(MENAFN- Asia Times)

Less than six months after the crash of a Boeing 737 passenger plane in southern China, the company is dominating the news headlines once again, this time because of the emergency landings of two planes operated by the Indian carrier SpiceJet.

The first SpiceJet incident was due to a crack in the windshield, and the second was because of a problem with the fuel indicator. No one was harmed in either case. India's Aircraft Accident Investigation Bureau (AAIB) will probe both incidents.

It is worth recalling that last August the MAX series aircraft were re-certified in India, after Boeing complied with the requirements of the local regulatory bodies, including the creation of a simulator in the country.

Considering the fact that these are not the first incidents for the company, the issue might be in“poor internal safety oversight” in SpiceJet rather than the Boeing itself. Howbeit, headwinds for the American aerospace company don't end there. In the US, for example, the company still faces a tougher regulatory climate.

The deadline to win approval for the 737 MAX 10 is this December. According to Mike Fleming, senior vice-president at Boeing Commercial Airplanes,“missing the deadline for the 737 MAX 10 could require Boeing to revamp the jet's crew-alerting system and institute separate pilot training, which would raise costs to airlines and put orders at risk.”

Boeing chief executive officer Dave Calhoun, however, believes that“the drip, drip, drip” of bad news about the company is coming to an end.

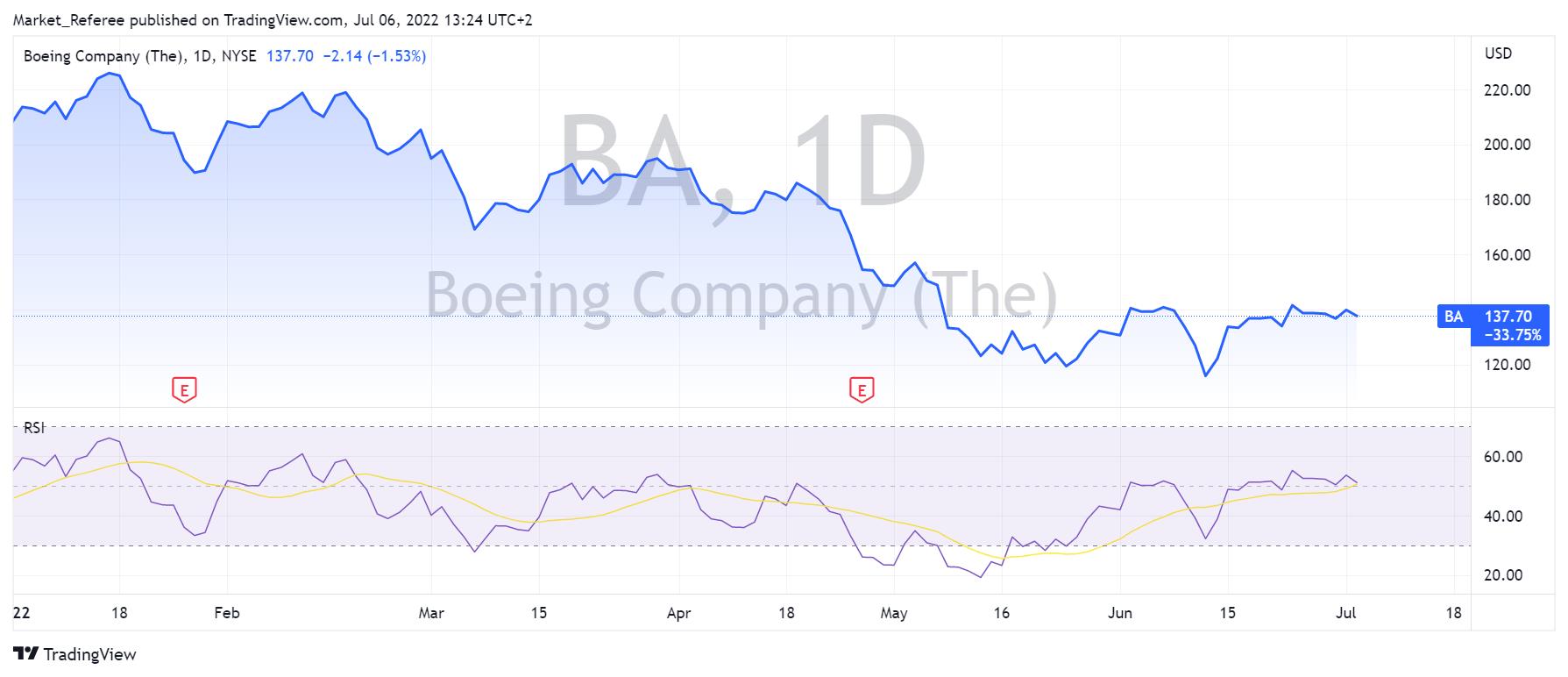

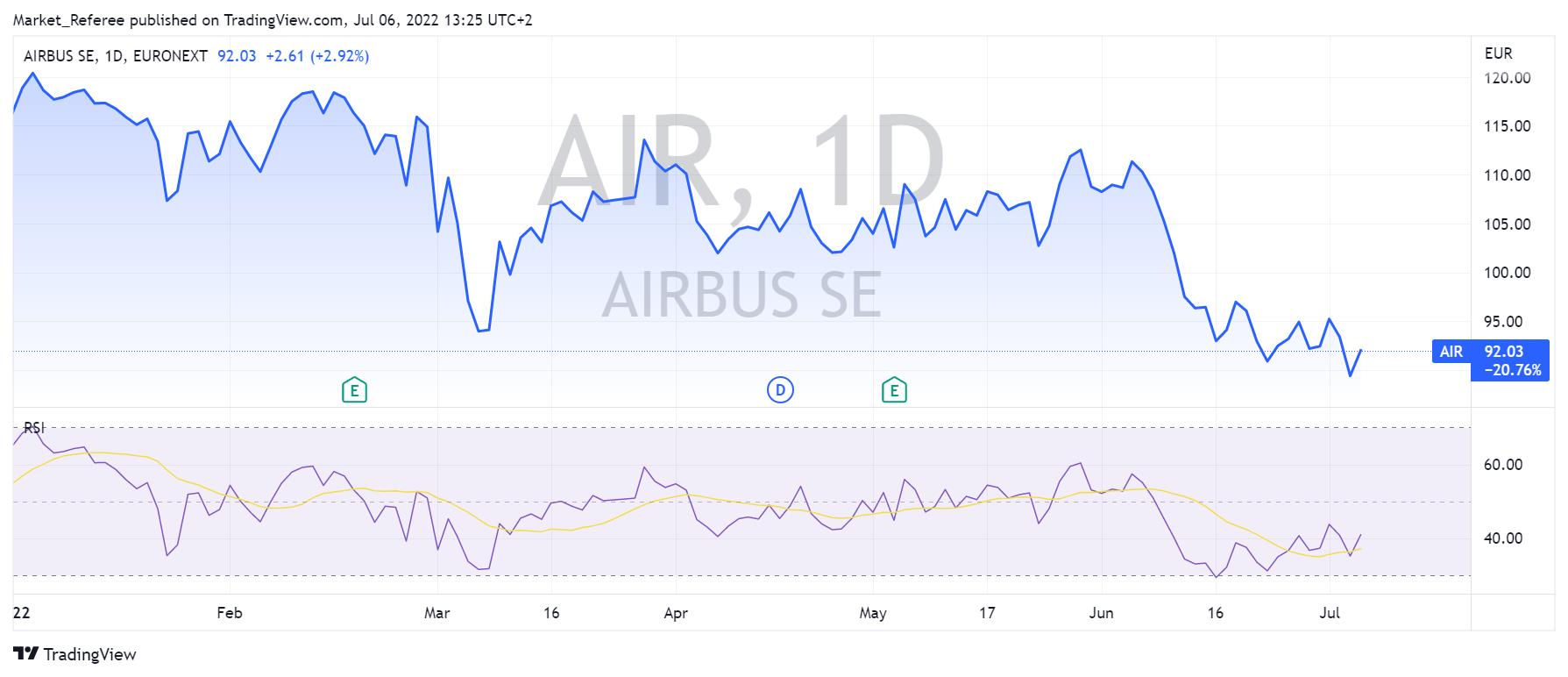

Speaking of market performance, year-to-date, shares of the Boeing Company are down 33%. For comparison, Airbus SE stocks lost around 20% in the same period. So what is it exactly that investors don't like in Boeing?

Recently, Boeing marketing executive Darren Hulst acknowledged a narrow-body sales gap with rival the French rival.

By the way, this month four Chinese airlines pledged to buy a total of almost 292 Airbus jets, worth more than US$37 billion. Most probably, this“sudden” decision was driven by geopolitical tensions with the US.

Regarding Boeing's financials, the last couple of years have been rather difficult. During the Covid-19 pandemic, the company's debt rose from less than $15 billion to more than $60 billion.

The threat of an impending recession both in Europe and the US does not add any optimism to the situation. As airline profits fall, so will demand for new planes. It will probably take many months if not years to recover.

If demand and margins for the MAX and 787 fall, it will be difficult to improve Boeing's financial position. Overall, betting on Boeing looks quite risky; nevertheless, the potential return also increases.

What about its bonds? Back in February, Fitch Ratings affirmed the“BBB-” credit rating (expectations of default risk are currently low) of Boeing. The outlook is“stable.”

The problem is that the company still has some issues to solve, including charges for production delays for modified 747-800 jumbo jets, weakened cash profitability, a shortage of engineers, geopolitical tensions (this one won't be easy), R&D constraints, lack of regular dividends, etc.

Finally, yet importantly, one should forget about competition from Airbus. The good news for Boeing is that in addition to the same uncertainty about the future of the global economy, Airbus failed to manage to resolve a bitter legal and safety dispute over the A350 passenger jet with Qatar Airways.

MENAFN08072022000159011032ID1104501038

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.