NBH Preview: Hungarian Inflation Expectations Leave No Room For A Rate Cut

We still see no room for the National Bank of Hungary (NBH) to ease monetary policy in the short term. In our view, the central bank will leave the interest rate complex unchanged at its next rate-setting meeting in May. The base rate will remain at 6.50% with a +/- 100bp interest rate corridor, a high conviction call.

In fact, our baseline remains that there will be no rate cuts this year, as the Monetary Council now pays primary attention to elevated inflation expectations. We do not rule out the possibility that the situation in the last quarter of the year could allow for some easing, but we see little chance of this for the time being. However, if economic activity were to weaken significantly, there could be scope for unconventional easing measures, particularly through balance sheet interventions.

Despite the government's efforts to curb prices, notably in food, inflation has remained persistently high. If the NBH wants to talk about any hawkish shift in forward guidance, it's likely to happen this month as the full impact of previous measures is becoming clearer. However, the introduction of new price controls on household goods and the proposal for additional measures affecting drug prices suggest a more cautious, wait-and-see approach might be warranted.

The backgroundAs expected, the National Bank of Hungary kept its key interest rate unchanged at 6.50% in April as well. The interest rate corridor also remained in place with a range of +/- 100bp around the base rate. In line with its stability-oriented approach, this decision was mostly influenced by the high inflation expectations and global uncertainties. Despite some dovish shift in the Hungarian and global story, the forward guidance remained hawkish. It highlighted that rates can remain unchanged for an extended period now, while the risks to growth and inflation have increased and maintaining the financial stability is key to achieving price stability.

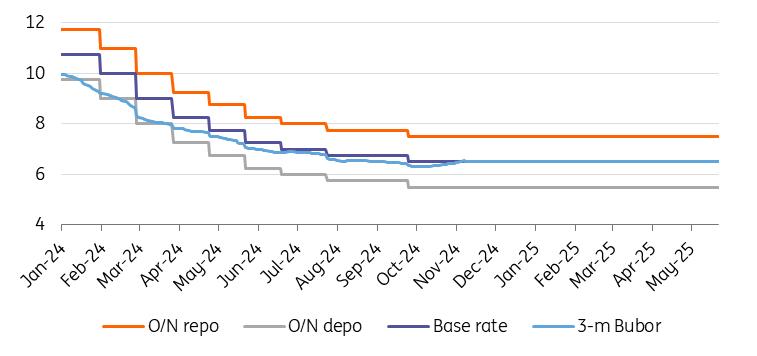

The main interest rates (%)

Source: NBH, ING

Headline inflation slowed both in March and April after the acceleration in February. However, this was in line with the NBH's forecast. The government is discussing the extension of the current price curb measures, which could push inflation down still further. Longer term, though, we expect higher inflation in the second half of the year. Our forecast for 2025 as a whole is now at 4.5% for headline inflation, while core inflation is probably going to be even higher.

Moreover, the introduction of an increasing number of price control measures will result in a temporary reduction in the inflation rate, but will lead to longer-term inflation issues as price changes will only be delayed, not eliminated. In this regard, we fear that market players (both households and corporations) will become accustomed to a 4% inflation rate, which will then become the anchor instead of the 3% inflation target.

Headline and underlying inflation measures (% YoY)Source: HCSO, NHB, ING

In terms of risk perception from a monetary policy perspective, the budget deficit in April was high. This is mainly due to interest payments on retail government bonds, meaning the budget deficit remains frontloaded. Taking this into account, we have already reached 71% of this year's deficit target. The government remains committed to its deficit target of 3.7% of GDP for 2025.

However, given our expectation of weaker economic activity and lower nominal growth than the government anticipates, we forecast a deficit of 4.7%. As for external balances, there has been no deterioration that would raise concerns in this area. Looking ahead, we expect new production capacity to support exports and boost import activity in 2026 only.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Reseach

- B2PRIME Strengthens Institutional Team's Growth With Appointment Of Lee Shmuel Goldfarb, Formerly Of Edgewater Markets

- BTCC Exchange Scores Big In TOKEN2049 With Interactive Basketball Booth And Viral Mascot Nakamon

- Ares Joins The Borderless.Xyz Network, Expanding Stablecoin Coverage Across South And Central America

- Primexbt Launches Stock Trading On Metatrader 5

- Solana's First Meta DEX Aggregator Titan Soft-Launches Platform

- Moonacy Protocol Will Sponsor And Participate In Blockchain Life 2025 In Dubai

- Primexbt Launches Instant Crypto-To-USD Exchange

Comments

No comment