Dutch High Street Malaise Not Over Yet

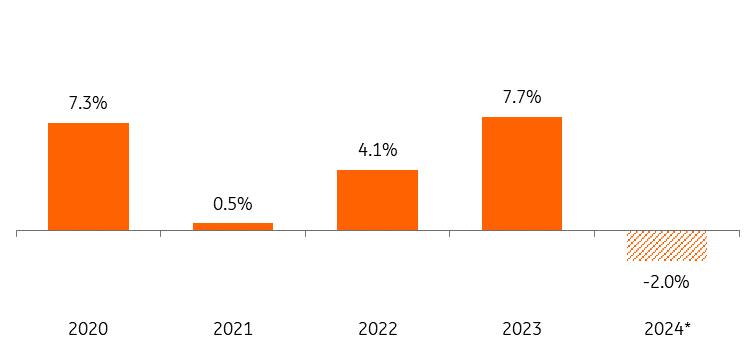

After retail sales contracted last year, for the first time in a decade, we expect further falls in 2024. The expected contraction (-0.5%) is set to be smaller than last year (-3%). This is mainly a result of a decline in sales in the food segment due to a tobacco ban that will take effect on July 1. In contrast, sales volumes in the non-food segment and in e-commerce are set to increase slightly this year.

Sales in food lower again, while non-food and e-commerce are set to increase slightly in 2024Retail sales volumes in the Netherlands, year-on-year

Source: CBS, forecast 2024 ING Research First decline in supermarket sales in 20 years

At 1%, expected sales growth (by value) in the Dutch retail sector this year is considerably lower than the 5% sales growth achieved last year. This is mainly due to a sharp drop in expected sales in the food segment (-2%). As a result of the tobacco ban that will take effect on July 1, supermarkets are set to lose more than 1.5 billion euros in sales by 2024, turning annual growth into contraction for the first time in twenty years. Tobacco sales are expected to shift to petrol stations, tobacco and convenience stores, and cross-border shops. The mid-year introduction of the tobacco ban will continue to affect supermarket sales in 2025.

2024 Dutch food retail sales growth is expected to shrink, hit by the tobacco banSales growth (value) in Dutch food retail (including tobacco sales), year-on-year

Source: CBS, forecast 2024 ING Research Purchasing power set to improve in 2024

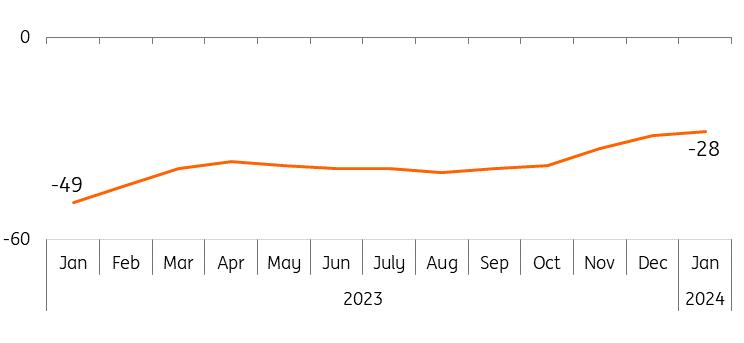

We expect sales growth of 3% for retail non-food in 2024. Consumers will have more to spend on average this year, thanks to a combination of lower inflation, higher wages and an improving housing market. Consequently, consumer confidence is significantly better in early 2024 than a year earlier, although it remains relatively low. Consumers are expected to spend more on the high street again this year, although remaining subdued. More is expected to be spent on clothing, furniture and personal care products

Dutch consumer confidence has improved significantly in early 2024Consumer confidence indicator by month, seasonally adjusted

Source: CBS, ING Research Double-digit e-commerce growth rates a thing of the past

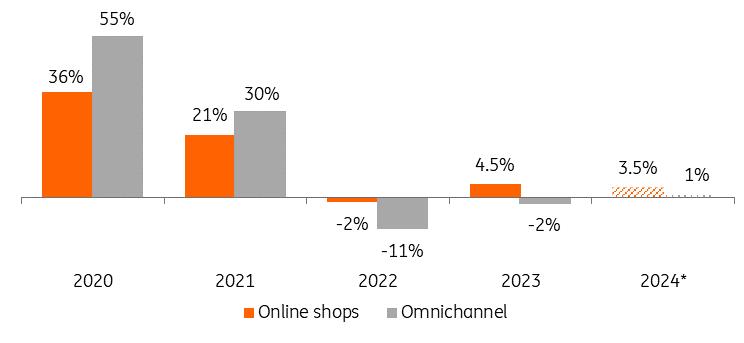

Following the turbulent pandemic years, e-commerce has returned to calmer waters with 2023 sales growth at 4.5%. With the disappearance of lockdowns at the beginning of 2022, online purchases started to return to physical stores. Double-digit online growth figures appear to be a thing of the past. This year, e-commerce sales are expected to grow by approximately 3.5%. In the years ahead, there is expected to be a further shift from physical stores to the online sales channel. Consumers continue to appreciate the convenience of online shopping and retailers are increasingly adopting omnichannel strategies in which they often offer a smaller range in-store than online.

Double-digit e-commerce sales growth came to a halt in 2022Sales growth (by value) in online shops and omnichannel, year-on-year

Source: CBS, forecast 2024 ING Research Staff shortages put brakes on growth

A major challenge for retailers is staff shortages, with more than four in ten having to deal with these. Aside from increased workloads, staff shortages are putting the brakes on growth as many shops adopt reduced opening hours or (temporarily) close branches. One of the reasons for these staff shortages is that the retail sector has trouble competing on employment conditions with sectors such as healthcare and the hospitality industry. Almost one in four retailers indicate that the transfer of staff to other sectors is by far the biggest obstacle they face here.

Limited room for price cutsRecently Dutch discounter Action and Swedish furniture retailer Ikea announced price cuts for a wide range of products. Price reductions were also implemented at supermarkets last year, including on dairy products and on vegetable oils and fats. This was possible thanks to lower raw material and transport costs, and came despite higher staff costs. No large-scale food and non-food price cuts are expected this year.

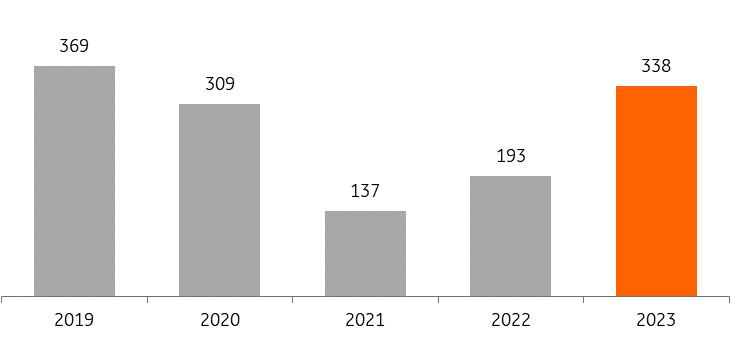

Bankruptcies up 75% in 2023Last year, after two years of relatively few bankruptcies, there were 338 bankruptcies in the retail sector. This is an increase of 75% on 2022 levels. Companies going bankrupt included electronics chain BCC, sports retailers Perry Sport and Aktiesport and discounter Big Bazar. The number of bankruptcies in 2023 was almost back to the pre-pandemic levels of 2019.

High street bankruptcies up 75% in 2023Number of bankruptcies in Dutch retail (excluding car sales), by year

Source: CBS, ING Research The high street has been in dire straits for some time now

The high street has been in dire straits for some time now. Retailers have faced one crisis after another in recent years. After the pandemic came the energy crisis, which in turn led to high inflation and resulted in rising rents, and higher energy, purchasing and personnel costs. Economic growth almost came to a standstill last year and consumers kept a close watch on spending. Retailers also have to repay tax debts accrued during the pandemic, putting further pressure on the viability of an increasing number of stores. It is therefore likely that the number of business closures and bankruptcies in retail, especially in the non-food sector, will be higher this year than in 2023.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment