(MENAFN- Asia Times) TOKYO – When economic historians look back at the exact inflection-point moment when China's yuan went truly international, July 2021 could figure prominently.

On July 16, we learned the People's bank of China was exploring cross-border payments in digital yuan. For all the controversies facing President Xi Jinping's government – including doubts about a“V-shaped” recovery – PBOC officials were working quietly behind the scenes to float the first e-currency backed by the government of a top economy.

Though details have come in dribs and drabs, it's generally believed that Beijing is aiming to introduce the digital yuan in time for the Winter Olympics in February 2022, at least for limited use. But recent days brought new developments that have a clear rubber-hitting-the-road quality.

Setting the stage for cross-border digital payments means fuller yuan convertibility might soon be a reality. There seems little logic to a China offering a“yuan-lite” in digital form for very long.

At the same time, the central government appears to be endowing local Shanghai officials with unprecedented freedom to enact local laws. And, equally important, to devise tax incentives and steps toward capital market liberalization.

This latter step could mean new key industries – from semiconductors, biotechnology to aviation to artificial intelligence – will enjoy a 15% corporate tax rate , well down on the 25% norm.

It could boost confidence among local business people and entrepreneurs and foreign investors alike. It also, by turning Shanghai into a giant special enterprise zone, could create a new model to be applied across mainland metropoles.

Either step would be a big deal for China's evolving role as a global financial power. Coming together, it could be the Big Bang moment for which many global investors have been hoping and waiting for in the Xi era.

Printed money's days may be numbered. Photo: AFP

Trust issues

With an emphasis on“could,” of course. Xi's crackdowns on China's most innovative tech founders have investors everywhere scratching their heads – and harboring trust issues. Beijing's step-by-step efforts to dismantle the autonomy of Hong Kong – which has since lost its freest economy status to Singapore – is hardly the stuff of Adam Smith or Milton Friedman.

The depth and openness of an economy matters more than just sheer size, says Cornell University's Eswar Prasad. China, he says, still“needs an institutional framework that wins the confidence of foreign investors, including an independent central bank, the rule of law, and institutionalized checks and balances among various arms of the government.

“Most of the existing reserve currencies have those attributes. China is showing no indication of moving in that direction.”

Yet executed well and transparently, the intentions being telegraphed in July 2021 could be quite the gamechanger.

China's determination to be first out of the gate with a central bank digital currency , or CBDC, is catching officials at the Federal Reserve in Washington, the European Central Bank in Frankfurt and the Bank of Japan in Tokyo napping. It also enables PBOC officials and Xi's inner circle to play an outsized role in re-writing the rules of the future of money.

This prospect strikes fear in the hearts of geopolitical wags. Since taking power in 2012, Xi made no mystery of his desire to challenge the dollar's hegemony. In 2016, China won a place for the yuan in the International Monetary Fund's (IMF) special-drawing-rights basket, joining the dollar, euro, yen and pound.

Now, beating Washington to market with a digital currency has China finally leading.

“The dollar isn't at threat of losing its status as the global reserve currency any time soon,” says Josh Lipsky at the Atlantic Council, where he runs a digital currency tracker .“But if a digital yuan proliferates … it could slowly undermine the bite of the dollar, the attractiveness of the dollar, the use of the dollar in sanctions. And that's what people talk about.”

Digital battlefields

One of the early battlefields, Lipsky says, is in global debt circles. China, it's well known, is internationalizing its US$18 trillion government market. The likes of Goldman Sachs, JPMorgan, BlackRock, Credit Suisse, Schroders, Vanguard and Amundi and peers can't seem to expand their Shanghai staffs fast enough to deal in Chinese debt.

Right now, most global debt is in dollars. Beijing, he says,“really wants to get that debt into yuan” and digitalization may only accelerate that proposition.

Generally speaking, it's not necessarily a problem for the US that China is first out of the gate with a digital currency.“It's a mistake,” he says for the conversation to get framed as China versus the US. At least 75 countries, after all, are working on a central bank-backed digital unit of exchange.

For China, though, it is more important to get the digital yuan right, than to be first. To earn global trust and increase efficiencies, Xi's team must find the right balance between cybersecurity and libertarian instincts.

Beijing's capitalist credentials have had a rough few months. The cumulative effect of crackdowns on Hong Kong's autonomy, the scrapping of Jack Ma's Ant Group's initial public offering (IPO) and the more recent Didi Global listing fiasco have global investors worried Xi is prioritizing control over openness.

The argument that Beijing is protecting user data when policing Alibaba, Ant, Baidu, Didi, JD.com, Tencent and TikTok owner ByteDance and myriad others does little to allay concerns that a digital yuan will be a surveillance boon for the Communist Party.

Winning trust in a global yuan, says Mark Sobel, a former senior US Treasury Department official, requires striking a clear and verifiable happy medium between Beijing's control-freak tendencies and privacy. Trouble is, Xi's regulators have so far convinced few foreign investors they're willing to take a hands-off approach.

The PBOC, says Sobel, who's now at the Center for Strategic and International Studies (CSIS) in Washington, has a capable and outward-looking staff.“But,” he says,“the PBOC is not independent. And digitalizing the RMB changes none of this.”

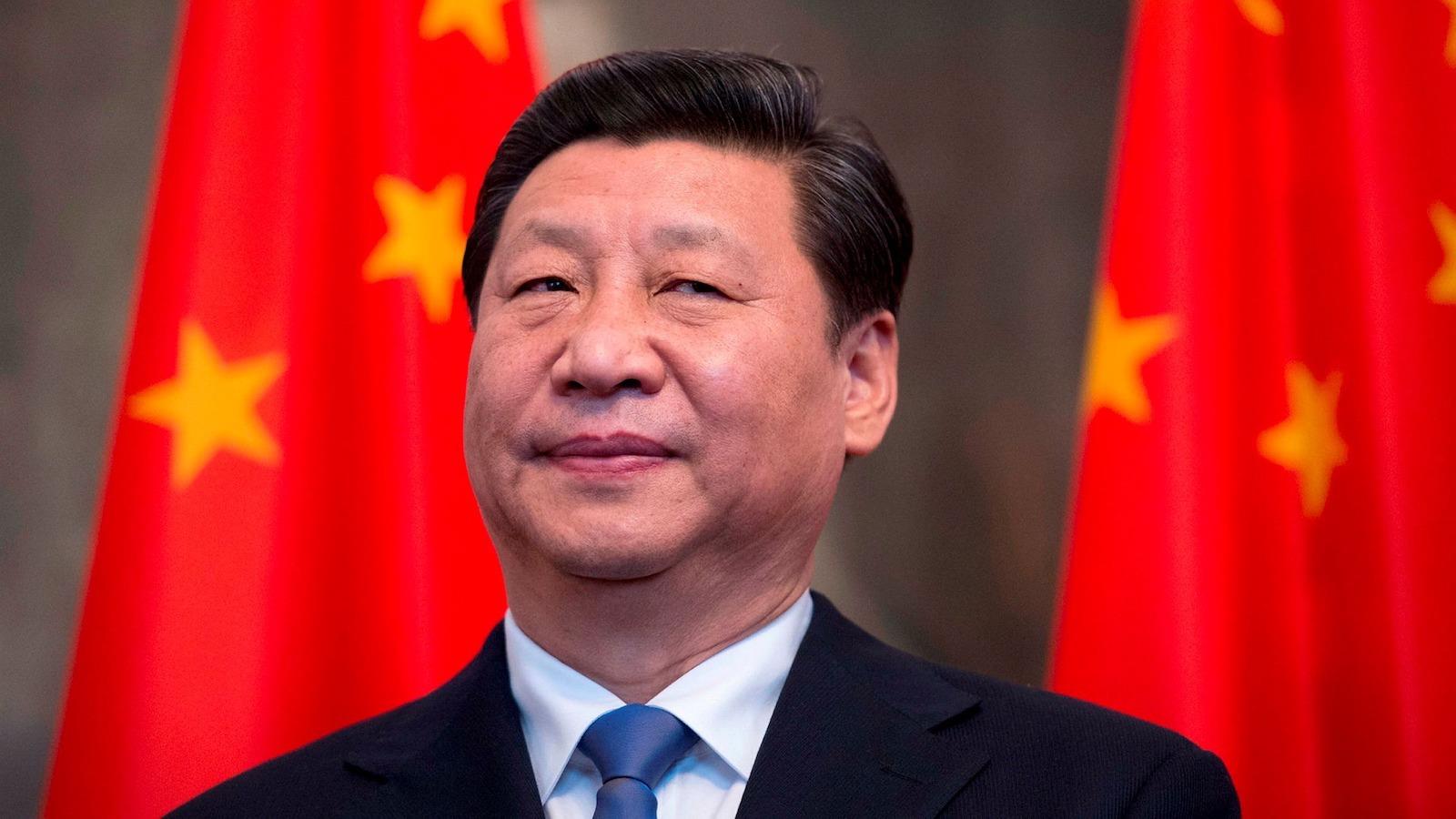

Will President Xi Jinping ease controls on China's currency? Photo: AFP

Hands-on approach

Xi's government, it follows, might be better off going slow with the digital yuan rollout to ensure the future of Chinese money has as few bugs as possible. And as few avoidable geopolitical stumbles as possible, too.

Though the details of the Ant Group IPO shelving in November and this month's Didi probe differ, both have fanned concerns abroad that Xi isn't serious about letting market forces play a“decisive” role in Beijing's policymaking.

The news of the last few days offers a timely opportunity to flip the script.

Giving Shanghai authorities autonomy on taxation would indeed be off-brand for Xi's inner circle. On the one hand, a 15% tax in mainland China's most important financial center could silence criticism in Group of Seven (G7) circles that Xi hasn't signed onto their minimum corporate rate pact. On the other, it sends a powerful signal to other local governments.

This is especially true of Xi's so-called Greater Bay Area . Think of the world's biggest special enterprise zone as a“Silicon Valley East” in southern China. It groups Hong Kong and Macau together with Shenzhen and eight other municipalities all destined to become powers all their own: Guangzhou, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen and Zhaoqing.

Last year, Xi signed on to the 15-nation Regional Comprehensive Economic Partnership , a trade deal that put China's economy directly at the center of the aspirations of three billion people angling for middle-to-higher income status. To HSBC economist Natalie Blyth, it's nothing short of a“tipping point” that accelerated the“regional shift from West to East and the rise of Asia.”

A view of the Greater Bay Area. Photo: Asia Times

The Greater Bay Area, in theory, is a process of generating any number of tech“unicorns” that would eventually stage IPO's in Shenzhen, Shanghai or Hong Kong. The specter of getting the Shanghai treatment – tax-policy autonomy – in the South could accelerate the zone's development and attractiveness.

It also could turbocharge Xi's ambitions to dominate global tech by 2025. In June alone, mainland makers of semiconductors, memory and logic components produced 30.8 billion chips , a roughly 40% surge from a year ago. A month earlier, mainland companies churned out nearly 30 integrated circuits – about 1 billion a day. Imagine what can be achieved with new Shanghai-like tax incentives and other policy tweaks.

Hong Kong's days numbered?

Bill Bishop, the editor of the widely read Sinocism China newsletter, notes that recent hints from Beijing seem like“great news for Shanghai and its development and real estate.” It remains to be seen, though, what this means for Hong Kong, a city in a state of regulatory flux.

“If implemented,” Bishop says, these tax changes“would seem to go a long way to Shanghai replacing Hong Kong as a key financial gateway to the rest of the PRC.”

The real“if,” though, concerns Xi's confidence to create a credible digital currency that prioritizes efficiency and ease of use over state control.

The potential is boundless. Mainland consumers are already showing less and less interest in carrying notes and coins in their wallets. The PBOC's digital yuan trial has already topped $5 billion worth of transactions. Imagine once it's widely available. Across the nation, nearly 21 million people have opened digital wallets.

If China leans into digitalization to internationalize the yuan, this could be the Xi era reboot for which investors long hoped.

MENAFN19072021000159011032ID1102476692