403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

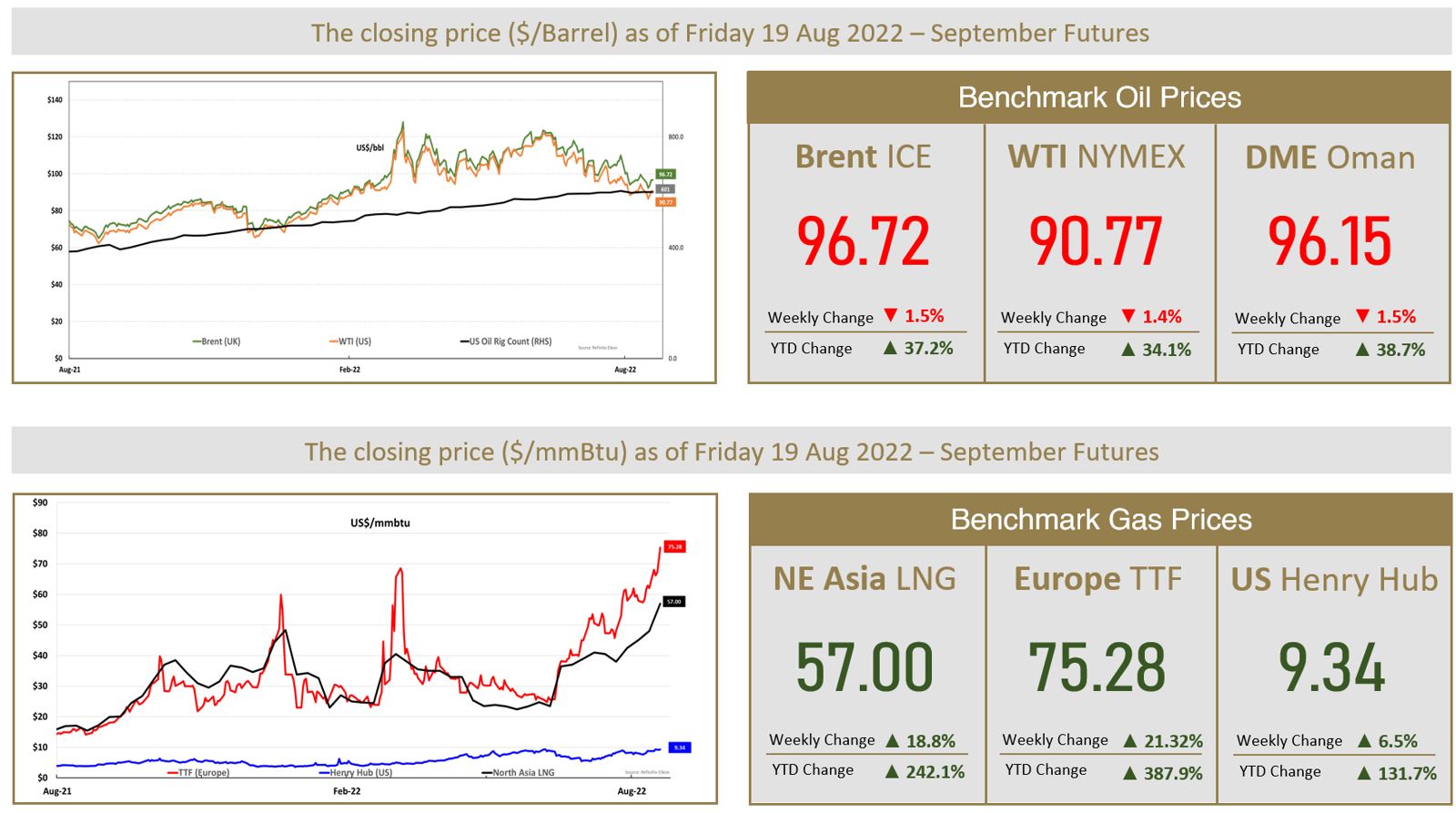

Oil Prices Down 1.5% for the Week on Recession Jitters

(MENAFN- The Al-Attiyah Foundation) Oil prices steadied on Friday but fell for the week on a stronger U.S. dollar and fears that an economic slowdown would weaken crude demand. Brent crude futures settled at $96.72 a barrel, gaining 13 cents. U.S. West Texas Intermediate crude ended 27 cents higher at $90.77. Both benchmarks fell about 1.5% on the week. Strength in the U.S. dollar hit a five-week high, which also capped crude's gains as it makes oil more expensive for buyers in other currencies. Data from the U.S. Energy Information Administration showed U.S. crude inventories fell sharply as the world's top producer exported a record 5 million barrels of oil per day last week, with oil companies finding demand from European nations looking to replace Russian crude. Meanwhile, the new secretary general of OPEC told Reuters he was optimistic about oil demand in 2023. The OPEC official also blamed lack of investment in the oil and gas sector following the price slump, sparked by COVID-19, for the group’s significantly reduced spare production capacity and ability to respond quickly to further potential supply disruption. In the United States, the number of oil rigs, an early indicator of future supply, was unchanged at 601 last week.

Asia Prices Hits Record High, Narrows Gap With Europe

Asian spot LNG prices hit a record high last week as Japanese and Korean buyers secured supply ahead of winter, narrowing the price differential with Europe. The average LNG price was estimated at $57 per mmBtu, up $9 from the previous week, industry sources said. Energy analysts said that Asian buyers in emerging economies are being priced out on the back of high prices, while in China, economic data this week showed industrial production is missing expectations, which is bearish for the country's LNG demand in the short term. In Europe, Dutch TTF hub prices rose 21.32% on Friday, closing at $75.28 per mmBtu. Meanwhile, Russia said it will halt natural gas supplies to Europe for three days at the end of the month via its main pipeline into the region. The Nord Stream pipeline had already been running at just a fifth of its capacity, stoking fears that Russia could halt flows completely heading into the winter heating season and make it more difficult to fill up storage facilities. In the U.S., natural gas futures rose about 2% to a 14-year high on Friday on record global gas prices, concerns about Russian gas exports to Europe and forecasts for hotter U.S. weather that will boost demand through early September.

By: The Al-Attiyah Foundation

Asia Prices Hits Record High, Narrows Gap With Europe

Asian spot LNG prices hit a record high last week as Japanese and Korean buyers secured supply ahead of winter, narrowing the price differential with Europe. The average LNG price was estimated at $57 per mmBtu, up $9 from the previous week, industry sources said. Energy analysts said that Asian buyers in emerging economies are being priced out on the back of high prices, while in China, economic data this week showed industrial production is missing expectations, which is bearish for the country's LNG demand in the short term. In Europe, Dutch TTF hub prices rose 21.32% on Friday, closing at $75.28 per mmBtu. Meanwhile, Russia said it will halt natural gas supplies to Europe for three days at the end of the month via its main pipeline into the region. The Nord Stream pipeline had already been running at just a fifth of its capacity, stoking fears that Russia could halt flows completely heading into the winter heating season and make it more difficult to fill up storage facilities. In the U.S., natural gas futures rose about 2% to a 14-year high on Friday on record global gas prices, concerns about Russian gas exports to Europe and forecasts for hotter U.S. weather that will boost demand through early September.

By: The Al-Attiyah Foundation

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment