India Alcoholic Beverages Market Size, Share, Industry Growth, Outlook And Report 20252033

Key Highlights:

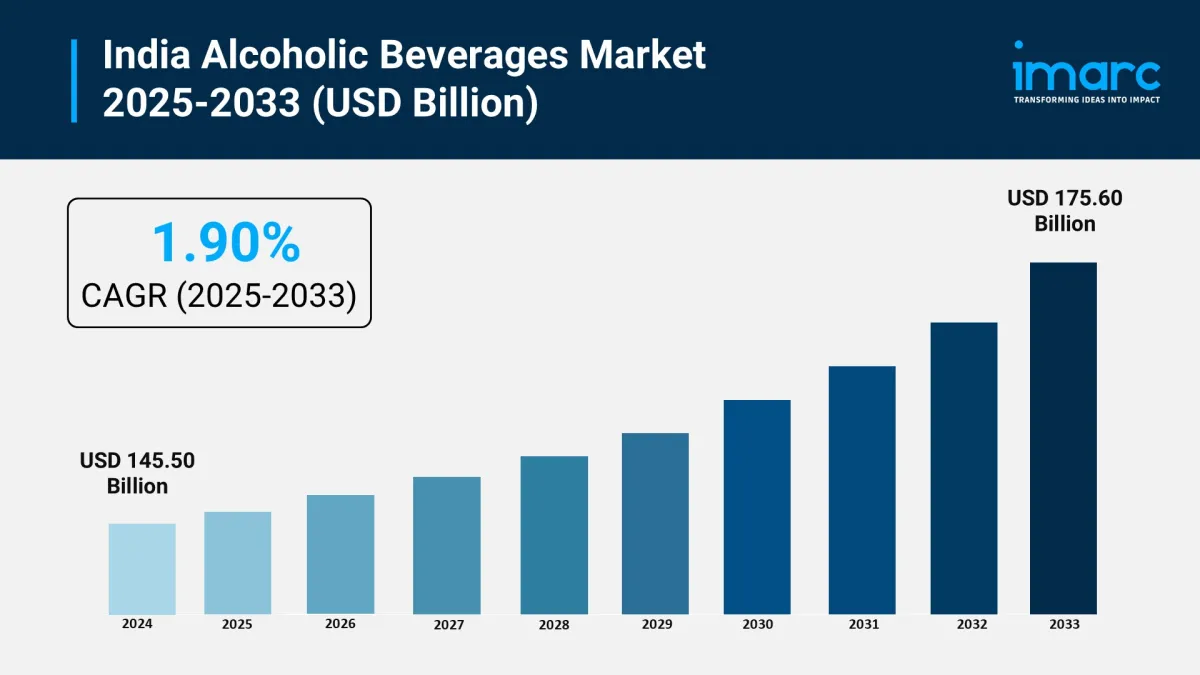

. 2024 Market Size: USD 145.50 Billion

. 2033 Forecast Size: USD 175.60 Billion

. CAGR (2025–2033): 1.90%

. Growing popularity of premium and craft alcoholic beverages

. Expansion of organized retail and e-commerce distribution

. Increasing urban nightlife and social drinking culture

. Entry of global brands and rising marketing investments

Get Free Sample Report: https://www.imarcgroup.com/india-alcoholic-beverages-market/requestsample

How Is AI Transforming the Market?

AI is revolutionizing the alcoholic beverages market through personalized product recommendations, inventory optimization, and targeted marketing. AI-powered analytics help companies forecast demand, identify emerging flavor trends, and optimize pricing strategies. Computer vision technology supports automated quality checks, while AI chatbots enhance customer engagement for online sales.

Key Market Trends and Drivers:

. Rising demand for premium spirits and craft beers

. Growing consumption of flavored alcoholic beverages

. Increased focus on sustainable and recyclable packaging

. Strong marketing and brand collaborations with events and influencers

. Expanding penetration of online alcohol delivery platforms

Explore the Full Report with Charts, Table of Contents, and List of Figures: https://www.imarcgroup.com/india-alcoholic-beverages-market

Market Segmentation:

By Category:

. Beer

. Wine

. Still Light Wine

. Sparkling Wine

. Spirit

. Baijiu

. Vodka

. Whiskey

. Rum

. Liqueurs

. Gin

. Tequila

. Others

By Alcoholic Content:

. High

. Medium

. Low

By Flavor:

. Unflavored

. Flavored

By Packaging Type:

. Glass Bottles

. Tins

. Plastic Bottles

. Others

By Distribution Channel:

. Supermarkets and Hypermarkets

. On-Trade

. Specialist Retailers

. Online

. Convenience Stores

. Others

By Region:

. North India

. South India

. East India

. West India

Competitive Landscape:

The competitive landscape includes market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant. Detailed profiles of major companies are included in the report.

Latest Developments:

. January 2025 – Anheuser-Busch InBev (AB InBev), producer of Budweiser beer, announced plans to invest Rs 1,000 crore in a new manufacturing facility in Uttar Pradesh, signing an MoU during the World Economic Forum in Davos.

. January 2025 – United Breweries, Heineken's Indian unit, confirmed it would resume beer supplies to Telangana following discussions with the state government to resolve pricing and payment issues.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Reseach

- B2PRIME Strengthens Institutional Team's Growth With Appointment Of Lee Shmuel Goldfarb, Formerly Of Edgewater Markets

- BTCC Exchange Scores Big In TOKEN2049 With Interactive Basketball Booth And Viral Mascot Nakamon

- Ares Joins The Borderless.Xyz Network, Expanding Stablecoin Coverage Across South And Central America

- Primexbt Launches Stock Trading On Metatrader 5

- Solana's First Meta DEX Aggregator Titan Soft-Launches Platform

- Moonacy Protocol Will Sponsor And Participate In Blockchain Life 2025 In Dubai

- Primexbt Launches Instant Crypto-To-USD Exchange

Comments

No comment