Switch Announces $3.5 Billion In Securitized Debt Financings

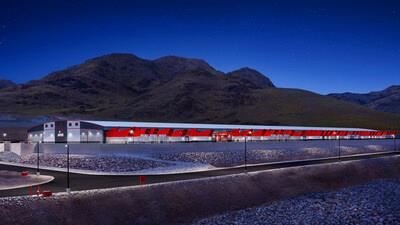

Switch Citadel Campus, Tahoe-Reno

Switch logo (PRNewsFoto/Switch)

The issuances include an inaugural $2.4 billion CMBS offering and a $1.1 billion ABS offering

LAS VEGAS, March 25, 2025 /PRNewswire/ -- Switch , a premier provider of AI, cloud and enterprise data centers, today announced the successful completion of two securitized financing transactions. The transactions include a $2.4 billion Single Asset Single Borrower (SASB) CMBS loan and a $1.1 billion Asset Backed Security (ABS) issuance. The combined proceeds, totaling $3.5 billion, will refinance the majority of the company's outstanding acquisition financing, which supported the take-private transaction led by DigitalBridge and IFM Investors in December 2022.

"We are thrilled to announce the completion of two landmark transactions: our third ABS and our inaugural CMBS issuances. These comprised $3.5 billion of new securitized debt, bringing our total issuance over the past 12 months to more than $5.2 billion," said Thomas Morton, President of Switch. "These two transactions, which we successfully closed only one month apart, make Switch the largest issuer of securitized data center paper during the past year."

Highlights :

-

The CMBS issuance of $2.4 billion is the largest green data center CMBS transaction ever completed, and the second largest data center CMBS transaction in history

The ABS offering of $1.1 billion is the third in our master trust which now totals $2.8 billion, and the largest green data center ABS transaction ever completed

Switch is the largest data center ABS issuer over the past 12-months

"Both of these transactions mark significant milestones in repaying our acquisition financing and their timing highlights the resiliency of the Switch platform and our ability to access the capital markets at scale," said Madonna Park, Chief Financial Officer of Switch. "New and existing investors continue to show strong interest in our differentiated assets and business model, and we plan to remain a repeat issuer."

CMBS

Switch's inaugural CMBS transaction includes its Las Vegas 7, Las Vegas 9 and Reno 2 data centers. The $2.4 billion offering includes 66 unique investors across seven tranches. All series of notes in this CMBS issuance were designated as green bonds and received second-party opinion (SPO) from Sustainalytics.

Citigroup Global Markets Inc., Barclays, Goldman Sachs & Co. LLC, RBC Capital Markets and Wells Fargo Securities, LLC led the transaction as Co-Lead Managers and Joint Bookrunners. Switch was advised by Simpson Thatcher & Bartlett LLP, Dechert LLP served as lenders' counsel and Orrick, Herrington & Sutcliffe LLP represented the underwriters.

ABS

Switch closed its third ABS issuance on March 13, 2025, for $1,093 million. This transaction includes its Las Vegas 10 and Las Vegas 11 data centers. The $1.1 billion offering was structured to include two classes of notes. All series of notes in this issuance were designated as green bonds under International Capital Markets Association green bond principles in accordance with Switch's Green Financing Framework. The deal was led by Morgan Stanley and TD Securities (USA) LLC as Co-Structuring Advisors.

In addition to Co-Structuring Advisors Morgan Stanley and TD Securities, BMO Capital Markets, MUFG and Société Generale acted as Joint Bookrunners. Citizens Capital Markets, ING, Scotiabank, Standard Chartered Bank and Truist Securities acted as Passive Bookrunners. BofA Securities, BNP Paribas, CIBC Capital Markets, Mizuho, Natwest, PNC Capital Markets LLC, and SMBC Nikko acted as Co-Managers. Switch was advised by Kirkland & Ellis and Latham & Watkins represented the underwriters.

About Switch

Switch, founded in 2000 by CEO Rob Roy, stands at the forefront as the leading data center campus designer, builder and operator. As the AI, cloud and enterprise data center experts, Switch provides the most modular, scalable and sustainable data centers to the most discerning clients. The company offers a comprehensive, future-proof portfolio ranging from highly dense liquid cooled AI to hyperscale cloud and the industry's highest rated and most-secure enterprise data centers. To learn more, visit and follow Switch on LinkedIn , Facebook and X .

SOURCE Switch, Ltd.

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE? 440k+Newsrooms &

Influencers 9k+

Digital Media

Outlets 270k+

Journalists

Opted In GET STARTED

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment