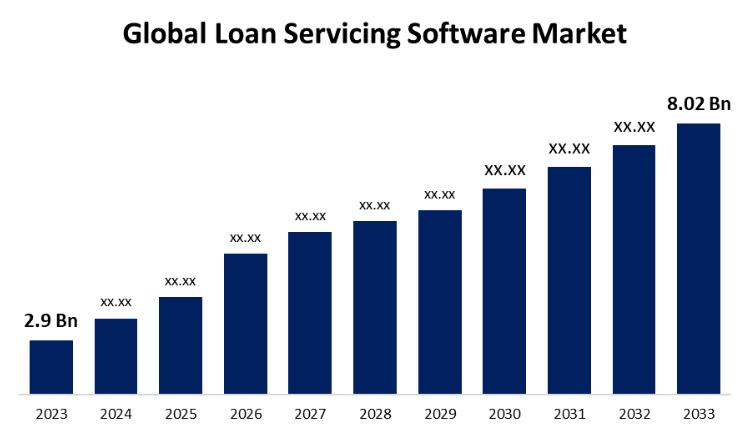

(MENAFN- GlobeNewsWire - Nasdaq) The Global Loan Servicing Software market Size was Valued at USD 2.9 Billion in 2023, the Worldwide Loan Servicing Software Market Size is Expected to Reach USD 8.02 Billion by 2033, according to a research report published by Spherical Insights & Consulting. Companies Covered: Black Knight Inc, C Loans Inc., DownHome Solutions, Fiserv Inc., LOAN SERVICING SOFT Inc, Nucleus Software Exports Ltd, Oracle Corp., Cyrus Technoedge Solutions Pvt. Ltd., financial industry Computer Systems Inc, Graveco Software Inc., Applied Business Software Inc, Constellation Software Inc., Fidelity National Information Services Inc., Nortridge Software LLC. And other key vendors.

New York, United States , July 07, 2024 (GLOBE NEWSWIRE) -- The Global Loan Servicing Software Market Size is to Grow from USD 2.9 Billion in 2023 to USD 8.02 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 10.71% during the projected period.

Get a Sample PDF Brochure:

Loan servicing software is functioning in the banking, financial services, and insurance (BFSI) industry to streamline banking processes and enhance the customer experience by providing borrowers with easy access to their loan information and payment options. Loan servicing software aims to increase revenue for investors, optimize customer satisfaction, simplify portfolio management, and reduce operating costs. It helps mortgage lenders, banks, and credit unions with real-time and accurate data analysis related to pricing and monitoring potential clients' credit profiles. The financial sector is subject to governing changes and compliance standards, which require sophisticated software solutions that can guarantee compliance with laws such as CCPA, GDPR, and many banking regulations. For financial institutions, sophisticated compliance capabilities in debt servicing software become essential. As the loan servicing process becomes more sophisticated, there is a growing need for software programs that can handle repetitive duties such as processing payments, monitoring loans, and managing compliance. However, financial institutions frequently require loan servicing software to interface with various downstream systems, including core banking, accounting, and customer relationship management (CRM) software. Compatibility issues and data migration difficulties are examples of integration barriers that can hinder the adoption and performance of debt-servicing software.

Browse key industry insights spread across 250 pages with 110 Market data tables and figures & charts from the report on the " Global Loan Servicing Software Market Size, Share, and COVID-19 Impact Analysis, By Component (Software, and Solution), By Deployment (On-premise, and Cloud), By Enterprise Size (Large Enterprises, and Small and Medium-sized Enterprises), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033."

Buy Now Full Report:

The software segment is anticipated to hold the greatest share of the global loan servicing software market during the projected timeframe.

Based on the component, the global loan servicing software market is divided into software and solutions. Among these, the software segment is anticipated to hold the greatest share of the global loan servicing software market during the projected timeframe. This is attributed to manual methods of loan processing being very time-consuming and prone to paperwork and other administrative errors. Older debt management methods are not only more prone to errors, but they can also be incredibly unnecessary. Hence, one of the primary benefits of loan servicing software is that it eliminates the need for these manual methods.

The cloud segment is anticipated to hold the largest share of the global loan servicing software market during the projected timeframe.

Based on the deployment, the global loan servicing software market is divided into on-premise and cloud. Among these, the cloud segment is anticipated to hold the largest share of the global loan servicing software market during the projected timeframe. The cloud-based segment dominates the market due to improved customer satisfaction and experience, efficient document management, faster process execution, increased reliability and accessibility from any location, rapid deployment, and scalability. Market growth has been largely driven by the rise in the adoption of cloud-based debt management software among large and medium-sized enterprises.

The large enterprises segment is predicted to hold the largest share of the loan servicing software market during the estimated period.

Based on the end-user, the global loan servicing software market is divided into large enterprises and small and medium-sized enterprises. Among these, the large enterprises segment is predicted to hold the largest share of the loan servicing software market during the estimated period. Customers from large institutions are provided with a flowchart, where they can track the loan process. Also, the dashboard notifies them with real-time updates. It improves customer visibility. Moreover, it speeds up the time spent serving customers. Customers will be satisfied when they are served in less time and data is maintained accurately.

Inquire Before Buying This Research Report:

North America is expected to hold the largest share of the global loan servicing software market over the forecast period .

North America is expected to hold the largest share of the global loan servicing software market over the forecast period. This is attributed to the increasing banking sector and rising fintech start-up culture, growing adoption of loan servicing software across multiple businesses, and mounting demand for lucrative solutions and facilities drive market growth. Furthermore, the region promoted from improved emphasis on the introduction of debt-servicing software solutions and services. Furthermore, in the US, personal and home loans are on the rise, and consumers are demanding a robust debt settlement process. Most lending companies in the U.S. are adopting digital services to provide loans to consumers.

Asia Pacific is predicted to grow at the fastest pace in the global loan servicing software market during the projected timeframe. This is attributed to the increasing adoption of digital loan services and innovations. Moreover, China's loan servicing software market had the largest market share and the Indian loan servicing software market was the fastest-growing market in the Asia-Pacific region. Factors of increasing economic activity such as increasing access to credit and modernization of financial services. Developing countries in Asia Pacific are more inclined to seek loans for housing finance and the demand for debt management software market has increased in recent years.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Major vendors in the Global Loan Servicing Software Market are Black Knight Inc, C Loans Inc., DownHome Solutions, Fiserv Inc., LOAN SERVICING SOFT Inc, Nucleus Software Exports Ltd, Oracle Corp., Cyrus Technoedge Solutions Pvt. Ltd., Financial Industry Computer Systems Inc, Graveco Software Inc., Applied Business Software Inc, Constellation Software Inc., Fidelity National Information Services Inc., Nortridge Software LLC, and other key vendors.

Get Discount At @

Recent Developments

In February 2024 , Sagent, a fintech-software-backed company that upgrades mortgage servicing for lenders and banks, launched Dara, a mortgage software platform. The move was intended to consolidate all data and user experience for homeowners and services throughout the servicing lifecycle.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Loan Servicing Software Market based on the below-mentioned segments:

Global Loan Servicing Software Market, By Component

Global Loan Servicing Software Market, By Deployment

Global Loan Servicing Software Market, By Enterprise Size

Large Enterprises Small and Medium-sized Enterprises

Global Loan Servicing Software Market, Regional

North America Europe Germany Uk France Italy Spain Russia Rest of Europe

Asia Pacific China Japan India South Korea Australia Rest of Asia Pacific

South America Brazil Argentina Rest of South America

Middle East & Africa UAE Saudi Arabia Qatar South Africa Rest of the Middle East & Africa

Browse Related Reports:

Global Trade Surveillance Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution, Services), By Deployment (On-Premise, Cloud), By Enterprise Size (Large Enterprises, SMEs), By End User (Banks, Institutional Brokers, Retail Brokers, Market Centers & Regulators, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Global B2B Payments Market Size, Share, and COVID-19 Impact Analysis, By Payment Type (Domestic Payments, and Cross-Border Payments), By Payment Method (Bank Transfer, Card, and Online Payments), By Verticle Type (BFSI, IT and ITES, Retail and E-commerce, Travel and Hospitality, Healthcare, Media and Entertainment, Transportation and Logistics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Neobanking Market Size, Share, and COVID-19 Impact Analysis, By Account Type (Business account, Savings account), By Services (Mobile-banking, Payments, money transfers, savings, Loans, Others), By Application Type (Personal, Enterprises, Other applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Global Revenue Management Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution, Services), By Solution (Billing & Payment, Price Management, Revenue Assurance & Fraud Management, Channel Management, Others), By Deployment Mode (On-premises, Cloud), By Organization Size (Large Enterprises, Small & Medium Enterprises), By Vertical (Telecom, Hospitality, Transportation, Healthcare, Retail & eCommerce, BFSI, Utilities, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: + 1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: ... , ...

Contact Us:

Follow Us: LinkedIn | Facebook | Twitter

MENAFN07072024004107003653ID1108414085