(MENAFN- ING) US: PCE deflator still too high for comfort

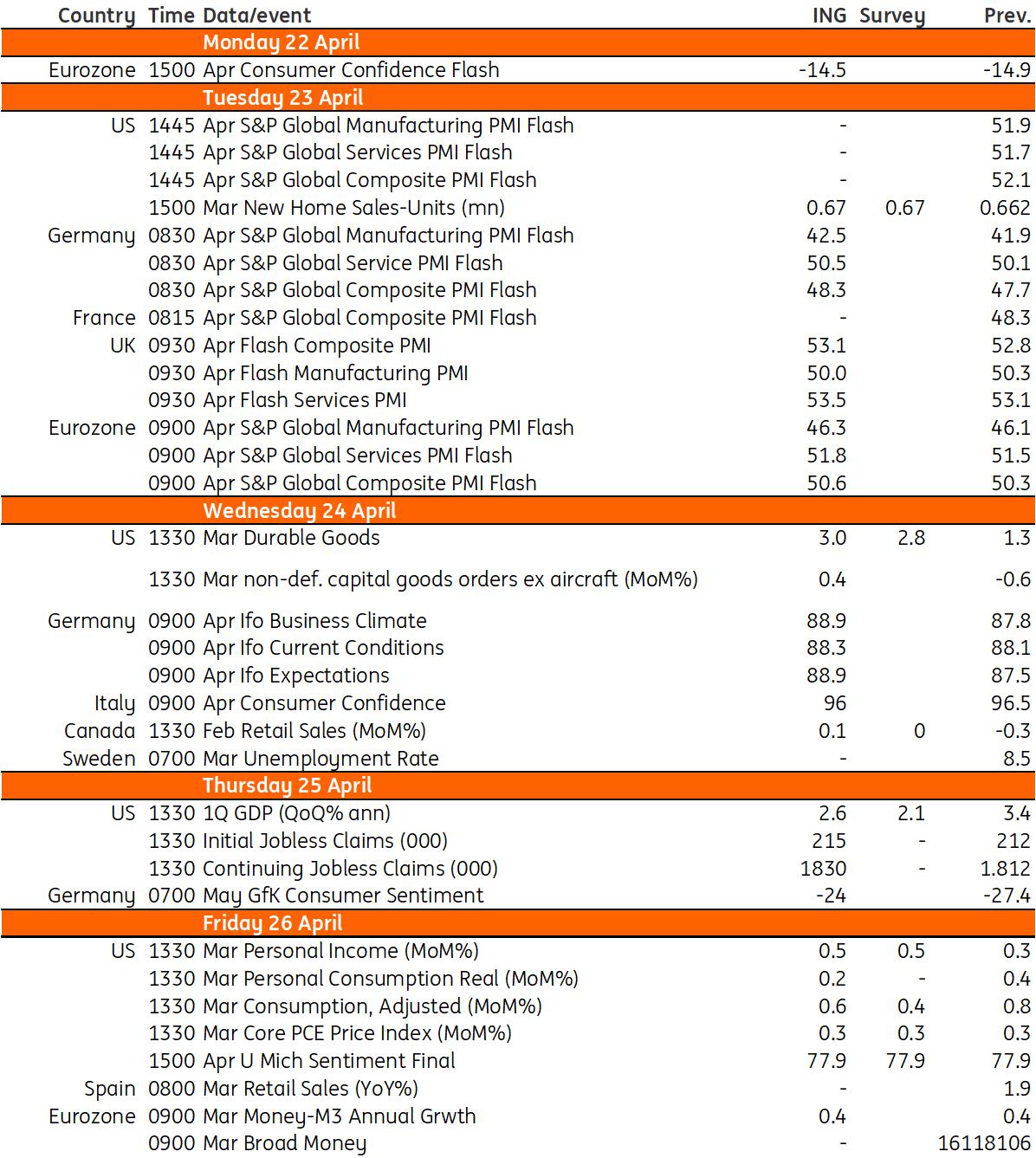

Vigorous GDP growth stands in stark contrast to weak business surveys - GDP expanded at a 4.9% annualised rate in 3Q23 and 3.4% in 4Q23 yet the ISM reports and NFIB small business optimism are at levels more consistent with GDP growth in the 0-1% range. We expect to see a moderation in the growth rate down to around 2.6% for 1Q 2024, above the 2.1% consensus forecast yet still broadly in line with trend growth. Consumer spending likely slowed based on the monthly data we have seen while government spending likely remained firm and business spending remained mixed. We expect to see consumer spending come under increasing pressure through the rest of the year given real household disposable income is flatlining, household savings built up during the pandemic have largely been exhausted while 25-year highs for consumer borrowing costs add to the headwinds for spending.

In terms of inflation, the core CPI print came in at 0.4% month-on-month, roughly double the rate we need to see to bring annual inflation down towards 2% over time. The core PCE is a broader measure of inflation though and measures some of the key components, such as medical care and insurance, differently. We expect it to come in at 0.3% MoM or 2.8% year-on-year, which is lower than the CPI, but still too high for comfort, which should confirm market expectations that the earliest opportunity for a Federal Reserve interest rate cut is September.

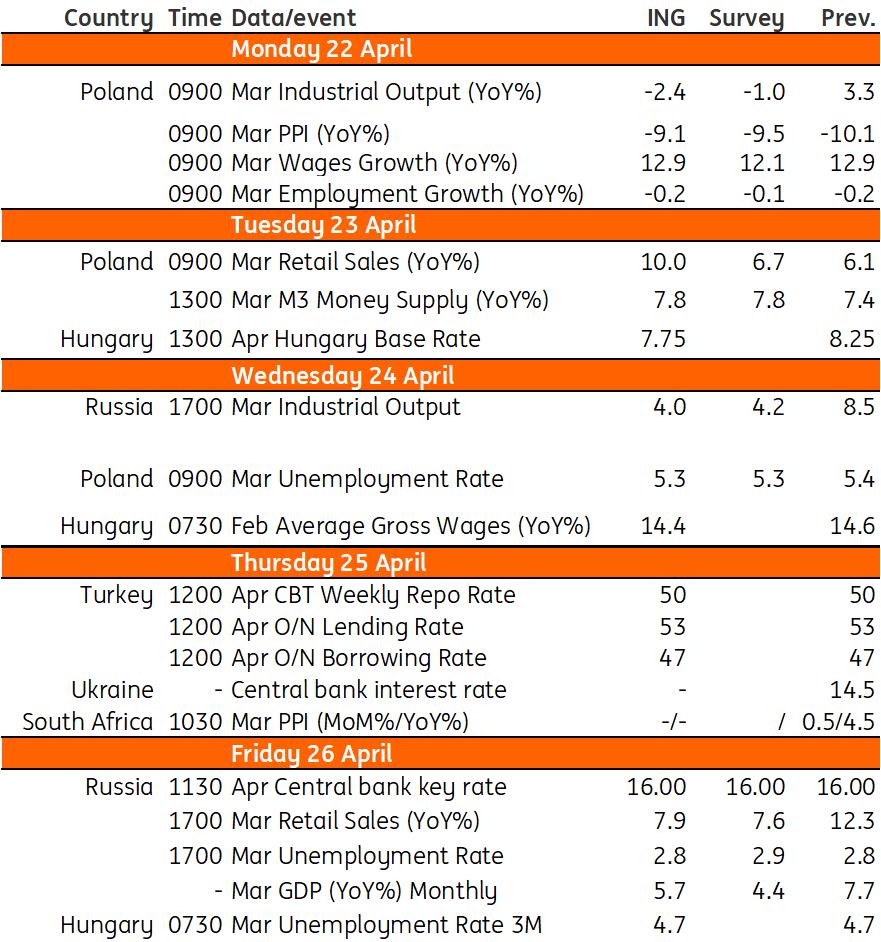

Poland: Scarcity of labour supply to keep unemployment low

Industrial output (Mar): -2.4% YoY

With the upward revision of January data alongside the February release and continued signs of recovery in global manufacturing, the outlook for Poland's industry has improved somewhat. Still, the global recovery is uneven, with the German industrial sector lagging behind. In such an environment, the improvement in Polish industry is gradual. We forecast that in March, industrial output fell 2.4% YoY, mainly due to unfavourable calendar effects. In MoM seasonally adjusted terms, we should see further expansion.

PPI (Mar): -9.1% YoY

Downward pressure on tradable goods prices continued in March, while energy commodity prices were relatively low. We forecast that prices in manufacturing and mining increased in MoM terms and annual deflation in PPI eased to -9.1% YoY from -10,1% YoY in February.

Wages (Mar): 12.9% YoY

Shortages of labour and a hefty increase in the minimum wage from the beginning of 2024 are keeping wage growth in the enterprise sector at double-digit levels. We believe that the increase in March was broadly in line with the February increase, despite a lower number of working hours. In March and April, teachers and civil servants receive their wage hikes at 30% and 20%, respectively, but this is not directly included in the enterprise sector wage data.

Employment (Mar): -0.2% YoY

Even though news about sizable redundancies has hit headlines more often than before, the overall level of employment in the enterprise sector remains relatively stable and only slightly lower than last year. We project this year to bring a slight decline in employment vs. 2023 despite an economic recovery. Supply-side constraints seem to be playing a more important role in the labour market than any delayed impact from last year's economic slowdown.

Retail sales (Mar): 10.0% YoY

CPI inflation has surprised to the downside recently, while nominal wages continue rising buoyantly. The improvement in real disposable income is unprecedented and we expect it to eventually translate into higher spending. Even though households seem to be increasing precautionary savings, the scope for stronger consumption remains sizable. We expect a strong retail sales reading for March and continued improvement in purchases by the end of the year.

Unemployment (Mar): 5.3%

The preliminary estimate of the Ministry of Family, Labour and Social Policy is in line with our 5.3% registered unemployment forecast for March. Despite some signs of softer employment trends, scarcity of labour supply is keeping unemployment low. By mid-2024, the unemployment rate may fall below 5%.

Hungary: Key interest rate may be lowered to 7.75%

The main event of next week is the National Bank of Hungary's rate-setting meeting on Tuesday. The central bank will open a well-telegraphed new era of monetary easing. This implies a further slowdown in the pace of loosening. The recent unfavourable turn in domestic and external developments justifies a more cautious stance than in previous months. As a result, we see a reduction in the size of future interest rate cuts as entirely understandable. We expect the NBH to lower the key interest rate from 8.25% to 7.75% at its April meeting and to continue to adopt a cautious, prudent tone. Aside from the rate-setting meeting, we will see a stable unemployment rate in March and only a slight slowdown in wage growth in February. With regards to the latter, we expect to see a more marked slowdown only in the coming months, as the corporate wage-setting cycle runs from spring to spring. Last year's huge pay rise will eventually be absorbed into the base, and anecdotal evidence suggests that companies will raise wages by less than 10% this year.

Turkey: Policy rate likely to stay unchanged at 50%

Last month, as a response to the increased pressure on inflation and FX, the CBT delivered an unexpectedly strong 500bp rate hike, a large set of macro-prudential measures and significant efforts to mop up excess TRY liquidity. This month, we think the bank would prefer to see the impact of the tightening on the inflation outlook and keep the policy rate unchanged at 50%.

Key events in developed markets next week

Refinitiv, ING Key events in EMEA next week

Refinitiv, ING

MENAFN19042024000222011065ID1108115793

Author:

Adam Antoniak , James Knightley, Peter Virovacz, Muhammet Mercan

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.