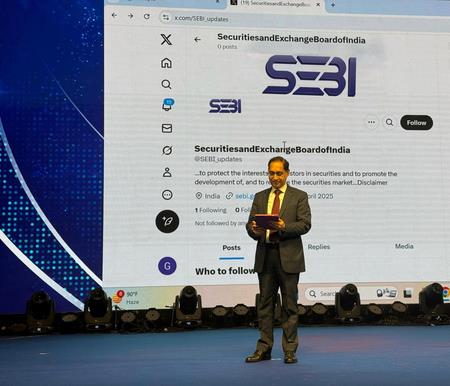

Capital Markets Central To 'Viksit Bharat' Push, Mfs Hold Huge Opportunity: SEBI Chairman

Pandey said at an event here that capital markets are instrumental in achieving the country's developmental aspirations, adding that companies have raised approximately Rs 2 lakh crore from the primary market this year, indicating robust investors' confidence.

"There is a deep well of domestic capital waiting to be deployed," Pandey said, adding that SEBI is committed to simplifying and speeding up the capital-raising process, enabling businesses to access funds more efficiently.

"We are facilitators of capital formation, and our goal is to help businesses raise capital seamlessly to power India's growth and transformation," the SEBI Chairperson said.

He characterised the regulator's approach as "optimum regulation," which adjusts guardrails without stifling innovation.

“We've made several regulatory changes and will continue a consultative approach,” he added.

Pandey highlighted structural opportunities, pointing out that mutual fund assets under management are below 25 per cent of GDP, with urban participation at approximately 15 per cent and rural participation at 6 per cent.

“There's huge opportunity in deepening mutual fund penetration,” Pandey said, noting that 22 per cent of non-investors aware of mutual funds plan to invest in the next year.

The SEBI Chairman added that the regulator will conduct a comprehensive review of short-selling and securities lending and borrowing norms to align them with global standards.

Pandey, however, admitted that India's securities lending market is underdeveloped compared to other markets, reiterating commitment to reforms aimed at enhancing transparency, liquidity, and investor-friendliness.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment