ATEX Reports Updated Mineral Resource Estimate Of 475 Million Tonnes Of 0.88% Cueq Indicated And 1.5 Billion Tonnes Of 0.75% Cueq Inferred

| Category | COG | Tonnes (Mt) | Grade | Contained Metal | |||||||||||

| Cu | Au | Ag | Mo | CuEq | AuEq | Cu | Au | Ag | Mo | CuEq | AuEq | ||||

| (%) | (g/t) | (g/t) | (g/t) | (%) | (g/t) | (Mt) | (koz) | (koz) | (kt) | (Mt) | (koz) | ||||

| Gold Oxide | Measured | - | - | - | - | - | - | - | - | - | - | - | - | - | - |

| Indicated | - | - | - | - | - | - | - | - | - | - | - | - | - | - | |

| Inferred | 0.16 g/t Au | 47 | - | 0.35 | 1.34 | - | - | 0.36 | - | 531 | 2,028 | - | - | 543 | |

| | |||||||||||||||

| Copper - Gold Sulphide | Measured | - | - | - | - | - | - | - | - | - | - | - | - | - | - |

| Indicated | 0.35% Cu | 475 | 0.58 | 0.25 | 1.39 | 70.4 | 0.88 | - | 2.75 | 3,822 | 21,222 | 33 | 4.17 | - | |

| Inferred | 0.35% Cu | 1,511 | 0.50 | 0.20 | 1.16 | 70.6 | 0.75 | - | 7.54 | 9,896 | 56,126 | 107 | 11.30 | - | |

| Notes to accompany the Mineral Resource Estimate : | |||||||||||||||

| (1) The Independent and Qualified Person for the Mineral Resource Estimate, as defined by NI 43-101, is David Machuca-Mory , PhD, PEng, from SRK Consulting (Canada) Inc., and the effective date is September 1, 2025. | |||||||||||||||

| (2) Mineral Resources have been classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards on Mineral Resources and Mineral Reserves. | |||||||||||||||

| (3) Reasonable prospects of eventual economic extraction were considered by applying appropriate cut-off grades and reporting within potentially mineable envelopes. | |||||||||||||||

| (4) Metal prices considered were US$2,750 /oz Au, US$3.80 /lb Cu, US$27.00 /oz Ag, and US$22.00 /lb Mo. | |||||||||||||||

| (5) Cut-off grades considered for oxide and sulphide block model estimates were, respectively, 0.16 g/t Au and 0.35% Cu. | |||||||||||||||

| (6) Metallurgical recoveries used for open pit oxides based on Coarse Bottle Roll and CIL Leach test work are 76.0% for gold and 50.0% for silver. | |||||||||||||||

| (7) Metallurgical recoveries used for underground sulphides based on initial flotation tests was 94.0% for copper, 95.0% for gold, 80.0% for silver, and 64.0% for molybdenum. | |||||||||||||||

| (8) Au-Ox epithermal Mineral Resource estimates are reported within a conceptual pit optimized with a slope angle of 45° and assuming US$2.43/t for mining costs, US$5.45/t for processing costs, and US$1.31/oz for gold selling costs. | |||||||||||||||

| (9) Cu-Au porphyry related Mineral Resource Estimates are reported assuming bulk underground extraction techniques within an envelope around 40m x 40m x 40m mineable shapes above a cut-off of 0.30% Cu. | |||||||||||||||

| (10) Tonnage is expressed in millions of tonnes; metal content is expressed in thousands of ounces, for gold and silver, millions of tonnes, for copper, and thousands of tonnes for molybdenum. | |||||||||||||||

| (11) All figures rounded to reflect the relative accuracy of the estimates and totals may not add up due to rounding. (12) Gold Equivalent (AuEq) is calculated assuming US$27/oz Ag and US$2,750/oz Au and metallurgical recoveries of 76% for Au and 50% for Ag using the formula AuEq g/t = Au g/t + 0.005856 * Ag g/t). | |||||||||||||||

| (13) Copper Equivalent (CuEq) is calculated assuming US$3.80/lb Cu, US$2,750/oz Au, US$27/oz Ag, and US$22/lb Mo and metallurgical recoveries of 94% for Cu, 95% for Au, 80% for Ag, and 64% for Mo using the formula CuEq % = Cu % + (10499.12432 * Au g/t /10000) + (82.424482 * Ag g/t /10000) + (3.5790963 * Mo g/t /10000). |

The following table sets out the change in the MRE for the Valeriano Project, compared to the MRE reported on September 12, 2023.

Table 2: Mineral Resource Estimate for Copper-Gold Sulphide, Contained Metal Change from 2023 to 2025

| Category | COG | Cu | Au | Ag | Mo | CuEq | CuEq | |

| (Mt) | (koz) | (koz) | (kt) | (Mt) | (Blbs) | |||

| 2025 MRE | Indicated | 0.35% Cu | 2.8 | 3,822 | 21,222 | 33 | 4.2 | 9.2 |

| Inferred | 0.35% Cu | 7.5 | 9,896 | 56,126 | 107 | 11.3 | 25.0 | |

| 2023 MRE iv | Inferred | 0.40% Cu | 7.1 | 9,014 | 43,602 | 90 | 9.4 | 20.7 |

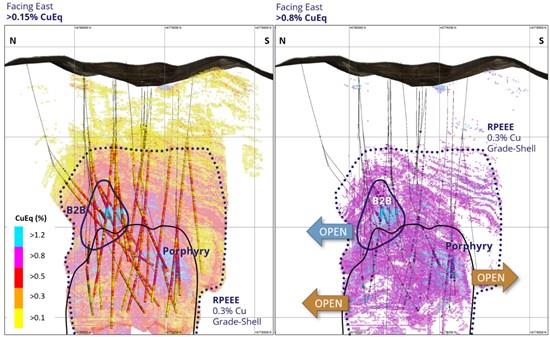

Figure 1. Long sections with lithology, MRE block model and RPEEE (0.3% Cu grade-shell)

To view an enhanced version of this graphic, please visit:

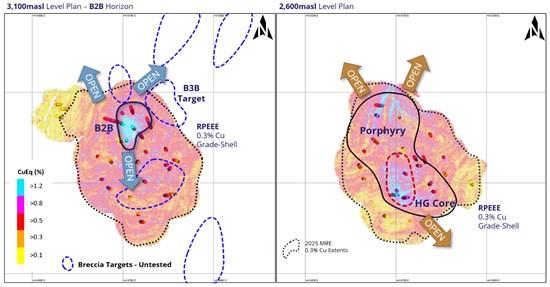

Figure 2. Level plans with lithology, MRE block model and RPEEE (0.3% Cu grade-shell)

To view an enhanced version of this graphic, please visit:

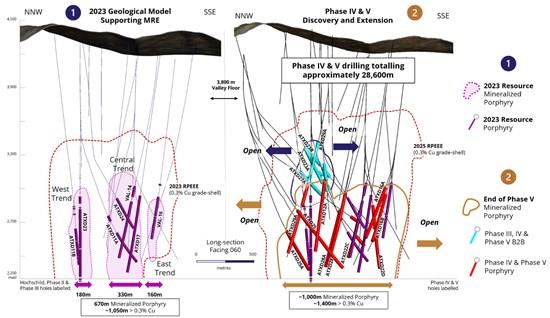

Figure 3. Improvements over 2023 MRE

To view an enhanced version of this graphic, please visit:

MINERAL RESOURCE HIGH-GRADE COMPONENTS REMAIN OPEN FOR EXPANSION

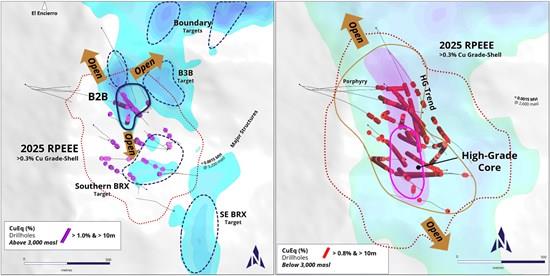

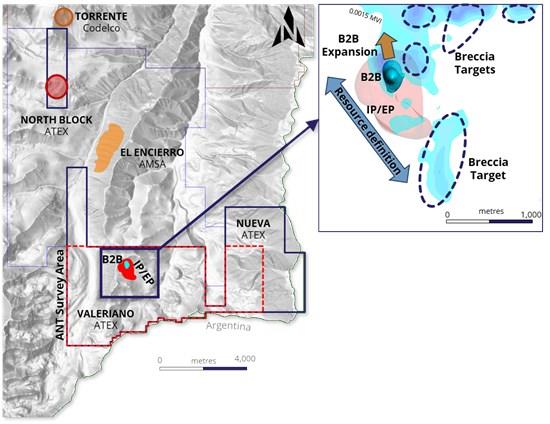

The B2B Zone represents a significant growth opportunity, reporting an initial Indicated Resource of 28.4 Mt of 1.36% CuEq (0.95% Cu, 0.33 g/t Au, 1.98 g/t Ag and 134.0 g/t Mo), and an additional 2.6 Mt in the Inferred category of 1.05% CuEq (0.74% Cu, 0.28 g/t Au, 1.74 g/t Ag and 22 g/t Mo), at a 0.6% copper cut-off grade. This high-grade breccia zone positions the Project for a potential and economically compelling starter conventional underground mine, accessible from the lower elevation valley floor at 3,800 metres, creating a more visible pathway to earlier and lower cost production. Expansion potential remains open heading into the Phase VI drill program and the following Phase VII campaign designed to follow up on the strong Phase V results, where the final B2B Zone hole, ATXD25C, intersected 2.26% CuEq (1.69% Cu, 0.80 g/t Au, 5.0 g/t Ag and 30 g/t Mo) over 7.5 metresv highlighting the strength of the mineral system and setting the stage for additional high-grade discoveries.

In addition, the high-grade porphyry core contains 118 Mt of Indicated Resources at 1.07% CuEq (0.68% Cu, 0.35 g/t Au, 1.74 g/t Ag, 42.8 g/t Mo) and 161 Mt of Inferred Resources at 1.01% CuEq (0.63% Cu, 0.34 g/t Au, 1.88 g/t Ag, 37.6 g/t Mo) at a 0.5% cut-off. This demonstrates the potential for a higher-grade start up that could derisk initial project economics in the future. This high-grade core could continue to increase in size and grade through future infill and expansion drilling. Currently this core only represents 42% and 27% of the Indicated and Inferred Mineral Resources, respectively.

With multiple high-impact B2B-style targets planned to be tested and extensional opportunities with the high-grade porphyry trend at 1,000 metres length and still open to the north-northwest and southeast, there remains strong potential to unlock considerable value as drilling advances.

Figure 4. MRE B2B Zone and High-Grade Core expansion potential

To view an enhanced version of this graphic, please visit:

RESOURCE SENSITIVITY ANALYSIS

Sensitivity analysis on the MRE was completed at various cut-off grades with the results presented in Tables 3 and Table 4 below.

Table 3. Indicated Cu-Au Porphyry Mineral Resource Sensitivity Analysis*

| Cut-off Grade (Cu%) | Tonnes (Mt) | Grade | Contained Metal | ||||||||

| Cu (%) | Au (g/t) | Ag (g/t) | Mo (g/t) | CuEq ** (%) | Cu (Mt) | Au (koz) | Ag (koz) | Mo (kt) | CuEq (Mt) | ||

| 0.20 | 571 | 0.53 | 0.24 | 1.34 | 68.4 | 0.82 | 3.02 | 4,365 | 24,539 | 39.0 | 4.65 |

| 0.25 | 551 | 0.54 | 0.24 | 1.35 | 68.8 | 0.83 | 2.98 | 4,262 | 23,905 | 37.9 | 4.57 |

| 0.30 | 520 | 0.56 | 0.24 | 1.37 | 69.5 | 0.85 | 2.89 | 4,086 | 22,833 | 36.1 | 4.42 |

| 0.35 | 475 | 0.58 | 0.25 | 1.39 | 70.4 | 0.88 | 2.75 | 3,822 | 21,222 | 33.5 | 4.17 |

| 0.40 | 417 | 0.61 | 0.26 | 1.42 | 71.6 | 0.91 | 2.53 | 3,457 | 19,039 | 29.9 | 3.81 |

| 0.45 | 350 | 0.64 | 0.27 | 1.46 | 72.8 | 0.96 | 2.24 | 3,011 | 16,399 | 25.4 | 3.36 |

| 0.50 | 278 | 0.68 | 0.28 | 1.51 | 74.4 | 1.02 | 1.90 | 2,508 | 13,485 | 20.7 | 2.83 |

| 0.55 | 210 | 0.74 | 0.30 | 1.57 | 75.9 | 1.09 | 1.54 | 2,000 | 10,611 | 15.9 | 2.28 |

| 0.60 | 153 | 0.80 | 0.31 | 1.64 | 77.5 | 1.17 | 1.22 | 1,548 | 8,084 | 11.9 | 1.79 |

| 0.65 | 110 | 0.86 | 0.33 | 1.72 | 79.4 | 1.26 | 0.95 | 1,182 | 6,093 | 8.7 | 1.38 |

| 0.70 | 80 | 0.93 | 0.35 | 1.80 | 81.6 | 1.35 | 0.75 | 911 | 4,649 | 6.5 | 1.08 |

Table 4. Inferred Cu-Au Porphyry Mineral Resource Sensitivity Analysis*

| Cut-off Grade (Cu%) | Tonnes (Mt) | Grade | Contained Metal | ||||||||

| Cu (%) | Au (g/t) | Ag (g/t) | Mo (g/t) | CuEq ** (%) | Cu (Mt) | Au (koz) | Ag (koz) | Mo (kt) | CuEq (Mt) | ||

| 0.20 | 2,398 | 0.42 | 0.18 | 1.05 | 70.3 | 0.64 | 10.02 | 13,971 | 80,649 | 168.5 | 15.39 |

| 0.25 | 2,142 | 0.44 | 0.19 | 1.08 | 70.4 | 0.67 | 9.44 | 12,876 | 74,050 | 150.8 | 14.38 |

| 0.30 | 1,841 | 0.47 | 0.19 | 1.11 | 70.5 | 0.71 | 8.61 | 11,507 | 65,782 | 129.8 | 13.00 |

| 0.35 | 1,511 | 0.50 | 0.20 | 1.16 | 70.6 | 0.75 | 7.54 | 9,896 | 56,126 | 106.7 | 11.30 |

| 0.40 | 1,180 | 0.53 | 0.21 | 1.21 | 70.6 | 0.79 | 6.30 | 8,141 | 45,808 | 83.3 | 9.37 |

| 0.45 | 869 | 0.57 | 0.23 | 1.27 | 70.5 | 0.85 | 4.98 | 6,361 | 35,470 | 61.3 | 7.37 |

| 0.50 | 602 | 0.62 | 0.24 | 1.34 | 70.4 | 0.91 | 3.71 | 4,699 | 25,914 | 42.4 | 5.47 |

| 0.55 | 394 | 0.67 | 0.26 | 1.41 | 70.3 | 0.97 | 2.63 | 3,285 | 17,897 | 27.7 | 3.84 |

| 0.60 | 249 | 0.72 | 0.28 | 1.49 | 70.4 | 1.05 | 1.80 | 2,215 | 11,913 | 17.5 | 2.61 |

| 0.65 | 156 | 0.78 | 0.29 | 1.56 | 70.6 | 1.12 | 1.22 | 1,474 | 7,836 | 11.0 | 1.76 |

| 0.70 | 99 | 0.84 | 0.31 | 1.63 | 70.8 | 1.20 | 0.83 | 990 | 5,201 | 7.0 | 1.19 |

*The reader is cautioned that the figures in this table should not be misconstrued for a Mineral Resource Statement. The figures are only presented to show the sensitivity of the block model estimates to the selection of a cut-off grade.

** Copper Equivalent (CuEq) is calculated assuming US$3.80/lb Cu, US$2,750/oz Au, US$27/oz Ag, and US$22/lb Mo and metallurgical recoveries of 94% for Cu, 95% for Au, 80% for Ag, and 64% for Mo using the formula CuEq % = Cu % + (10499.12432 * Au g/t /10000) + (82.424482 * Ag g/t /10000) + (3.5790963* Mo g/t /10000).

PHASE VI DRILLING TO DRIVE NEXT STAGE OF MINERAL RESOURCE GROWTH

The updated Mineral Resource estimate represents a point-in-time foundation of what continues to emerge as a much larger, district-scale copper-gold system. Considerable potential exists to further expand this endowment, with Phase VI drilling set to commence this month with three rigs currently on-site and more set to arrive before the end of the month. Phase VI will be ATEX's largest program to date and strategically planned to both grow and refine the current Mineral Resource while also advancing new discovery opportunities. Key objectives include building on the momentum of the high-grade B2B Zone, where drilling to date has demonstrated strong continuity and upside; systematically testing additional B2B-style targets in the surrounding area alongside new regional targets that could open up fresh discovery corridors; and continuing to step out within the Valeriano Porphyry system, which remains open in multiple directions with its full extent still undefined. Testing of the broader porphyry system will remain dynamic and can be modified or adjusted to maintain flexibility of the exploration strategy and unlock the greatest value.

Figure 5. Mineral Resource expansion potential

To view an enhanced version of this graphic, please visit:

MINERAL RESOURCE ESTIMATION METHODOLOGY

Complete details for the MRE reported in Table 1 will be documented in a technical report prepared in accordance with NI 43-101 (the " New Technical Report ") to be filed under the Corporation's SEDAR+ profile at as soon as practicable and not later than 45 days after the date of this news release. Once filed, the New Technical Report will supersede the Company's current technical report entitled "Independent Technical Report for the Valeriano Copper-Gold Project, Atacama Region, Chile," with an effective date of October 7, 2023, in its entirety.

The Mineral Resource estimation methodology used by the Qualified Person (" QP "), David F. Machuca-Mory, PhD, PEng to update the Mineral Resource estimates on the Valeriano Project included the following procedures:

- Compilation and verification of the updated database.

Review of the component parts of the 3D geology model built by ATEX for mineralization, lithology and alteration. Definition of estimation domains based on the current geological understanding of the deposit and the statistical analysis of grades in relation to the modeled mineralization, lithology and alteration domains.

Data conditioning (compositing and capping). Definition of a local anisotropy field based on the mineralization profiles.

Geostatistical analysis including variography and local anisotropy analysis. Block modelling and specific gravity interpolation by inverse distance weighting.

Ordinary kriging estimation of copper, gold, silver, molybdenum and arsenic grades using local anisotropy variograms. Post processing of all estimated grades by Local Uniform Conditioning.

Validation of estimates through visual inspection and statistical analysis, including swath plots and Change of Support models. Resource classification based on criteria of geological continuity and confidence and drill hole density.

Assessment of the "reasonable prospects for eventual economic extraction" and selection of appropriate reporting cut-off grades, considering a open pit mining method for the oxides mineralization and a bulk underground mining method for the porphyry-related sulphides mineralization. Preparation of a Mineral Resource Statement.

Reconciliation with the previous Mineral Resource estimate.

The mineralization, lithology and alteration domains were built conjointly by ATEX and SRK using implicit and explicit modelling techniques in LeapFrogTM software. Mineralized and discrete features were modelled with explicit inputs based on the informing datasets and geological cross sections interpreted by ATEX geologists. The geostatistical Mineral Resource estimates were completed by SRK using RMSPTM software.

ANALYST WEBCAST AND CONFERENCE CALL

Details of the updated MRE will be presented by Ben Pullinger, President and CEO of ATEX, in a webcast conference call on September 24, 2025, at 8:00 am EST. Webcast and conference call details are provided below.

Webcast / Conference Call Details:

Date: September 24, 2025

Time: 8:00 AM EST

Listen only webcast:

North American Dial In for Analyst Q&A: 1-866-807-9684

International Dial In for Analyst Q&A: 1-412-317-5415

QUALITY CONTROL AND QUALITY ASSURANCE

Drill holes are collared with a PQ drill bit, reduced to HQ and, sequentially, to NQ as the drill holes progressed deeper. Drill core produced by the drill rigs was extracted from the core tubes by the drill contractor under the supervision of ATEX employees, marked for consistent orientation and placed in core boxes with appropriate depth markers added. Full core boxes were then sealed before being transported by ATEX personnel to the Valeriano field camp. Core at the field camp is processed, quick logged, checked for recovery, photographed, and marked for specific gravity, geotechnical studies and for assays. From camp, the core is transferred to a secure core-cutting facility in Vallenar, operated by IMG, a third-party consultant. Here, the core trays are weighed before being cut using a diamond saw under ATEX personnel oversight. ATEX geologists working at this facility double-check the selected two-metre sample intervals, placing the samples in seal bags and ensuring that the same side of the core is consistently sampled. Reference numbers are assigned to each sample and each sample is weighed. The core trays with the remaining half-core are weighed and photographed. Additionally, core logs are updated, and specific gravity and geotechnical samples are collected. The remaining core is stored in racks at the Company's secure facility in Vallenar.

From Vallenar samples are sent to an ALS preparation facility in Copiapó. ALS is an accredited laboratory which is independent of the Company. The prepared samples were sent to the ALS assay laboratories in either Santiago, Chile and Lima, Peru for gold (Au-AA24), copper (Cu-AA62), molybdenum (Mo-AA62) and silver (Ag-AA62) assays as well as and multi-element ICP (ME-MS61) analysis. No data quality problems were indicated by the QA/QC program.

QUALIFIED PERSON

The scientific and technical information related to the MRE in this news release has been reviewed and approved by Dr. David F. Machuca-Mory from SRK Consulting (Canada) Inc., an independent qualified person (as defined in NI 43-101).

Mr. Ben Pullinger, P.Geo., registered with the Professional Geoscientists Ontario, a qualified person (as defined by NI 43-101) has reviewed and approved of the other scientific and technical information contained in this press release. Mr. Pullinger is not considered independent under NI 43-101 as he is President and CEO of ATEX.

ABOUT ATEX

ATEX is exploring the Valeriano Copper-Gold Project which is located within the emerging copper gold porphyry mineral belt linking the prolific El Indio High-Sulphidation Belt to the south with the Maricunga Gold Porphyry Belt to the north, located in the Atacama Region, Chile. This emerging belt, informally referred to as the Link Belt, hosts several copper gold porphyry deposits at various stages of development including, Filo del Sol (Lundin Mining/BHP), Josemaria (Lundin Mining/BHP), Lunahausi (NGEx Minerals), La Fortuna (Teck Resources/Newmont) and El Encierro (Antofagasta/Barrick).

For further information, please contact:

Ben Pullinger,

President and CEO

Email: ...

Aman Atwal,

Vice President, Business Development and Investor Relations

Email: ...

1-647-398-9405

or visit ATEX's website at .

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS:

This news release contains forward-looking statements, including predictions, projections, and forecasts. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "planning", "expects" or "does not expect", "continues", "scheduled", "estimates", "forecasts", "intends", "potential", "anticipates", "does not anticipate", or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements involve known and unknown risks, future events, conditions, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, prediction, projection, forecast, performance or achievements expressed or implied by the forward-looking statements.

Such forward-looking statements include, among others: statements regarding the timing of filing of the New Technical Report; statements regarding the further growth and expansion of the MRE; statements regarding plans for the evaluation of exploration properties including the Valeriano Copper Gold Project; the success of evaluation plans; the success of exploration activities especially to the significant expansion of the high-grade corridor; mine development prospects; potential for future metals production; changes in economic parameters and assumptions; all aspects related to the timing and extent of exploration activities, including the Phase VI program contemplated in this press release; timing of receipt of exploration results; the interpretation and actual results of current exploration activities and mineralization; changes in project parameters as plans continue to be refined; the results of regulatory and permitting processes; future metals price; possible variations in grade or recovery rates; failure of equipment or processes to operate as anticipated; labour disputes and other risks of the mining industry; the results of economic and technical studies; delays in obtaining governmental and local approvals or financing or in the completion of exploration; timing of assay results; as well as those factors disclosed in ATEX's publicly filed documents.

Although ATEX has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its regulation services provider has reviewed or accepts

responsibility for the adequacy or accuracy of the content of this news release.

i Source: S&P Global, "Major Copper Discoveries", .

ii Source: S&P Global, "Major Copper Discoveries", .

iii See news release titled "ATEX Completes Phase V Program Ending in High-Grade B2B Mineralization - Strategic Objectives Achieved with Resource Update Expected in 2H 2025" reported on July 30, 2025.

iv See NI 43-101 technical report titled "Independent Technical Report for the Valeriano Copper-Gold Project, Atacama Region, Chile" by Joled Nur, CCCRRM-Chile, and David Hopper, CGeol, with an effective date of September 1, 2023, filed at on October 25, 2023, for additional details on the 2023 Mineral Resource Estimate for the Valeriano project.

v See news release titled: ATEX Completes Phase V Program Ending in High-Grade B2B Mineralization - Strategic Objectives Achieved with Resource Update Expected in 2H 2025.

To view the source version of this press release, please visit

SOURCE: ATEX Resources Inc.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Motif AI Enters Phase Two Of Its Growth Cycle

- Chaingpt Pad Unveils Buzz System: Turning Social Hype Into Token Allocation

- NOVA Collective Invest Showcases Intelligent Trading System7.0 Iterations Led By Brady Rodriguez

- With Seal, Walrus Becomes The First Decentralized Data Platform With Access Controls

- B2PRIME Secures DFSA Licence To Operate From The DIFC, Setting A New Institutional Benchmark For MENA & Gulf Region

- Bitmex Launches Alpha Showdown Trading Competition Featuring 3 BTC Prize Pool And Additional Rewards

Comments

No comment