Germany Closing Factories At Home, Opening Them In China

As a result, many of Germany's most established companies are downsizing at home, shedding thousands of jobs, while investing heavily in China. This shift underlines the profound impact of current policies on Germany's industrial landscape, with long-term implications for the local economy and employment.

Asia Times examines here the key factors and the companies that are reshaping their operations abroad.

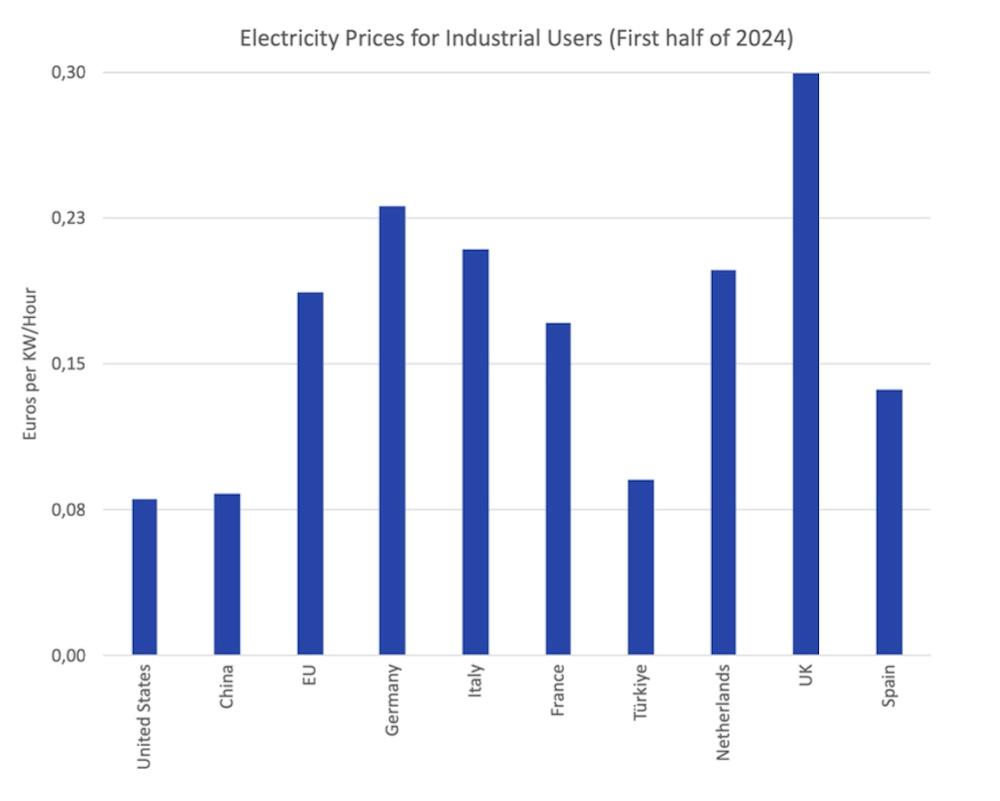

High energy costs in Germany: The result of ideological policiesGermany's energy policies have driven industrial electricity prices to levels that are among the highest in the world, second only to the UK. By 2023, the average price for industrial users will have reached almost US$250 per MWh; even this cost level is unsustainable without substantial government subsidies, which have now reached unprecedented levels.

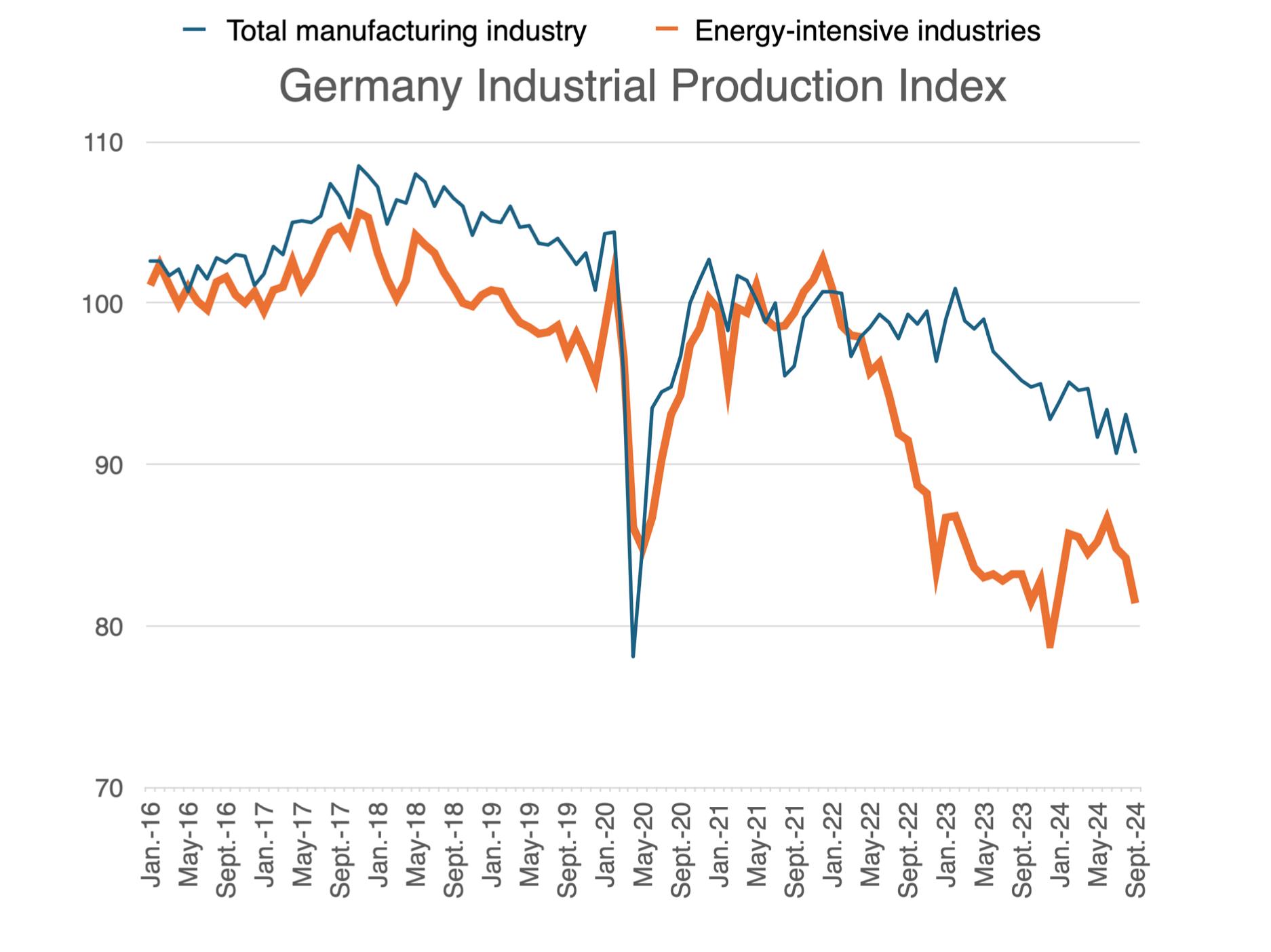

Germany's reliance on renewable energy sources such as wind and solar, combined with the phasing out of nuclear power, has increased the country's reliance on imports and caused severe price volatility, ultimately putting pressure on both industry and taxpayers. These high prices have forced many companies to consider scaling back operations in Germany in favor of expanding abroad, particularly in China .

Industrial energy consumption down by more than 16% in 2 yearsIn 2023, energy consumption in Germany's industrial sector fell to 3,282 petajoules, a decrease of 7.8% compared to 2022. This decline followed an already significant reduction in 2022, when industrial energy use fell by 9.1% year-on-year to 3,558 petajoules. Taken together, these reductions represent an overall decrease in industrial energy use of about 16.3% over the two-year period.

Graphic: Asia TimesEnergy supply in Germany: Increased import dependence

Germany's domestic energy production has also shifted, with renewable energy sources reaching a record 61.5% of total energy production in early 2024. However, this shift has led to a 23% increase in electricity imports in the first half of 2024, highlighting Germany's reliance on foreign energy sources to supplement its variable renewable production.

The variability of renewable energy supply, coupled with high domestic prices, poses risks for businesses that require stable and affordable electricity. Germany's continued reliance on renewables is also expected to increase import dependency, further discouraging companies from expanding domestically.

Massive subsidies for renewablesIn 2024 alone, Germany will provide 20 billion euros in subsidies to renewable energy producers. These payments ensure that renewable energy suppliers receive guaranteed minimum prices, despite sharply falling market prices.

This centrally planned system, in which the government steps in to pay renewable energy producers when wholesale prices fall, has placed a heavy burden on the state budget, leaving less financial room for other critical investments.

In fact, the original budget for subsidies in 2024 was 10.6 billion euros (US$21 billion), but as energy prices have fallen, the projected need has doubled. These rising subsidy costs are adding to fiscal pressure and complicating budget negotiations, especially given the government's commitment to adhere to the debt brake.

The role of lost Russian gas and the Nord Stream pipelines in Germany's industrial declineThe cessation of Russian gas imports has had a profound impact on Germany's energy landscape , disrupting its industrial base and driving up energy costs. Russian natural gas was a cornerstone of Germany's energy supply, providing reliable and affordable energy for decades. However, the geopolitical fallout from the war in Ukraine and the sabotage of the Nord Stream pipelines in September 2022 severed this critical energy link.

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment