First implemented in July 2017, the ADGSM allows the minister to regulate liquefied Natural gas (LNG) exports in response to domestic shortages. The revised policy empowers the government to decide to activate the ADGSM every quarter, departing from the previous annual intervention.

Australia's quarterly domestic gas supply interventions could pose challenges for Japanese LNG importers in mitigating potential shortfalls because they will need to manage the changes in 90 days, rather than a year.

Latest stories

zte leaving ericsson, nokia in its 5g dust

still an enigma, prigozhin resurfaces in belarus

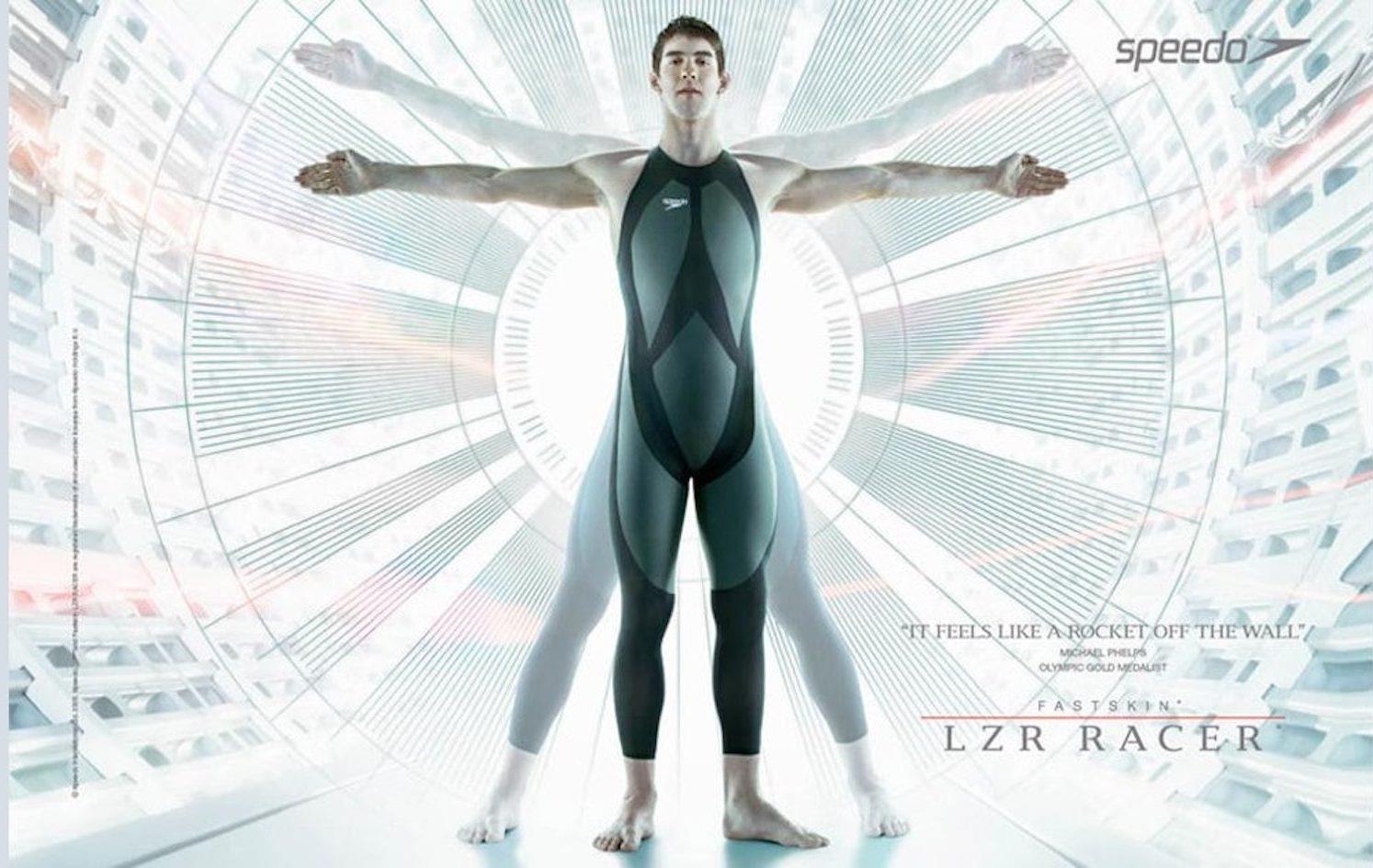

decrying us clash's new phase, china invokes speedo

These concerns arise within the broader context of a changing global energy landscape. While natural gas is widely regarded as a transitional fuel , its flexibility in power generation is crucial, at least until electricity grids are equipped with better storage options to balance out the intermittency of renewable energy sources.

Japan is highly dependent on Australia for its natural gas supplies. Image: EAF

Natural gas also offers lower emissions than coal, making it an attractive option for countries committed to decarbonization.

But the ongoing Russia-Ukraine conflict has injected further complexity into the equation. In response to sanctions, Russia has

cut its gas supply

to Europe. EU imports of Russian gas in March 2023 were

74% lower

compared to the same month in 2021. Europe has

shifted its focus

from Russian pipeline gas to LNG, triggering a surge in global demand.

LNG prices skyrocketed to unprecedented heights, impacting markets worldwide, before returning to pre-crisis levels. The monthly average prices of Asian LNG

surged significantly , rising from US$27.8 per million metric British thermal unit in February 2022 to a historical peak of $54 per million metric British thermal unit in August 2022.

Spot LNG prices soared to a staggering high of $70.50 per million metric British thermal unit in August 2022 as Europe swiftly

absorbed all available cargoes

in anticipation of the potential loss of all Russian pipeline supplies.

But Asian

lng prices fell

to the lowest level in nearly two years due to weak demand from top regional importers and as inventories remained high.

For LNG buyers like Japan, ensuring stable and affordable gas supplies has become an arduous task in the face of such market turbulence. To protect its energy security, Japan

continues to hold interest

in Sakhalin, Russia's natural gas project, despite having imposed economic sanctions on the country.

A long-term contract for the Sakhalin project could provide the LNG that

japan urgently requires

at a price lower than the market price.

As the world's leading LNG exporter, LNG price hikes have also directly impacted Australia's domestic market. In December 2022, the

australian government implemented

a temporary price cap on domestic coal at AU$125 (US$84.7) per tonne and natural gas at AU$12 per gigajoule to alleviate the financial burden on domestic consumers.

But the supplies of natural gas to retailers have expectedly

dwindled since the implementation

of the price cap policy. This situation led to the revision of the ADGSM.

While the ADGSM allows Australia to accelerate its own energy transition while protecting the welfare of consumers, it could also lead to higher emissions, slowing the transition to clean energies elsewhere.

Without access to Australian LNG, at the current technology level, Japan and other major Asian economies are likely to burn more coal .

The Wujing Coal-Electricity Power Station in Shanghai on September 28, 2021. Photo: Asia Times Files / AFP / Hector Retamal

In the summer of 2022,

japan relied

on aging coal-fired power plants to tackle the energy crisis. China experienced a

0.7% decline

in natural gas demand in 2022, the first drop since 1982, while coal consumption

increased by

4.3% during the same period. This surge in coal consumption hinders global emission reduction efforts and exacerbates environmental concerns.

The spillover effect of

australia's natural gas security policy

underscores the importance of global cooperation in tackling the multifaceted challenges of energy transitions,

energy security

and international politics.

Australia's ADGSM reforms serve as a stark reminder of the interconnectedness of global energy markets and the need for cautious and informed decision-making in a rapidly changing world.

As the global energy landscape evolves, policymakers must remain attentive to the ripple effects caused by their decisions.

Xunpeng Shi is Professor and Research Principal at the Australia-China Relations Institute at the University of Technology Sydney. Edward Sung is a PhD candidate at the Institute for Sustainable Futures at the University of Technology Sydney.

This article was originally published by East Asia Forum and is republished under a Creative Commons license.

Like this:Like Loading... Related