South Korea: Industrial Production Beat The Market Consensus, Adding Upside Risks To Growth In 2Q24

Date

5/30/2024 11:17:17 PM

| 2.2% | Industrial Production % MoM sa |

| Higher than expected |

IP rebounded firmly despite the decline of chip production

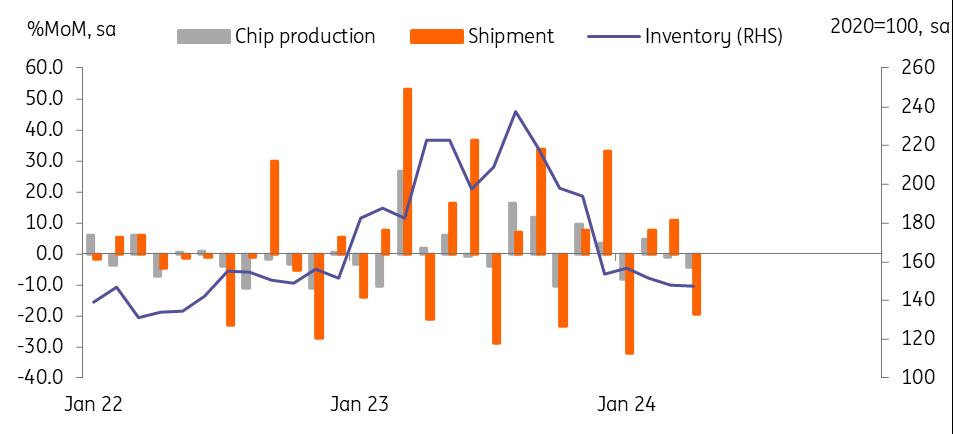

Mining and manufacturing industrial production (IP) rebounded by a stronger-than-expected 2.2% MoM sa (vs revised -3.0% in March, 1.0% market consensus). By industry, production of cars (8.1%) and chemicals (6.4%) rose firmly but the decline in semiconductors (-4.4%) deepened from -0.9% in March. However, as chip inventories have declined for three months, we are not yet concerned about the two-month decline in semiconductor production.

Semiconductor output has declined for two months, but inventories have fallen for three months

Source: CEIC Service activity posted a modest gain in April

Service activity rose 0.3% MoM sa in April, after a 1.1% decline in March. By industry, wholesale (3.4%), and transportation (1.3%) rose firmly but social welfare (-2.5%) hotels/restaurants (-2.1%), and leisure (-0.2%) declined. In our view, the outlook for service activity is still cloudy as overall entertainment-related service activity turned soft with retail sales services declining for a third month.

Retail sales declined, more than offsetting the previous month's gain

Retail sales dropped 1.2% MoM sa in April, mainly due to weak durable goods consumption such as cars, while non-durable (0.4%) and semi-durable goods (0.5%) gained. The sequential 3-month over 3-month comparison deepened its contraction to -2.1% in April from -0.5% in March, showing a clear slowdown in goods consumption and supporting our view that the strong private consumption in 1Q24 GDP will be temporary.

Retail sales contracted sharply in April

Source: CEIC Investment outcomes were mixed

Today's data showed that facility investment will likely weaken, while construction should recover on the back of the improvement in non-residential building and plant construction. Equipment investment fell by 0.2% MoM sa in April, after a 6.3% drop in March. The decline was modest but foward-looking orders data declined for two months. By sector, transportation equipment rose 0.3% but machinery investment declined more deeply by -0.4%. With machinery orders also declining for a second month, we believe that sluggish facility investment is likely to continue in the current quarter. Meanwhile, construction investment rose 5.0% the first rise in three months with both building (6.1%) and civil engineering (1.7%) up. We believe that weak residential construction is likely to continue but the recovery by industry and government is likely to provide support.

GDP outlook

We currently expect 2Q24 GDP to decelerate quite sharply to 0.1% QoQ sa from the previous quarter's 1.3% growth. The main reasons for the slowdown are a smaller positive contribution from net exports and a contraction of private spending and investment. We saw that the rebound in manufacturing and services didn't fully offset the previous month's decline, while the decline in retail sales was larger than the previous month's gain, so the growth momentum is clearly slowing down. However, given the larger share of exports/manufacturing in Korea's GDP, today's data outcome adds some upside risks to our current GDP forecasts.

MENAFN30052024000222011065ID1108279202

Author:

Min Joo Kang

*Content Disclaimer:

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/about/disclaimer/

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.