More inflation shoes to drop on NASDAQ by end-2022

Date

1/21/2022 4:04:18 PM

(MENAFN- Asia Times)

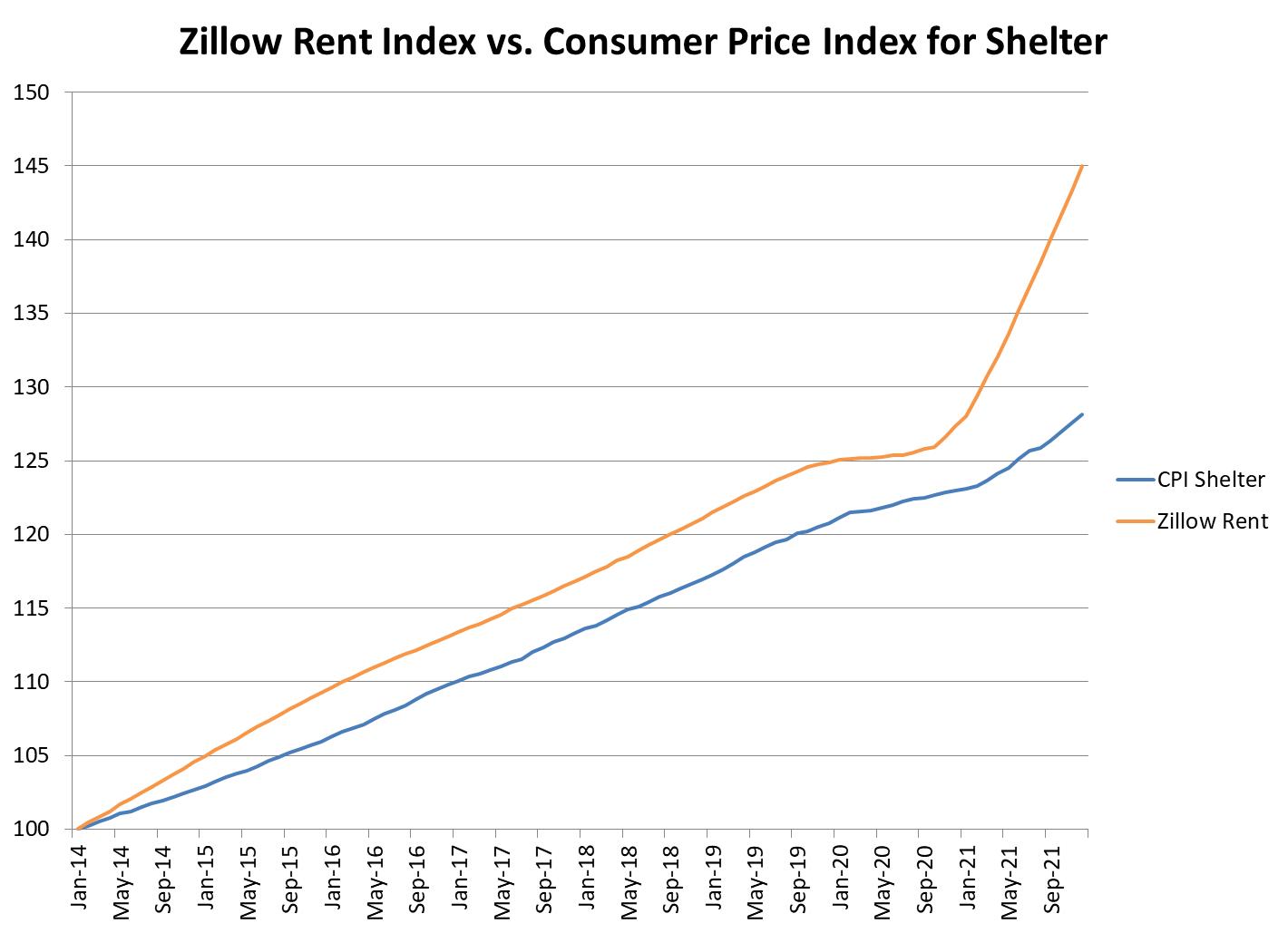

The latest reading for the Zillow index of US rents shows no letup in the worst bout of housing inflation in US history. Year on year, the average US rent rose 14%, according to the Real estate website. That should worry equity investors, who have watched the nasdaq give up nearly 8% of its value during the past week as bond yields rose.

Shelter accounts for a third of the US government's Consumer Price Index, but the official numbers have lagged far behind private-sector surveys. Lagged data reporting means that today's observed price increases will ratchet into faster CPI inflation months from now, putting more pressure on the US Federal Reserve to tighten credit. That's bad for stocks.

There's no let-up in inflation pressures in most of the available high-frequency data, including input costs to service businesses, used cars, and transport costs, along with shelter (“Nowhere to hide in US stock market ,” Jan. 20, 2022). Input costs to US manufacturers rose less quickly in December, to be sure, but the subsequent jump in the oil price to a seven-year high probably will lead to a worse reading in January.

We have called attention to the underreporting of shelter costs in several past articles (see“US rent hikes will explode consumer inflation in 2022 ,” August 27, 2021). Lags explain part of the divergence of private and official measures of rent inflation. As leases roll over and are renewed, higher rents work their way through the economy.

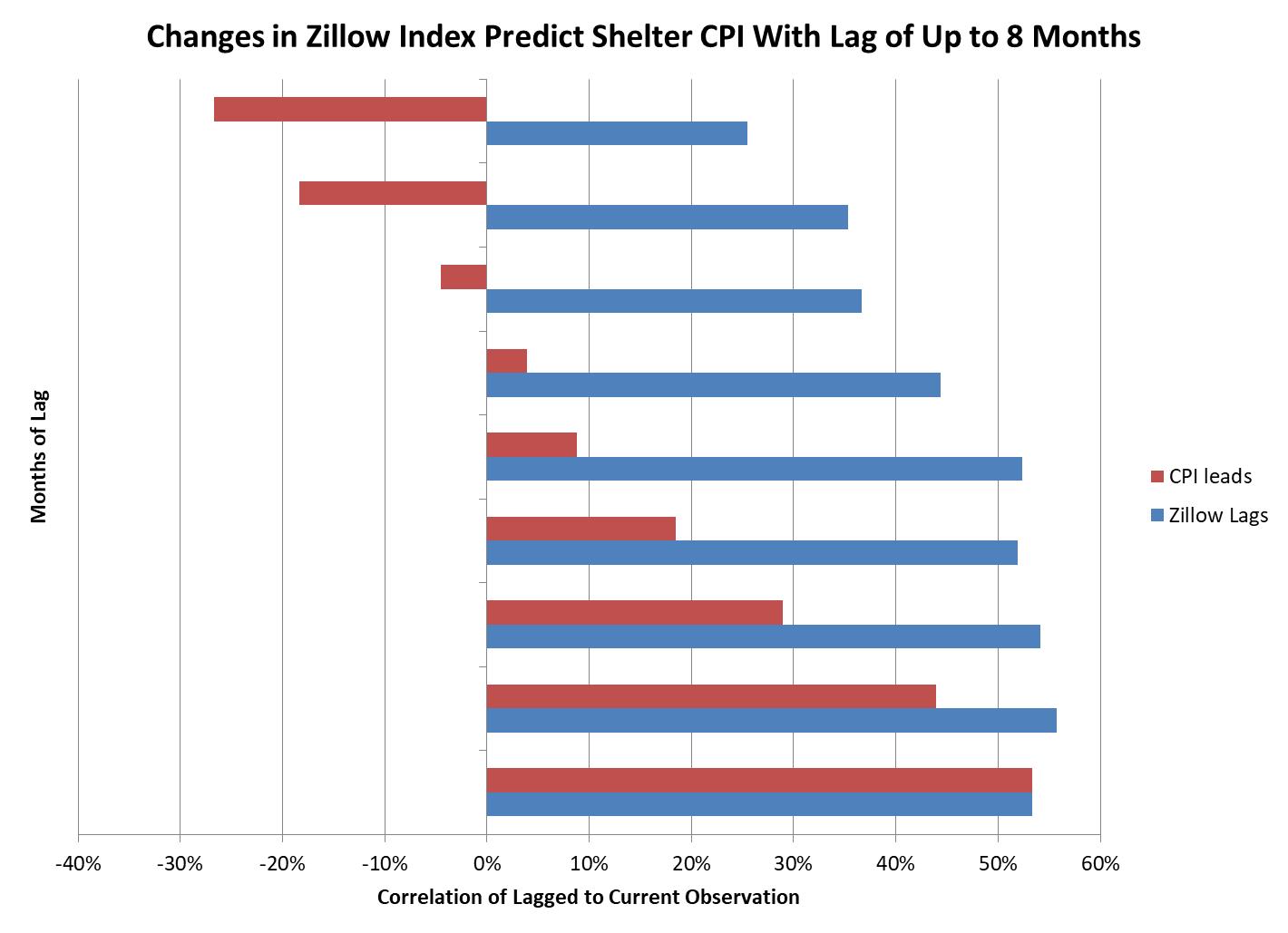

Changes in the Zillow Index, for example, have an impact on the CPI shelter inflation rate with lags of up to eight months.

Inflation hasn't crested. It hasn't even decelerated. And the cycle of higher inflation, rising expectations of higher interest rates and Federal Reserve tightening will continue to weigh on stocks through the first half of this year – at least.

MENAFN21012022000159011032ID1103575836

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.