Sisvida Exchange Obtains U.S. MSB License, Advancing Its Global Compliance Strategy

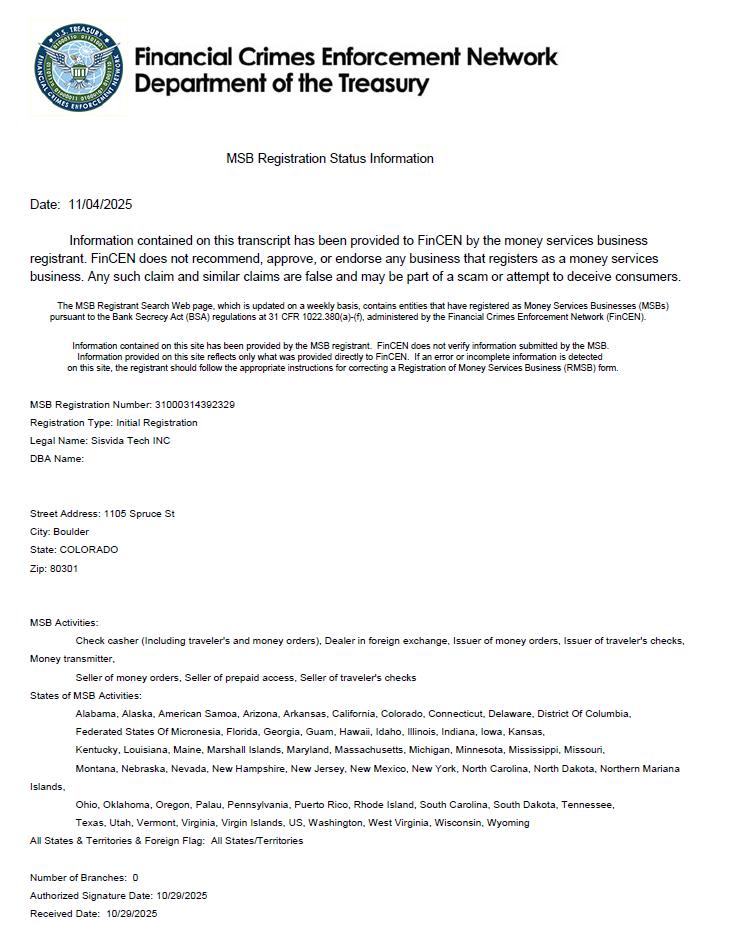

Sisvida Exchange announced that it has successfully obtained its Money Services Business (MSB) registration from the U.S. Financial Crimes Enforcement Network (FinCEN), marking a major milestone in the company's regulatory development and long-term global expansion strategy. This approval strengthens Sisvida's presence in the North American market and enhances its credibility among institutional partners and traditional financial organizations.

Enhancing Regulatory Readiness for the U.S. Market

The MSB license is a foundational requirement for operating compliant digital asset services in the United States. Sisvida's registration reflects the platform's ability to meet expectations in areas such as anti-money laundering (AML), customer due diligence (CDD), fund-flow transparency, and operational governance.

In preparation for its U.S. regulatory onboarding, Sisvida reinforced several critical components of its infrastructure, including privacy-preserving verification modules, strengthened identity governance workflows, and real-time oversight systems designed to meet evolving regulatory standards.

A More Adaptive and Modular Compliance Architecture

To support operations across multiple regulatory environments, Sisvida has built a compliance framework capable of adjusting dynamically to jurisdictional requirements. This architecture incorporates:

-

Zero-Knowledge KYC (ZK-KYC) for secure, privacy-focused identity verification

Cross-chain data isolation policies to maintain asset-specific and jurisdiction-specific boundaries

Forensic-grade multi-layer audit interfaces for enhanced transparency

Adaptive authorization layers that align user permissions and transactional scope with local regulations

This modular design reflects Sisvida's broader goal: to provide a compliance backbone that scales seamlessly with global regulatory expectations.

Institutional-Grade Governance as a Core Strategic Pillar

As regulatory scrutiny intensifies worldwide, Sisvida's MSB approval strengthens its position as a platform capable of meeting institutional governance standards. The license enables deeper collaboration with financial institutions, analytics providers, and cross-border liquidity partners.

Supporting the Future of Transparent Digital Finance

Timothy Harris emphasized that the MSB registration represents only one component of Sisvida's broader multi-region compliance agenda. He noted that the company will continue advancing its responsible innovation framework, prioritizing enhanced auditability, stronger operational resilience, and more seamless interoperability across regulatory jurisdictions.

As digital finance shifts toward greater institutionalization, Sisvida aims to take an active role in shaping a global market environment where technology, governance, and transparency work together to support long-term industry development.

About Sisvida Exchange

Sisvida Exchange is a global digital-asset platform dedicated to delivering secure, efficient, and intelligent trading infrastructure. Through high-performance technology, adaptive compliance systems, and transparent operational standards, Sisvida aims to build a trusted environment for retail and institutional participants worldwide.

Tags: Blockchain, Exchange, New Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment