(MENAFN- ING) Rising house prices and increasing sales of new construction are small signs that the demand for Dutch new-build houses is increasing once again. Major bottlenecks for housing construction in the coming years remain a structural shortage of building land, complex project development and legal delays

In this article Good news for new construction: rising prices of existing homes Sales of new-build houses increase again Lowest

turnover of project developers reached Order

books remain well filled Building permits become the biggest bottleneck 73,000 new-build Dutch homes in 2023, set to decrease to 65,000 in 2024 Good news for new construction: rising prices of existing homes

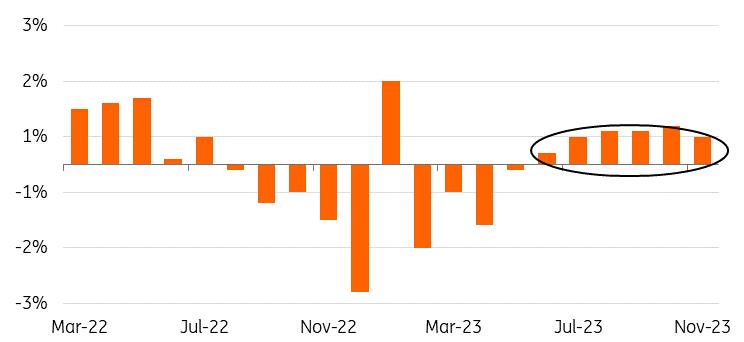

For several months now, prices of existing homes in the Netherlands have been rising. Since the lowest point in May, prices have now risen by almost 3%. The main reasons are that interest rates have not risen further and wages have increased, which has improved affordability and consumers can borrow more again. As a result, we could see higher prices in a still-tight housing market. This is good news for the new residential sector. The correlation of price developments between existing construction and new construction is high. Both are substitutes for each other, so the prices cannot diverge too far. If project developers can also increase the prices of new construction as a result, this will provide extra supply. Projects that previously were out of budget due to high costs of, for example, building materials, can now be profitable again, although it often remains difficult.

Prices of existing homes rise again

Development of selling prices of existing owner-occupied homes (YoY)

Dutch Central Statistical Office & ING Research Sales of new-build houses increase again

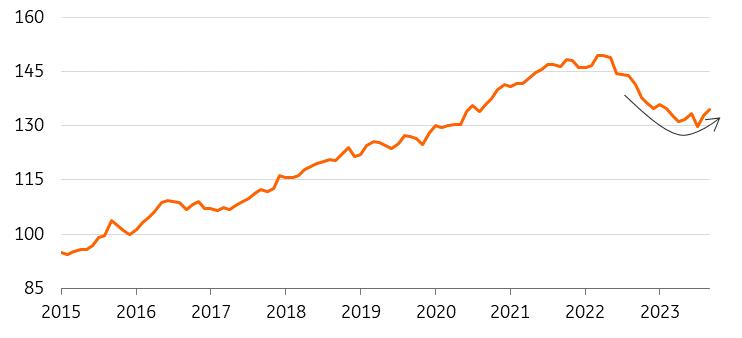

Dutch consumers are searching more on the internet for 'new-build homes', according to the number of searches for this Dutch term (Nieuwbouw) in Google. The search behaviour of this is still at a low level but more searching could lead to more buying. In the period September-November 2023, 29% more new-build homes were sold than in the same period a year earlier. This is still considerably less than in the same months in previous years, but it is a first sign of a possible further recovery.

Purchases of new-build homes are rising again

Development of new-build houses sales (3-month moving average)

WoningBouwersNL, ING Research Lowest turnover of project developers reached

Turnover of project developers dropped sharply from the end of 2022 but since the summer of 2023, the lowest point seems to have been reached. In the autumn, they rose slightly again. This also seems to indicate some recovery for the new-build residential construction.

Revenue declines in Dutch project development are over

Monthly Dutch

revenue development December

2015=100 project developers (12-month moving average up to September 2023)

Dutch Central Statistical Office & ING Research Order books remain well filled

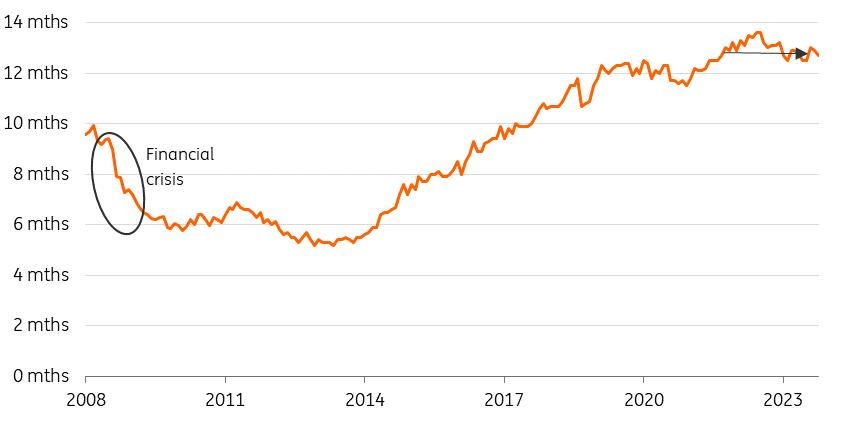

The work stock of home builders has remained remarkably stable for the past two years. In October, the average home builder had 12.9 months of work in their portfolio. That is only 0.3 months less than in October 2021 when the work stock was almost at its peak. Compared to the developments during the financial crisis in 2008 and 2009, there has been hardly any decrease now. There may be various reasons for this:

. The economic downturn during the financial crisis was more widespread than the economic downturn now;

. Order books of home builders consist not only of new construction but also of renovation and sustainability. The growth in these latter sub-sectors (renovation & sustainability) is more stable and higher, which also increases their share in the total housing construction;

. Due to the increasing staff shortages and more self-employed people, construction companies can work more months ahead (order books are calculated in months of work stock) because the core number of permanent employees has become relatively smaller;

. Projects have become more complex to execute in recent years, resulting in more work and longer duration.

Stock of work in order books construction stable

Work stock in months production housing construction per month until October 2023

EIB, ING Research Building permits become the biggest bottleneck

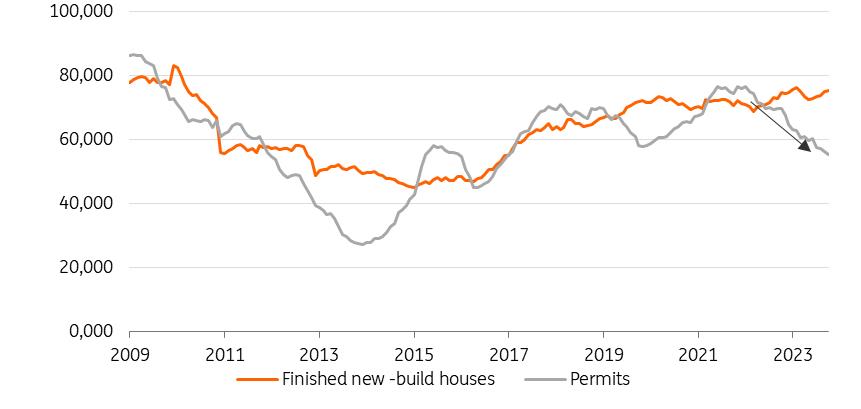

In October 2023, 5,658 building permits for new homes were issued. That is a further contraction (-15%) compared to the same month in 2022. 2021 was the peak with more than 75,800 permits. In 2022, this dropped by 15% to 64,500 and in 2023, we expect to end up at around 56,000 – despite the huge ambitions of the government. The demand for new-build houses seems, as we indicated above, to have improved somewhat. Now, however, it is the supply side that will become the main bottleneck due to a shortage of building land, complex project development and legal delays. Housing construction projects are also increasingly facing overloading of the electricity grid, causing new construction to be postponed due to a lack of connection possibilities to the grid.

Decrease in number of building permits for new houses

Development of issuance of building permits for new construction dwellings. Rolling annual total up to and including October 2023

Dutch Central Statistical Office & ING Research 73,000 new-build Dutch homes in 2023, set to decrease to 65,000 in 2024

In general, a decrease in the number of permits does not immediately result in a reduction in the number of completed homes. It usually takes about 18 months due to the often long construction time. Because the end of the last peak of the number of issued building permits was in mid-2022, we expect that the number of completed new homes will start to decline in early 2024. ING Research estimates that the number of completed new Dutch homes in 2023 will be around 73,000 and decrease to 65,000 in 2024. If the bright spots described above actually continue, we expect some recovery in 2025.

MENAFN03012024000222011065ID1107681690

Author:

Maurice van Sante

*Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/about/disclaimer/

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.