BRIC By BRIC, De-Dollarization Only A Matter Of Time

Trump did not tell his supporters that the measure to protect the dollar would be painful for American households, with many consumer goods likely to double in price. Around 70% of products sold at Walmart and Target are sourced from China, the nation at the forefront of de-dollarization.

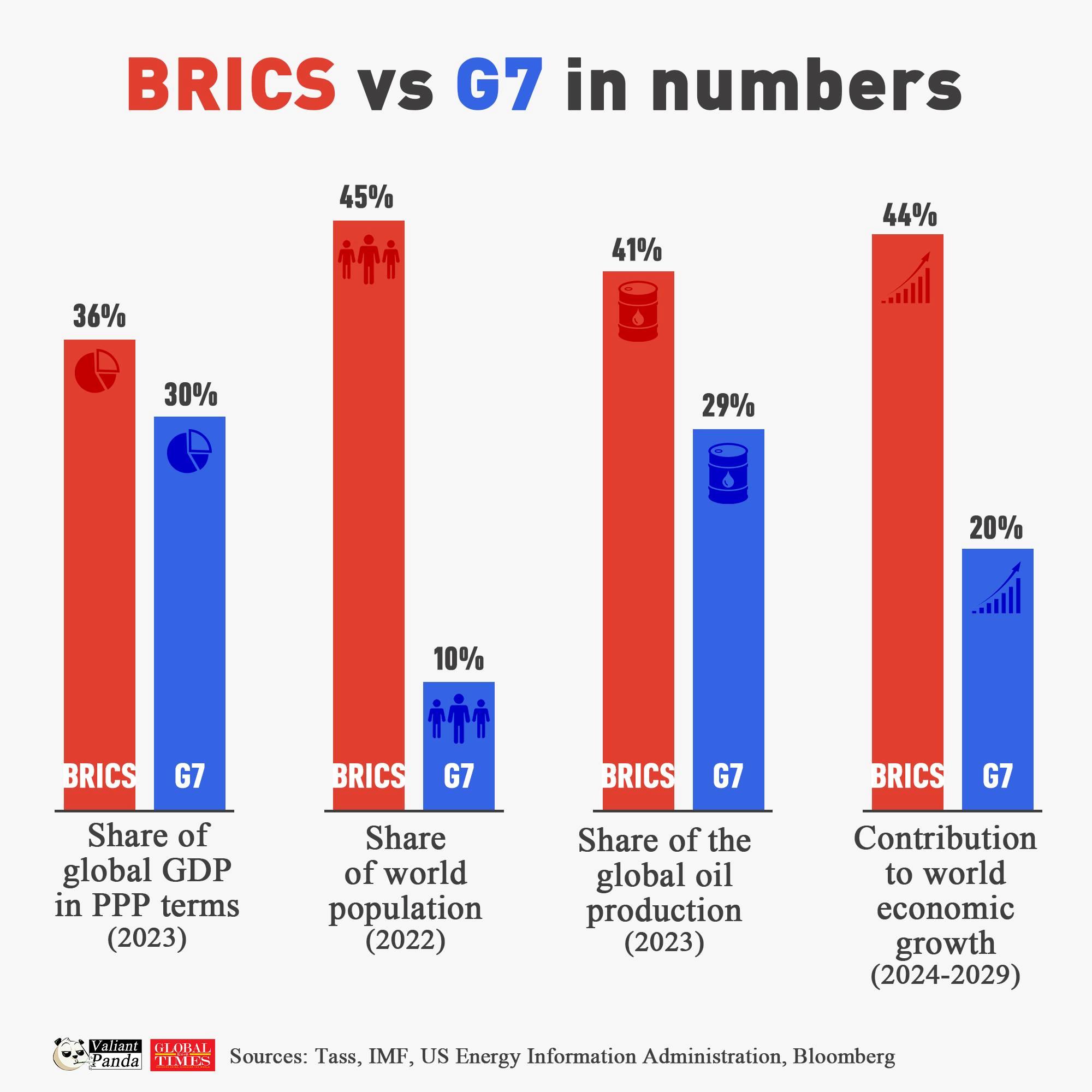

Trump made his announcement on the eve of the highly anticipated annual BRICS summit, scheduled for October 22-24 in Kazan, Russia. Crucially, the meeting may announce a roadmap for developing an alternative to the current dollar-centric global financial system.

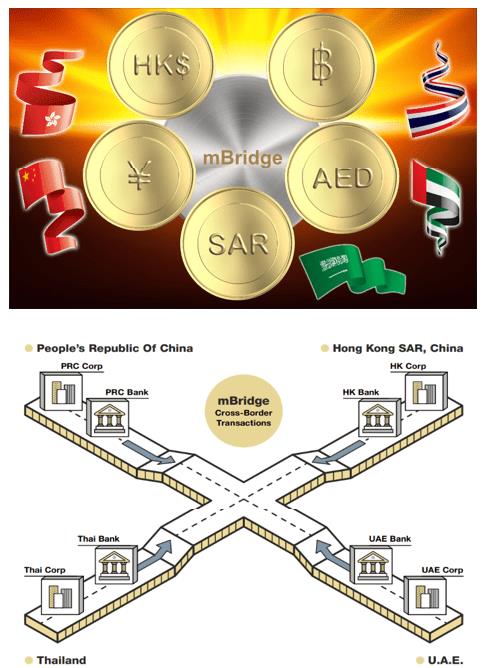

Details are still scarce but some observers expect the meeting will announce a multicurrency payment platform. Some BRICS watchers even predict the announcement of a roadmap for a gold-backed BRICS trading currency.

