(MENAFN- Asia Times)

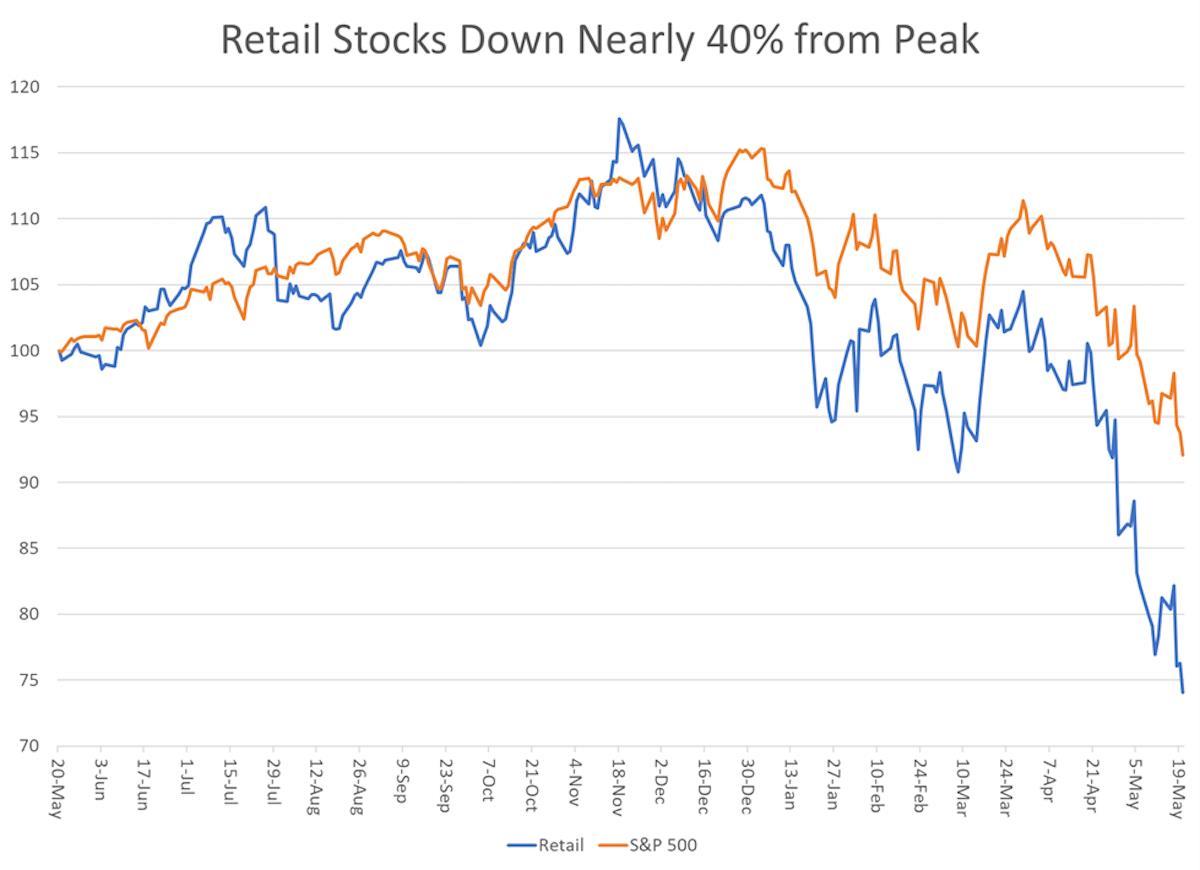

US stock prices and President Biden's approval rating continued to tank, as inflation swamped household income. Only 39% of Americans approve of Biden's performance, and just 33% of Democrats think the country is heading in the right direction. That's no surprise, given the nearly 40% collapse of retailers' stock prices this year. The S&P 500 is teetering on the edge of a bear market – that is, a peak-to-trough decline of 20% or more.

The Biden stimulus – compounding the errors of the trump Administration – amounted to a Ponzi scheme that threw $6 trillion of spending power at US consumers while at the same time constricting supply. That's like handing out 10,000 vouchers for 5,000 available hot dogs at a baseball game.

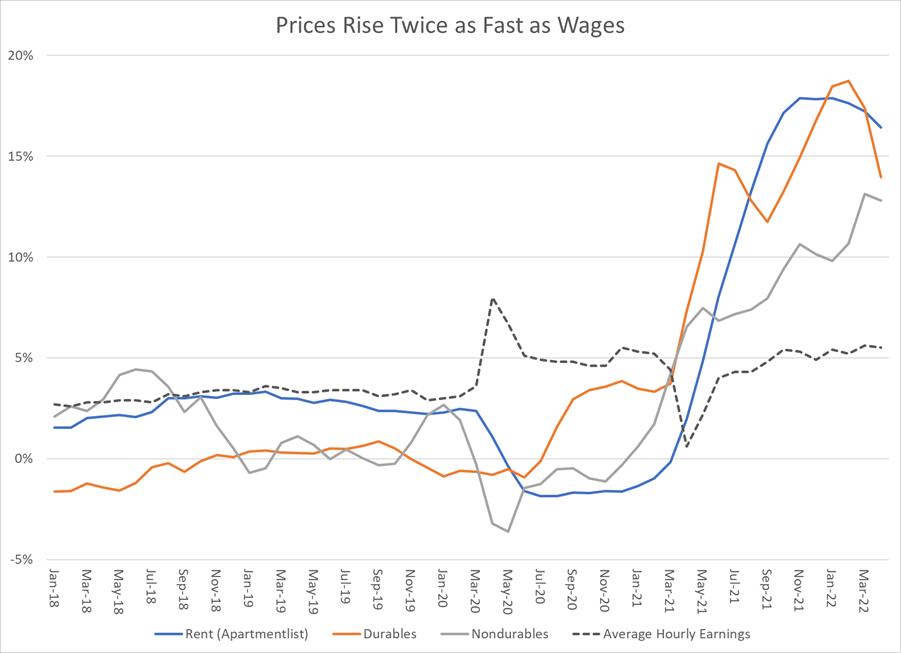

The result is an inflation rate of 12%, not the 8% reported by the Bureau of Labor Statistics. Hourly earnings are rising by just 5% a year, so real income is crashing. Americans have been running up credit-card debt to make up the difference, but the meltdown of retail stocks signals that the post-COVID consumer boom is over.

US consumer prices rose by 8.3% in the year through April, according to official data, but that includes an inflation estimate for shelter inflation of just 5% a year. Rents rose 16% during the twelve months through April 30 according to both Zillow and Apartmentlist.com, the two most comprehensive private indices. Shelter is a third of the consumer price index, so the private-sector shelter numbers based on actual transactions add another 4 percentage points to consumer price inflation.

The Asia Times adjusted inflation rate of 12% implies that the fall in real earnings during the first quarter of 2022 was the worst on record, worse than the 1979-1980 recession – the last time that inflation rate was in double digits. After-tax earnings fell even more because inflation pushes workers into higher tax brackets and increases their effective tax rate.

The Trump administration bears some of the blame. The massive federal handout to counteract the economic impact of the Covid epidemic began under the previous administration. Biden made things much worse.

That explains why the retail sector led the market down, after warnings from Wal-Mart and Target that the giant retailers couldn't pass on rising costs to their customers.

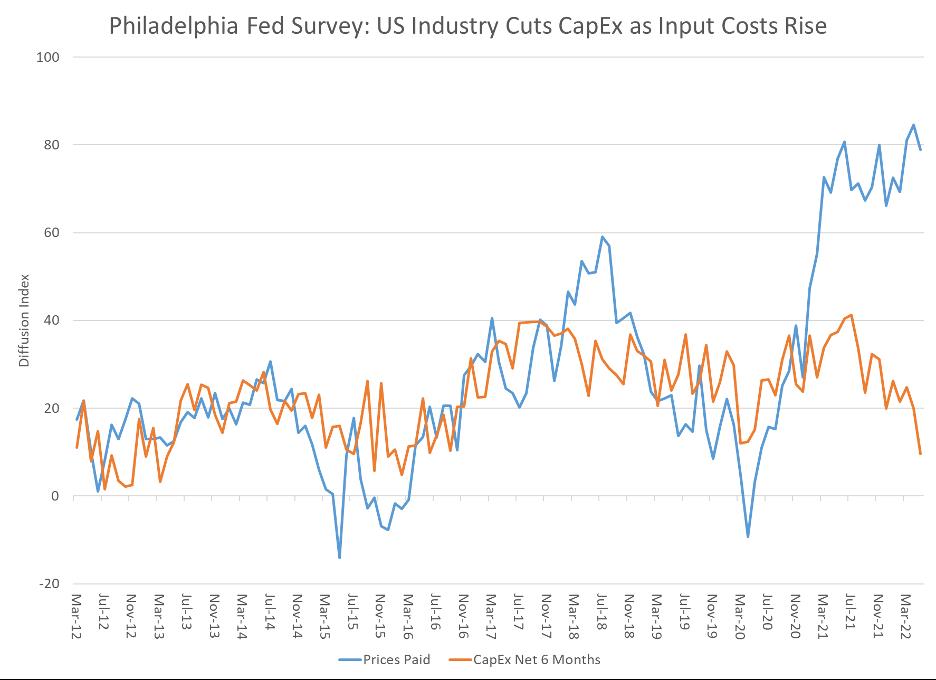

Inflation is crushing capital investment as well as consumption. The Philadelphia Federal Reserve's monthly survey of manufacturing, closely followed as an early indicator of economic activity, showed a sharp drop in overall activity. Prices paid for raw materials as well as labor continued to rise, while planned capital expenditures sank.

The Philly Fed series is a diffusion index, so a reading of 80 for prices paid means that 80% of respondents to the survey are paying higher prices than the previous month. Higher input costs mean lower revenues and shrinking profits, and less money for capital spending.

Lots of additional demand but no additional supply, lots of hot dog vouchers but not enough hot dogs, is the culprit in Biden's great inflation. The Federal Reserve abetted the bunko game by expanding its balance sheet by $6 trillion, in effect printing money to pay for the consumer stimulus.

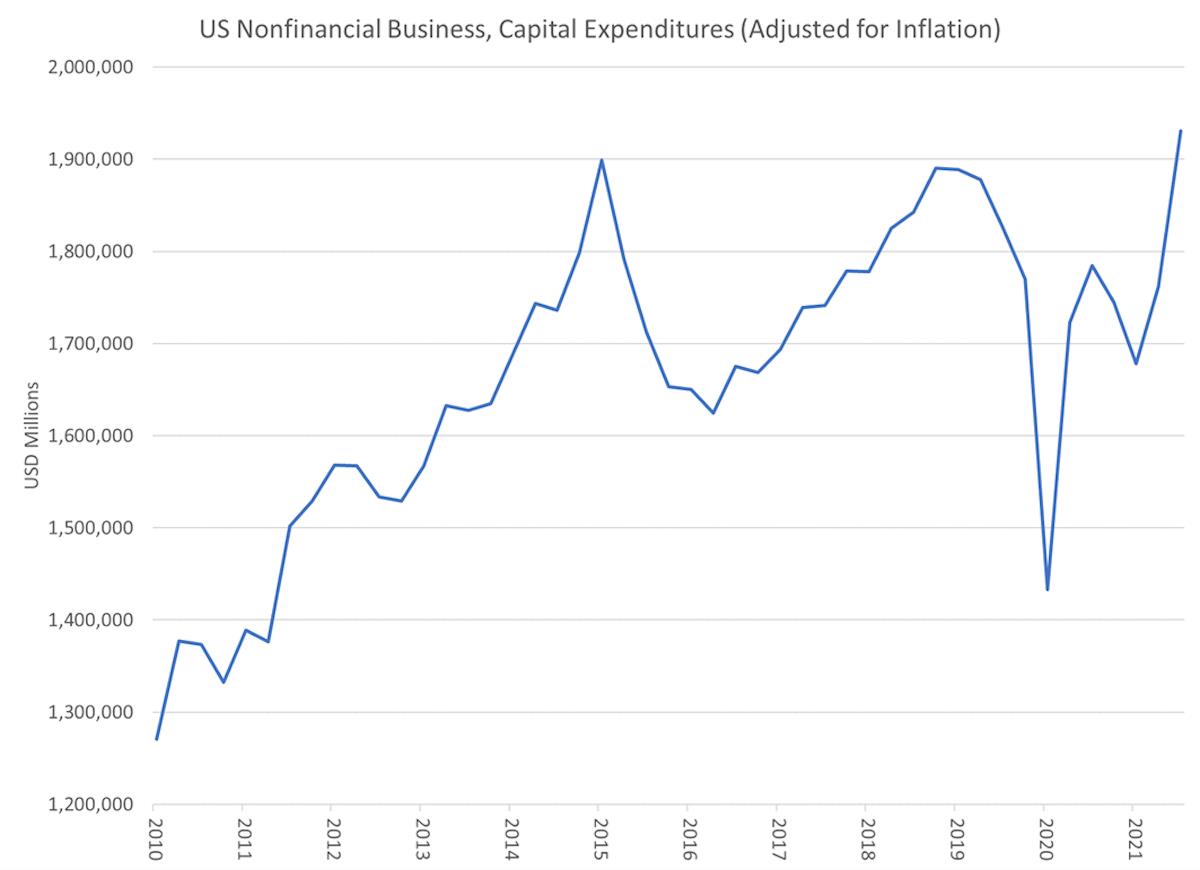

But the problem comes from the supply side. American business invested as much in 2021 as it did seven years earlier, leaving an enormous deficit in productive capacity. That's why raising interest rates will have no impact on inflation – except perhaps indirectly by taking some air out of the home price bubble – as I wrote in this space on April 6 (“Unseemly fed-ishisms in US monetary policy”).

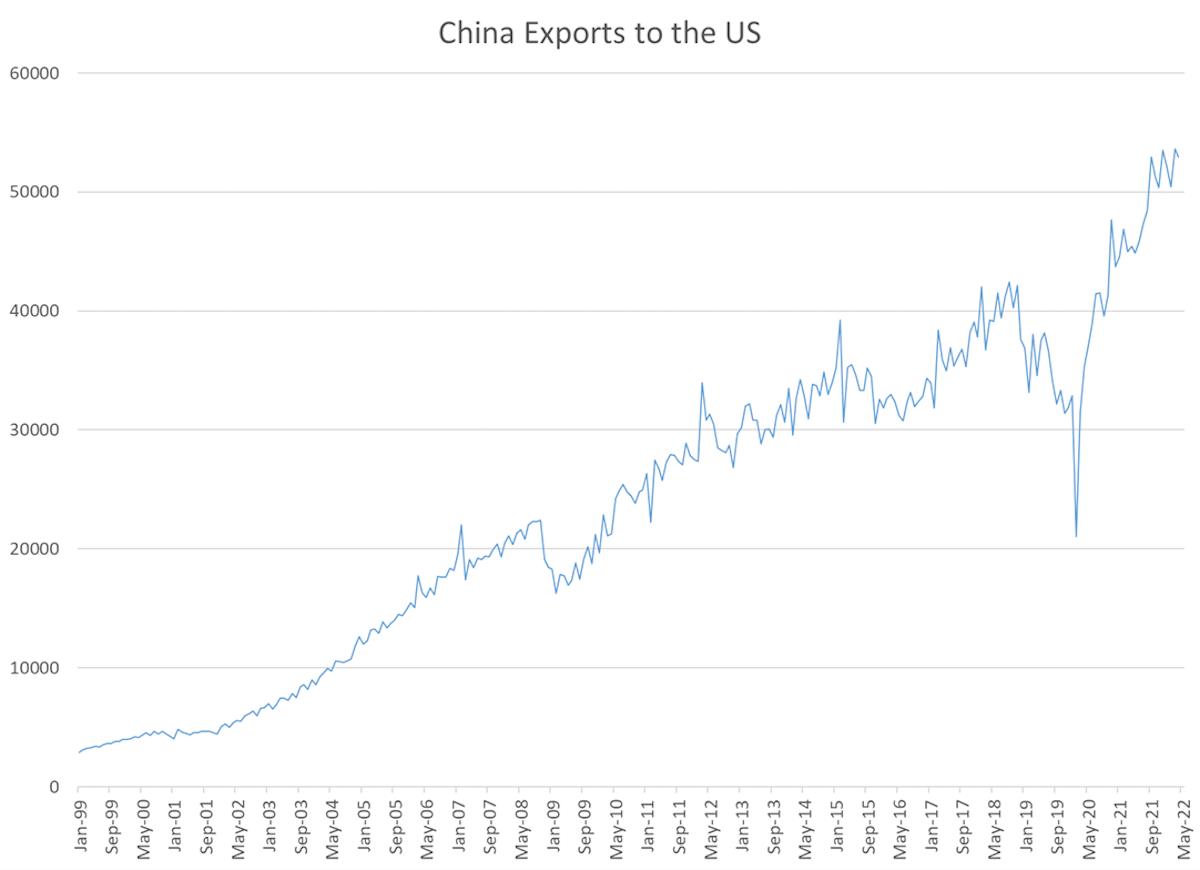

The under-invested US economy couldn't satisfy the tsunami of demand unleashed by the stimulus. Biden's bunko money couldn't find enough US goods, so it bought goods from China. That underscores the failure of Trump's China tariffs: Between Aug. 2019 when the tariffs took effect and April 22, China's exports to the US rose by 55% seasonally adjusted. The only sensible suggestion to come from the Biden Administration regarding inflation was made by Treasury Secretary Janet Yellen, who observed that removing the tariffs would reduce inflation modestly.

The collapse of corporate CapEx will only make inflation worse. American nonfinancial businesses invested barely as much in 2021 as they did in 2014. The Trump corporate tax reform of 2017 is partly to blame. It reduced the headline rate on corporate taxes but eliminated depreciation allowances for capital investments. As a result, the constituent companies of the S&P 500 spent more money buying back their own stock than on capital investment in 2018, the first time that had happened since the 2008 recession.

MENAFN20052022000159011032ID1104250543

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.