Daura Capital Corp. Provdes Update On Proposed Qualifying Transaction

| | December 31, 2023* (audited) | December 31, 2022* (unaudited) | |||

| | | | |||

| Total Revenues | S/ | -- | S/ | -- | |

| Net Income (Loss) | S/ | 67,349 | S/ | 81,002 | |

| Total Assets | S/ | 2,960,201 | S/ | 2,808,584 | |

| Total Long-term Liabilities | S/ | 2,688,221 | S/ | 2,761,226 |

* Presented in Peruvian soles ("S/")

About the Qualifying Transaction

Daura entered into a definitive share exchange agreement dated July 16, 2024 (the " Share Exchange Agreement ") with Estrella and the Estrella Shareholders, whereby Daura has agreed to acquire all of the outstanding shares of Estrella from the Estrella Shareholders in exchange for an aggregate of 7,000,000 common shares in the capital of Daura (the " Daura Shares "). It is expected that, upon completion of the proposed Qualifying Transaction, the Company will change its name to Daura Gold Corp. (the " Resulting Issuer "), with Estrella being a wholly owned subsidiary of the Resulting Issuer.

The Qualifying Transaction will be an arm's length transaction and approval from the shareholders of Daura is not expected to be required. No finders fees or commissions are expected to be paid in connection with the completion of the Qualifying Transaction.

Closing of the Qualifying Transaction remains subject to the satisfaction of certain conditions precedent, including but not limited to, closing of the Concurrent Financing (see " Concurrent Financing ", below), satisfactory completion by Daura of its due diligence investigations, and the receipt of all required third party consents, waivers or approvals, including the approval of the TSXV.

Daura previously advanced to Estrella the sum of US$25,000 as a non-refundable deposit, and loaned to Estrella an additional $75,000 and US$115,000 (collectively, the " Loans "). The Loans are secured by the assets of Estrella and bear interest at a rate of 10% per annum. The advance and the Loans were previously provided to Estrella in 2019 and 2020 in connection with the Company's prior efforts to acquire Estrella, which efforts were mutually terminated by the parties due to unfavorable market conditions at the time. However, the Loans remained outstanding due to Estrella's inability to repay them. No new loans or deposits will be advanced to Estrella prior to completion of the Qualifying Transaction.

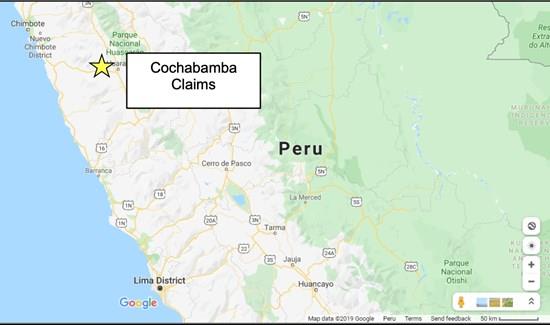

Upon completion of the Qualifying Transaction, it is anticipated that the resulting entity (the " Resulting Issuer ") will cease to be a capital pool company and will be classified as a Tier 2 mining issuer engaged in the business of exploring and developing the Cochabamba Project. In addition, the Resulting Issuer may explore and develop such other properties and interests as may be subsequently acquired by the Resulting Issuer.

Proposed Directors, Officers and Insiders of the Resulting Issuer

Upon completion of the Qualifying Transaction, it is currently anticipated that Daura's existing board of directors, consisting of Mark Sumner, Duncan Quinn-Smith, and Christina Cepeliauskas will remain with the Resulting Issuer, with Dr. Lima, the majority shareholder of Estrella, also expected to join the Resulting Issuer's board of directors. Luis Saenz is expected to be appointed as the Chief Executive Officer of the Company, with William Tsang continuing as the Chief Financial Officer of the Resulting Issuer.

The following provides a brief background of each person who is expected to be a director or officer of the Resulting Issuer upon completion of the Qualifying Transaction.

Luis Saenz, Chief Executive Officer

Mr. Sáenz is a finance executive with over 30 years of experience in corporate finance, strategic consulting, and metal trading with a focus on Latin America. He was recently CEO of Compañía Minera Quiruvilca (Peru) and Director of Business Development for Latin America at the engineering multinational Ausenco (Australia). Mr. Sáenz is founder and former CEO of Li3 Energy (later Bearing Lithium Corp. (TSX: BRZ)), which held a stake in the Maricunga lithium project in Chile, recently sold to Codelco. In addition, he is a Director of Atico Mining Corporation (TSX: ATY), which operates the El Roble mine in Colombia and develops the La Plata polymetallic project in Ecuador. Throughout his career, Mr. Sáenz has held senior executive positions at Standard Bank of South Africa, Merrill Lynch and Pechiney World Trade. He has a BA in Economics and International Affairs from Franklin & Marshall College in Lancaster, PA.

William Tsang, Chief Financial Officer

Mr. William Tsang is currently a Senior Accountant at Seabord Management Inc. He is a Chartered Professional Accountant with a Bachelor of Commerce from the University of British Columbia and has more than 10 years of financial accounting and auditing experience in the mineral exploration and mining industry. He had worked in public practice providing professional services and advice to publicly traded companies on the NYSE, TSX-V, and OTC markets on various public reporting services, such as Qualifying Transactions for Reverse Take-Over, mergers and acquisitions, and financing transactions. In addition to being the current CFO for Daura, Mr. Tsang currently acts as the CFO of Lara Exploration Inc. and Pampa Metals Corporation.

Mark Sumner, Director

Mr. Sumner is the founder and managing director of Kiwanda Group LLC (the "Kiwanda Group"), a US-based resources venture capital business. Founded in 2007, Kiwanda Group has financed mining and exploration projects across a range of commodities and regions, with a particular focus on metals in South America. Prior to founding Kiwanda Group, Mr. Sumner was an investment specialist at Madison Avenue Financial Group, a private wealth boutique based in Portland, OR. Mr. Sumner is also on the board of BiFox Ltd., an unlisted Chilean phosphate rock development company. Mr. Sumner previously held the position of Executive Chairman for Valor Resources Ltd.

Duncan Quinn-Smith, Director

Mr. Quinn-Smith has law degrees from the University of Bristol (LL.B), Bristol, England, and Columbia University (LL.M), New York, USA. Mr Quinn-Smith was formerly an attorney at the offices of Kirkland & Ellis LLP in New York City, specializing in all aspects of private equity transactions. He founded DQ, LLC, a luxury lifestyle brand, in 2003 where he holds the position of Chief Executive Officer.

Christina Cepeliauskas, Director

Ms. Cepeliauskas is a CPA, CGA professional accountant with more than 25 years of financial accounting and treasury experience in the mineral exploration and mining industry. She is currently the CAO of EMX Royalty Corp. ("EMX") and was the CFO of EMX for 12 years from September 2008 to July 2021. She was the CFO of Pan Gold Resources Inc from May 2009 to August 2022 and CFO of Reservoir Capital Corp from May 2009 to May 2019. She has been a member of the Institute of Corporate Directors since May 2015 since she completed the comprehensive Corporate Directors Program.

Raul Ernesto Lima Osorio, Director

Dr. Lima is the majority shareholder of Estrella. Upon completion of the Qualifying Transaction, it is anticipated that Dr. Lima will own more than 10% of the outstanding common shares of the Resulting Issuer. Dr. Lima has over 20 years of experience in the mining and exploration business across South America. Dr. Lima has been responsible for numerous mining development and construction projects throughout Uruguay, Brazil, Chile, Venezuela, Argentina and Peru. Dr. Lima's notable engineering and construction experience in South America includes engineering and development of the San Grigorio gold mine in Uruguay for Rea Gold Corporation (now operated by Orosur), construction and engineering of the $450 million Pirquitas open pit silver mine in Argentina for Silver Standard Resources and engineering and construction of the Tucano Gold-Iron Mining Project in Brazil for Beadell Resources Ltd. Dr. Lima was previously Chief Operating Officer for Valor Resources Limited, an ASX-listed metals company focused on the development of the Berenguela Polymetallic Project in the Puno Department of Peru. He is currently the Chief Operating Officer of Bifox Limited, an Australian company developing fertilizer assets in Chile.

Dr. Lima holds an engineering degree from the University of the Republic in Montevideo, Uruguay, an MBA from ORT University in Montevideo and a Doctorate in Management with a focus on mining projects from University of Phoenix. Dr. Lima is a resident of Montevideo, Uruguay and speaks fluent English, Portuguese and native Spanish.

Concurrent Financing

Pursuant to the Concurrent Financing, the Company intends to issue a minimum of 16,666,667 units (each a "Unit") and a maximum of up to 25,000,000 Units at a price of $0.06 per Unit for gross proceeds of between $1,000,000 and $1,500,000. Each Unit will consist of one Daura Share and one (full) share purchase warrant (each a " Warrant "), with each whole Warrant entitling the holder to purchase one additional Daura Share at a price of $0.10 per share for a period of two years from the date of issuance. Net proceeds from the Concurrent Financing will be used to fund exploration of the Estrella project portfolio, expenses related to the Qualifying Transaction and for general working capital purposes.

Subject to the approval of the TSXV, Daura may pay eligible finders a fee equal to 7% of the Concurrent Financing in cash, and 7% in share purchase warrants under the QT Financing.

All securities issued under the Concurrent Financing will be subject to hold periods expiring four months and one day after the date of issuance. Additional restrictions may apply under the rules of the TSXV and applicable securities laws.

This news release does not constitute an offer to sell, or solicitation of an offer to buy, nor will there be any sale of any of the securities offered in any jurisdiction where such offer, solicitation or sale would be unlawful, including the United States of America. The securities being offered as part of the Concurrent Financing have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the " U.S. Securities Act "), or any state securities laws, and accordingly may not be offered or sold in the United States except in compliance with the registration requirements of the U.S. Securities Act and any applicable state securities laws, or pursuant to available exemptions therefrom.

Closing of the Concurrent Financing is subject to the approval of the TSXV.

Sponsorship of the Qualifying Transaction

Sponsorship of a Qualifying Transaction of a capital pool company is required by the TSXV unless exempt in accordance with TSXV policies. Daura intends to apply for an exemption from the sponsorship requirements.

Additional Information

In accordance with the policies of the TSXV, the Daura Shares are currently halted from trading and will remain halted until further notice.

Daura and Estrella will provide further details in respect of the Qualifying Transaction, in due course once available, by way of press releases.

All information provided in this press release related to Estrella has been provided by management of Estrella and has not been independently verified by management of Daura.

Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the Qualifying Transaction, any information released or received with respect to the Qualifying Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative.

For further information please contact:

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment