(MENAFN- GlobeNewsWire - Nasdaq) New York, NY, Nov. 04, 2024 (GLOBE NEWSWIRE) -- Tide Capital has observed an increase in Cryptocurrency allocations by institutional investors. bitcoin is beginning to outperform U.S. Stocks and gold, indicating a new main uptrend may be on the horizon. While the Altcoin season has yet to commence, Tide Capital believes the meme sector deserves close attention.

Macro Stability Fuels Risk Asset Rally

As we enter the fourth quarter, Tide Capital notes that the U.S. Economy exhibits resilience, with inflation effectively controlled. market expectations for a“soft landing” have solidified. Supported by robust fiscal and monetary policies, U.S. stock markets are reaching new highs, benefiting overall risk assets.

However, the significant U.S. debt increase to stimulate the economy has raised concerns about trust in the dollar. Investors are turning to gold as a hedge against potential dollar credit collapses, driving gold prices to new records.

In this context, Bitcoin, often referred to as“digital gold”, has surged past $70,000. Unlike six months ago, Bitcoin has undergone effective consolidation, absorbing previous selling pressures and resulting in a healthier holding structure.

Overall, the macro environment appears stable, with risk assets benefiting from U.S. fiscal and monetary support. Looking ahead, Tide Capital anticipates further interest rate cuts from the Federal Reserve and an end to quantitative tightening (QT) next year, enhancing liquidity for risk assets.

BTC Outperforms U.S. Stocks and Gold: Main Uptrend May Be Underway

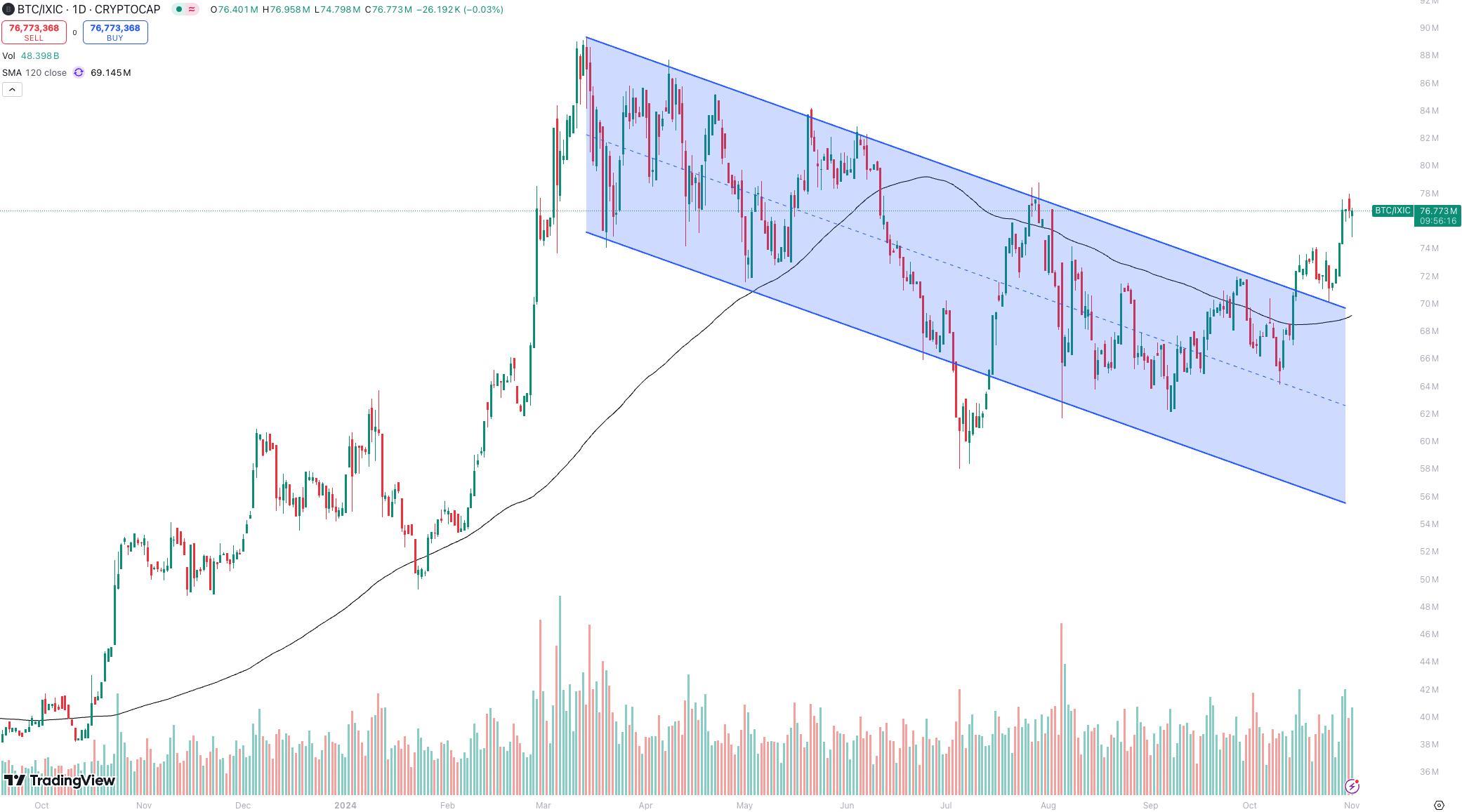

Importantly, Tide Capital noted that Bitcoin has recently outperformed the Nasdaq index. The BTC/NASDAQ ratio has broken through its downward trend, stabilizing above the 120-day moving average, indicating a shift in institutional asset allocation toward Bitcoin.

Meanwhile, MSTR, a shadow stock of Bitcoin, has outperformed Bitcoin itself, reaching historical highs. MSTR's business model focuses on issuing bonds to purchase Bitcoin, effectively serving as a leveraged instrument for Bitcoin investments. MSTR's continued rise reflects strong institutional confidence in Bitcoin's future performance.

In tandem with these developments, Bitcoin ETFs have seen significant inflows over the past few days, reminiscent of the substantial BTC price increases following the introduction of Bitcoin ETFs. On October 30, Bitcoin ETFs recorded a net inflow of $900 million, marking the second-highest single-day total on record.

CME data, reflecting U.S. institutional trading activity, indicates a significant rise in BTC futures open interest, reaching a new high of $12.7 billion.

These data points signal a substantial uptick in institutional interest in Bitcoin, with off-market funds accelerating their inflow into BTC. As Bitcoin begins to outperform other asset classes, Tide Capital suggests that a new main uptrend may have quietly commenced.

The Altcoin Season Has Not Yet Arrived, but the Meme Sector Is Worth Watching

Despite Bitcoin nearing its historical peak, the overall performance of altcoins remains subdued. Excluding BTC, the total market capitalization of cryptocurrencies (TOTAL2) is still relatively low, failing to surpass September highs, which indicates a lack of upward momentum in the altcoin market.

This trend suggests that new capital inflows are primarily directed toward Bitcoin, with minimal investments in other cryptocurrencies. The dominance of Bitcoin (BTC.D) has recently reached new highs, exceeding 60%. Until Bitcoin breaks its historical peak, Tide Capital anticipates that bullish sentiment will remain focused on BTC, making it challenging for altcoins to attract significant inflows.

However, the meme sector is an exception that Tide Capital is monitoring closely. Among the top 100 tokens, six of the ten best performers over the past 30 days are meme coins. In a constrained funding environment, small-cap meme coins have captured significant attention and liquidity.

The emergence of innovative token issuance and trading platforms is accelerating the adoption of meme coins. For instance, Pump.fun launched on the Solana network this year, offering users convenient meme token issuance and early trading services, with trading volume once accounting for over half of Solana's activity. In October, achieved record levels in both token deployment and revenue, with daily income surpassing $1 million.

Overall, Tide Capital observes that the influence of the meme sector in the cryptocurrency market is continually expanding. Despite the lack of inherent utility in meme tokens, the underlying infrastructure is evolving positively, consistently lowering barriers and enhancing user experience.

As the macro environment becomes more accommodative and investor risk appetite increases, Tide Capital expects that the meme sector may deliver even more impressive performances.

Conclusion

Tide Capital concludes that institutional investors are ramping up their allocations to cryptocurrencies, indicating that BTC's new main uptrend may have quietly begun.

CONTACT: Amber Kim

amber at

MENAFN04112024004107003653ID1108848245

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.