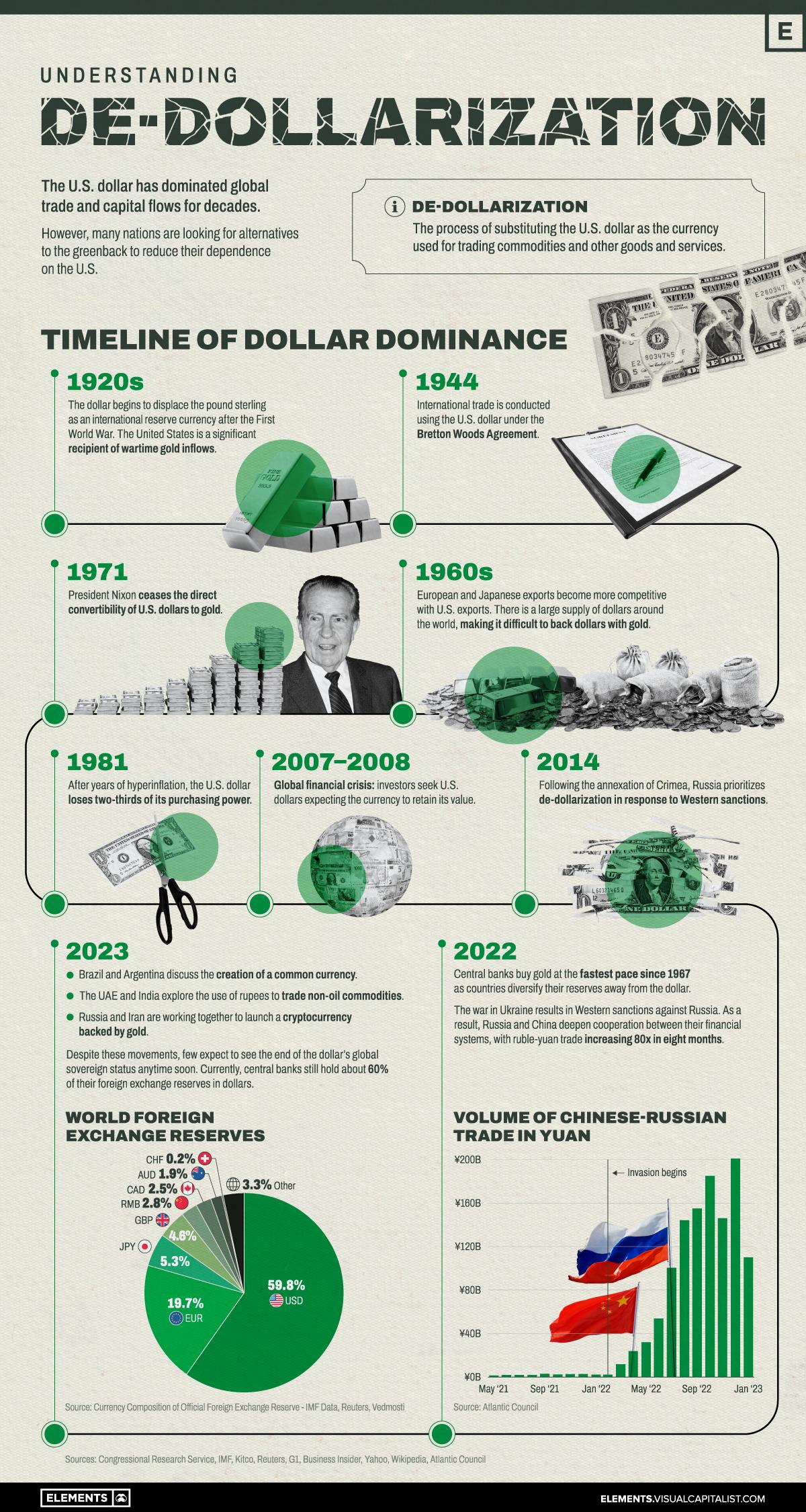

Bretton WoodsThe creation of an alternative to the current dollar system would be historic for several reasons. It would mark the first credible attempt to move past the 1944 Bretton Woods Agreement that established the postwar global financial system.

Under Bretton Woods, the dollar was tied to the fixed price of gold while all other currencies were pegged to the dollar. Nations with dollar-denominated trade surpluses could exchange their dollars for gold with the US central bank at the so-called gold window.

The dollar system created financial stability but gave the US near total control over the global financial system. US banks became the clearinghouses for global trade. A Japanese company buying goods from India had to buy dollars to pay its supplier in India. The centralized system enabled the US to ban any person, business or country from the global financial system.

Bretton Woods started to unravel in 1971 when US President Richard Nixon decoupled the dollar from gold. Faced with rising trade deficits, the US chose to close the gold window rather than balance its trade, effectively defaulting on its Bretton Woods obligations.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment