Australia: Mixed News From The Labour Front

| 38,500 | Employment growth 1 month change |

| Higher than expected |

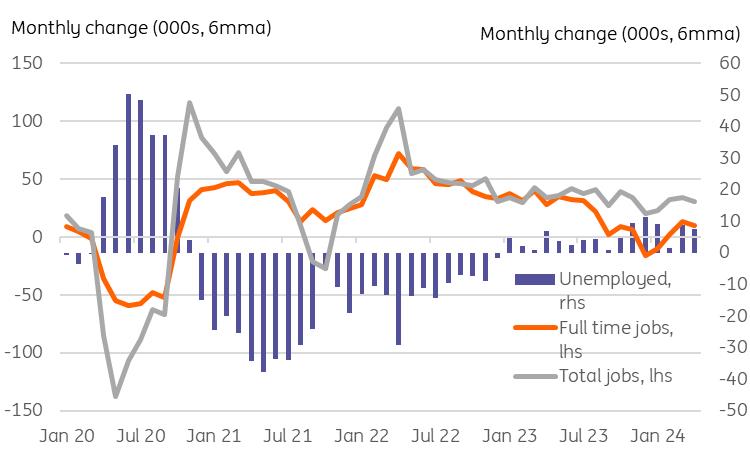

Employment growth of 38,500 was stronger than the consensus expectation for 23,700 job gains in April. But the good news ends there. Full-time jobs with their higher wages and other benefits fell by 6,100 and there was a small downward revision to the previous month's gains. Part-time employment growth made up all of the increase in the headline figure.

There was also a bigger-than-usual increase in the number of unemployed. Total unemployment rose by just over thirty-thousand in April. This was less than the increase in the labour force but was enough to push up the unemployment rate from an upward revised 3.9% to 4.1%, helped higher also by some convenient rounding (4.054% to 3dp). Labour participation rose to 66.7% from 66.6%, which equates to a 68,800 increase in those employed or looking for work. This is about double the 6-month average and points to a still fast-growing pool of available labour in search of a dwindling supply of quality jobs. It is early days yet, and this data is very choppy so reading anything much into a single month's data is extremely risky.

As a case in point, when looking at 6-month moving averages (see chart below), today's data really hasn't moved the needle regarding employment growth or the change in the number of unemployed.

Monthly employment and unemployment changes (6mma)

CEIC, ING RBA need more than this to deliver any cuts

As far as this affects Reserve Bank (RBA) rate policy, today's release is probably only of marginal relevance. Any softening in the labour data is still fairly speculative at this point, though the wage price data earlier in the week were a help if they really are pointing to a peak in wage growth. We will need to see a lot more than this if we want to see rate cut expectations for this year increase. And the inflation data so far isn't providing enough support. The outlook for RBA rates this year remains cloudy. A year-end cut is still possible, but only if this labour data softens more meaningfully than this and the inflation run-rate drops significantly, and soon.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment