(MENAFN- DailyFX) Bitcoin Price & Emerging Markets FX Correlations Overview:

- Per theEmerging Markets Crisis Monitor , external debt-to-GDP ratios, implied FX volatility, and bond risk premia are some of the key factors that traders need to keep an eye on when looking for potential trade opportunities in EM FX.

- Geopolitical tensions on the Syrian-Turkish border coupled with threats from US President Donald trump towards Turkey have hit the Turkish Lira in recent days.

- Meanwhile, the IndianRupee(via USDINR) has the most significant 5-daycorrelation withbitcoinprices among emerging market FX, currently at 0.99.

Looking for a guide on how to analyze Emerging Market Currencies (EM FX)? Read theEmerging Markets Crisis Monitor .

Per theEmerging Markets Crisis Monitor , external debt-to-GDP ratios, implied FX volatility, and bond risk premia are some of the key factors that traders need to keep an eye on when looking for potential trade opportunities in EM FX.

Countries that run have excessive external financing via their current account, foreign direct investment, and export growth, plus high external debt-to-GDP, are likely to have currencies that face difficulties. Currencies facing high implied volatility, bond risk premia, and inflation are prime contenders for weakness.

Among the list of EM FX currencies that currently fit the bill for some of these criteria are: the Chinese Yuan, the Indian Rupee, the Russian Ruble, the Turkish Lira, and the South African Rand.

Geopolitical tensions on the Syrian-Turkish border coupled with threats from US President Donald Trump towards Turkey have hit the Turkish Lira in recent days. One week ago, the 5-day correlation betweenUSDTRYand bitcoin prices was 0.32; now it is 0.46. Meanwhile, the Indian Rupee (via USDINR) has the most significant 5-day correlation with bitcoin prices among emerging market FX, currently at 0.99.

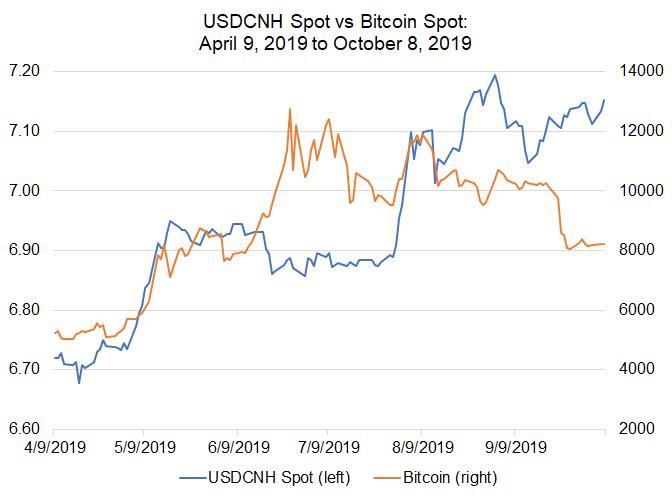

Chinese Yuan (USDCNH) vs Bitcoin (BTCUSD)Technical Analysis: Daily Chart (April to October 2019) (Chart 1)

Since the start of October,USDCNHhas added 0.2% while bitcoin prices have fallen by -1.4%. The current 5-day and 20-day correlations between USDCNH and bitcoin prices are 0.77 and -0.79, respectively. On longer-term horizons, the 3-month and 6-month correlations are -0.17 and 0.43, respectively. In our last update on USDCNH and bitcoin prices, the 3-month and 6-month correlations were -0.18 and 0.56.

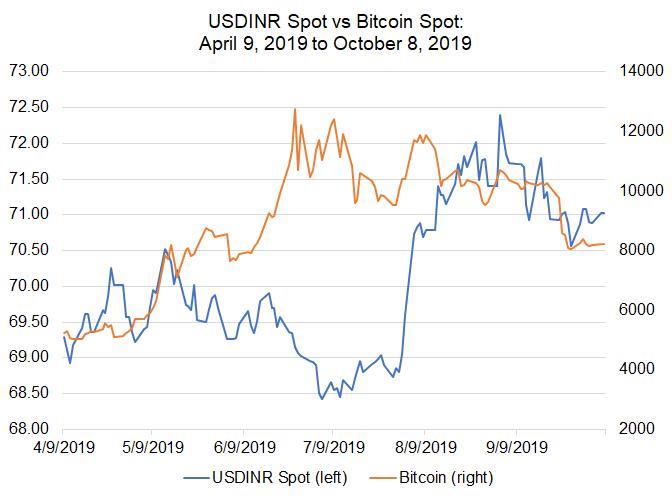

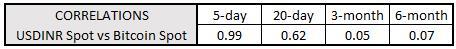

Indian Rupee (USDINR) vs Bitcoin (BTCUSD)Technical Analysis: Daily Chart (April to October 2019) (Chart 2)

Since the start of October, USDINR has gained 0.9% while bitcoin prices have fallen by -1.4%. The current 5-day and 20-day correlations between USDINR and bitcoin prices are 0.99 and 0.62, respectively. On longer-term horizons, the 3-month and 6-month correlations are 0.05 and 0.07, respectively. In our last update on USDINR and bitcoin prices, the 3-month and 6-month correlations were -0.07 and 0.13.

Among the emerging market FX discussed in this report, USDINR has the most significant 5-day correlation with bitcoin prices.

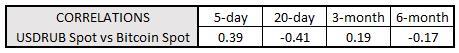

Russian Ruble (USDRUB) vs Bitcoin (BTCUSD)Technical Analysis: Daily Chart (April to October 2019) (Chart 3)

Since the start of October,USDRUBhas gained 0.6% while bitcoin prices have fallen by -1.4%. The current 5-day and 20-day correlations between USDRUB and bitcoin prices are 0.39 and -0.41, respectively. On longer-term horizons, the 3-month and 6-month correlations are 0.19 and -0.17, respectively. In our last update on USDRUB and bitcoin prices, the 3-month and 6-month correlations were 0.07 and -0.10.

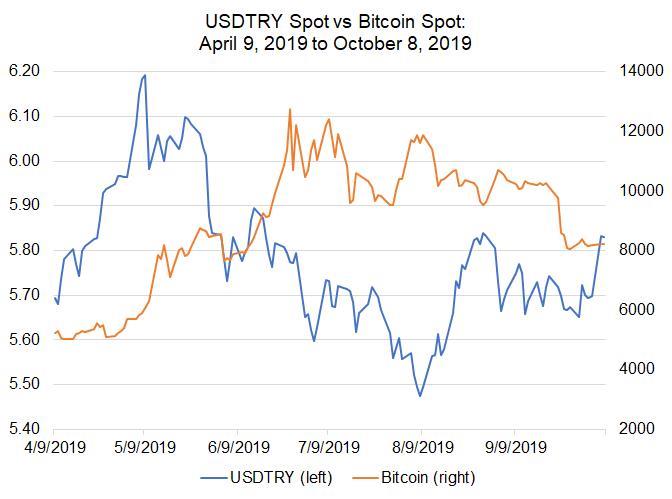

Turkish Lira (USDTRY) vs Bitcoin (BTCUSD)Technical Analysis: DailyChart (April to October 2019) (Chart 4)

Thus far in October, USDTRY has added 3.3% while bitcoin prices have fallen by -1.4%. The current 5-day and 20-day correlations between USDTRY and bitcoin prices are 0.46 and -0.06, respectively. On longer-term horizons, the 3-month and 6-month correlations are -0.46 and -0.70, respectively. In our last update on USDTRY and bitcoin prices, the 3-month and 6-month correlations were -0.37 and -0.66.

Among the emerging market FX discussed in this report, USDTRY has the most significant 3-month and 6-month correlations with bitcoin prices.

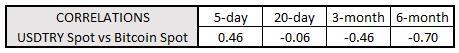

South African Rand (USDZAR) vs Bitcoin (BTCUSD)Technical Analysis: DailyChart (April to October 2019) (Chart 5)

Since the start of October,USDZARhas gained 1.1% while bitcoin prices have fallen by -1.4%. The current 5-day and 20-day correlations between USDZAR and bitcoin prices are 0.80 and -0.87, respectively. On longer-term horizons, the 3-month and 6-month correlations are -0.07 and 0.04, respectively. In our last update on USDZAR and bitcoin prices, the 3-month and 6-month correlations were -0.09 and 0.17.

Among the emerging market FX discussed in this report, USDZAR has the most significant 20-day correlation with bitcoin prices.

Why Does Crypto Typically Benefit When EM FX Suffers?

A quick recap: bitcoin and cryptocurrencies are not 'safe haven currencies' per se, as they lack key features of being a currency in the first place, main of which is a 'stable store of value.' But if you're not using bitcoin and other cryptocurrencies as 'stores of value,' then, given the electronic nature of the globalized economy in 2019, the cryptocurrency market, coins and tokens can all be used as intermediaries to move capital beyond of the reach of governmental agencies.

Why would a market participant want to move capital around without government interference? If capital controls are in place, then it may be impossible to render the production of goods or services at fair value, especially in an emerging market economy. It may not be due to domestic conditions alone, either fiscally (via elections) or monetarily (via central banking independence). Instead, it could be due to external factors, like economic fallout from an international trade dispute – say, the US-China trade war.

Bitcoin Price and Emerging Market FX Relationship Conclusions

What's bad for EM FX –like the Chinese Yuan and South African Rand – is typically good for cryptocurrencies – like bitcoin – in general. It remains the case that, if bitcoin prices and the cryptocurrency market are going to continue their 2019 rally, the best bet may be for the US-China trade war to deepen further.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoringtrader sentiment ; quarterlytrading forecasts ; analytical and educationalwebinars held daily ; trading guides to help youimprove trading performance , and even one for those who arenew to FX trading .

-pp---- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio,

Follow him in the DailyFX Real Time News feed and Twitter at@CVecchioFX

MENAFN0810201900760000ID1099101341

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.