(MENAFN- DailyFX) Advertisement May FX Seasonality Overview:

- 'Sell in May and go away is a popular financial euphemism. It also happens to have been complete nonsense in recent years.The US S & P 500 has positive seasonal averages for both 5- and 10-years.

- April showers bring May flowers? While April has been the worst month of the year for the US Dollar , May has been the best over both the 5- and 10-year lookback periods.

- The commodity currencies haven't fared well in May, neither have gold prices . May has come somewhat of an atypical month in the macro world.

The beginning of the month warrants a review of the seasonal patterns that have influenced forex markets over the past several years. For May, our focus is on the trailing 5-year and 10-year performances, both of which fully capture trading during the era of quantitative easing and expanding government deficits since the 2008/2009 Global Financial Crisis not dissimilar from the environment we find ourselves in during the coronavirus pandemic recovery.

Monthly Forex Seasonality Summary May 2021

Forex Seasonality in Euro (via EUR/USD)

May is a very bearish month for EUR/USD , from a seasonality perspective. Over the past 5-years, it has been the third worst month of the year for the pair, averaging a loss of -0.37%. Over the past 10-years, it has been the worst month of the year, averaging a loss of -1.63%.

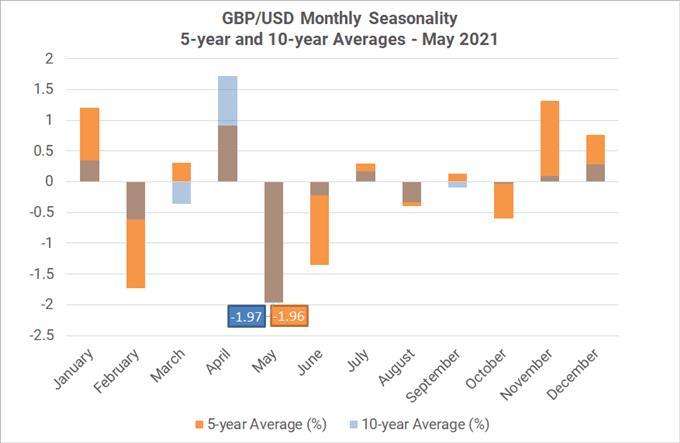

Forex Seasonality in British Pound (via GBP/USD)

May is a very bearish month for GBP /USD , from a seasonality perspective. Over the past 5-years, it has been the worst month of the year for the pair, averaging a loss of -1.96%. Over the past 10-years, it has been the worst month of the year, averaging a loss of -1.97%.

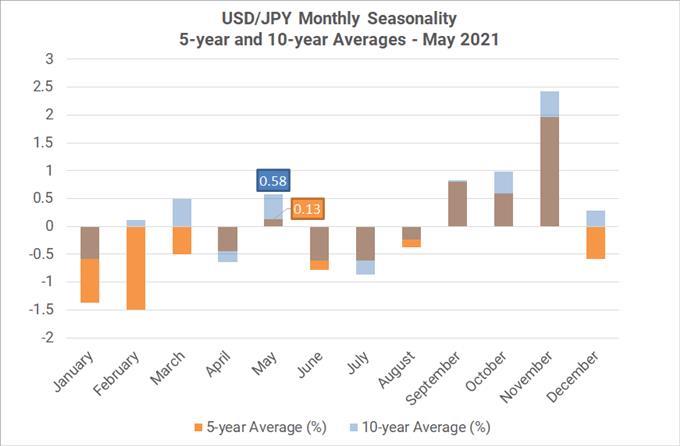

Forex Seasonality in Japanese Yen (via USD/JPY)

May is a bullish month for USD/JPY , from a seasonality perspective. Over the past 5-years, it has been the fourth best month of the year for the pair, averaging a gain of +0.13%. Over the past 10-years, it has been the fourth best month of the year, averaging a gain of +0.58%.

Forex Seasonality in Australian Dollar (via AUD/USD)

May is a very bearish month for AUD /USD, from a seasonality perspective. Over the past 5-years, it has been the second worst month of the year for the pair, averaging a loss of -0.86%. Over the past 10-years, it has been the worst month of the year, averaging a loss -2.44%.

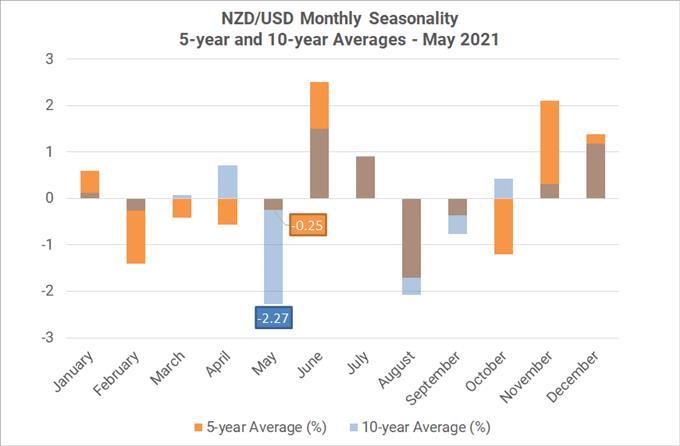

Forex Seasonality in New Zealand Dollar (via NZD/USD)

May is a bearish month for NZD /USD, from a seasonality perspective. Over the past 5-years, it has been the sixth worst month of the year for the pair, averaging a loss of -0.25%. Over the past 10-years, it has been the worst month of the year, averaging a loss of -2.27%.

Forex Seasonality in Canadian Dollar (via USD/CAD)

May is a very bullish month for USD/CAD , from a seasonality perspective. Over the past 5-years, it has been the third best worst month of the year for the pair, averaging a loss of gain of +0.76%. Over the past 10-years, it has been the best month of the year, averaging a gain of +1.6%.

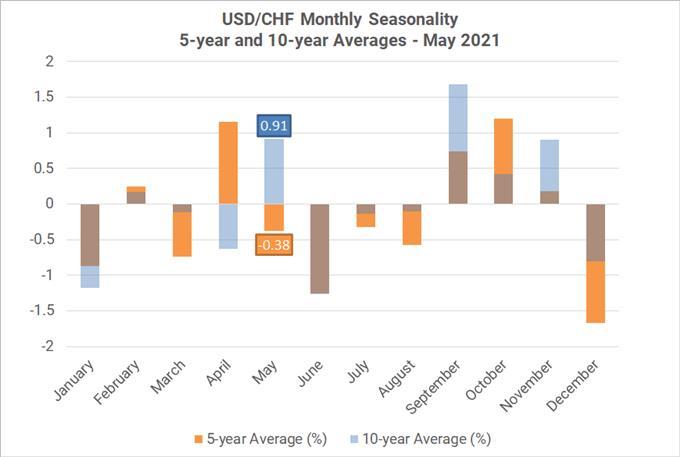

Forex Seasonality in Swiss Franc (via USD/CHF)

May is a mixed month for USD/CHF , from a seasonality perspective. Over the past 5-years, it has been the sixth worst month of the year for the pair, averaging a loss of -0.38%. Over the past 10-years, it has been the second best month of the year, averaging a gain of +0.91%.

Forex Seasonality in US S & P 500

May is a bullish month for the US S & P 500, from a seasonality perspective. Over the past 5-years, it has been the sixth worst month of the year for the index, averaging a gain of +0.56%. Over the past 10-years, it has been the fourth worst month of the year, averaging a gain of +0.04%. Not only are the May seasonal averages positive for the US S & P 500, but so too are the 5- and 10-year seasonal averages for June and July; ‘sell in May and go away' hasn't been valid recently (but then again, if you look at December, neither too has been the famed Santa Claus rally).

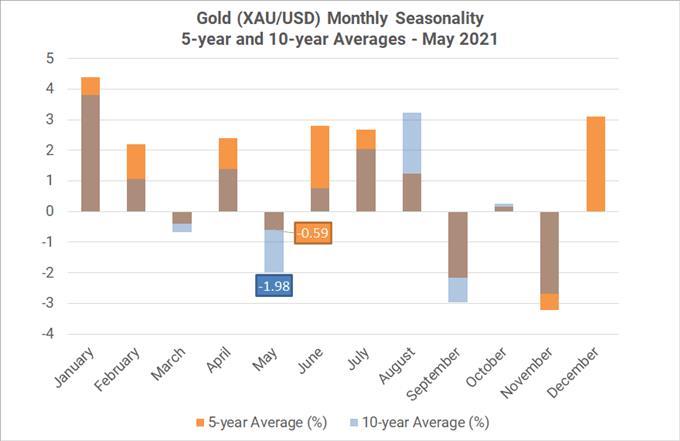

Forex Seasonality in Gold (via XAU/USD)

May is a very bearish month for gold (XAU/USD), from a seasonality perspective. Over the past 5-years, it has been the third worst month of the year for the precious metal, averaging a loss of -0.59%. Over the past 10-years, it has been the third worst month of the year, averaging a loss of -1.98%.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

MENAFN03052021000076011015ID1102021255

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.