073 | 25,978 | 24,167 | 29,194 | 25,624 | 33,053 | 40,844 | 33,798 | 8,908 | 14,723 |

| Waste Mined | kt | 51,688 | 52,796 | 42,512 | 44,506 | 40,616 | 58,505 | 46,496 | 53,993 | 55,827 | 50,743 | 54,371 | 43,337 | 35,784 | 39,872 | 53,842 | 52,959 |

| Total material mined (excl. rehandle) | kt | 65,974 | 66,618 | 55,131 | 59,095 | 55,706 | 79,793 | 73,569 | 79,970 | 79,994 | 79,937 | 79,995 | 76,390 | 76,628 | 73,670 | 62,750 | 67,682 |

| Stripping ratio | w:o | 3.62 | 3.82 | 3.37 | 3.05 | 2.69 | 2.75 | 1.72 | 2.08 | 2.31 | 1.74 | 2.12 | 1.31 | 0.88 | 1.18 | 6.04 | 3.60 |

| | | | | | | | | | | | | | | | | | |

| Tonnes milled per day | TPD | 44,997 | 44,997 | 44,997 | 44,997 | 44,997 | 49,863 | 65,001 | 65,000 | 65,000 | 64,824 | 65,009 | 64,997 | 65,009 | 64,822 | 65,000 | 65,000 |

| | | | | | | | | | | | | | | | | | |

| Head Grades Milled: | | | | | | | | | | | | | | | | | |

| Copper | % | 0.35 % | 0.28 % | 0.28 % | 0.35 % | 0.44 % | 0.24 % | 0.27 % | 0.22 % | 0.23 % | 0.27 % | 0.24 % | 0.27 % | 0.30 % | 0.26 % | 0.17 % | 0.20 % |

| Gold | g/t | 0.07 | 0.08 | 0.06 | 0.07 | 0.10 | 0.15 | 0.18 | 0.12 | 0.13 | 0.16 | 0.14 | 0.15 | 0.18 | 0.15 | 0.09 | 0.07 |

| Silver | g/t | 1.53 | 1.22 | 1.07 | 1.47 | 1.91 | 0.43 | 0.51 | 0.39 | 0.41 | 0.46 | 0.43 | 0.45 | 0.48 | 0.45 | 0.34 | 0.70 |

| | | | | | | | | | | | | | | | | | |

| Recoveries: | | | | | | | | | | | | | | | | | |

| Copper | % | 88 % | 89 % | 87 % | 88 % | 89 % | 89 % | 89 % | 88 % | 88 % | 89 % | 88 % | 89 % | 89 % | 89 % | 82 % | 86 % |

| Gold | % | 65 % | 65 % | 65 % | 65 % | 65 % | 70 % | 70 % | 70 % | 70 % | 70 % | 70 % | 70 % | 70 % | 70 % | 69 % | 65 % |

| Silver | % | 70 % | 70 % | 70 % | 70 % | 70 % | 65 % | 65 % | 65 % | 65 % | 65 % | 65 % | 65 % | 65 % | 65 % | 66 % | 70 % |

| | | | | | | | | | | | | | | | | | |

| Recovered Metal: | | | | | | | | | | | | | | | | | |

| Copper | Mlb | 112 | 92 | 88 | 111 | 141 | 87 | 128 | 100 | 107 | 124 | 109 | 124 | 140 | 122 | 75 | 91 |

| Gold | Koz | 25 | 27 | 20 | 25 | 33 | 62 | 94 | 62 | 69 | 83 | 74 | 82 | 98 | 79 | 50 | 33 |

| Silver | Koz | 566 | 451 | 397 | 542 | 708 | 165 | 252 | 194 | 201 | 230 | 213 | 222 | 240 | 222 | 171 | 371 |

| | Units | 2039 | 2040 | 2041 | 2042 | 2043 | 2044 | 2045 | 2046 | 2047 | 2048 | 2049 | 2050 | 2051 | 2052 |

| Ore mined | kt | 26,372 | 25,733 | 21,986 | 765 | 16,375 | 27,146 | 28,057 | 26,980 | 20,780 | 23,239 | 24,954 | 26,031 | 28,038 | 507 |

| Waste Mined | kt | 47,003 | 47,362 | 37,887 | 28,897 | 31,244 | 41,322 | 44,712 | 47,821 | 53,640 | 52,799 | 43,493 | 31,952 | 41,883 | 28,521 |

| Total material mined (excl. rehandle) | kt | 73,374 | 73,094 | 59,873 | 29,662 | 47,618 | 68,468 | 72,769 | 74,802 | 74,420 | 76,038 | 68,447 | 57,983 | 69,920 | 29,027 |

| Stripping ratio | w:o | 1.78 | 1.84 | 1.72 | 37.79 | 1.91 | 1.52 | 1.59 | 1.77 | 2.58 | 2.27 | 1.74 | 1.23 | 1.49 | 56.28 |

| | | | | | | | | | | | | | | | |

| Tonnes milled per day | TPD | 64,993 | 64,832 | 65,008 | 65,000 | 65,000 | 64,824 | 65,002 | 65,007 | 65,000 | 64,822 | 65,000 | 65,000 | 65,012 | 64,822 |

| | | | | | | | | | | | | | | | |

| Head Grades Milled: | | | | | | | | | | | | | | | |

| Copper | % | 0.34 % | 0.40 % | 0.23 % | 0.15 % | 0.22 % | 0.25 % | 0.22 % | 0.28 % | 0.33 % | 0.20 % | 0.24 % | 0.18 % | 0.24 % | 0.15 % |

| Gold | g/t | 0.11 | 0.10 | 0.08 | 0.04 | 0.08 | 0.10 | 0.10 | 0.11 | 0.08 | 0.10 | 0.11 | 0.06 | 0.10 | 0.05 |

| Silver | g/t | 1.22 | 1.77 | 0.66 | 0.45 | 0.64 | 0.70 | 0.65 | 0.96 | 1.39 | 0.68 | 0.81 | 0.57 | 0.77 | 0.51 |

| | | | | | | | | | | | | | | | |

| Recoveries: | | | | | | | | | | | | | | | |

| Copper | % | 89 % | 89 % | 89 % | 90 % | 89 % | 89 % | 89 % | 89 % | 87 % | 89 % | 90 % | 89 % | 90 % | 82 % |

| Gold | % | 65 % | 65 % | 65 % | 65 % | 65 % | 65 % | 65 % | 65 % | 65 % | 65 % | 65 % | 65 % | 65 % | 65 % |

| Silver | % | 70 % | 70 % | 70 % | 70 % | 70 % | 70 % | 70 % | 70 % | 70 % | 70 % | 70 % | 70 % | 70 % | 70 % |

| | | | | | | | | | | | | | | | |

| Recovered Metal: | | | | | | | | | | | | | | | |

| Copper | Mlb | 157 | 185 | 107 | 73 | 102 | 117 | 102 | 130 | 151 | 95 | 112 | 84 | 111 | 67 |

| Gold | Koz | 54 | 48 | 42 | 20 | 42 | 49 | 49 | 53 | 40 | 49 | 55 | 32 | 50 | 26 |

| Silver | Koz | 654 | 945 | 354 | 242 | 343 | 372 | 347 | 513 | 740 | 365 | 432 | 303 | 412 | 271 |

SOURCE Copper Mountain Mining Corporation

MENAFN28092022003732001241ID1104938451