(MENAFN- Evertise Digital)

-< />

The global industrial valves market is projected to witness significant growth due to the increasing demand for efficient flow control solutions in the energy & power sector. This sector requires valves for various applications, including handling high-integrity slurries, tight shutoff capabilities, and easy disc replacement to manage abrasive materials. As countries strive to fulfill growing energy needs while minimizing environmental impact, the demand for advanced industrial valves in power generation plants is expected to surge.

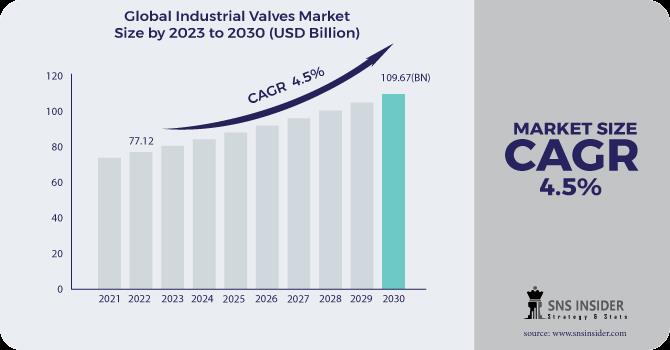

The SNS Insider report estimates the Industrial Valves Market Size to be valued at USD 79.86 Billion in 2023. The market is expected to reach USD 114 Billion by 2031, growing at a CAGR of 4.52% over the forecast period 2024-2031.

Download Sample Copy of Report:

Some of Major Key Players in this Report:

Emerson Electric Schlumberger Flowserve Corporation IMI plc Neles Corporation Spirax Sarco Limited Crane Conbraco Industries Inc Kitz Corporation Trillium Flow Technologies Bray International

Growing Demand Across Diverse Industries

Industrial valves play a crucial role in various industries by regulating and controlling the flow of liquids, gases, slurries, and vapors. They are manufactured from robust materials like carbon steel, cast iron, and stainless steel to ensure efficient operation in demanding environments. Key industries utilizing industrial valves include:

Water & Wastewater Treatment: Growing urbanization necessitates efficient wastewater treatment systems, driving the demand for industrial valves in this sector.

Oil & Gas: Exploration and upgradation activities in the oil & gas industry are fueling the demand for butterfly valves due to their suitability for these applications.

Food & Beverages: Industrial valves ensure hygiene and safety in food processing by regulating the flow of materials.

Chemicals: The chemical industry requires valves with high corrosion resistance and tight shutoff capabilities, leading to a rise in demand for specialized valves.

Market Analysis: A Multifaceted Approach

The industrial valves market can be analyzed through various lenses, including:

Market Analysis: This involves studying market trends, growth drivers, and challenges to identify potential opportunities and threats.

SWOT Analysis: This framework assesses the Strengths, Weaknesses, Opportunities, and Threats impacting the market.

Opportunities: Identifying emerging trends and untapped markets can present lucrative business opportunities for valve manufacturers.

Growth Factors: Understanding factors such as increasing automation, infrastructure development, and expanding end-user industries is crucial for market growth projections.

Recent Developments in the Industrial Valves Market

Several recent developments highlight the constant innovation and adaptation within the industrial valves market:

June 2023: Flowserve Corporation introduced the Valtek® Valdisk

high-performance butterfly valve, ideal for chemical plants and oil refineries requiring tight shutdowns during high-cycle operations.

April 2023: Kitz Corporation, a leading valve manufacturer, expanded its production capacity to cater to the growing demand for valves in the semiconductor industry.

April 2022: Emerson launched a Smart Valve Positioner designed for diverse environmental conditions, offering compact operation, dependable positioning, and enhanced safety.

December 2022: Emerson introduced the Crosby J-Series pressure relief valve line, featuring bellows leak detection technology for improved performance and reduced emissions.

Segment Analysis: Understanding Market Diversity

The industrial valves market can be segmented by type, material, end-user, and function. Here's a breakdown of the prominent segments:

By Type: Globe valves dominate the market due to minimal leakage, superior full-closing characteristics, and fast opening/closing times. Butterfly valves are witnessing rising demand in the oil & gas industry, while check valves are expected to experience steady growth due to their unidirectional flow control, preventing process disruptions.

By End User: The energy & power industry holds the largest share due to the requirement for tight shutoff valves handling abrasive slurries and efficient flow control in power generation plants.

Impact of Global Events

The Russia Ukraine war has Results to price fluctuations for raw materials used in valve manufacturing. The potential infrastructure rebuilding efforts in the aftermath of the conflict could create future demand for industrial valves.

An economic slowdown could Results to delays in infrastructure projects and reduced investments in industries Such as oil & gas, impacting the demand for industrial valves. some sectors Such as water & wastewater treatment might experience continued growth due to their essential nature.

Enquiry Before Buy:

Key Regional Developments

Asia Pacific dominates the industrial valves market due to Increasing urbanization and rising demand for advanced wastewater treatment systems. China's pharmaceutical industry is embracing IoT-integrated valves for automation and precise fluid control. Similarly, Japan's high-precision semiconductor industry necessitates PFA/PTFE-lined valves for superior performance. Government investments in infrastructure development and industrial projects further stimulate the demand for industrial valves in this region.

North America region is growing with the Highest CAAGR due to The Increase in oil sands and shale gas production in North America creates a substantial demand for industrial valves used in exploration, transportation, and processing. Replacing aging and inefficient valves in midstream infrastructure for gas transportation presents a significant growth opportunity. The growing trend towards renewable energy sources Such as wind and solar power will require specialized valves for efficient operation, creating a new market segment.

Key Takeaways for the Industrial Valves Market Study

The increasing demand for efficient flow control solutions in the energy & power sector, driven by factors like handling abrasive materials and tight shutoff requirements, is a prominent growth driver.

Industrial valves cater to a wide range of industries, including water & wastewater treatment, oil & gas, food & beverages, chemicals, and pharmaceuticals. Each industry has specific valve needs, creating a diverse and dynamic market landscape.

Recent advancements such as IoT-integrated valves and smart valve positioners highlight the growing focus on automation and enhanced functionality within the industrial valves market.

Asia Pacific is the dominant market due to factors such as Increasing urbanization and advancements in sectors such as pharmaceuticals and semiconductors. North America presents significant opportunities due to the shale gas boom and infrastructure development.

Buy Complete Report:

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Our staff is dedicated to giving our clients reliable information, and with expertise working in the majority of industrial sectors, we're proud to be recognized as one of the world's top market research firms. We can quickly design and implement pertinent research programs, including surveys and focus groups, and we have the resources and competence to deal with clients in practically any company sector.

Contact Us:

Akash Anand – Head of Business Development & Strategy

...

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

MENAFN21042024005025011514ID1108119245