403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

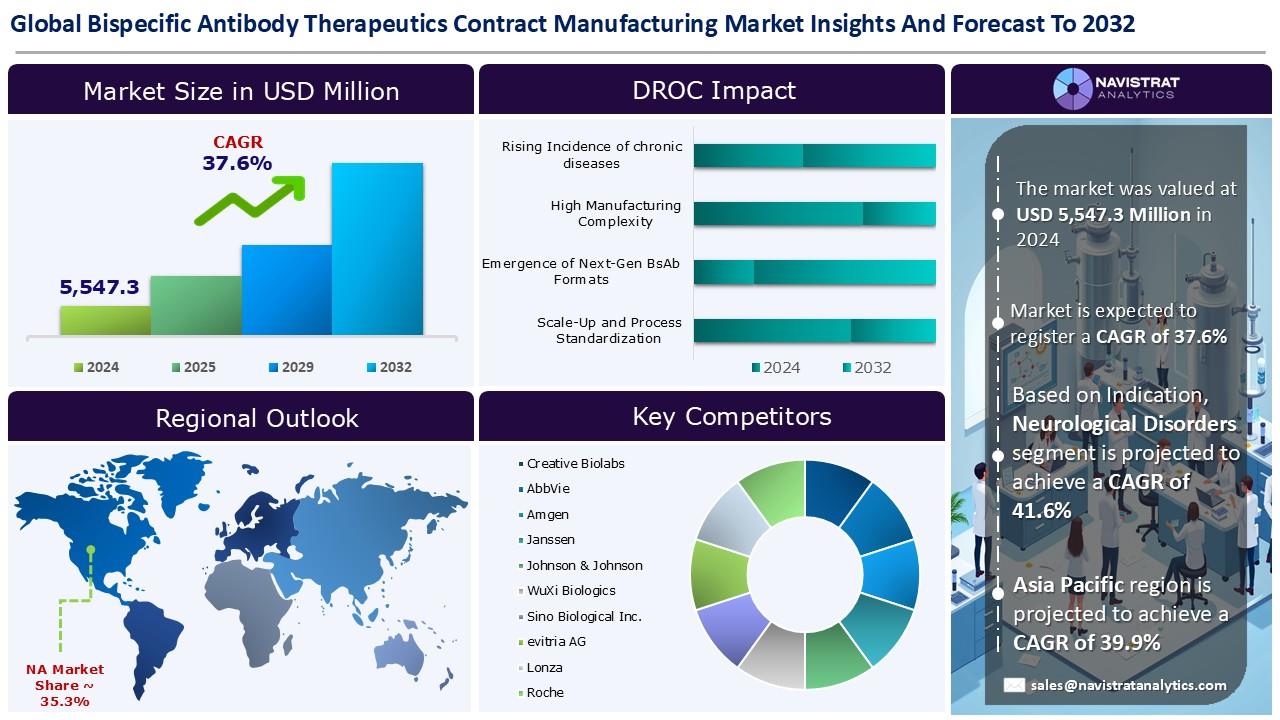

Bispecific Antibody Therapeutics Contract Manufacturing Market Size to Reach USD 71,565.5 million in 2032

(MENAFN- Navistrat Analytics) August 05, 2025 - The growing prevalence of chronic illnesses is a major factor driving revenue growth in the bispecific antibody therapeutics contract manufacturing market. As reported by the American Cancer Society, an estimated 36,110 new cases of multiple myeloma are expected to be diagnosed in the U.S. in 2025—comprising 20,030 men and 16,080 women. Around 12,030 deaths are anticipated, including 6,540 men and 5,490 women. In the U.S., the average lifetime risk of developing multiple myeloma is less than 1%, approximately 1 in 108 for men and 1 in 133 for women. However, an individual’s actual risk may vary based on personal risk factors.

In January 2025, Bora Biologics—a rapidly growing arm of leading CDMO Bora Pharmaceuticals—announced a partnership with DotBio, a Singapore-based biopharmaceutical company focused on next-generation antibody therapies. Under this collaboration, Bora will support the development and manufacturing of DotBio’s lead candidate, DB007, a novel tri-specific antibody targeting undisclosed cancer indications. The support will encompass the asset’s chemical, manufacturing, and controls (CMC) strategy and extend through clinical development, leveraging Bora’s 48,400-square-foot (4,500-square-meter) center of excellence located in Zhubei, Taiwan.

One of the major challenges in developing bispecific antibodies is selecting the appropriate target antigens. These targets must not only be therapeutically relevant but also ideally work in synergy to enhance efficacy. Unlike monoclonal antibodies, bispecific antibodies involve more complex processing. Their structural complexity poses difficulties in achieving high-quality production, maintaining purity, and ensuring batch-to-batch consistency. Proper pairing of heavy and light chains is crucial for the antibody's functionality. To address these challenges, technologies like the Duobody platform and the "knobs-into-holes" method have been introduced, though precise control and optimization during manufacturing remain essential.

Segments market overview and growth Insights

Based on the indication, the Bispecific Antibody Therapeutics Contract Manufacturing market is segmented into oncology, infectious diseases, neurological disorders, autoimmune and inflammatory disorders, and others. The oncology segment held the largest market share in 2024. As per the American Cancer Society, about 13,360 new cases of invasive cervical cancer are projected to be diagnosed in the United States in 2025, with an estimated 4,320 deaths among women resulting from the disease. Cervical pre-cancers are identified much more often than invasive forms. The condition is most diagnosed in women between the ages of 35 and 44, with the average age at diagnosis being 50. It is uncommon in women younger than 20.

In April 2023, Lonza—a global partner in pharmaceutical, biotech, and nutrition development and manufacturing—entered into an agreement with ABL Bio, a leading Korean biologics company specializing in bispecific antibodies for immuno-oncology and neurological disorders. Through this collaboration, Lonza will support the development and production of ABL Bio’s novel bispecific antibody.

Regional market overview and growth insights

North America held the largest market share in the Bispecific Antibody Therapeutics Contract Manufacturing market in 2024, driven by rising incidence of chronic diseases and technological advancements in antibody engineering. In March 2025, ImmunoPrecise Antibodies Ltd. entered a strategic partnership with a major biotechnology company valued in the multibillion-dollar range to advance the discovery and development of antibody-drug conjugates (ADCs) and bispecific antibodies for cancer therapy. This collaboration leverages IPA’s proprietary B-cell Select platform and AI-powered discovery technologies, alongside contract research expertise, to enhance the accuracy and efficiency of drug development.

Competitive Landscape and Key Competitors

The Bispecific Antibody Therapeutics Contract Manufacturing market is characterized by a fragmented structure, with many competitors holding a significant share of the market. List of major players included in the Bispecific Antibody Therapeutics Contract Manufacturing market report are:

o Creative Biolabs

o AbbVie

o Amgen

o Janssen

o WuXi Biologics

o Sino Biological Inc.

o evitria AG

o Lonza

o Roche

o Medelis

o Biointron Biologics

o MabPlex International Co. Ltd.

o Pure Biologics

Major strategic developments by leading competitors

Porton Pharma Solutions: In December 2024, Porton Pharma Solutions and Dragon Sail Pharmaceutical Co., Ltd. officially signed a strategic partnership agreement in Guilin, southern China. The collaboration is focused on advancing research, development, manufacturing, and supply chain integration for antibody-drug conjugates (ADCs). The goal is to establish an all-inclusive, one-stop service platform for ADC therapeutics, encompassing the entire pipeline—from active pharmaceutical ingredients to finished products, and from early-stage discovery through to commercial-scale production.

Fujifilm Corporation: In April 2024, Fujifilm Corporation announced a USD 1.2 billion investment to expand its end-to-end manufacturing capabilities at its Holly Springs facility in North Carolina. This significant funding will support the addition of eight new 20,000-liter mammalian cell culture bioreactors, aimed at boosting large-scale production capacity. These bioreactors are anticipated to be fully operational by 2028.

Navistrat Analytics has segmented bispecific antibody therapeutics contract manufacturing market based on product type, route of administration, stage of development, fragment type, and indication:

• Product Type Outlook (Revenue, USD Million; 2022-2032)

o Monovalent Bispecific Antibodies

o Bivalent or Multivalent Bispecific Antibodies

• Route of Administration Outlook (Revenue, USD Million; 2022-2032)

o Intravenous (IV)

o Subcutaneous (SC)

o Others

• Stage of Development Outlook (Revenue, USD Million; 2022-2032)

o Clinical Stage

o Commercial Stage

• Fragment Type Outlook (Revenue, USD Million; 2022-2032)

o Bispecific T-Cell Engager (BiTE)

o Dual-Affinity Re-Targeting Proteins (DARTs)

o Tandem diabodies (TandAbs)

• Indication Outlook (Revenue, USD Million; 2022-2032)

o Oncology

o Infectious Diseases

o Neurological Disorders

o Autoimmune and Inflammatory Disorders

o Others

• Regional Outlook (Revenue, USD Million; 2022-2032)

o North America

a. U.S.

b. Canada

c. Mexico

o Europe

a. Germany

b. France

c. U.K.

d. Italy

e. Spain

f. Benelux

g. Nordic Countries

h. Rest of Europe

o Asia Pacific

a. China

b. India

c. Japan

d. South Korea

e. Oceania

f. ASEAN Countries

g. Rest of APAC

o Latin America

a. Brazil

b. Rest of LATAM

o Middle East & Africa

a. GCC Countries

b. South Africa

c. Israel

d. Turkey

e. Rest of MEA

@Navistrat Analytics

In January 2025, Bora Biologics—a rapidly growing arm of leading CDMO Bora Pharmaceuticals—announced a partnership with DotBio, a Singapore-based biopharmaceutical company focused on next-generation antibody therapies. Under this collaboration, Bora will support the development and manufacturing of DotBio’s lead candidate, DB007, a novel tri-specific antibody targeting undisclosed cancer indications. The support will encompass the asset’s chemical, manufacturing, and controls (CMC) strategy and extend through clinical development, leveraging Bora’s 48,400-square-foot (4,500-square-meter) center of excellence located in Zhubei, Taiwan.

One of the major challenges in developing bispecific antibodies is selecting the appropriate target antigens. These targets must not only be therapeutically relevant but also ideally work in synergy to enhance efficacy. Unlike monoclonal antibodies, bispecific antibodies involve more complex processing. Their structural complexity poses difficulties in achieving high-quality production, maintaining purity, and ensuring batch-to-batch consistency. Proper pairing of heavy and light chains is crucial for the antibody's functionality. To address these challenges, technologies like the Duobody platform and the "knobs-into-holes" method have been introduced, though precise control and optimization during manufacturing remain essential.

Segments market overview and growth Insights

Based on the indication, the Bispecific Antibody Therapeutics Contract Manufacturing market is segmented into oncology, infectious diseases, neurological disorders, autoimmune and inflammatory disorders, and others. The oncology segment held the largest market share in 2024. As per the American Cancer Society, about 13,360 new cases of invasive cervical cancer are projected to be diagnosed in the United States in 2025, with an estimated 4,320 deaths among women resulting from the disease. Cervical pre-cancers are identified much more often than invasive forms. The condition is most diagnosed in women between the ages of 35 and 44, with the average age at diagnosis being 50. It is uncommon in women younger than 20.

In April 2023, Lonza—a global partner in pharmaceutical, biotech, and nutrition development and manufacturing—entered into an agreement with ABL Bio, a leading Korean biologics company specializing in bispecific antibodies for immuno-oncology and neurological disorders. Through this collaboration, Lonza will support the development and production of ABL Bio’s novel bispecific antibody.

Regional market overview and growth insights

North America held the largest market share in the Bispecific Antibody Therapeutics Contract Manufacturing market in 2024, driven by rising incidence of chronic diseases and technological advancements in antibody engineering. In March 2025, ImmunoPrecise Antibodies Ltd. entered a strategic partnership with a major biotechnology company valued in the multibillion-dollar range to advance the discovery and development of antibody-drug conjugates (ADCs) and bispecific antibodies for cancer therapy. This collaboration leverages IPA’s proprietary B-cell Select platform and AI-powered discovery technologies, alongside contract research expertise, to enhance the accuracy and efficiency of drug development.

Competitive Landscape and Key Competitors

The Bispecific Antibody Therapeutics Contract Manufacturing market is characterized by a fragmented structure, with many competitors holding a significant share of the market. List of major players included in the Bispecific Antibody Therapeutics Contract Manufacturing market report are:

o Creative Biolabs

o AbbVie

o Amgen

o Janssen

o WuXi Biologics

o Sino Biological Inc.

o evitria AG

o Lonza

o Roche

o Medelis

o Biointron Biologics

o MabPlex International Co. Ltd.

o Pure Biologics

Major strategic developments by leading competitors

Porton Pharma Solutions: In December 2024, Porton Pharma Solutions and Dragon Sail Pharmaceutical Co., Ltd. officially signed a strategic partnership agreement in Guilin, southern China. The collaboration is focused on advancing research, development, manufacturing, and supply chain integration for antibody-drug conjugates (ADCs). The goal is to establish an all-inclusive, one-stop service platform for ADC therapeutics, encompassing the entire pipeline—from active pharmaceutical ingredients to finished products, and from early-stage discovery through to commercial-scale production.

Fujifilm Corporation: In April 2024, Fujifilm Corporation announced a USD 1.2 billion investment to expand its end-to-end manufacturing capabilities at its Holly Springs facility in North Carolina. This significant funding will support the addition of eight new 20,000-liter mammalian cell culture bioreactors, aimed at boosting large-scale production capacity. These bioreactors are anticipated to be fully operational by 2028.

Navistrat Analytics has segmented bispecific antibody therapeutics contract manufacturing market based on product type, route of administration, stage of development, fragment type, and indication:

• Product Type Outlook (Revenue, USD Million; 2022-2032)

o Monovalent Bispecific Antibodies

o Bivalent or Multivalent Bispecific Antibodies

• Route of Administration Outlook (Revenue, USD Million; 2022-2032)

o Intravenous (IV)

o Subcutaneous (SC)

o Others

• Stage of Development Outlook (Revenue, USD Million; 2022-2032)

o Clinical Stage

o Commercial Stage

• Fragment Type Outlook (Revenue, USD Million; 2022-2032)

o Bispecific T-Cell Engager (BiTE)

o Dual-Affinity Re-Targeting Proteins (DARTs)

o Tandem diabodies (TandAbs)

• Indication Outlook (Revenue, USD Million; 2022-2032)

o Oncology

o Infectious Diseases

o Neurological Disorders

o Autoimmune and Inflammatory Disorders

o Others

• Regional Outlook (Revenue, USD Million; 2022-2032)

o North America

a. U.S.

b. Canada

c. Mexico

o Europe

a. Germany

b. France

c. U.K.

d. Italy

e. Spain

f. Benelux

g. Nordic Countries

h. Rest of Europe

o Asia Pacific

a. China

b. India

c. Japan

d. South Korea

e. Oceania

f. ASEAN Countries

g. Rest of APAC

o Latin America

a. Brazil

b. Rest of LATAM

o Middle East & Africa

a. GCC Countries

b. South Africa

c. Israel

d. Turkey

e. Rest of MEA

@Navistrat Analytics

Navistrat Analytics

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment