Horizon Robotics, IPO In Hong Kong,Backed By Large Military Company

Established in 2015, Horizon Robotics initially focused on the AIoT field, surveillance and smart city markets . However, after burning through $500 million, Horizon faced a critical juncture in 2019, prompting a significant downsizing and a strategic pivot to the automotive industry .This strategic shift proved advantageous as Horizon Robotics secured its first major automotive client, Changan Automobile, a subsidiary of China South Industries Group Corporation, one of China's largest defense contractors. This partnership enabled Horizon to deploy its AI chips in the automotive sector.

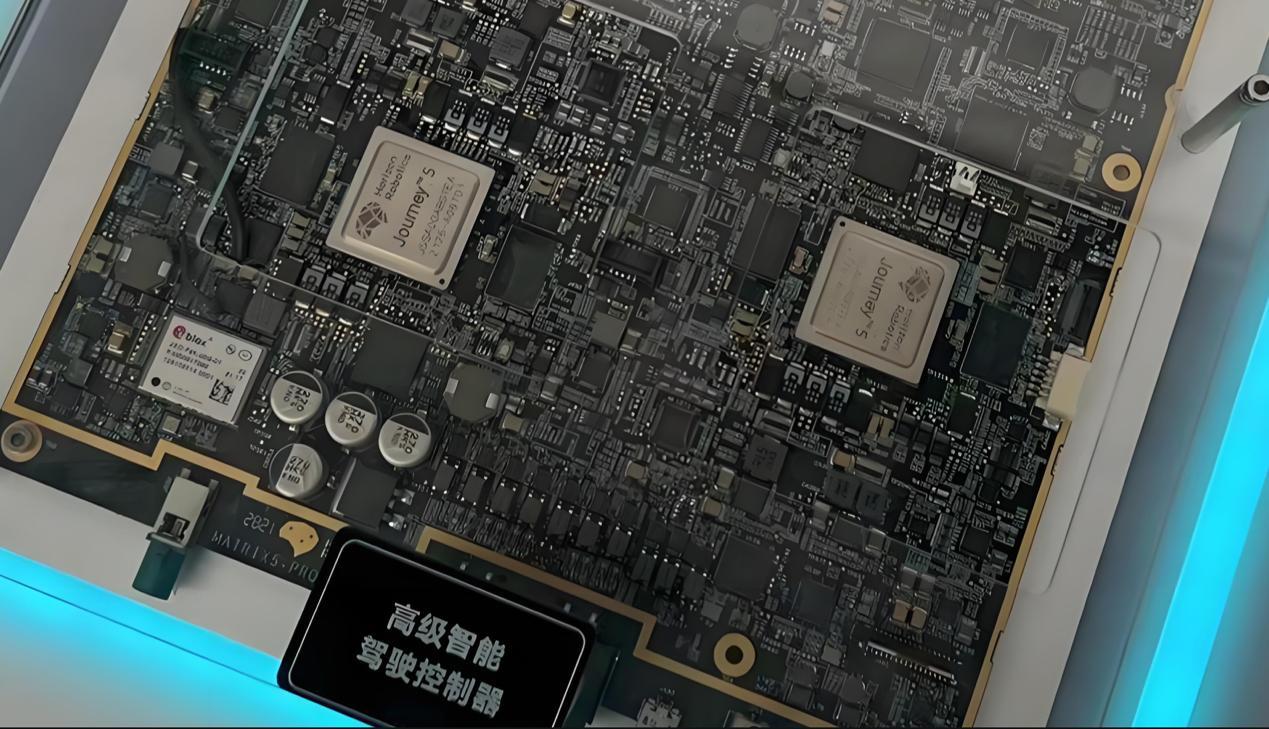

While Horizon Robotics has been struggling with its SOC design since the beginning, the most shipment of its chip is still the imaging processor outsourced from 3rd party design service company back to 2018, the first SOC Journey 5 designed in-house has been proved market failure with shipment only in one car maker since its announced in 2022.

To further solidify its relationship with Changan and its stakeholders to support its business, Horizon Robotics established a joint venture named Changxian Technology. This venture not only supports Changan's comprehensive adoption of Horizon's technology but also positions Horizon to engage in potential confidential projects, given that China South Industries Group Corporation holds a 16.56% stake in the joint venture.

Horizon Robotics also collaborates with China North Industries Group Corporation (Norinco), leveraging its Journey AI chips . These strategic partnerships have fueled Horizon's rapid growth. According to its filing with the Hong Kong Stock Exchange, the company shipped 5 million chips in 2023, generating over RMB 1.5 billion in revenue. Additionally, Horizon formed a joint venture with Volkswagen Group's subsidiary, CARIAD, in December 2023, securing an RMB 1.3 billion investment and a contract worth RMB 600 million, which constituted 40% of its annual revenue.

Disclaimer: The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment