CoinSwitch Kuber raises $260 million, becomes India's second crypto unicorn

Date

10/7/2021 6:05:50 PM

(MENAFN- NewsBytes) Cryptocurrency exchange CoinSwitch Kuber announced it has raised $260 million in a Series C round of funding, bumping up its valuation to $1.9 billion. This makes the Bengaluru-based start-up India's second crypto unicorn—a private firm with a value of over $1 billion—after CoinDCX. Investments in CoinSwitch Kuber reflect a growing interest in India's cryptocurrency market despite the government's unclear stance on cryptocurrencies. Here's more.

In this article

- Coinbase Ventures, Andreessen Horowitz lead investor pack

- CoinSwitch Kuber ahead in competition with CoinDCX

- Meanwhile, government delays tabling bill on cryptocurrency transactions, regulations

- What is the future of cryptocurrency in India?

Series C funding Coinbase Ventures, Andreessen Horowitz lead investor pack

New investors Coinbase Ventures and top Silicon Valley firm Andreessen Horowitz (a16z) led the investor pack. Notably, this is a16z's first bet on an Indian company. Paradigm, Ribbit Capital, Sequoia Capital India, and Tiger Global were the other investors. Founded by Ashish Singhal, Govind Soni, and Vimal Sagar Tiwari in 2017, CoinSwitch Kuber has now raised a total of $300.6 million in funding.

Competition CoinSwitch Kuber ahead in competition with CoinDCX

CoinSwitch Kuber is now more valuable than rival CoinDCX at $1.1 billion. The annual revenue of CoinSwitch Kuber, which reached 10 million users in September, is $50 million, said CEO Singhal earlier. Meanwhile, CoinDCX's estimated annual revenue is $20 million. In August, the Mumbai-based exchange with over 3.5 million users raised $90 million from investors led by Facebook co-founder Eduardo Saverin's B Capital Group.

India's stance Meanwhile, government delays tabling bill on cryptocurrency transactions, regulations

Now, let's look at what the Reserve Bank of India and the Indian government think about cryptocurrency exchanges. India was supposed to table a bill proposing banning cryptocurrencies by March 2021. It would also define what can be considered valid crypto transactions . The bill is still in the works. Authorities, however, previously made it clear cryptocurrencies will not become a valid tender for payment.

Booming investment What is the future of cryptocurrency in India?

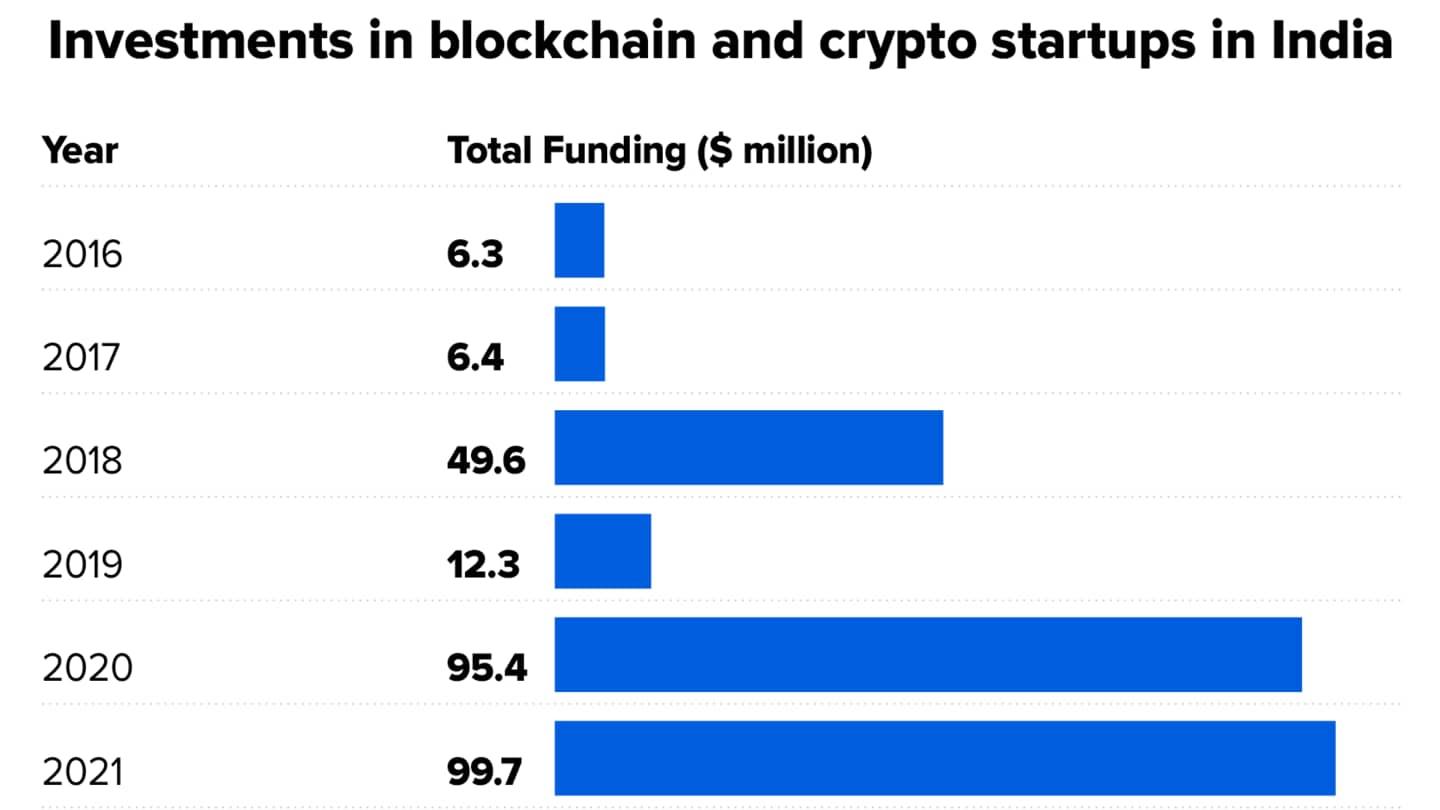

Despite policy delays, there is increasing foreign investment in crypto and blockchain start-ups in India. According to a June 2021 Dazeinfo report, the investment in the Indian cryptocurrency and blockchain start-ups has seen a whopping 1482% rise in the last five years. However, there are some worries about regulations in the short run, said Singhal. But he is confident of success in the future.

MENAFN07102021000165011035ID1102936181

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.