Highland Copper Announces Updated Process Plant Flow Sheet Demonstrating Increased Copper Recoveries Of 87.6% And Reduced Processing Costs

| Sample | Interval [m] | Received sample mass [kg] | Assays | |||||||||

| From | To | Cu | Fe | Au | Ag | S | CuOx | CuCN | SO4 | S2 | ||

| CW-25-210 | 143.46 | 146.26 | 40.9 | 1.89 | 6.39 | - | 2.70 | 0.55 | 0.40 | 1.17 | 0.03 | 0.52 |

| CW-25-211 | 142.95 | 145.15 | 34.1 | 1.83 | 6.23 | - | 4.17 | 0.51 | 0.41 | 1.17 | 0.04 | 0.48 |

| CW-25-212 | 173.26 | 176.24 | 45.4 | 2.29 | 6.19 | - | 5.03 | 0.62 | 0.42 | 1.52 | 0.01 | 0.61 |

| CW-25-213 | 172.82 | 175.80 | 45.4 | 2.20 | 6.09 | - | 4.67 | 0.66 | 0.21 | 1.76 | 0.07 | 0.59 |

| CW-25-214 | 228.20 | 230.51 | 35.5 | 2.21 | 6.16 | - | 4.53 | 0.61 | 0.23 | 1.82 | 0.02 | 0.59 |

| CW-25-215 | 227.86 | 230.38 | 38.0 | 2.24 | 6.00 | - | 3.00 | 0.58 | 0.24 | 1.74 | 0.02 | 0.57 |

| CW-25-216 | 200.45 | 203.39 | 42.3 | 2.26 | 6.03 | - | 3.67 | 0.60 | 0.22 | 1.79 | 0.03 | 0.58 |

| CW-25-217 | 201.14 | 203.92 | 42.3 | 2.42 | 5.92 | - | 4.73 | 0.63 | 0.22 | 1.90 | 0.02 | 0.61 |

| CW-25-218 | 168.34 | 170.96 | 40.7 | 2.16 | 6.25 | - | 5.33 | 0.58 | 0.21 | 1.79 | 0.04 | 0.54 |

| CW-25-219 | 167.50 | 170.14 | 39.5 | 2.57 | 6.16 | - | 7.33 | 0.66 | 0.22 | 1.98 | 0.05 | 0.60 |

| Composite | 404.0 | 2.14 | 6.04 | 0.02 | 5.70 | 0.61 | 0.20 | 1.95 | 0.04 | 0.53 | ||

| CW-25-211FR | 145.53 | 148.37 | 41.7 | 2.18 | 6.15 | - | 2.07 | 0.61 | 0.40 | 1.56 | 0.03 | 0.58 |

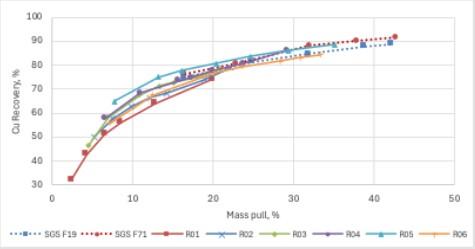

To confirm the representativeness of the 2025 composite sample, preliminary rougher bench-scale flotation tests were done. The objective of these tests was to replicate the metallurgical performance observed during the 2018 flotation program, thereby providing confidence in the validity of the new sample set.

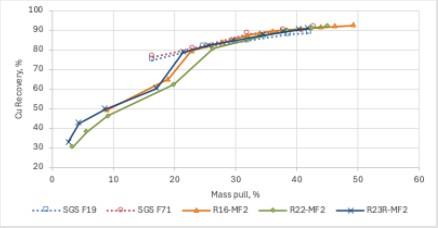

Figure 2 presents the mass pull versus recovery curves from these preliminary tests, alongside historical data from the 2018 campaign – specifically Test F19 and Test F71. Test F19 represented the optimal rougher flotation conditions applied during the majority of the 2018 test work, while test F71 served as the baseline for a campaign which employed excessive NaHS dosages exceeding 2,600 g/t.

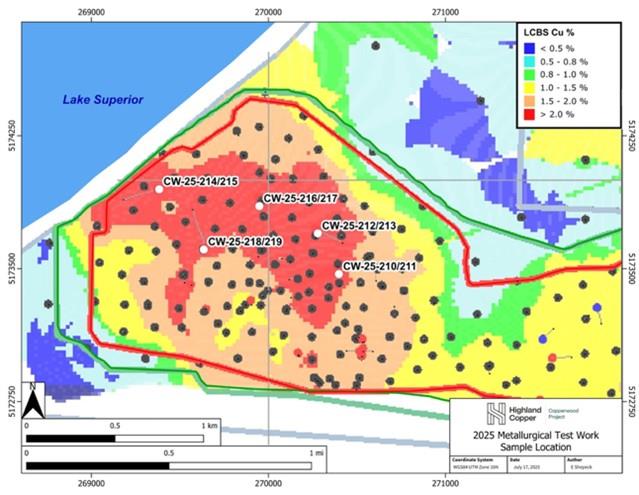

Figure 1: 2025 metallurgical test work sample locations corresponding with 2018 SGS metallurgical campaign.

As shown in Figure 2, the 2025 sample demonstrates a metallurgical response consistent with the 2018 baseline results. This correlation supports the representativeness of the new composite material. On this basis an additional 19 rougher and 20 cleaner kinetic flotation tests were carried out to optimize the process flowsheet and refine the reagent scheme.

Figure 2: Mass pull versus Recovery curves for preliminary rougher tests, confirming similar response to 2018 SGS baseline

Process flowsheet and reagent scheme optimization

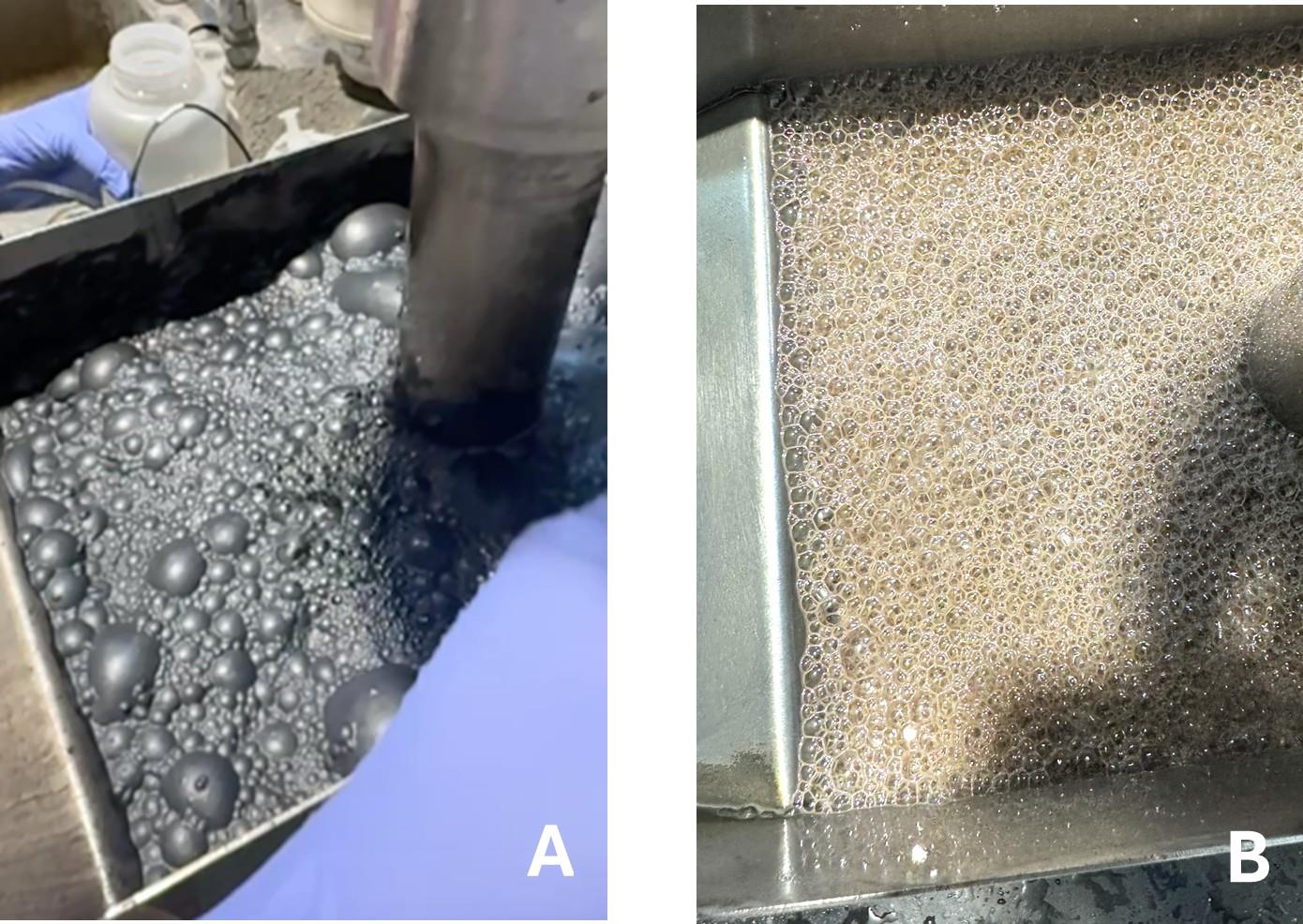

Preliminary rougher flotation testing revealed that the Copperwood ore body contains bimodal mineralogical fractions: a fast-floating component that responds quickly to flotation and a slower-floating bulk fraction with more protracted kinetics. As shown in Figure 3, the fast-floating material generates a high-grade initial froth characterized by well-loaded bubbles (Panel A). However, after approximately 7 minutes of flotation time, froth quality deteriorates, becoming brittle and poorly loaded (Panel B). While metallurgical upgrading continues beyond this point, the recovery rate slows significantly, requiring extended flotation residence times. An assay-by-size analysis of tailings confirmed the presence of a low-grade ultrafine (sub 20mm) fraction, likely introduced through overgrinding in the previous single-stage milling setup.

Figure 3: Initial high-grade froth (panel A) and depleted brittle froth (panel B) after 7 minutes of flotation

Adoption of an MF2 circuit

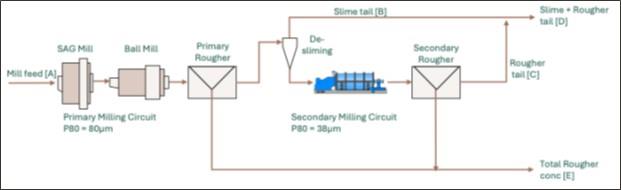

To address these challenges, the flowsheet was revised to adopt a mill-float-mill-float (MF2) configuration, incorporating a de-sliming stage between the primary and secondary milling circuits (see Figure 4). This approach, widely established in metallurgical operations, helps mitigate overgrinding and the associated fines losses. Grind optimization test work determined the optimal parameters as:

- Primary circuit grind P80: 80 μm Secondary circuit grind P80: 38 μm

Bench-scale de-sliming was performed via wet screening at 38 μm, while later pilot-scale testing employed cyclone separation.

Figure 4: Revised front-end of the circuit showing desliming and mill-float-mill-float (MF2) configuration

De-sliming Efficiency and Mass Rejection

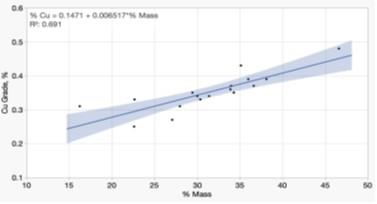

Test work demonstrated a strong linear relationship (R2 = 0.691) between the mass fraction and copper grade in the de-slime fraction (see Figure 5). At a target grade of 0.3% Cu in the de-slime product, up to 25% of the mass of the primary rougher tailings can be rejected ahead of secondary milling. This not only reduces the size requirement for the secondary milling circuit but also prevents overgrinding and associated fine particle losses.

Figure 5: Linear relationship between deslime mass fraction and Cu grade of deslime fraction

Comminution Circuit Power Saving

The 2023 FSU contemplated an MF1 circuit comprising a 5.5 MW SAG mill and a 5.5 MW ball mill in closed circuit with cyclones, producing a flotation feed P80 of 45 μm and drawing 4.8 and 5.0 MW respectively. This configuration included a single rougher stage with 50 minutes of residence time, followed by a 2.2 MW regrind mill drawing 1.9 MW. In total, the circuit incorporated 13.2 MW of installed comminution power, with a projected power draw of 11.7 MW.

Under the new configuration, designed for a coarser primary grind target of 80 μm, DRA's mill sizing indicates that a 3.8 MW SAG mill and 3.8 MW ball mill represent the optimal setup for the primary milling circuit, with projected power draws of 3.3 MW and 3.4 MW, respectively. Following the de-slime step, a new secondary milling circuit (3.0 MW installed, 2.0 MW power draw) will deliver the secondary grind target of 38 μm. In addition, a 1.5 MW regrind mill (1.4 MW projected draw) will regrind the rougher concentrate to a target P80 of 10 μm.

Altogether, the revised comminution circuit is projected to draw just 10.1 MW, representing between 10% and 13.7% reduction in power requirements compared with the 2023 FSU design-highlighting both improved operating efficiency and the potential for meaningful cost and energy savings.

Reagent Scheme Optimization

In parallel with flowsheet improvements, the flotation reagent suite was also optimized to improve both performance and cost-efficiency (see Table 2). Key changes include:

- Replacement of SIBX collector with PAX Substitution of A-249 promoter with A-407 Adjust pH and redox potential in the primary rougher conditioning stage, reducing NaHS dosage Elimination of Polypropylene glycol methyl ether (D-250) Elimination of n-Dodecyl Mercaptan (NDM)

In the 2023 FSU, flotation reagents accounted for $6.50 per tonne milled in operating costs. The revised 2025 reagent suite is projected to reduce this cost to $5.49 per tonne (at current reagent pricing), yielding a savings of up to $1.00 per tonne. In addition to the cost reduction, the updated reagent scheme offers a substantially improved environmental, health, and safety (EH&S) profile.

Table 2: Reagent regimes and contribution to operating costs (updated to 2025 reagent pricing)

| Reagent type | Dosage (g/t) | |

| 2023 Feasibility | 2025 reagent suite (approximate dosages) | |

| Sodium Isobutyl Xanthate (SIBX) | 317 | - |

| Potassium Amyl Xanthate (PAX) | - | 450 |

| A249 promotor | 335 | - |

| A407 propotor | - | 265 |

| Sodium Hydrosulphide (NaHS) | 1089 | 550 |

| Carboxymethyl Cellulose Sodium (CMC) | 138 | 110 |

| Sodium Silicate | 98 | 330 |

| Methyl Isobutyl Carbinol (MiBC) | 33 | 100 |

| Polypropylene glycol methyl ether (D-250) | 75 | - |

| n-Dodecyl Mercaptan (NDM) | 89 | - |

| Contribution to operating cost ($/t milled) | $ 6.50 | $ 5.49 |

Enhanced Rougher Recovery

Figure 6 presents the mass pull versus recovery curves from selected MF2 bench-scale flotation tests, shown alongside the 2018 campaign baselines from Test F19 and Test F71. A notable step-change is observed at approximately 20% mass pull, which reflects the transition between flotation products from the primary and secondary milling stages. Data points below the 20% mass pull correspond to the primary milling circuit and primary rougher flotation, while those above 20% represents recovery contributions from the secondary milling circuit and roughers.

Figure 6: Mass pull versus Recovery curves for MF2 bench tests compared with 2018 SGS baseline

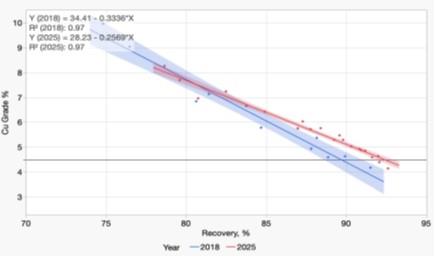

Figure 7 presents linear grade-recovery curves fitted to the secondary rougher flotation data from both the 2018 and 2025 test programs. The fitted models yield R2 values of 0.97 for both datasets, indicating a strong correlation between grade and recovery in the secondary rougher stage. The shaded regions represent the 95% confidence intervals for each regression line.

Figure 7: Fitted Grade-Recovery curves for 2025 MF2 rougher tests compared with 2018 SGS baseline

At the target rougher concentrate grade of 4.5% copper, the updated reagent scheme and MF2 circuit achieved a rougher recovery of up to 92.4%, compared to 89.7% in the 2018 baseline. Importantly, the non-overlapping confidence intervals confirm that this improvement is statistically significant, underscoring the technical merit of the revised flowsheet and reagent strategy.

Consistent Cleaner Recovery

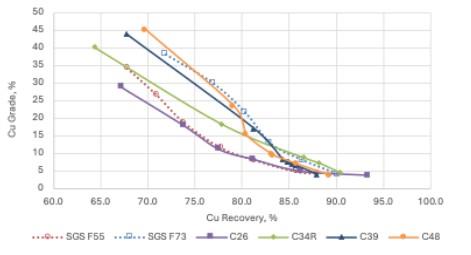

Bench-scale cleaner optimisation focussed on refining reagent addition rates and evaluating the impact of regrind size on performance. Figure 8 illustrates the grade versus recovery curves from selected 2025 cleaner kinetic tests, presented alongside historical data from the 2018 campaign – specifically Test F55 and Test F73.

- Test F55 represented the best cleaner performance under conditions of natural pH and a regrind P80 of 14mm, which was applied during most of the 2018 test work. Test F73 served as the baseline cleaner performance incorporating stagewise NaHS dosages exceeding 2,600 g/t.

As shown in Figure 8, 2025 cleaner recoveries were comparable to or exceeded those achieved in the 2018 baseline tests, indicating strong and reliable downstream circuit performance. Notably, Test C48, conducted at a regrind P80 of 10μm using the revised 2025 reagent scheme (as detailed in Table 2), delivered cleaner performance outperforming Test F55 and comparable to Test F73.

Figure 8: Grade versus Recovery curves for 2025 cleaner kinetic tests compared with 2018 SGS baseline

Underscored by locked cycle tests

While kinetic rate flotation tests, used in the earlier rougher and cleaner optimization work, provide valuable insights, they do not account for the circulating loads that occur in an operating flotation circuit. To better approximate real operating conditions, locked-cycle tests are employed, offering a more realistic measure of recovery, grade, and concentrate mass pull.

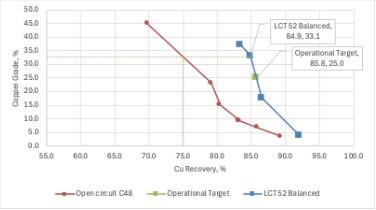

Using the test C48 conditions as a basis-but incorporating closed-circuit cleaners-a locked-cycle test (C52) was completed, with results summarized in Table 3. For comparison, the average locked-cycle test results for the Copperwood Main Zone from the 2023 FSU (see Table 13.29) are also shown.

At a comparable copper recovery (85.4% vs. 85.8%), the locked-cycle test delivered a significant improvement in concentrate grade-32.9% Cu compared with 25.1% Cu. This shift in the grade-recovery curve is primarily attributed to a lower mass pull to concentrate (5.9% vs. 7.3%).

Table 3: Results of locked cycle test C52 using test C37 configuration and closed-circuit cleaners

| Cycle | Mass pull [%] | Grade [%] (Ag = g/t) | Recovery [%] | ||||||

| Cu | Fe | Ag | S | Cu | Fe | Ag | S | ||

| A | 5.5 | 36.2 | 7.3 | 72.3 | 10.5 | 82.9 | 7.5 | 77.2 | 84.9 |

| B | 3.4 | 45.1 | 7.8 | 88.6 | 13.2 | 77.0 | 4.9 | 65.3 | 80.8 |

| C | 4.7 | 37.3 | 7.9 | 69.5 | 10.7 | 78.9 | 6.6 | 66.7 | 87.0 |

| D | 6.8 | 29.8 | 7.3 | 56.5 | 8.6 | 85.6 | 8.7 | 75.8 | 88.3 |

| E | 6.0 | 33.2 | 6.6 | 64.0 | 9.7 | 85.0 | 7.1 | 75.4 | 87.4 |

| F | 5.9 | 32.6 | 6.6 | 61.3 | 9.2 | 85.7 | 7.2 | 74.8 | 89.1 |

| Cycle E+F Average | 5.9 | 32.9 | 6.6 | 62.5 | 9.4 | 85.4 | 7.1 | 75.1 | 88.3 |

| FSU Table 13.29 | 7.3 | 25.1 | 61.2 | 85.8 | 78.8 |

Because test C48 served as the basis for the C52 locked-cycle test, it is reasonable to conclude that the shape of the grade-recovery curve is maintained, but shifted to the right as a result of the closed cleaner circuit. The grade-recovery curve for test C48 is shown in Figure 9, together with the balanced grade-recovery curve obtained from locked-cycle test 52. At a concentrate grade of 33.1% Cu, the open circuit test C48 would have yielded a recovery of 74.9%; however, the balanced locked-cycle test achieved 84.9%, representing a positive shift of +10.0%.

By moving along the locked-cycle grade-recovery curve to a reduced concentrate grade of 25% Cu, it is projected that the circuit will yield a recovery of 85.8% Cu. This correlates well with the 2023 FSU average locked-cycle test results for the Copperwood Main Zone of 85.8% recovery at 25.1% Cu grade. These results underscore the robustness of the redesigned flowsheet and its ability to achieve comparable outcomes to the 2023 FSU, but at substantially lower operating costs.

Positive Pilot-scale Results for Ultrafine Flotation Technology

Ultrafine flotation technology plays a critical role in recovering very fine particles-typically those smaller than 20 μm-that are often lost in conventional flotation circuits. QEMSCAN analysis of Copperwood ore confirmed that the liberation size of the copper mineralization is sub-20 μm, supporting the historical process design which incorporated a regrind P80 of 14 μm.

The primary objective of evaluating ultrafine flotation at Copperwood is to enhance the grade-recovery curve, a key driver of project economics. In addition, this technology offers potential secondary benefits, including reduced processing plant footprint and a lower environmental impact, aligning with the project's sustainability objectives.

Figure 9: Shift in grade-recovery curve from open circuit to closed circuit locked cycle test

The Jameson Cell, developed by Glencore Technology, was selected for pilot testing. It addresses many of the design and performance limitations of conventional flotation and column cells. With over 500 installations worldwide-including more than 140 in copper circuits-the Jameson Cell is a proven solution, extensively documented in technical literature and industrial case studies.

Following the confirmation of the MF2 circuit configuration and optimized reagent regime through bench-scale testing, the program advanced to the pilot application of ultrafine flotation using a Jameson L150 laboratory unit at Base Met Labs.

Pilot-scale flotation tests, using 40kg batches from the composite sample, were conducted on both the primary and secondary rougher applications, as well as the open circuit cleaner application. Prior to each test, a representative sample was extracted from the conditioning tank post-reagent conditioning and subjected to a three-stage dilution test-a standard Glencore Technology method using a D12 Denver bench-top flotation cell. This approach is designed to mimic Jameson Cell conditions and allows for direct comparison of performance and scale-up parameters.

The mass pull versus recovery curve from a primary rougher test, together with a grade versus recovery curve from the corresponding dilution test, is plotted alongside the benchmark MF2 Test R23R in Figure 10. These results demonstrated a distinct and favorable shift in flotation performance with the use of a Jameson Cell, indicating improved kinetics and recovery potential and affirming the value of ultrafine flotation technology in the Copperwood flowsheet.

Table 4 presents a comparative analysis of bench-scale flotation performance achieved during the 2025 testing campaign using conventional flotation cells, versus a configuration utilizing Jameson L150 cells in both the primary and secondary rougher applications. In both scenario's, the test work employed the revised reagent scheme (as detailed in Table 2) and the MF2 flowsheet configuration (see Figure 4 for stream references). Key observations from the data include:

- The 95% confidence interval for the Rougher Tail mass fraction (stream C) in the conventional cell baseline is 18.4% to 23.7% with a mean of 21.0%. The Jameson cell configuration yielded a significantly higher rougher tail mass fraction of 32.0%, a statistically significant difference. This suggests improved selectivity and reduced entrainment in the rougher circuit using ultrafine flotation technology.

Figure 10 is available at

Figure 10: Comparison of L150 Jameson cell mass pull versus recovery curve with 3-stage dilution and 2025 baseline rougher tests.

- The copper grade in the conventional Rougher Tail (stream C) had a 95% confidence interval of 0.35% to 0.51% Cu, with a mean of 0.43% Cu. The Jameson cell circuit achieved a lower tailings grade of 0.30% Cu, indicating a statistically significant improvement in rougher recovery. At a comparable rougher copper recovery of 90%, the Jameson L150 cell produced a rougher concentrate grade of 5.4% Cu, compared to the baseline range of 4.3% to 4.7% Cu (95% confidence interval). This higher concentrate grade is statistically significant and confirms that the ultrafine flotation technology delivers a favorable shift in the rougher grade-recovery curve.

Table 4: Jameson L150 and bench test comparison on rougher performance (see Figure 4 for circuit configuration)

| Test ID | Type | Avg Calc Feed [A] | Slime Tail [B] | Rougher Tail [C] | Slime+ Rougher Tail [D] | Total Rougher Concentrate [E] | ||||||||

| % Cu | Mass | Grade %Cu | Recovery %Cu | Mass | Grade %Cu | Recovery %Cu | Mass | Grade %Cu | Recovery %Cu | Mass | Grade %Cu | Recovery %Cu | ||

| BL1847-22R | Bench Rougher | 2.25 | 30.4 | 0.33 | 4.5 | 24.65 | 0.33 | 3.62 | 55.0 | 0.33 | 8.1 | 45.0 | 4.6 | 91.9 |

| BL1847-23 | Bench Rougher | 2.25 | 34.3 | 0.35 | 5.3 | 23.87 | 0.44 | 4.67 | 58.2 | 0.39 | 10.0 | 41.8 | 4.8 | 90.0 |

| BL1847-34R | Bench Rougher-Cleaner | 2.25 | 35.1 | 0.43 | 6.7 | 19.34 | 0.35 | 3.01 | 54.5 | 0.40 | 9.7 | 45.5 | 4.5 | 90.3 |

| BL1847-37 | Bench Rougher-Cleaner | 2.25 | 36.0 | 0.39 | 6.2 | 18.94 | 0.49 | 4.13 | 54.9 | 0.42 | 10.4 | 45.1 | 4.5 | 89.6 |

| BL1847-36 | Bench Rougher-Cleaner | 2.25 | 32.8 | 0.37 | 5.4 | 19.71 | 0.46 | 4.03 | 52.5 | 0.40 | 9.4 | 47.5 | 4.3 | 90.6 |

| BL1847-39 | Bench Rougher-Cleaner | 2.25 | 33.6 | 0.46 | 6.9 | 19.69 | 0.51 | 4.47 | 53.3 | 0.48 | 11.3 | 46.7 | 4.3 | 88.7 |

| Bench-test baseline performance | 2.25 | 33.7 | 0.39 | 5.8 | 21.03 | 0.43 | 3.99 | 54.7 | 0.40 | 9.8 | 45.3 | 4.5 | 90.2 | |

| BL1847-38 | Jamo L150 | 2.25 | 30.7 | 0.42 | 5.7 | 32.01 | 0.30 | 4.27 | 62.7 | 0.36 | 10.0 | 37.3 | 5.4 | 90.0 |

Encouraged by the improved rougher performance, additional Jameson L150 pilot plant tests were conducted under the MF2 circuit configuration, incorporating both the de-slime circuit and revised reagent regime. The combined primary and secondary rougher concentrates were milled in a pilot ISAMill to a P80 of 15 μm before being fed into an L150 Jameson cell operating in open-circuit primary cleaner duty.

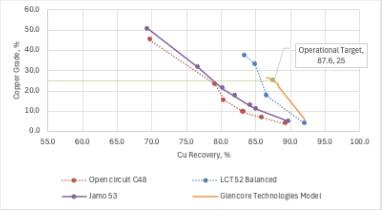

The grade-recovery curve for this“Jamo 53” test is shown in Figure 11, alongside the open-circuit and locked-cycle test results presented in Figure 9 for comparison. The results clearly demonstrate that the L150 open-circuit test outperformed the C48 baseline. To predict closed-circuit performance, all pilot plant, three-stage dilution, and locked-cycle test results were provided to Glencore Technologies, who incorporated the data into a closed-circuit simulation model.

Figure 11: Conventional vs Jameson cell performance in open and closed circuit

The modeled grade-recovery curve for the Jameson cleaner circuit (Figure 11) indicates that at a concentrate grade of 25% Cu, the circuit is expected to deliver recoveries of up to 87.6%. Importantly, because the simulation is based on test work completed at an accredited laboratory, Glencore Technologies is prepared to offer a process guarantee for this performance.

Quality Control:

All metallurgical test work was carried out at Base Metallurgical Laboratories Ltd. (Base Met Labs) in Kamloops, British Columbia. The laboratory maintains rigorous internal quality control protocols to ensure the accuracy and reliability of reported data. Base Met Labs participates in the Intertek Global Proficiency Program, conducting regular internal proficiency testing as part of its quality assurance procedures.

Qualified Person Statement:

The information in this news release relating to metallurgical test work results is based on, and fairly reflects, information reviewed by Dr. Aghil Ojaghi, P.Eng., Senior Process Engineer at DRA for the Copperwood Project and independent from the Company. Dr. Ojaghi is a Qualified Person under National Instrument 43-101 – Standard of Disclosure for Mineral Projects. He is a professional engineer with relevant experience in metallurgical testing and process plant design and has reviewed and approved the technical content as it pertains to his area of responsibility. Dr. Ojaghi consents to the inclusion of this information in the form and context in which it appears.

The overall technical content of this news release has been reviewed and approved by Dr. Wynand van Dyk, a Qualified Person as defined by NI 43-101. Dr van Dyk is employed as Project Director by Copperwood Resources Inc, a wholly owned subsidiary of Highland Copper.

About Highland Copper Company:

Highland Copper Company Inc. is a Canadian company focused on exploring and developing copper projects in the Upper Peninsula of Michigan, U.S.A. The Company owns the Copperwood deposit through long-term mineral leases and 34% of the White Pine North project through a joint venture with Kinterra Copper USA LLC. The Company also owns surface rights securing access to the Copperwood deposit and providing space for infrastructure at Copperwood as required. The Company has 736,363,619 common shares issued and outstanding. Its common shares are listed on the TSX Venture Exchange under the symbol "HI" and trade on the OTCQB Venture Market under symbol "HDRSF".

More information about the Company is available on the Company's website at and on SEDAR+ at .

Cautionary Note Regarding Forward-Looking Information:

This news release contains“forward-looking statements” and“forward-looking information” (collectively“forward-looking statements”) within the meaning of applicable Canadian securities legislation. These statements include, without limitation, statements with respect to: the potential to advance engineering studies and project optimization at Copperwood, and the anticipated benefits thereof; the completion of lock-cycle variability testing in Q4 2025; completion of process design criteria; and the determination to make a construction decision in 2026. The forward-looking statements are subject to a number of assumptions, including those set out in the technical reports entitled“Feasibility Study Update Copperwood Project Michigan, USA” and the Company's annual information form for the year ended June 30, 2024 (the“AIF”). These underlying assumptions may prove to be incorrect. Important factors that could materially impact the Company's expectations include: the results of metallurgical testing in laboratory environments may not be repeated in industrial settings; reagent prices are subject to fluctuations, which may reduce or eliminate expected reagent cost savings; new flow designs may change capital cost requirements, which have not yet been estimated; completion of remaining work programs may not lead to a construction decision; changes in project parameters as plans continue to be refined; availability of services, materials and skilled labour to complete work programs, testing and drilling; effects of regulation by governmental agencies; the fact that permit extensions, renewals and amendments are subject to regulatory approvals, which may be conditioned, delayed or denied; advancement to a construction decision at Copperwood is subject to additional studies, for which the Company will require additional funds, which may not be available on a timely basis and accordingly could delay a construction decision; the Company will be required to repay the loan facility from Kinterra in July, 2026, or will have its interest at White Pine diluted; unexpected cost increases, which could include significant increases in estimated capital and operating costs and the effects of inflation; fluctuations in metal prices and currency exchange rates; general market and industry conditions, the results of baseline studies and test work may result in unforeseen issues which could delay or hamper advancement of the projects, and the other risks set out in the Company's public disclosure documents, including the AIF, filed on SEDAR+. Although the Company believes that the assumptions and factors used in preparing the forward-looking statements in this news release are reasonable, undue reliance should not be placed on forward looking statements. All forward-looking statements in this press release are based on information available to the Company as of the date hereof, and the Company undertakes no obligation to update forward-looking statements except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information or media requests, please contact:

Barry O'Shea, CEO

Email: ...

Website:

1 See“Feasibility Study Update Copperwood Project Michigan, USA” with an Effective Date of March 6, 2023, prepared for the Company by G Mining Services Inc. available under the Company's profile at

2 The SGS report entitled“Optimization Flotation Testwork on Material from the Copperwood Deposit”, Project 16256-002-Final Report, August 28, 2018 forms the baseline used in the previous process design, and is discussed in the 2023 Feasibility Study (FSU) for the Copperwood project.

Photos accompanying this announcement are available at

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment