| 4.6% | Unemployment rate (Jan-Mar) ING Forecast 4.7% / Previous 4.7% |

| Better than expected |

The latest Hungarian unemployment statistics from the Hungarian Central Statistical Office (HCSO) offer a glimmer of hope for the labour market. The March 2024 model estimate indicates an improvement in the unemployment rate, which now stands at 4.4%. Meanwhile, the official three-month moving average survey rate has also edged down by 0.1ppt to 4.6% in the January–March period. However, it's still too early to declare a trend reversal. In our view, to confirm a genuine turnaround we need to see similar positive changes for at least three consecutive months.

The number of unemployed individuals also shows improvement according to both statistics, hovering at around 220,000-230,000. Interestingly, while the unemployment rate for men has risen gnificantly, women have experienced a substantial improvement, offsetting this increase. This is the primary driver behind the overall improvement in the official unemployment rate for the first quarter of this year.

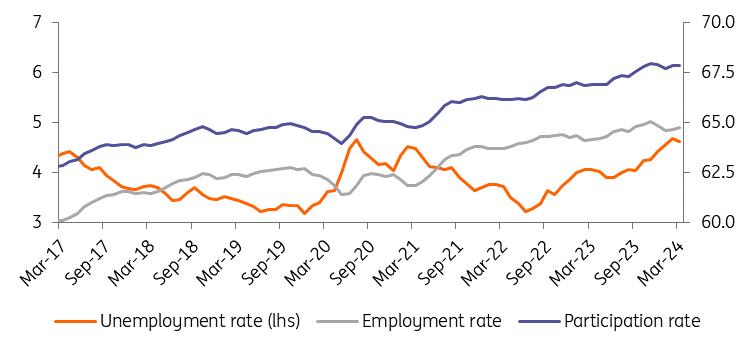

Historical trends in the Hungarian labour market (%, 3-m moving average)

Source: HCSO, ING A closer look at the data reveals that the number of economically active individuals has started to rise again, not only according to the monthly model estimates but also based on the three-month averages (although the improvement in the latter is minimal). This can be considered an encouraging sign, potentially foreshadowing a slow but sustained positive trend. The reasons behind this rise in the activity rate are still speculative. However, gender-disaggregated data suggests that women are returning to the workforce, possibly driven by the need to maintain a dual-income household in the face of rising living costs.

It's important to remember that while the inflation rate is slowing, this doesn't signify falling prices. And although wages are rising dynamically across the national economy, this is primarily driven by salary adjustments in the education sector. Meanwhile, the pace of wage growth in the private sector is slowing significantly. It's crucial to note that the changes observed in the latest labour market data are, in several cases, within the statistical margin of error. Therefore, it's prudent to wait for the data from the next two months to confirm whether the slight improvement in activity and employment is sustainable or merely a temporary, isolated change.

Despite the current improvement, we still consider this to be only temporary, and we anticipate a further slow erosion in the labour market during the coming months. While most companies are still committed to retaining their existing workforce, the number of companies forced to rationalise and ultimately reduce headcount due to declining (primarily external) demand is clearly increasing. Another significant trend is the elimination of previously open positions, making it more challenging for job seekers to find employment. This, combined with the expected increase in activity, could potentially push the unemployment rate higher. The big question is how quickly those returning to the labour market will be able to find new jobs.

On a positive note, the weak economic performance is feeding through to the real economy – and, consequently, the labour market – at a somewhat slower pace than usual. We believe the second half of the year could bring genuine stabilisation and perhaps even the beginnings of an improvement in Hungarian labour market. This is supported by various confidence indices and surveys, which are already showing an upward trend in most sectors – not only in Hungary, but across Europe.

However, as we have seen, the labour market typically lags behind changes in the real economy by a considerable margin. Therefore, the expected improved economic performance in the first half of this year is likely to only be reflected in companies' labour market decisions in the second half. Consequently, we anticipate a slight deterioration in unemployment data until mid-year, followed by a more significant improvement in the second half. Overall, the unemployment rate for the year could hover at around 4.5%.

MENAFN26042024000222011065ID1108144182

Author:

Peter Virovacz, Dávid Szőnyi

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.