403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Qatar capital spending to rise sharply in coming quarters: BMI

(MENAFN- Gulf Times) Qatar will record high levels of capital spending over the coming quarters on the back of large-scale government investments into infrastructure development and projects linked to economic diversification, BMI Research has said in a new report.

According to the Fitch Group company, capital expenditure will expand across all GCC states except Bahrain over the coming quarters, as governments invest in infrastructure and projects linked to various economic diversification programmes.

BMI researchers say rising hydrocarbon prices will strengthen fiscal positions across the GCC — where hydrocarbons make up over half of government revenues in all member states.

BMI forecasts Brent crude prices to average $54 per barrel in 2017, rising gradually towards $70 in 2022 — a substantial increase from the $45.1 level recorded in 2016.

All GCC states are likely to continue to issue debt to help cover their deficits over the years ahead. This includes those states with still-large fiscal buffers, such as Saudi Arabia, Qatar and Kuwait, which will be reluctant to draw down heavily on reserves, given the negative impact such action would have on investor sentiment and confidence in their currency pegs to the dollar. Most are likely to borrow substantially on the international capital markets, in order to limit domestic liquidity pressures, BMI said.

Even in those states where the fiscal deficit is forecast to be relatively small, including Kuwait and the UAE, governments are likely to issue debt, as borrowing costs remain relatively low and as they look to deepen their capital markets.

'We nevertheless note that, overall, http://172.17.99.108/newspress/backup/files/images/2017/08/24/185470.jpg?tmp=1503603157 the size of issuances will probably be smaller than those seen over the past year, as financing needs will have lessened somewhat since 2016 when hydrocarbon prices were at a multi-year low.

'Despite growing debt burdens, we see little imminent risk to debt sustainability and expect all GCC states to retain access to foreign funding over the years ahead. Even after ramping up sharply in recent quarters, debt-to-GDP ratios remain low compared globally.

'In the years ahead, debt accumulation is set to decelerate as hydrocarbon prices rise and currency risks are minimised by dollar pegs, underpinning investor confidence in the region, BMI noted.

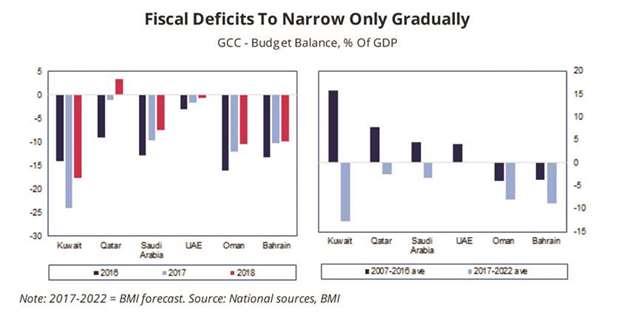

The report noted that fiscal deficits across the GCC are set to narrow gradually over the coming years, reaching a forecast average of 10.3% of GDP in 2017 and 5% annually on average over the 2018-2022 period.

This compares favourably to the 11.3% of GDP deficit estimated for 2016 for the region, largely reflecting the beneficial effects of rising oil and gas prices on fiscal revenues.

However, it is a far cry from the 4.1% surplus recorded for the region over the last decade. Indeed, even as high hydrocarbon prices ensure some narrowing of budgetary shortfalls, the pace of fiscal consolidation will be slow across the board, as the various Gulf governments look to minimise risks of social instability, thus keeping spending growth relatively elevated.

To cover their shortfalls, BMI expects GCC states to continue borrowing both domestically and internationally, ramping up their debt burdens.

While borrowing costs will rise, the Fitch Group company expects all GCC governments to retain access to foreign funding in the years ahead, as debt ratios remain relatively low across the region.

According to the Fitch Group company, capital expenditure will expand across all GCC states except Bahrain over the coming quarters, as governments invest in infrastructure and projects linked to various economic diversification programmes.

BMI researchers say rising hydrocarbon prices will strengthen fiscal positions across the GCC — where hydrocarbons make up over half of government revenues in all member states.

BMI forecasts Brent crude prices to average $54 per barrel in 2017, rising gradually towards $70 in 2022 — a substantial increase from the $45.1 level recorded in 2016.

All GCC states are likely to continue to issue debt to help cover their deficits over the years ahead. This includes those states with still-large fiscal buffers, such as Saudi Arabia, Qatar and Kuwait, which will be reluctant to draw down heavily on reserves, given the negative impact such action would have on investor sentiment and confidence in their currency pegs to the dollar. Most are likely to borrow substantially on the international capital markets, in order to limit domestic liquidity pressures, BMI said.

Even in those states where the fiscal deficit is forecast to be relatively small, including Kuwait and the UAE, governments are likely to issue debt, as borrowing costs remain relatively low and as they look to deepen their capital markets.

'We nevertheless note that, overall, http://172.17.99.108/newspress/backup/files/images/2017/08/24/185470.jpg?tmp=1503603157 the size of issuances will probably be smaller than those seen over the past year, as financing needs will have lessened somewhat since 2016 when hydrocarbon prices were at a multi-year low.

'Despite growing debt burdens, we see little imminent risk to debt sustainability and expect all GCC states to retain access to foreign funding over the years ahead. Even after ramping up sharply in recent quarters, debt-to-GDP ratios remain low compared globally.

'In the years ahead, debt accumulation is set to decelerate as hydrocarbon prices rise and currency risks are minimised by dollar pegs, underpinning investor confidence in the region, BMI noted.

The report noted that fiscal deficits across the GCC are set to narrow gradually over the coming years, reaching a forecast average of 10.3% of GDP in 2017 and 5% annually on average over the 2018-2022 period.

This compares favourably to the 11.3% of GDP deficit estimated for 2016 for the region, largely reflecting the beneficial effects of rising oil and gas prices on fiscal revenues.

However, it is a far cry from the 4.1% surplus recorded for the region over the last decade. Indeed, even as high hydrocarbon prices ensure some narrowing of budgetary shortfalls, the pace of fiscal consolidation will be slow across the board, as the various Gulf governments look to minimise risks of social instability, thus keeping spending growth relatively elevated.

To cover their shortfalls, BMI expects GCC states to continue borrowing both domestically and internationally, ramping up their debt burdens.

While borrowing costs will rise, the Fitch Group company expects all GCC governments to retain access to foreign funding in the years ahead, as debt ratios remain relatively low across the region.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment