US Households Feel More Pain

Date

6/28/2022 2:24:14 PM

(MENAFN- ING) Consumer concerns intensify as recession talk grips the market

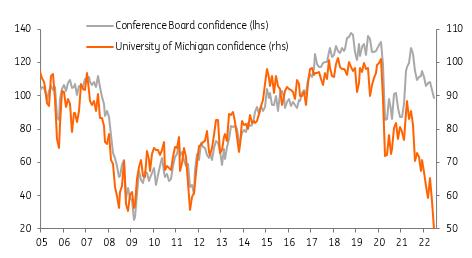

The conference board measure of consumer confidence fell more than expected in June to 98.7 from a downwardly revised 103.2 (consensus 100). The forward-looking expectations component bore the brunt, dropping from 73.7 to 66.4, taking this series to the lowest level since 2013. Respondents are becoming more pessimistic on business conditions, employment and their own income outlook. The current conditions series was little changed (147.1 versus 147.4 previously), presumably supported by the current strength of the jobs market and the positive support from wage gains.

US consumer confidence measures

Macrobond, ING

As the chart above shows the Conference Board confidence has not plunged as much as the University of Michigan sentiment index. That is because the Michigan measure seems to pick up more on the cost of living dynamics and financial positions so is perhaps more susceptible to equity market weakness and surging inflation. Traditionally, the Conference Board, is viewed as putting more emphasis on the labour market situation. Nonetheless, with both series clearly on a deteriorating trend, which won't be helped by rising interest rates as the Fed focuses on getting inflation under control, the risks are firmly centered on a weaker performance from consumer spending in the second half of the year.

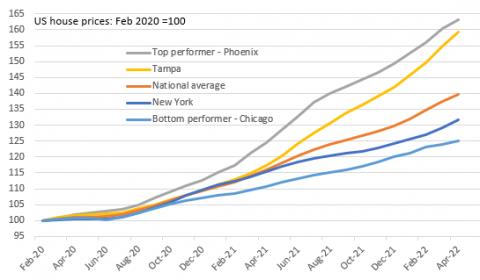

Solid house price gains continue

Rising interest rates and weak consumer confidence is not good news for the housing market even though the US Case-Shiller 20 city house price index rose 1.8%MoM/21.2%YoY in April. The strongest performers remain in the south (Tampa, Miami, Phoenix and Dallas) with the bottom performers in the North (Minneapolis, Chicago, Cleveland, New York). This means that nationally, home prices have risen 40% since the start of the pandemic as strong, stimulus fueled demand and greater options on where to live due to working from home, spurred buying activity amid a dearth of supply.

US house price levels through the pandemic

Macrobond, ING

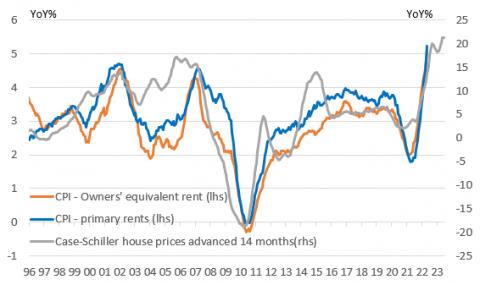

Housing boosts inflation for now, but expect a different story in 2023

The key take-away is that this series leads turning points in the primary and owners' equivalent rent series within CPI by around 14 months. The lag is due to actual rents typically only changing once a year while the survey respondents to the owners' equivalent rent series are not necessarily closely following house price changes month to month. The chart suggests that these housing CPI components will continue to keep headline and core inflation elevated for much of the rest of this year especially since housing is around 35% of the total basket of goods and services that make up CPI. It should support the 75bp case for the July FOMC meeting.

House prices and the key rent components within CPI

Macrobond, ING

However, if we are right and the surge in mortgage rates, plunge in mortgage applications and more supply coming to the housing market soon starts to take the steam out of house prices, it could be a key component that drags CPI sharply lower in the second half of 2023. With Federal Reserve rate hikes and the strong dollar set to dampen activity and if favourable supply conditions emerge surrounding energy and supply chains, 2% inflation by the end of 2023 in not inconceivable.

MENAFN28062022000222011065ID1104446952

Author:

James Knightley

*Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/about/disclaimer/

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.