India's Electronics Sector Needs Tariff Rationalization, Enhanced Support: NITI Aayog Report

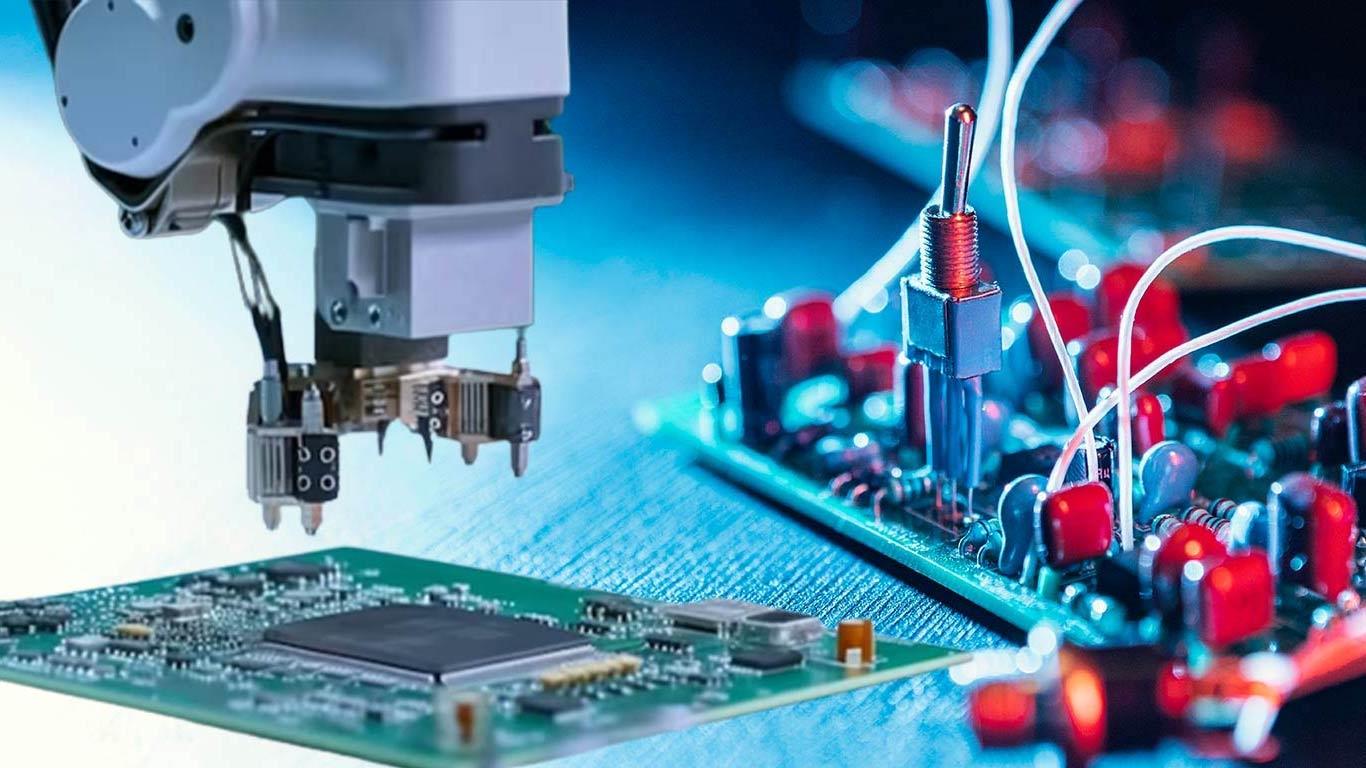

The report, released today, underscores the urgent need for tariff restructuring and enhanced support for component manufacturing to boost India's competitiveness in the global electronics market.

The report reveals that India's average tariff rate of 7.5 per cent on electronics components is substantially higher than competing nations like China (4 per cent), Malaysia (3.5 per cent), and Mexico (2.7 per cent). This disparity places Indian exports at a 5-6 per cent cost disadvantage in the global market, significantly impeding the growth of the sector.

Additionally, the study notes India's heavy reliance on imported components crucial for manufacturing mobile phones and other electronic devices, including microprocessors, GPUs, and specialized chips.

Despite existing incentive schemes, component manufacturing has seen low industry engagement. The report attributes this to schemes not aligning with the economic realities of the sector, highlighting a critical gap in policy implementation.

To address these challenges, the report advocates for streamlining the tariff structure to unlock India's export potential. It also suggests tailored support schemes, proposing opex support for less complex components and a hybrid support model (capex and opex) for more sophisticated components.

The recommendations extend to fiscal support for Indian companies focusing on design to scale up manufacturing of India-designed components and products.

The development of industrial clusters forms another key recommendation, with proposals for four large greenfield and six brownfield industrial clusters to strengthen supply chains.

The report also emphasises the importance of skill development, suggesting the establishment of Electronics Skill Training Hubs and expedited visa approvals for training professionals.

To facilitate technological advancement, the report calls for streamlining of technology transfer processes and fast-tracking approvals under Press Note 3 (2020) for critical ecosystem development proposals. These measures aim to enhance India's technological capabilities in the electronics sector.

Looking ahead, the report outlines three scenarios for the sector's growth by FY30. In a business-as-usual scenario, the sector could grow to USD 275 billion from USD 101 billion in FY23. An export-focused scenario projects growth to USD 500 billion, including USD 240 billion in exports. The most optimistic projection, factoring in boosted domestic demand, envisions the sector reaching USD 625 billion.

NITI Aayog CEO BVR Subrahmanyam emphasized that true self-reliance (Atmanirbharta) means producing more than importing and ensuring barrier-free movement of goods across borders. This perspective aligns with the report's recommendations for a more globally integrated and competitive electronics sector.

MeitY Secretary S Krishnan affirmed the government's commitment to developing a component scheme, acknowledging the need to double the domestic value addition in mobile phone manufacturing from the current 18-20 per cent to 35-40 per cent. This commitment signals a strong governmental push towards enhancing India's position in the global electronics value chain.

(KNN Bureau)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment