National Bank Of Hungary Preview: Now Is Not The Time To Surprise Markets

| 50bp | ING's rate cut expectation April meeting |

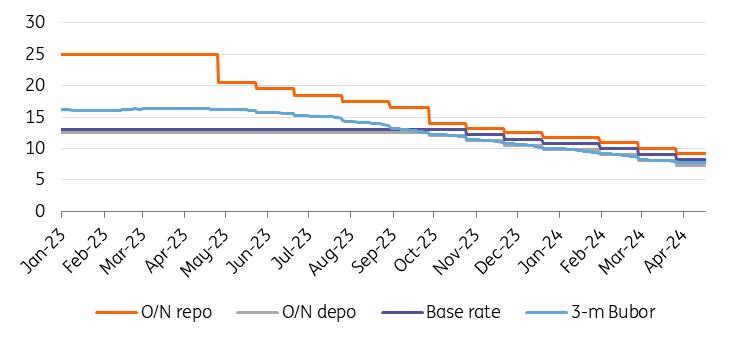

The National Bank of Hungary (NBH) cut its key interest rate by 75bp to 8.25% in March, therefore slowing down the pace of easing seen in February. What's more, the central bank has openly communicated that the pace of rate cuts will be slowed still further in the second quarter, as we discussed in our previous NBH Review .

The main interest rates (%)

Source: NBH, ING The unfavourable turn in the Hungarian inflation structure supports a smaller rate cut

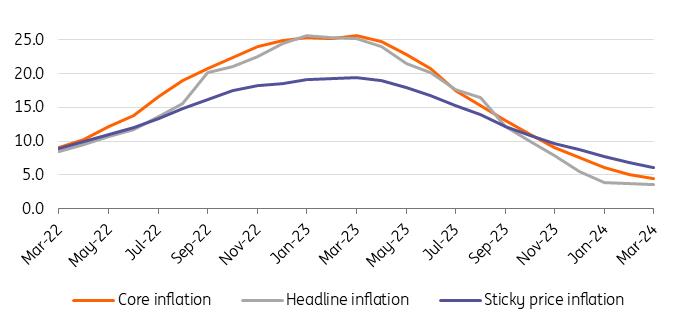

Disinflation has continued in March as headline inflation fell to 3.6% year-on-year (YoY). However, the monthly repricing was 0.8%, indicating a slight acceleration compared to the repricing seen in the first two months of this year. In contrast to previous months, we've seen an upside surprise to core inflation this time, as services repricing came in hot. We expect two rounds of reflation later this year, so we maintain our December 2024 inflation forecast in the range of 5.5-6.0% YoY.

The start of the year hasn't been particularly good on the economic activity front, judging by the latest retail sales and industrial production data. Nevertheless, average wages rose by 14.6% YoY in January, which may support the recovery in consumption but also poses an upside risk to services inflation. In this regard, we believe that the unfavourable turn in the composition of Hungarian inflation, coupled with the prospect of two rounds of reflation this year, would warrant a more cautious monetary policy approach.

Headline and underlying inflation measures (% YoY)

Source: HCSO, NBH, ING In terms of international factors, US inflation ruined the party

Services inflation is also proving to be particularly sticky in the United States, which doesn't bode well for rate cut expectations lately. The market has gone from pricing in more than six cuts in January to fewer than two by mid-April. The repricing we're seeing has broader implications, ranging from higher long-term yields to keeping the dollar firmly bid.

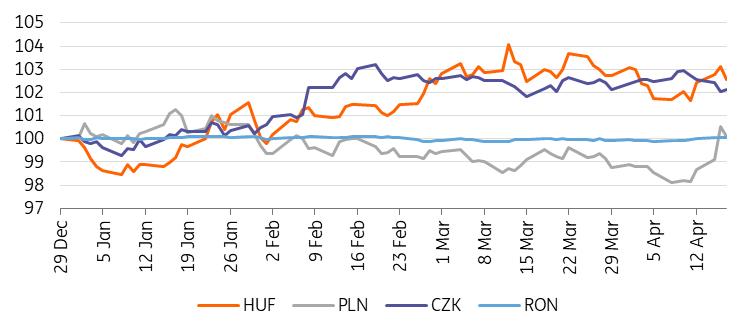

In this regard, emerging market (EM) currencies are particularly exposed to the dollar's outperformance, which might continue until US inflation and activity cool considerably. Despite the expected start of the ECB's rate-cutting cycle in June, we believe that EM currencies will feel the heat of USD strength, which would justify a more cautious approach from EM central banks. And let's not forget the recent flare-up between Israel and Iran, which keeps geopolitical risks at the forefront of policymakers' and markets' minds.

The ultimate signal pointing towards a smaller cut sizeThe repricing in the rates complex seen after the March meeting gave the forint a huge boost. What also undoubtedly helped was the sudden reconciliation of relations between the NBH governor and the Minister of National Economy. The combined effect was a stronger HUF (despite rising oil prices and gradually worsening global risk sentiment), leading to a retreat to as low as 389 versus the euro in early April. However, in light of the latest US data flow, the tide has turned, and the forint is back on a weakening path.

Performance of CEE FX versus EUREnd-2023 = 100%

Source: NBH, ING

In our view, all of these developments would have been enough to argue for a smaller rate cut in April, but the comments of Gyula Pleschinger, one of the members of the Monetary Council, sent the ultimate signal to markets on 12 April: "We definitely need a more cautious rate-cycle from here composed of smaller steps. It's not worth surprising the markets".

Our callAgainst this backdrop, we see the National Bank of Hungary slowing the pace of rate cuts to 50bp on 23 April. This could bring the key rate down to 7.75% after the rate-setting meeting, while we expect the Monetary Council to also cut both ends of the rate corridor by 50-50bp. In our view, the April rate-setting meeting will be a good opportunity for the NBH to confirm to the markets the previously telegraphed message that a new era in monetary policy will begin in the second quarter and that it will remain vigilant to any deterioration in the risk environment.

Our long-term view remains unchangedContrary to our previous call, that the key rate could be lowered to 6.5% by June, we now expect a slightly more hawkish outcome. In light of a smaller rate cut expectation at the April meeting, we now see the terminal rate at 6.75% by the end of the first half of the year. In fact, this would fit perfectly into the 6.50-7.00% range the NBH has recently considered realistic as a likely outcome for the policy rate by the end of 1H24.

Furthermore, as our December year-end inflation forecast is still in the range of 5.5-6.0% YoY, this leads us to believe that the terminal rate cannot go any lower after June. In this regard, we expect the key rate to be lowered to 6.75% by June, after which we expect a sustained pause by the NBH. This would, in turn, still maintain a positive real interest rate environment and keep some risk premium over regional rates supporting HUF assets.

Nevertheless, we see downside risks to our view. In the case of a favourable turn of events, such as a cooling of US inflation, lower reflationary prospects in Hungary and/or a dovish shift in the regional monetary policy outlook, we could see the NBH continuing the rate-cutting cycle after the June meeting using even smaller steps. In this regard, we would expect two further 25-25bp rate cuts at the July and August meetings, bringing the key rate down to 6.25%.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment