India Data Center Colocation Market To Surpass USD 5.54 Billion By 2030 With Occupancy Rates Exceeding 90% Arizton

"India Data Center Colocation Market Research Report by Arizton"Get Insights on 207 Existing Colocation Data Center Facilities across India

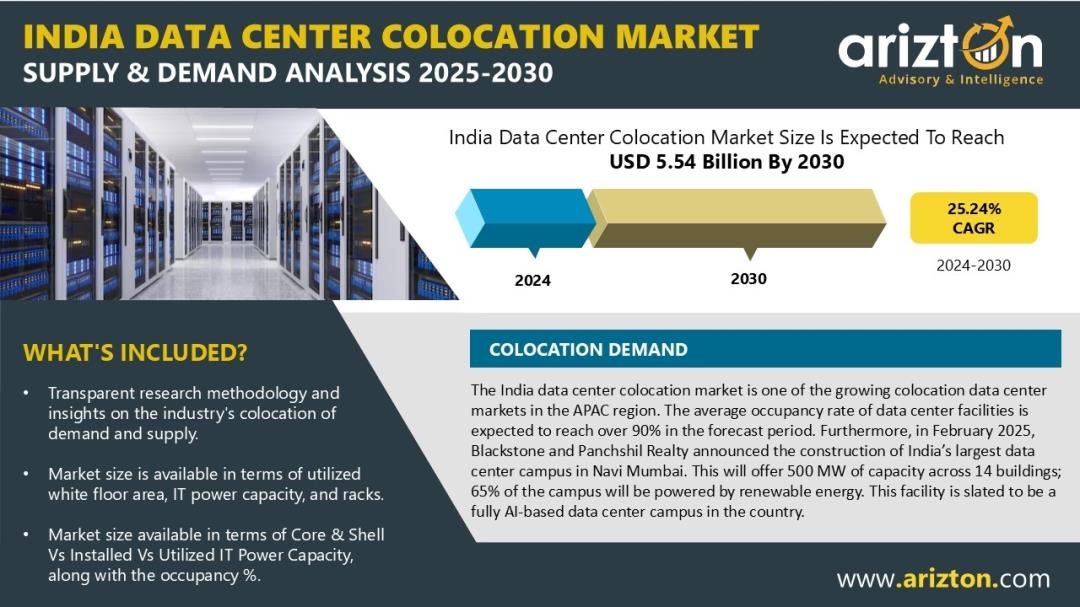

According to Arizton's latest research report, the India data center colocation market is growing at a CAGR of 25.24% 2024-2030.

Explore the Full Market Insights:

Report Summary:

MARKET SIZE - COLOCATION REVENUE: USD 5.54 Billion (2030)

CAGR - COLOCATION REVENUE: 25.24% (2024-2030)

MARKET SIZE - UTILIZED WHITE FLOOR AREA: 18.30 million sq. feet (2030)

MARKET SIZE - UTILIZED RACKS: 473.74 thousand units (2030)

MARKET SIZE - UTILIZED IT POWER CAPACITY: 3,900 MW (2030)

BASE YEAR: 2024

FORECAST YEAR: 2025-2030

India Data Center Colocation Market Outlook: Expected to Reach USD 5.54 Billion by 2030

The India data center colocation market is expanding rapidly, driven by rising digitalization and growing demand for high-megawatt campuses. Leading operators, including AdaniConneX, NTT DATA, CapitaLand, Colt Data Centre Services, Yotta Infrastructure, ST Telemedia, CtrlS, and Nxtra by Airtel, are developing facilities exceeding 100 MW, signaling strong growth in large colocation data centers.

As one of the fastest-growing colocation data center market in the APAC region, the average occupancy rate of data center facilities is expected to reach over 90% in the forecast period. Furthermore, in February 2025, Blackstone and Panchshil Realty announced India's largest data center campus in Navi Mumbai, 500 MW across 14 buildings, 65% powered by renewable energy, and fully AI-enabled.

Other major operators, including NTT DATA, CtrlS, Sify, ST Telemedia, Princeton Digital Group, Iron Mountain, Equinix, Colt, and Yotta, are poised to benefit from the rising demand. Additionally, AWS plans a USD 8.20 billion investment in Maharashtra by 2030, further boosting cloud adoption, job creation, and India's digital economy. These trends underscore India's emergence as a key data center colocation hub, driven by renewable energy integration, AI-driven operations, and large-scale campus developments.

Why India is Becoming a Hotspot for Colocation Investments

-

Growing Economy: India is the fifth-largest economy with a GDP of over USD 3.94 trillion (2024) and aims for high middle-income status by 2047.

Strong Connectivity: 19 operational submarine cables and 5 upcoming ensure reliable domestic and international data links.

Natural Disaster Risk: India faces cyclones, rainfall, landslides, and earthquakes, with a World Risk Index of 41.52, requiring resilient data center planning.

Skilled Workforce Demand: 8.3% unemployment highlights opportunities for talent in IT, cloud, and data center operations.

Data Protection Framework: The Digital Personal Data Protection Act, 2023 ensures secure and compliant handling of personal data, building investor confidence.

IoT and Big Data: Shaping India's Digital Future

The adoption of Internet of Things (IoT) and big data is accelerating in India, enabling companies to collect and analyze vast amounts of data for real-time insights, enhanced storage, scalability, and cost efficiency. Key sectors such as BFSI, healthcare, education, energy, and telecom are investing heavily in these technologies. Supported by initiatives like the Smart Cities Mission and Make in India, the government is collaborating with IoT companies to drive innovation. Rapid digitalization is fueling the adoption of IoT, AI, and big data, ensuring efficient data transfer, minimal delays, and high-speed connectivity across industries.

Vendor Landscape

Existing Colocation Operators

-

AdaniConneX

Nxtra by Airtel

Colt Data Centre Services

CtrlS Datacenters

Digital Connexion

Equinix

ESDS

Iron Mountain

Larsen & Toubro

NTT Data

Princeton Digital Group

RackBank

Sify Technologies

ST Telemedia Global Data Centres

Yotta Infrastructure

Bridge Data Centres

NxtGen Data Centre

Pi Datacenters

Other Data Center Facilities

New Colocation Operators

-

Blackstone & Panchshil Realty

ZR Power

CapitaLand

Digital Edge

Everstone

NES Data

SLG Capital

Techno Electric & Engineering (TEECL)

VueNow Group

What's Included in the India Data Center Colocation Market Study

The report offers clear insights into India's colocation market, covering market size by IT power, white floor area, and racks, occupancy trends, and Core & Shell vs Installed vs Utilized capacity. It analyzes current and future colocation demand, cloud operations, sustainability, and submarine cable developments. The study also provides a snapshot of 120 existing and 87 upcoming facilities across 15+ states, along with revenue, pricing trends, growth opportunities, and competitive landscape.

Related Reports That May Align with Your Business Needs

Japan Data Center Colocation Market - Supply & Demand Analysis 2025-2030

APAC Data Center Colocation Market - Industry Outlook & Forecast 2025-2030

What Key Findings Will Our Research Analysis Reveal?

-

What is the count of existing and upcoming colocation data center facilities in India?

How much MW of IT power capacity is likely to be utilized in India by 2030?

Who are the new entrants in the Indian data center industry?

What factors are driving the Indian data center colocation market?

Why Arizton?

100% Customer Satisfaction

24x7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton's report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

-

1hr of free analyst discussion

10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- What Is The Growth Rate Of The Europe Baby Food And Infant Formula Market In 2025?

- UK Digital Health Market To Reach USD 37.6 Billion By 2033

- Spycloud Launches Consumer Idlink Product To Empower Financial Institutions To Combat Fraud With Holistic Identity Intelligence

- Cryptogames Introduces Platform Enhancements Including Affiliate Program Changes

- What Does The Europe Cryptocurrency Market Report Reveal For 2025?

- Excellion Finance Launches MAX Yield: A Multi-Chain, Actively Managed Defi Strategy

Comments

No comment