403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Silver Outperforms Gold with a 25% surge – Saxo Bank MENA

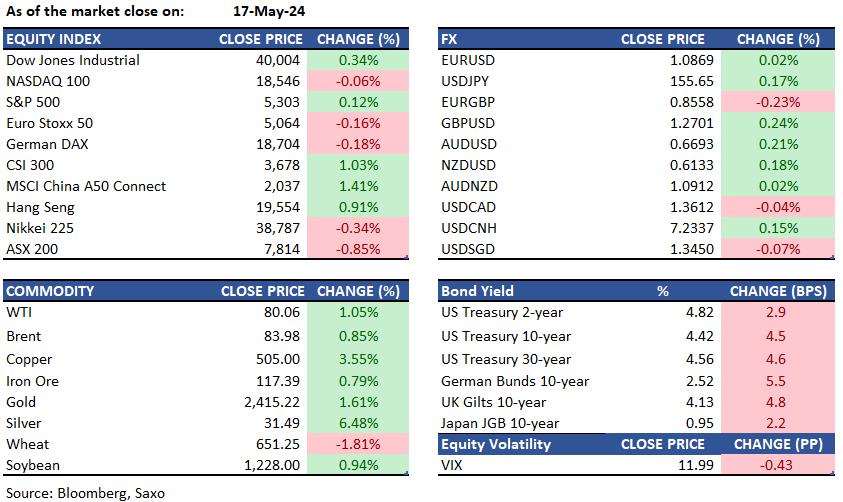

(MENAFN- Matrix PR) Commodities: Silver and other metals experienced significant price increases, with silver jumping over 6% on Friday. The metal has surged by more than 25% this year, outperforming gold and ranking as one of the top-performing major commodities of the year. The Bloomberg Commodity Index is heading towards its third consecutive monthly increase, a run that hasn't occurred since 2022 when core inflation rates were above 8%. The index has risen nearly 4% in May, setting it up for its strongest performance since July, and it is currently trending upwards past its 200-day moving average.

Oil prices maintained their weekly gains as attention turned to geopolitical tensions in Russia and the Middle East following recent attacks. Brent crude hovered near $84 a barrel after achieving its first weekly increase of the month, while West Texas Intermediate remained just under $80. Operations at a Russian refinery were suspended due to a Ukrainian drone strike, and a missile from Yemen's Houthi group struck a tanker en route to China in the Red Sea. Despite up around 9% this year, partly thanks to OPEC+ supply reductions, oil prices have moderated since mid-April amid a de-escalation of geopolitical risks. Hedge funds have shown a growing bearish outlook, with money managers cutting their net long positions in Brent for a second consecutive week.

Equities: Asian markets are poised for gains following a positive performance in US stocks, which reached new highs amid strong corporate earnings. Futures in Australia, Hong Kong, and China are up, though Japanese futures saw a slight dip. The S&P 500 and Dow Jones Industrial Average in the US continued their upward trajectory, with the Dow surpassing the 40,000 mark for the first time. On Friday, the S&P 500 Index saw a modest gain of 0.1%, with most of its major sectors advancing. Energy stocks led the increase, while notable rises in Alphabet Inc. and AmazonInc. helped lift the benchmark index. Investors are closely monitoring China's efforts to support its troubled property sector, with some skepticism about the adequacy of these measures. There is also attention on potential trade tensions with Europe. The optimism in China's stock market has boosted the broader Asian region, with the MSCI Asia Pacific Index on a six-day winning streak. In the US, the VIX index fell to its lowest since November 2019, suggesting reduced market volatility and anticipation of potential rate cuts by the Federal Reserve.

Fixed income: Treasury yields increased on Friday but experienced an overall decline last week, with two-year Treasuries falling over 20 basis points from their April high. In early Monday trading, Australian 10-year yields also rose. Despite these movements, Federal Reserve Governor Michelle Bowman indicated that cost pressures are likely to stay high for an extended period, although the expectation is that these pressures will ease eventually as interest rates are adjusted.

Ahead of a series of speeches from Federal Reserve officials, U.S. bond futures saw a slight uptick. U.S. 10-year futures inched higher by 1/32 to 109 7/32. Fed speakers will address the public on Monday, including Raphael Bostic, Christopher Waller, Philip Jefferson, Loretta Mester, and Michael Barr. Throughout the upcoming week, market participants will closely monitor key economic releases such as the May FOMC minutes, University of Michigan sentiment data, and durable goods orders to gauge the health of the U.S. economy and the potential direction of interest rates. Meanwhile, Japanese government bond (JGB) futures dipped in the last session of the previous week, closing down 16 ticks at 143.91, and Japan is set to auction inflation-linked bonds.

Macro:

- The U.S. Leading Economic Index decreased by 0.6% in April to 101.8, reflecting a decline in consumer confidence, reduced new orders, a negative yield spread, and a drop in new building permits. These factors indicate a potential slowdown in economic growth.

- In China, April Retail Sales increased by 2.3% compared to the consensus of 3.7%, while April Industrial Output rose by 6.7% year-on-year, surpassing the consensus of 5.5%. China's Jan-April Fixed Investment grew by 4.2% year-on-year, slightly below the consensus of 4.6%. Existing home prices in China fell by -0.94% MoM in April, resulting in a year-on-year decline of -6.79%, compared to -5.9% in March. New home prices also decreased by -0.58% MoM, leading to a year-on-year decline of -3.5%, down from -2.65% in March.

Oil prices maintained their weekly gains as attention turned to geopolitical tensions in Russia and the Middle East following recent attacks. Brent crude hovered near $84 a barrel after achieving its first weekly increase of the month, while West Texas Intermediate remained just under $80. Operations at a Russian refinery were suspended due to a Ukrainian drone strike, and a missile from Yemen's Houthi group struck a tanker en route to China in the Red Sea. Despite up around 9% this year, partly thanks to OPEC+ supply reductions, oil prices have moderated since mid-April amid a de-escalation of geopolitical risks. Hedge funds have shown a growing bearish outlook, with money managers cutting their net long positions in Brent for a second consecutive week.

Equities: Asian markets are poised for gains following a positive performance in US stocks, which reached new highs amid strong corporate earnings. Futures in Australia, Hong Kong, and China are up, though Japanese futures saw a slight dip. The S&P 500 and Dow Jones Industrial Average in the US continued their upward trajectory, with the Dow surpassing the 40,000 mark for the first time. On Friday, the S&P 500 Index saw a modest gain of 0.1%, with most of its major sectors advancing. Energy stocks led the increase, while notable rises in Alphabet Inc. and AmazonInc. helped lift the benchmark index. Investors are closely monitoring China's efforts to support its troubled property sector, with some skepticism about the adequacy of these measures. There is also attention on potential trade tensions with Europe. The optimism in China's stock market has boosted the broader Asian region, with the MSCI Asia Pacific Index on a six-day winning streak. In the US, the VIX index fell to its lowest since November 2019, suggesting reduced market volatility and anticipation of potential rate cuts by the Federal Reserve.

Fixed income: Treasury yields increased on Friday but experienced an overall decline last week, with two-year Treasuries falling over 20 basis points from their April high. In early Monday trading, Australian 10-year yields also rose. Despite these movements, Federal Reserve Governor Michelle Bowman indicated that cost pressures are likely to stay high for an extended period, although the expectation is that these pressures will ease eventually as interest rates are adjusted.

Ahead of a series of speeches from Federal Reserve officials, U.S. bond futures saw a slight uptick. U.S. 10-year futures inched higher by 1/32 to 109 7/32. Fed speakers will address the public on Monday, including Raphael Bostic, Christopher Waller, Philip Jefferson, Loretta Mester, and Michael Barr. Throughout the upcoming week, market participants will closely monitor key economic releases such as the May FOMC minutes, University of Michigan sentiment data, and durable goods orders to gauge the health of the U.S. economy and the potential direction of interest rates. Meanwhile, Japanese government bond (JGB) futures dipped in the last session of the previous week, closing down 16 ticks at 143.91, and Japan is set to auction inflation-linked bonds.

Macro:

- The U.S. Leading Economic Index decreased by 0.6% in April to 101.8, reflecting a decline in consumer confidence, reduced new orders, a negative yield spread, and a drop in new building permits. These factors indicate a potential slowdown in economic growth.

- In China, April Retail Sales increased by 2.3% compared to the consensus of 3.7%, while April Industrial Output rose by 6.7% year-on-year, surpassing the consensus of 5.5%. China's Jan-April Fixed Investment grew by 4.2% year-on-year, slightly below the consensus of 4.6%. Existing home prices in China fell by -0.94% MoM in April, resulting in a year-on-year decline of -6.79%, compared to -5.9% in March. New home prices also decreased by -0.58% MoM, leading to a year-on-year decline of -3.5%, down from -2.65% in March.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment