Former Binance CEO CZ's Yzi Labs Open To External Investors-What It Means

“There's always significant interest from external investors,” Ella Zhang, head of YZi Labs, told the Financial Times.“We're considering turning it into an external-facing fund in the future. But at this stage, we believe it's not the right time yet.”

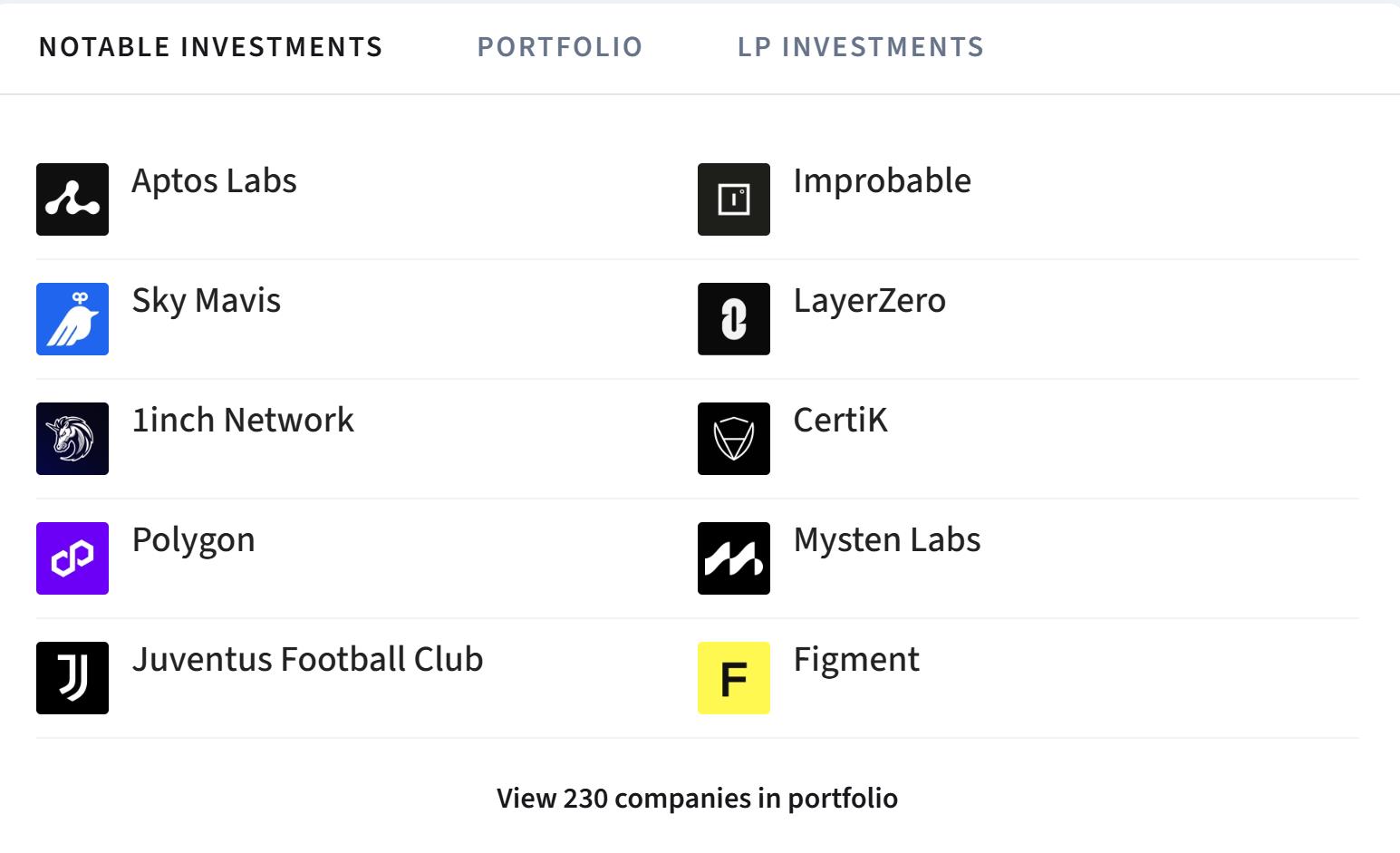

YZi Labs' portfolio includes leading projects across the crypto and Web3 space, such as Aptos Labs, Polygon , 1inch Network, Sky Mavis, along with infrastructure and security players like LayerZero, Mysten Labs, and CertiK. The fund's holdings encompass over 230 companies, according to Dealroom, highlighting its extensive reach within the blockchain industry.

YZi Labs portfolio. Source: Dealroom

Related: Standard Chartered venture arm plans $250M fund for digital assets

SEC Requests Confidential Demo of YZi Labs Portfolio CompaniesElla Zhang also revealed that the U.S. Securities and Exchange Commission (SEC) recently requested a private demonstration of companies backed by YZi Labs. The SEC's inquiry followed its chair's absence at the firm's demo day at the New York Stock Exchange, signaling a comparatively more approachable stance from US regulators on crypto under the Biden administration.

“Commissioner Paul Atkins and others are quite open-minded,” Zhang noted. Atkins has served as SEC chair since April 2025. This development indicates a shift towards more constructive engagement between regulators and innovative blockchain firms.

Meanwhile, Zhao stepped down from Binance last year after pleading guilty to a US criminal charge related to AML compliance. He served a four-month prison sentence and is currently seeking a pardon from President Donald Trump . Despite this, Zhao remains Binance 's largest shareholder and continues to exert influence over the industry.

Crypto market participants are closely monitoring regulatory developments as the industry matures, with increasing interest from institutional investors in blockchain, DeFi, and NFT ventures. The move by YZi Labs to consider inviting external capital marks a notable evolution in the institutionalization of crypto funds.

Recent Trends in Crypto Venture FundingThis shift comes amid rising demand for crypto -native investment funds. Notably, Galaxy Digital raised $175 million for its first externally managed venture fund in June, surpassing its initial $150 million target. Such developments underscore growing confidence in the potential returns from early-stage blockchain startups, which some analysts believe could offer multi-fold gains over traditional assets.

As the crypto industry expands, regulatory clarity and institutional participation will continue to shape the future of blockchain innovation and investment.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Motif AI Enters Phase Two Of Its Growth Cycle

- Chaingpt Pad Unveils Buzz System: Turning Social Hype Into Token Allocation

- NOVA Collective Invest Showcases Intelligent Trading System7.0 Iterations Led By Brady Rodriguez

- With Seal, Walrus Becomes The First Decentralized Data Platform With Access Controls

- B2PRIME Secures DFSA Licence To Operate From The DIFC, Setting A New Institutional Benchmark For MENA & Gulf Region

- Bitmex Launches Alpha Showdown Trading Competition Featuring 3 BTC Prize Pool And Additional Rewards

Comments

No comment