403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Cintas Corporation (CTAS) Stock Signal 23/07: (Chart)

(MENAFN- Daily Forex) Short Trade IdeaEnter your short position between 217.92 (the descending midpoint of its bearish price channel) and 221.32 (the close of its last bullish candle).Market Index Analysis

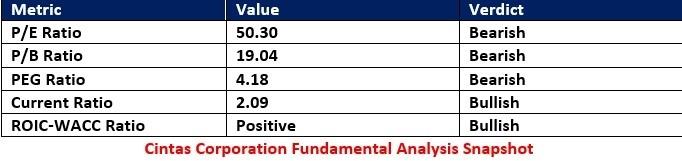

- Cintas Corporation (CTAS) is a member of the NASDAQ 100 and the S&P 500. Both indices are near record highs with technical cracks flashing warning signals. The Bull Bear Power Indicator of the S&P 500 shows a negative divergence.

- The CTAS D1 chart shows price action inside a bearish price channel. It also shows a breakdown below the 50.0% Fibonacci Retracement Fan level. The Bull Bear Power Indicator is bullish but displays rising bearish momentum. Trading volumes are higher during selloffs than during rallies. CTAS corrected as the S&P 500 Index rallied to fresh highs, a significant bearish development.

- CTAS Entry Level: Between 217.92 and 221.32 CTAS Take Profit: Between 184.61 and 196.38 CTAS Stop Loss: Between 229.24 and 236.12 Risk/Reward Ratio: 2.94

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Tappalpha's Flagship ETF, TSPY, Surpasses $100 Million In AUM

- Nigel Farage To Headline At UK's Flagship Web3 Conference Zebu Live 2025

- PU Prime Launches Halloween Giveaway: Iphones, Watches & Cash Await

- Cregis And Sumsub Host Web3 Compliance And Trust Summit In Singapore

- Luminadata Unveils GAAP & SOX-Trained AI Agents Achieving 99.8% Reconciliation Accuracy

- BTCC Exchange Announces Triple Global Workforce Expansion At TOKEN2049 Singapore To Power Web3 Evolution

Comments

No comment