Corporate Insight Releases 2025 Brokerage Experience Benchmark Reports

NEW YORK, July 8, 2025 /PRNewswire/ -- Corporate Insight (CI), the leading provider of competitive intelligence and customer experience research to the financial services industry, today announced the release of its 2025 Brokerage Experience Benchmark reports. These comprehensive analyses evaluate and rank the web and mobile platforms of 21 leading brokerage firms across almost 400 individual attributes.

Continue Reading

Corporate Insight tracked and evaluated all changes to brokerage websites and apps over the last year.

"The 2025 Benchmarks show sustained digital investment across the brokerage industry, with firms making strategic improvements in performance reporting, research tools and overall usability," says Ian Bonhotal, brokerage research manager at CI. "Firms are responding to investors who want clearer portfolio insights and more intuitive platforms."

The research identifies Fidelity as the top-performing brokerage firm for website experience with a score of 88 out of 100, followed by Charles Schwab and E*TRADE (both 85). Fidelity secures the top spot for the second consecutive year, extending its lead over second place from one point to three. The same three firms emerged as leaders in mobile experience, with Charles Schwab and Fidelity tying for first place (70 out of 100) and E*TRADE (68) placing third alongside J.P. Morgan SDI (68), which jumped five points, tied for the largest mobile score increase.

"Fidelity maintains its leadership position on desktop with consistent performance across all categories, ranking first in five of the eight categories," says James McGovern, senior VP of research at CI. "The firm leads in Account Information-the most important category to investors-thanks to enhanced performance reporting and improved positions analysis. Fidelity also excels in Research & Tools, where it outperforms the industry average by 34 points following enhancements to its fixed income dashboard, options analysis and watchlist."

"For mobile, Charles Schwab maintains a share of first place for the third consecutive year, driven by its best-in-class stock/ETF and options trade tickets," adds Bonhotal. "Fidelity tied for first place this year, ranking in the top three for four mobile categories. We're interested in tracking how these and other firms enhance their experiences to compete in the coming year, particularly as artificial intelligence (AI) becomes more deeply integrated into these platforms."

Key trends from the Benchmarks include:

-

Functionality trails usability, particularly on mobile – On average firms earn much higher usability scores compared with functionality. On desktop, the overall usability average sits at 77 and the overall functionality average at 64. For mobile, the gap is wider: The usability average is 71 and the functionality average is 49.

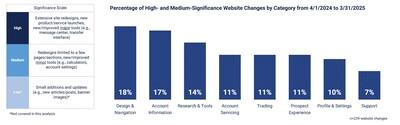

Design improvements focus on navigation – 18% of the high- and medium-significance website changes since the 2024 benchmark focused on Design & Navigation. Vanguard makes the biggest improvement in this category, adding homepage quicklinks and an embedded search field in the header.

Full-service firms move up – Merrill Lynch achieves a historic milestone, becoming the first full-service firm to reach the Leading tier (80+ score) in the website benchmark. The firm's score of 80 reflects the comprehensive digital capabilities it shares with Merrill Edge , particularly in trading and research.

"Full-service firms have traditionally lagged in digital capabilities due to their emphasis on advisor relationships, but Merrill Lynch's achievement demonstrates that firms can excel in both areas," adds McGovern. "This sets a new standard for other full-service firms seeking to enhance their digital offerings while maintaining their advisory focus."

The benchmarks evaluate brokerage firms across eight categories:

-

Account Information

Design & Navigation

Profile & Settings

Trading

Account Servicing

Research & Tools

Support

Prospect Experience

The reports include detailed profiles and rankings for:

-

Ally Invest

Ameriprise

Charles Schwab

Citi Self Invest

E*TRADE

Edward Jones

Fidelity

J.P. Morgan SDI

Merrill Edge

Merrill Lynch

Morgan Stanley

Raymond James

RBC

Robinhood

SoFi

T. Rowe Price

TIAA

U.S. Bancorp SDI

UBS

Vanguard

Wells Fargo Advisors

About Corporate Insight

Corporate Insight (CI) delivers competitive intelligence, user experience research and consulting services to the nation's leading financial services, insurance and healthcare organizations. As the recognized industry leader in customer experience research for over 30 years, our best-in-class research platform and unique approach of analyzing the actual customer experience helps organizations advance their competitive position in the marketplace.

For inquiries or to interview an analyst, contact:

Patrick Flood

(646) 876-7535

[email protected]

SOURCE Corporate Insight

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE? 440k+Newsrooms &

Influencers 9k+

Digital Media

Outlets 270k+

Journalists

Opted In GET STARTED

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment