Powell's second term underlines Biden's quandary

(MENAFN- Asia Times) Markets gave tepid applause to US President Joe Biden's decision Monday to designate Jerome Powell for a second term as Federal Reserve Chairman. The broad market rose slightly while the tech-heavy NASDAQ Index fell in tandem with bond prices.

Tech stocks have traded in lockstep with“real” (that is, inflation-indexed) interest rates for the past year and half, as investors treat the tech giants like utilities with stable long-term cash flows.

Powell might have been a punching bag for Republicans, who are making political hay out of the highest inflation in 40 years and the resulting fall in real wages. Throughout 2021 Powell insisted that inflation was“temporary” or“transitory ,” forecasting a gain this year in the Consumer Price Index of just 2.4% as late as last April.

As of October, the CPI had risen 6.2% year-on-year, and sharp increases in rents (between 9% and 15% a year in the major private surveys) as well as used cars (up another 4.9% in the first half of November and up 45% year-on-year) augur worse to come.

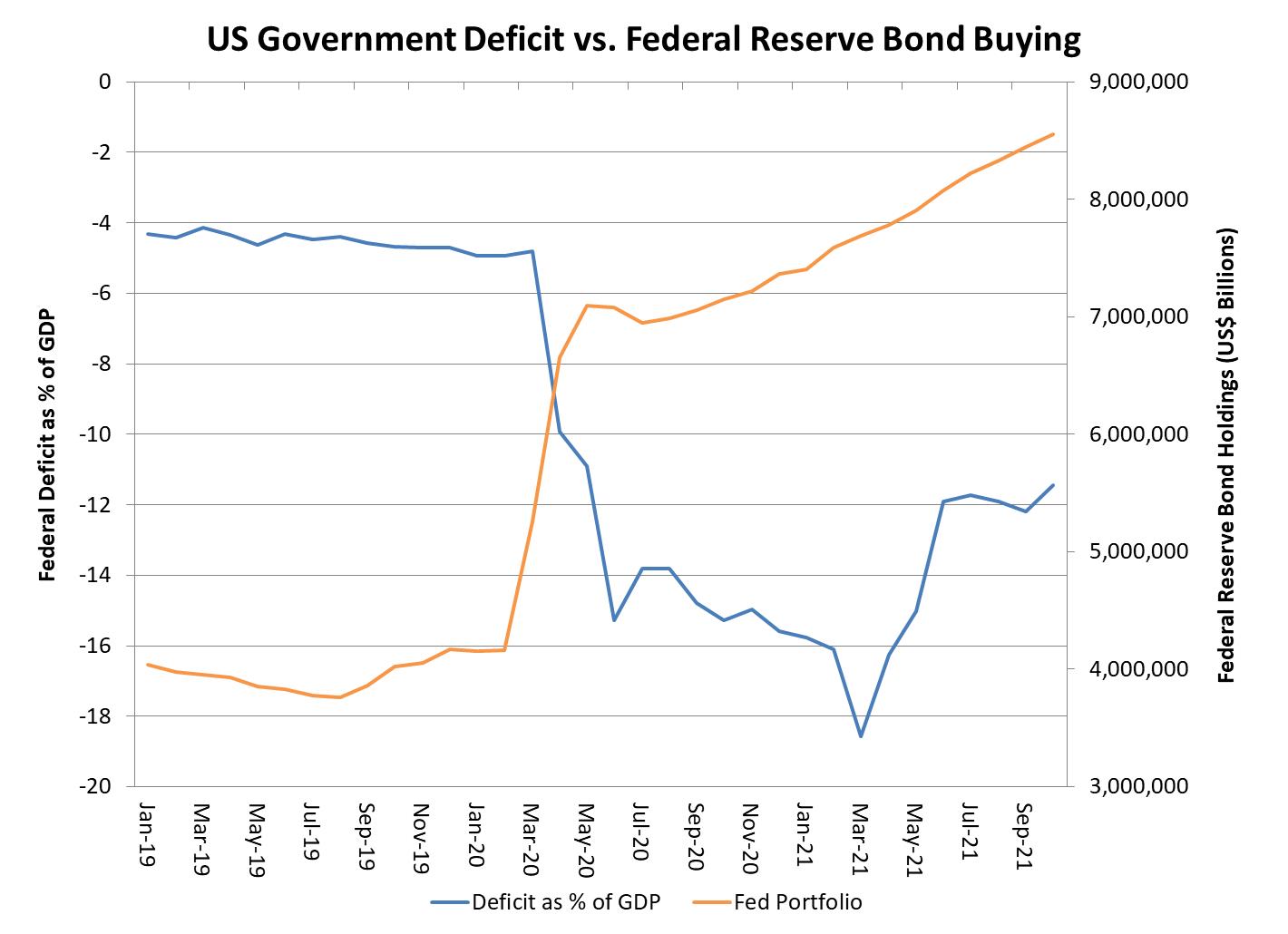

That should have come as no surprise to the Fed, which has accommodated the biggest peacetime budget deficit in US history at 12% to 14% of GDP, by buying more than US$5 trillion worth of securities from the market.

The federal government shoved $6 trillion in demand into the US economy – it borrowed another $1 trillion or so from banks – encouraging spending and discouraging millions of Americans from dropping out of the workforce.

Yet Powell emerged as the opponent of inflation, in contrast to Federal Reserve Governor Lael Brainard, the other leading candidate for the top slot, who was nominated as Vice-Chairman.

“We know that high inflation takes a toll on families, especially those less able to meet the higher costs of essentials like food, housing and transportation, We will use our tools both to support the economy and a strong labor market, and to prevent higher inflation from becoming entrenched,” Powell said Monday at a White House ceremony.

Republicans might have given Biden a drubbing in Senate confirmation hearings if he had chosen Brainard instead. Brainard is regarded as even more of an inflationist than Powell, and has picked fights in the past with major banks, who are also major Republican contributors.

Lael Brainard. Photo: Ralph Alswang / the salient fact is that the Republicans had to pass up an opportunity to pin the blame on Biden for rampant inflation because they don't have any ideas themselves. Prices rise when too much money – the $6 trillion stimulus – chases too few goods, with dilapidated US supply chains.

One way to stop inflation is to stage a recession by constricting incomes, and the Republicans don't want to take the blame for that. There is virtually no interest in the Republican Party in rebuilding supply chains. That's why Powell had a free pass from the Republicans.

The Fed has promised to gradually reduce the rate of increase of its $9 trillion-plus cornucopia of securities. The promised“taper” is set to start at the end of the year, but will only decelerate the inflationary impulse. As Biden's $2 trillion spending bill – likely to turn into a $4.6 trillion spending bill – kicks in, the deficit will grow and the Fed will continue to monetize it.

Biden will have to take other measures to mitigate inflation, for example, a reduction in the 25% tariff that the Trump administration slapped on most Chinese imports. Now that the US is importing $600 billion a year of Chinese goods, the effect of a tariff cut would be noticeable.

Treasury Secretary Janet Yellen as well as former Secretary of State Hillary Clinton have talked about tariff cuts. The Republicans will denounce the Biden administration as soft on China should the White House follow through, but the immediate drop in the prices of consumer goods may make it a popular measure.

As I reported on November 20 , the Federal Reserve is paying extra attention to import prices as a factor in today's runaway inflation, especially import prices from China. Although the dollar's exchange rate has held up well against its European and Japanese counterparts, it has lost about 8% of its value against the Chinese yuan since the Spring of 2020.

I conjectured that a deal might be possible in which the US cuts tariffs and in return, China eases monetary policy and causes the yuan to depreciate, making Chinese goods cheaper in the US.

China is busy trying to reduce debt and not inclined to ease monetary policy for domestic reasons, and the People's Bank of China appears comfortable with the present exchange rate of about 6.38 yuan to the dollar.

The United States would have to cut tariffs in advance of a change in Chinese monetary policy to persuade Beijing to play along.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment