What Makes A Lending Platform Trustworthy? A Checklist For Crypto Investors

Here is the thing: avoiding losses like that is not the same thing as avoiding risk. Success in today's $31 billion DeFi lending market depends on spotting the traits of trustworthy platforms and the red flags of those running on hype.

Let's dive in.

Collateral SecurityAsking a traditional bank for a $100,000 loan means endless paperwork, including bank statements and maybe even your firstborn's credit score. However, none of this matters with DeFi protocols. Millions leave these platforms for lenders based on volatile crypto tokens that might lose a significant part of their value overnight.

Collateral ModelsOvercollateralized models requiring up to 150% to 200% of the loan value in cryptocurrency create a perception of safety. Nevertheless, issues often arise during recessions. These over-leveraged lending protocols trigger liquidation cascades as they struggle to liquidate collateral quickly, leading to entire ecosystems' destabilization.

A newer approach is the use of real-world assets (RWAs) as collateral. Here, tangible assets like real estate, inventory, or machinery are tokenized and used to secure loans.

In contrast to the volatility-prone crypto assets, the RWA market has seen increased adoption with a year-on-year growth of up to 200% in tokenized RWAs. This is far from just a trend, but institutions appreciate that having assets with intrinsic, measurable value yields stability.

Red Flags to AvoidSome weaknesses in collateral systems are obvious, but many are hidden in plain sight, and investors easily miss them:

- Anonymous or unverified collateral claims: If a platform won't show you exactly what backs each loan, you're essentially betting on their word, which is like groping in the dark. Purely algorithmic asset pricing without human oversight: The bZx attack , which caused nearly $1 million in losses, proves how algorithmic vulnerabilities can be systematically manipulated. Lack of independent appraisals or documentation: This is indicative of a lack of transparency, which is also very risky for your investment. Single-asset concentration: If a platform relies on one asset class, a downturn there can threaten its entire solvency.

Just as there are red flags, there are also green flags that point to a platform's reliability:

- Physical asset backing with proper documentation Independent third-party appraisals Diverse collateral portfolio across asset classes

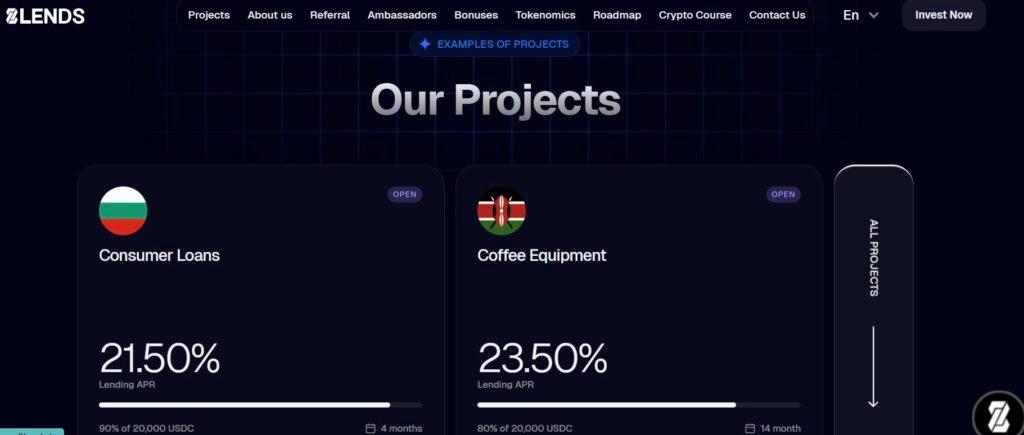

8lends meets all of these standards. It backs each loan with tangible collateral spread across multiple asset types like real estate, business inventory, and crypto.

On top of that, 8lends has a unique credit scoring system which allows up-and-comers shut out of the traditional banking system to execute societally beneficial and lucrative ideas with the support of a community of investors. Risk scoring is done between D and AAA, consistent with the top credit agencies, and built based on three weighted components:

- financial risk qualitative risk coverage & liquidity

This helps organizations make well-guided decisions, communicate with stakeholders, and monitor things that they can improve. This builds a foundation that stands the test of any crypto volatility cycle.

Due Diligence and Transparency StandardsWhen evaluating lending platforms, anonymous borrowers, weak transparency, and poor vetting processes are major red flags.

The Problems with Anonymous LendingThe ability to hold individuals accountable when lending goes wrong is a systemic problem that is typical of anonymous lending in crypto. Since borrowers are anonymous, the informed risk taken with lending suddenly turns into statistical gambling. Smart contracts may automate execution, but they can't replace human safeguards, such as legal action in the case of default.

Essential Transparency MarkersTransparency should be visible at every stage of the loan. Key markers include historical performance data, clear use-of-funds documentation, and borrower identity verification. These indicators are essential for meaningful due diligence.

Your Investment Evaluation FrameworkA solid framework can mean the difference between calculated risk and blind betting.

Focus on five key pillars:

- Transparency standards Collateral verification Regulatory compliance Legal enforceability Operational track record

If a platform falls short on any of these, it's worth rethinking your decision.

Ready to put this framework into practice?

With its diversified, real-world collateral, transparent borrower verification, and zero-commission lending model, 8lends gives you the confidence to grow your portfolio without blindly betting on hype. Don't settle for promises – invest where accountability meets innovation.

Explore opportunities with 8lends today and see how secure lending should be.

Crypto Investing Risk Warning

Crypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment