Bank Of Korea Preview: A Patchy Recovery Ahead

Date

5/21/2024 4:21:16 AM

| 98.4 | Composite consumer sentiment index vs 100.7 in April |

Consumer sentiment weakened while inflation expectations rose again in May

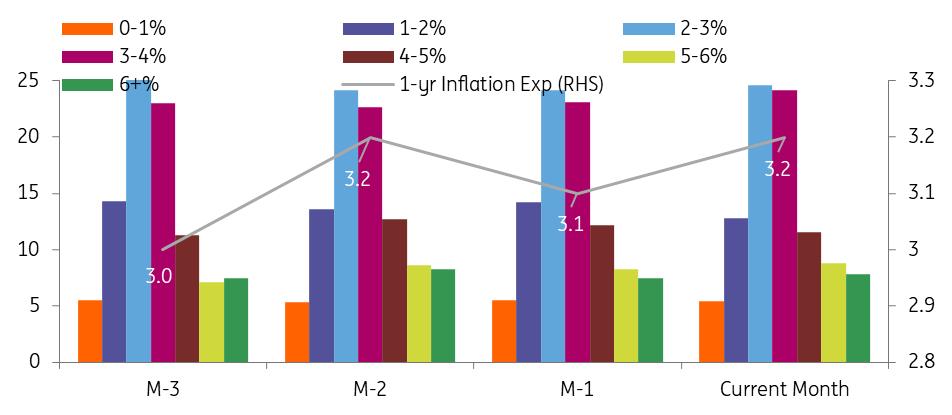

The consumer confidence index fell sharply to 98.4 in May (from 100.7 in April), below the neutral level for the first time in five months and the largest monthly decline since 2023 September. All sub-components declined, but the outlook indices – household income, living standard, and spending plan – fell more sharply, signalling weakness in consumer activity in the near future. What is more worrying when it comes to the Bank of Korea's policy decision is that inflation expectations rose to 3.2% in May from 3.1% in April.

Inflation expectations hover above 3% for four months in a row

Source: CEIC | 1.5% | First 20 days Exports in May (% YoY) vs 11.1% in April |

Semiconductors led overall export growth despite unfavourable calendar effects

Early May trade data showed continued solid external demand for semiconductors. Exports for the first 20 days of May were only up 1.5% year-on-year (11.1% in April) but the headline was distorted by unfavourable calendar effects. With two fewer working days, the average daily exports rose 17.7%. Among the main export items, chip exports were up 45.5% and vessel exports were up 155.8%. Yet, auto parts (-17.3%) and cars (-4.2%) fell, indicating a moderation in auto exports throughout this year.

By destination, exports to China (1.3%), the US (6.3%), Taiwan (48.5%), and Vietnam (10.5%) rose. Meanwhile, imports fell 9.8% YoY over the same period. Most import items declined, except for semiconductors, which rose 7%. We believe that global semiconductor industry is still on the recovery track. But, declines in commodity and machinery imports suggest a cloudy outlook for domestic growth.

Strong exports are mainly driven by semiconductors

Source: CEIC BoK preview

Today's data outcomes confirm our view of a patchy recovery path. Inflation expectations are anchored above 3% and consumer activity is expected to weaken, but exports are likely to lead overall growth. The BoK will likely remain hawkish in the coming months, but should shift its policy stance towards easing if domestic growth continues to deteriorate and starts to weigh on overall growth. We expect the BoK to cut in the fourth quarter of this year, in October.

MENAFN21052024000222011065ID1108238159

Author:

Min Joo Kang

*Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/about/disclaimer/

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.