(MENAFN- ING)

Above-target inflation amid lower rates and slower growth

The revised CNB projection delivers lower interest rates, slower economic expansion, and higher inflation. It seems a rather unlucky combination, however, the shift is in line with our own view of the unsatisfactory state of the Czech Economy in the context of the European economic underperformance.

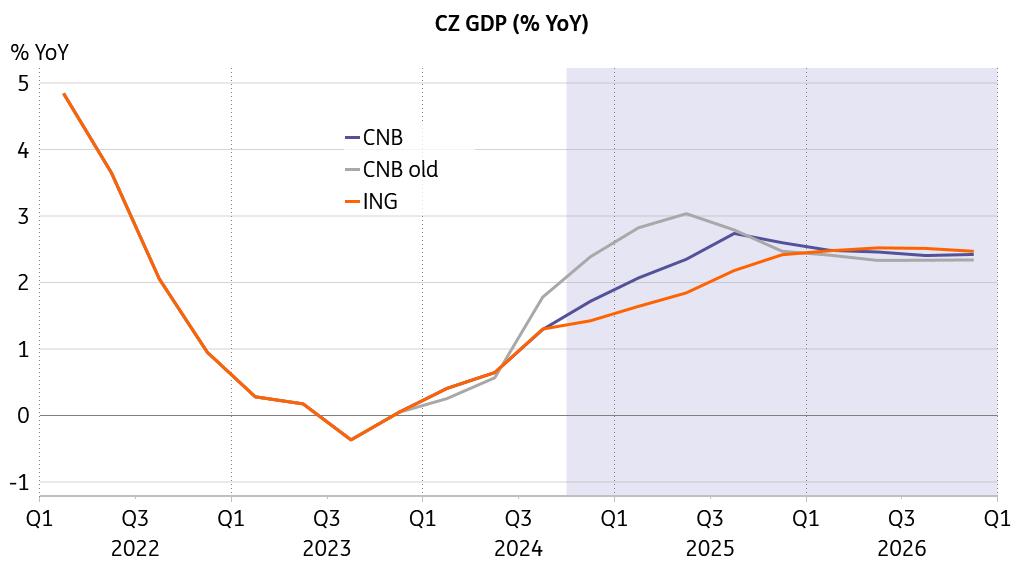

Economic recovery to carry on only gradually

Source: CNB, ING, Macrobond

The CNB model now assumes a 2.5% potential GDP growth. However, we see the potential growth as a bit more of a dynamic unobserved variable, which can degrade once the economy is not expanding, attracting investment, and broadly flourishing. Our estimate of potential growth for the end of this year is only 1.6%, reflecting the non-existent productivity growth, chronic underinvestment, lack of innovation, and deterioration in aggregate skillsets over the past five years. Despite such weak potential, the estimated output gap is mildly negative when computed in levels as a percentage of the cyclical growth component related to the potential component of economic growth. A negative output gap normally suggests an anti-inflationary setup of the economy when inflation is expected to decelerate or hover below the inflation target.

Still, the inflation rate in both the CNB and ING projection is expected to remain at the upper-bound threshold of the tolerance band for more than a year. We interpret such a situation as a negative supply shock that the European economy is experiencing, a situation when less output is produced at a higher cost. Should the Czech economic expansion gain pace, the potential output could gradually drift toward some 2%, and the output gap would close late next year. This is a situation when the economy operates at full capacity, yet it does not imply elevated price pressures, and inflation could come close to the target unless there is some other issue that has shifted inflation structurally higher than what we were used to.

Low potential growth and negative output gap Source: ING, Macrobond

Inflation was revised surprisingly upwards, especially in combination with the significantly lower outlook for nominal interest rates. Moreover, a significant portion of the rate revision is due to expert judgment and the adjustment of previously introduced manual interventions in the model forecast. The higher inflation path likely also reflects a bold revision in the exchange rate toward a noticeably weaker koruna over the forecast horizon.

Inflation to stay above the target Source: CNB, ING, Macrobond

Next week's CPI reading will likely bring an upward shift in both headline and core inflation, reflecting the still robust household spending. Food prices represent a wild card in the October reading, as firmer pricing in world food commodities and the weaker koruna, especially vis-à-vis the greenback, could push food price tags higher than assumed. In combination with a possibly less pronounced reduction in electricity end prices than announced by the major distributors, headline inflation could reach the upper limit of the CNB tolerance band in the forthcoming CPI print already. We expect headline inflation to peak at 3.4% in December.

Is the perception of on-target inflation shifting?

Core inflation averages 0.7% when looking at the period between 2009 and 2019. Meanwhile, core inflation jumped to 6.5%, considering the average from 2020 onward. This is a major shift in underlying price dynamics and in the overall cost of living. Nota bene, both headline and core inflation is likely to remain well above the inflation target over the coming year, at least. To be fair, the situation is not very different in many other countries when it comes to the main takeaway. Core inflation in Germany averaged 1.2% throughout the decade after 2009, while its average jumped to 3% for the period starting in 2020, which is more than double.

Core inflation is structurally higher Source: Macrobond

Such a setup represents a very different environment from the perspective of households. One could ask whether there is some shift in the definition of hitting the inflation target. Is it now perhaps shifting in the sense that inflation moving close to 3% is good enough? Perhaps not from the perspective of the monetary institutions, yet it might be perceived like that from the perspective of households. And, of course, your commitments are essential, especially if in the role of a central banker, but what is delivered in reality is what counts eventually. We believe that there is still some room for further monetary easing, but the degraded potential of the economy implying structurally higher inflation will prevent the base rate form declining too low too quickly. We expect the cutting cycle to resume in March next year, bringing the rate towards 3.25% in June.

Rates to go down only slowly and remain above 3% Source: CNB, ING, Macrobond

MENAFN08112024000222011065ID1108866487

Author:

David Havrlant

*Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/about/disclaimer/

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.