| 2.6% | Tokyo CPI %YoY |

| Higher than expected |

Tokyo consumer prices unexpectedly rose 2.6% YoY in March

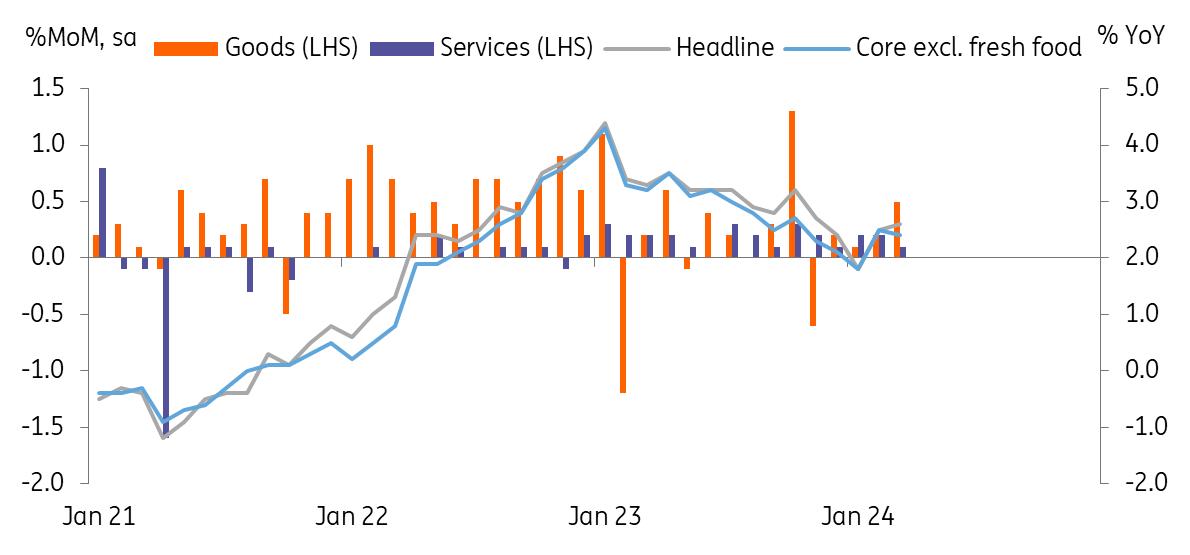

A leading indicator of nationwide consumer prices, Tokyo consumer prices rebounded to 2.6% year-on-year in March (vs a revised 2.5% in February, 2.5% market consensus). Core inflation exlcuding fresh food, a preferred measure for the BoJ, eased to 2.4% (vs 2.5% in February, 2.4% market consensus), but we don't think this would have any impact on the Bank of Japan's policy normalisation ahead. We expect inflation to ease, but to remain above 2% for a considerable time. On a monthly comparison, the Tokyo CPI accelerated to 0.3% month-on-month sa, rising for four months in a row. The gain in goods prices (0.5%) was more significant, indicating that companies set prices higher in the belief that consumers willingness to pay wouldn't be hurt too much. The rise in service prices (0.1%) were relatively modest, but have stayed on an upward trend for 12 months in a row. With stronger-than-expected wage negotiation results for FY24, the BoJ's sustainable inflation growth target is achievable this year.

Inflation remained above 2%

Source: CEIC | -0.1% | Industrial production %MoM, sa |

| Lower than expected |

Industrial production unexpectedly dropped again in February

Industrial production fell -0.1% MoM sa in February (vs -6.7% in January, 1.3% market consensus). Car manufacturers' production declined for a second month (-8% in February, -16.4% in January) as temporary production cuts were not fully restored. But, other production output also was weak. Machinery, steel, and chemical outputs all declined. Chip-production equipment was declined sharply by -12.6%, but not fully offseting the previous three months' increases. As global demand for IT/Semiconductor continues to be strong, we expect a recovery in the coming months. Today's weaker-than-expected IP adds downward risks to the current GDP forecast of a 0.5% QoQ growth.

| 1.5% | Retail sales %MoM, sa |

| Higher than expected |

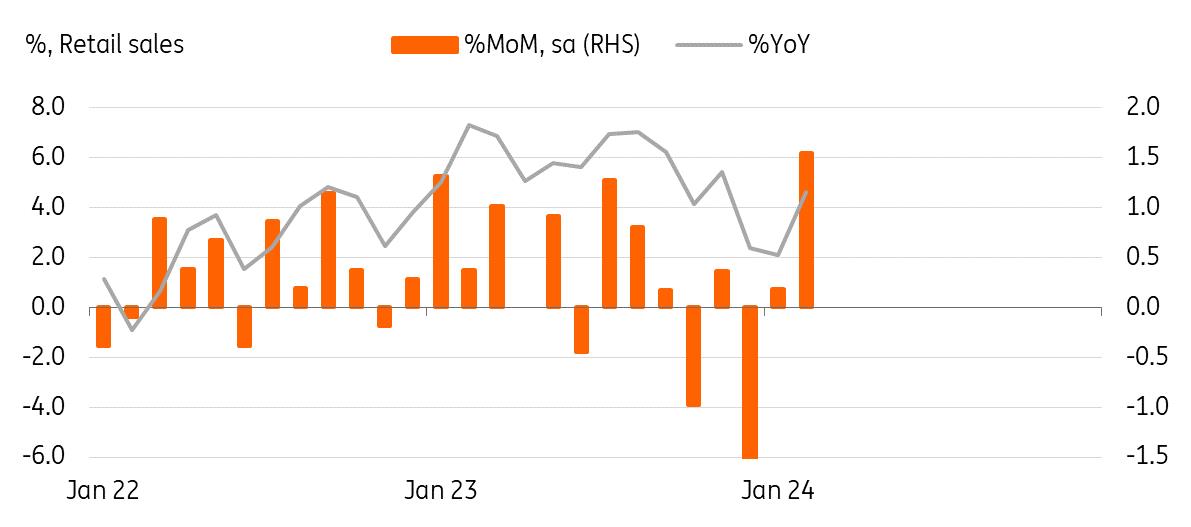

Solid retail sales was the highlight of today's data releases

Despite improvement in earnings and asset prices, household consumption remained sluggish thoughout last year. However, retail sales grew for a second month, and thus the BoJ's largest concern should be relieved – at least partially. Retail sales rose more than expected by 1.5% MoM sa in February. January retail sales were revised down to 0.2% from the flash 0.8% but the first two months' gain in retail sales were fairly solid. The gain was widespread except for weak motor vehicle sales, which have declined for three months in a row. But, we believe this is somewhat related to the recent production interruption due to a safety scandal of a major car manufacturer. General merchandise, apparels, and machinery sales all rose for a second month. We believe that household consumption will rebound from the current quarter and continue to improve over the course of this year, and thus it will support the BoJ's policy normalisation later this year.

Retail sales rose for a second month

Source: CEIC | 2.6% | Jobless rate 1.26 Job-to-Application ratio |

| Worse than expected |

Labour conditions soften a bit in February

The jobless rate unexpectedly rose to 2.6% in February (vs 2.4% in January and market consensus), while the job-to-application ratio slid to 1.26 from 1.27 in January. We saw manufacturing jobs shed in February, which is likely related to the production interruption issue. Thus, we are not too worried about the labour conditions just yet.

Bank of Japan watch

We think that the BoJ should welcome the solid retail sales and sticky inflation. Industrial production declined for a second month, however, once car production normalises then IP should rebound in the near future. We believe that if the BoJ confirms that consumption is recovering while inflation remains above 2%, then the BoJ is likely to move forward with rate hikes in the second half of 2024. We expect the BoJ's policy rate to reach 0.5% by year-end, as we believe that strong wage growth will lead to a consumption recovery this year and a policy rate of 0.5% should be considered accommodative given the macro conditions.

MENAFN28032024000222011065ID1108035339

Author:

Min Joo Kang

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.