(MENAFN- ING)

External factors have dominated

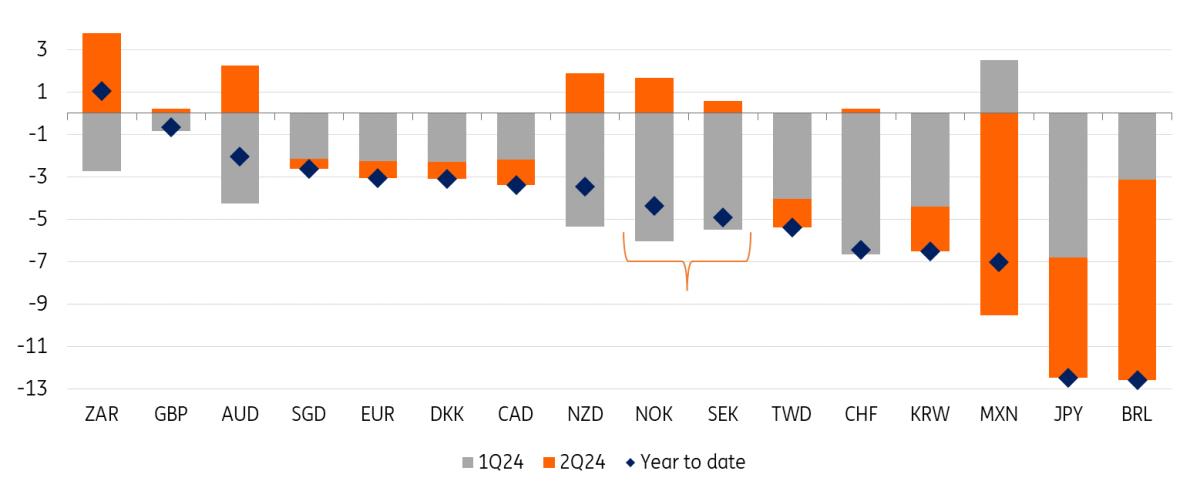

The Norwegian krone and Swedish krona have followed very similar patterns so far this year: a weak first quarter and a second-quarter rebound. In line with its lower liquidity character, and in turn higher beta to risk sentiment, NOK has shown higher volatility than SEK.

Performance of major currencies versus USD (%)

Source: ING, Refinitiv

External drivers have dominated so far this year for Scandinavian FX. As shown in the chart below, NOK has had a slightly higher sensitivity than SEK to moves in short-term USD rates, which also explains the wider moves on both upside and downside in NOK. However, the correlation for both currencies with Federal Reserve pricing has been similar – and crucially, very strong in the first half of this year.

Two very sensitive currencies to Fed expectations Source: ING, Refinitiv

Policy divergence should gain traction

The dominance of USD rates as a driver for NOK and SEK has led to domestic stories taking a back seat. The NOK/SEK cross rate has only recently shown some responsiveness to the widening in the short-term rate differential in favour of NOK due to the relatively more hawkish stance of Norges Bank compared to the Riksbank. As shown in the chart above, NOK/SEK and its 2-year swap rate differential tend to converge over time. That happened quite clearly in 2022, when a dovish Norges Bank depressed the rate differential.

The drop in NOK/SEK in 2022/2023 was less pronounced than what the rate spread would have suggested, but that was due to domestic economic risks affecting Sweden (e.g., the commercial real estate crisis). Later on, the rate spread moved back in favour of NOK and against SEK, halting the NOK/SEK decline.

NOK/SEK and its short-term swap rate gap Source: ING, Refinitiv

Why the policy divergence?

Both Norway and Sweden are very rate-sensitive economies, with an elevated percentage of households affected by variable rates. However, as shown in the chart below, the two countries are in different positions compared to their pre-Covid standards.

Quarterly growth has been similar in both countries in the past 12 months, but core inflation is 1.6% above pre-Covid standards in Sweden and 1.9% in Norway. Crucially, inflation in Sweden is much closer to the 2.0% target shared by both central banks. The largest difference is in the labour market; unemployment at 8.3% is above pre-Covid levels in Sweden, while it is still below (and very low at 2.0%) in Norway.

Macroeconomic comparison: Norway vs Sweden Source: ING, Refinitiv

Central bank communication and moves have mirrored this divergence. The Riksbank is pledging to cut twice or three times more in the second half of the year after a 25bp reduction in May to 3.75%, while Norges Bank recently revised its own rate projections to signal that the policy rate should be kept at the current 4.50% till end of 2024. Our calls are 75bp of easing from the Riksbank and 25bp by Norges Bank this year.

It must be clarified that our call for one cut in Norway is mostly a function of the view that we'll see three cuts by the Fed this year, and given Norges Bank's sensitivity to global rates, we believe that there will be enough pressure in Norway to start cutting rates in December. Should the Fed end up cutting less than three times this year, it will be increasingly likely that Norges Bank will stick to its plan to keep rates on hold into 2025.

Sweden's domestic concerns will, in our view, make the Riksbank more stickily dovish and therefore less sensitive to external central bank developments. Bankruptcies are at their highest level since the 1990s and the inflation-jobs balance is consistent with more cuts.

The FX factor in central bank decisions

One major concern for both Scandinavian central banks has been currency weakness. Both Norges Bank and the Riksbank explicitly discuss inflationary risks related to weaker currencies, but the past year and a half has seen Norwegian policymakers being more prone to using the policy rate to support NOK.

The Riksbank first used covert FX intervention via a reserve hedging programme – which helped EUR/SEK trade up to 2% below its fair value, in our estimates – but then cut rates in the middle of a SEK selloff in May. We read that May move as a signal that the Riksbank board was not as concerned about SEK levels as they may have conveyed in verbal intervention attempts.

Incidentally, after the recent (externally-driven) SEK appreciation, the Riksbank has more room to cut rates without the currency concern. Levels below 11.50 in EUR/SEK should not be enough to trigger major alarms, and it is our base case that the external environment will prevent a big jump in the pair.

NOK outperformance this summer

When focusing on a three-month horizon (i.e., the summer months), we expect NOK to appreciate relative to SEK due to global, regional and policy divergence factors. As we discuss later in this note, things can change with expectations for US elections in November.

The short-term NOK:SEK swap rate gap already argues for a stronger NOK/SEK, but for this appreciation pressure needs to be smoothed by a stable risk environment and no changes in the monetary policy gap. We believe this summer will see these two conditions co-exist, as we expect US macroeconomic data to point gradually to a Fed rate cut in September and keep high-beta currencies in demand, while – as discussed in the previous paragraph – the Riksbank remains in a position to be structurally more dovish than Norges Bank this year.

Markets are pricing in 65bp of easing in Sweden and only 5bp Norway by year-end, against our call for 75bp in Sweden and 25bp in Norway. While this could hint at a shrinking in the NOK:SEK rate advantage, that would not be enough to significantly hinder NOK/SEK appreciation (the carry gap would remain very wide), and we think a dovish tilt in Norges Bank communication may only come after the Fed has started cutting in September. Incidentally, Norges Bank has been scaling down FX purchases from NOK1bn+ in late 2023 to 400m in July, which allows greater upside freedom to NOK. Oil price dynamics do not suggest a significant rebound in Norges Bank purchases in the second half of the year.

Externally, SEK is structurally more exposed to EU political turmoil, and an extension of EGB spreads instability beyond the French vote risk event should weigh on SEK more than NOK. When adding the higher sensitivity of NOK to a decline in USD short-term rates (our base case), we expect NOK/SEK to trade above parity this summer and even above the 1.0120 May highs. We identify 1.02 as the level that would be consistent with the rate and external environment before the US election risk kicks in.

US election impact

Our base case assumption is that a return of Donald Trump as US president will trigger a risk-off/USD-on environment, which would weigh on high-beta currencies like SEK and NOK. With the first presidential debate deemed to be won by Trump, there is a growing chance that markets will move ahead of time to position for the US vote. Ultimately, the longer-term impact will depend on whether a new Trump presidency will include the most hard-line policies of his manifesto, especially when it comes to protectionism and fiscal policy. We expect, instead, a Democrat win to be a positive development for high-beta currencies.

Focusing on a Trump victory scenario and the impact on Scandinavian currencies, we estimate that NOK could suffer more in the short term due to its low liquidity character, which makes it more volatile than SEK in market turmoil. However, evidence from the first Trump term suggests that SEK might face greater issues than NOK in the longer run from US protectionist policies.

EUR/NOK and EUR/SEK mis-valuation Source: ING

As shown above, EUR/SEK trade more in overvalued territory (according to our medium-term BEER real FX fair value model) compared EUR/NOK during the first Trump term. That is entirely consistent with the high sensitivity of the Swedish economy to global trade swings, with rising protectionism hitting growth and leading to lower rates and a weaker currency.

Norway oil and gas export dominance means less impact from protectionism over the medium term, even if the Norwegian krone has a generally higher beta to risk sentiment in the shorter run.

Our EUR/NOK and EUR/SEK profiles

We see downside potential for both EUR/NOK and EUR/SEK this summer as we expect a risk-on dovish repricing in rate expectations, and the euro may be held back by wider eurozone peripheral spreads even beyond the French election.

As discussed above, the Norwegian krone is on a stronger position to rally, and we think hitting 11.00 versus the euro is very much possible before the US election risk kicks in, while Riksbank cuts may keep EUR/SEK more supported.

From the fourth quarter of this year onwards, the outlook is highly uncertain for NOK and SEK, as it largely depends on the post-US election market environment, geopolitical picture and Fed policy stance. For now, based on lingering medium-term overvaluation of both EUR/NOK and EUR/SEK, we retain a moderately downward-sloping profile for the two pairs on a 12-month horizon.

ING's forecasts for EUR/NOK and EUR/SEK Source: ING, Refinitiv

MENAFN28062024000222011065ID1108385887

Author:

Francesco Pesole