(MENAFN- ING) A deeper look at the BSP's latest consumer expectations survey

In this article Household consumption shows surprising resolve What's helped

fuel consumption? More

debt Weapon of choice?

credit cards Consumer loans used for revenge spending? Not clear Consumers saving less today than during

COVID PHL outlook remains upbeat but what do the consumer think? Rising consumer debt to only have modest impact on rates and currency Conclusion:

GDP fueled by spending but consumers looking more vulnerable Household consumption shows surprising resolve

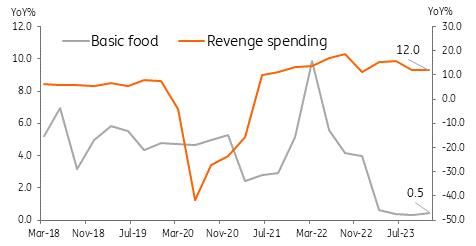

Philippine fourth quarter GDP surprised on the upside, registering a 5.6% year-on-year gain (compared to the 5.2% median estimate), thanks to a sustained push in government construction alongside robust consumption. Household spending was the main driver of growth, motoring along at 5.3%YoY with expenditure on so-called revenge spending items still managing to grow strongly.

We had anticipated some drop off in expenditure on these discretionary items given stubbornly high inflation and elevated borrowing costs, however Filipino consumers have yet to slow down on these purchases. This study hopes to answer the question how are households able to carry on with this pace“revenge spending” and more importantly, how has this frenzied pace of consumption impacted the Filipino consumer so far.

We look to the BSP's Consumer Expectations Survey (CES) for some answers.

Revenge spending, the extended rerun

Philippine Statistics Authority What's helped fuel consumption? More debt

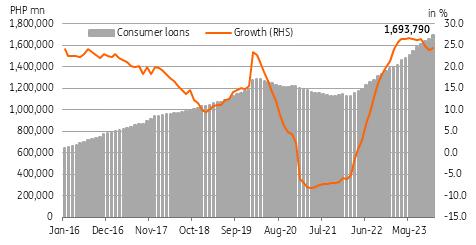

With the Philippine economy reopening in mid-2022, Filipinos went to town (literally), sparking a sustained run of double-digit growth for spending on discretionary items such as recreation, restaurants and hotels. The episode of revenge spending has extended much longer than we had anticipated prompting the question of how households could sustain this spending in the face of high inflation and elevated borrowing costs. Short answer: they borrowed.

In 2022, households racked up quite a bit of debt, presumably to fund these so-called revenge expenditures. The outstanding level of consumer loans hit PHP1 as of November 2023, up sharply from PHP1 at the start of 2022.

While the overall household debt-to-GDP ratio remains relatively low (10.1% as of June 2023), we would like to determine whether this development has impacted households and their outlook for the economy.

Outstanding consumer loans have risen sharply during the period of re-opening

Bangko Sentral ng Pilipinas Weapon of choice? Credit cards

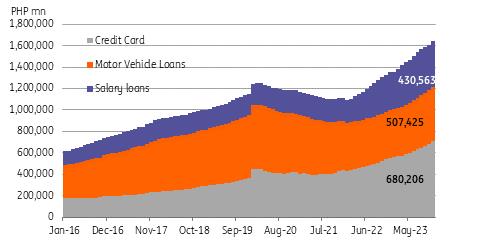

Breaking down consumer debt by loan type, we see that the sharp rise was driven by the rapid increase of credit card-based loans (grey). Latest data shows credit card loans topping PHP680bn, up from the PHP428bn at the start of 2022 and almost double the volume reported in January 2020.

The rise in credit card loans was so pronounced that it recently overtook car loans (in terms of volume), which had previously been the largest segment of consumer credit. If consumers were willing to take on debt just to sustain consumption, it appears that their weapon of choice was their credit card.

Has a credit card, will revenge spend

Bangko Sentral ng Pilipinas Consumer loans used for revenge spending? Not clear

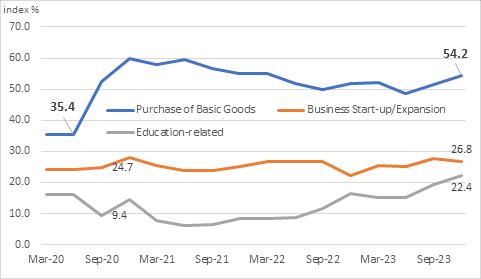

We have seen how consumers have taken on an increased amount of debt since 2022. But how exactly have these loan proceeds been utilised? Have these loans been fueling this phenomenon of revenge spending?

According to the BSP CES, consumers use loan proceeds for just about all types of daily expenses but the top three are 1) the purchase of basic goods, 2) business expansion and 3) education. It would be interesting to note that more households now utilise loans for basic goods than in the period before Covid. Before the pandemic, roughly 35% of households used loans for things like groceries but now it appears to be more prevalent, with 54.2% now borrowing for these purchases. Loans to cover education and business expansion have also picked up but the most substantial increase remains spending on basic items.

How about loan proceeds being used to fund“revenge spending”? Based on the BSP survey, funds used to cover leisure activities remains roughly unchanged at only 0.8%. Does this imply that the recent rise in consumer debt has not fueled this revenge spending binge? Possibly.

However, it could also be plausible that consumers are now simply re-allocating budgets (cash in hand) to indulge in revenge spending activities while using loan proceeds increasingly to cover basic goods and services.

Consumers increasingly taken on debt for basic goods

Bangko Sentral ng Pilipinas Consumers saving less today than during Covid

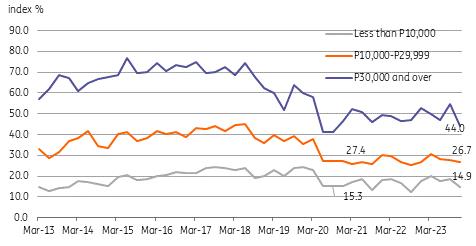

Meanwhile, with the pace of consumption sustained via increased debt, we had also expected consumers to cut back on savings given re-allocated budgets and the need to service new loans. This appears to be the case, with households now less able to save – only 29.1% are able to save as of the fourth quarter of last year according the latest CES survey. This is lower than the pre-Covid level of 37.8%, although it is an improvement from the 24.7% recorded during the lockdowns of 2020.

Breaking down savings across monthly income groups, we notice that low and middle-income households are reporting even lower levels of saving than during Covid. This suggests that two out of the three income groups are substantially challenged in terms of allocating budgets across spending, debt service and savings. Households who belong to these income groups account for 62.1% of total households in CES the survey.

While we can argue that consumers are possibly more confident about putting off savings (because of improved employment opportunities), we believe that low levels of savings could still make consumers more vulnerable during potential economic downturns. Furthermore, the inability of these households to build savings could also impact potential investment decisions as the lack of savings could disqualify them from taking on housing or vehicle loans in the future.

Households even more challenged today compared to Covid period

Bangko Sentral ng Pilipinas PHL outlook remains upbeat but what do the consumer think?

Fiscal authorities remain upbeat about the growth prospects of the economy, targeting GDP growth of 6.5-7.5% YoY for 2024. Meanwhile, inflation has moderated with the BSP's baseline inflation forecast pointing to inflation sliding back within target (2.8% as of January 2024) after missing the target in 2023.

Do Filipino consumers share this upbeat economic outlook? Are they just as optimistic about inflation moderating?

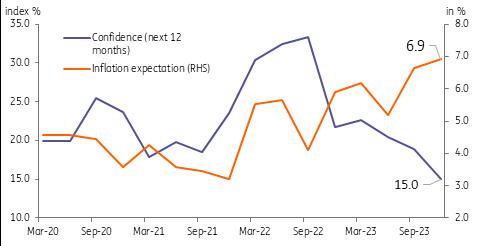

While the BSP's CES survey does not have a specific measure on GDP per se, the survey does ask respondents if they remain optimistic over economic prospects over the next 12 months. As of the fourth quarter of 2023, it appears that consumers are less optimistic – citing faster inflation, lower income, fewer jobs, as well as concerns over the effectiveness of government policies to control inflation, provide public transportation and financial assistance.

In particular, households are increasingly worried about inflation accelerating further in 2024. The BSP's recent emergency rate hike last October 2023 was carried out citing“the need to anchor consumer inflation expectations”.

Back then, it was estimated that households forecast inflation to hit 6.6% in 2024. The latest survey results now have consumers expecting inflation to worsen further, rising to 6.9%, even after BSP's off-cycle rate increase.

Consumers less optimistic about economy, see inflation faster

Bangko Sentral ng Pilipinas Rising consumer debt to only have modest impact on rates and currency

The recent trends in consumer debt may have only a modest impact on both the exchange rate and local borrowing costs. Rising consumer debt may prompt a marginal increase in overseas Filipino (OF) remittances with foreign based relatives forced to send home more foreign currency to cover the increased cost of living or debt service.

However, we do not expect a dramatic increase in remittance flows if this does occur given that remittance growth has not hit 5% over the past five years, possibly highlighting the constraints faced by OFs to increase remittances even if they wanted to.

Meanwhile, we do not anticipate that the rise in consumer debt will have a substantial impact on local borrowing costs given the relatively small share of consumer loans to total (11%). Furthermore, the CES survey shows that despite the increase in consumer debt, households have largely been able to service debt on time with only a marginal increase in delinquency rate. This, alongside the relatively small volume of consumer loans could suggest that any potential pressure on local rates from this sector could be modest.

Conclusion: GDP fueled by spending but consumers looking more vulnerable

Overall, the results of the BSP's CES suggest that households have taken have on more debt and now save less. It remains unclear whether this borrowing binge helped directly fuel the run of revenge spending although we think it could still be doing so indirectly.

Meanwhile, with households saddled with more debt and able to save less, consumers are now less optimistic about the economy with inflation their primary source of concern. Declining optimism (or rising pessimism) among consumers may eventually impact their savings and investment decisions over the course of the year. We believe that higher debt levels and lower savings rates may eventually hamper the ability of Filipino consumers to sustain this pace of expenditure in the coming year. This potential slowdown in household consumption, given its substantial contribution to overall GDP, could cap the overall growth prospects of the economy. It will be imperative for government officials to combat price pressures in 2024 to help bolster sagging consumer sentiment to ensure a sustainable run of growth.

PSA and ING estimates

MENAFN06022024000222011065ID1107814643

Author:

Nicholas Mapa