We Expect Another Fed Hold, But With Pushback On Rate Cut Prospects

the peak. There is growing evidence that tight monetary policy and

restrictive credit conditions are having the desired effect on depressing inflation. However, the Fed will not want to

endorse the market pricing of significant rate cuts until they are confident price pressures are quashed In this article Fed to leave rates unchanged, oppose market pricing of cuts Markets pricing 125bp of cuts, the Fed will likely stick to 50bp prediction Fed to talk up prolonged restirctive stance But the Fed will eventually turn dovish The Fed will try to keep the market rates impact to a minimum Fed pushback could dent recent high-yield FX rally

Fed Chair, Jay Powell Fed to leave rates unchanged, oppose market pricing of cuts

The Federal Reserve is widely expected to leave the fed funds target range at 5.25-5.5% at next week's FOMC meeting. Softer activity numbers, cooling labour data and benign MoM% inflation prints signal that monetary policy is probably restrictive enough to bring inflation sustainably down to 2% in coming months, a narrative that is being more vocally supported by key Federal Reserve officials. The bigger story is likely to be contained in the individual Fed member forecasts – how far will they look to back the market perceptions that major rate cuts are on their way? We strongly suspect there will be a lot of pushback here.

Markets pricing 125bp of cuts, the Fed will likely stick to 50bp predictionThere has been a big swing in expectations for Federal Reserve policy since the last FOMC meeting, with markets firmly buying into the possibility of some aggressive interest rate cuts next year. Back on November 1st, after the Fed held rates steady for the second consecutive meeting, fed funds futures priced around a 20% chance of a final hike by the December FOMC meeting with nearly 90bp of rate cuts expected through 2024. Today, markets are clearly of the view that interest rates have peaked with 125bp of rate cuts priced through next year. Underscoring this shift in sentiment, we have seen the US 10Y Treasury yield fall from just shy of 5% in late October to a low of 4.1% on December 6th.

Federal Reserve rhetoric has certainly helped the momentum of the moves. Chief amongst them is the quote from Fed Governor Chris Waller suggesting that if inflation continues to cool“for several more months – I don't know how long that might be – three months, four months, five months – that we feel confident that inflation is really down and on its way, you could then start lowering the policy rate just because inflation is lower”.

The real Fed funds rate (nominal rate less inflation) is indeed now positive and we expect it to move above 3% as inflation continues to fall. Does it need to be this high to ensure inflation stays at 2%? We would argue not, and so too, it appears, do some senior members of the Fed. Other officials, such as Atlanta Fed president Raphael Bostic, suggest that the US hasn't“seen the full effects of restrictive policy”. However, there are still some residual hawks. San Francisco Fed President Mary Daly is still contemplating“whether we have enough tightening in the system”.

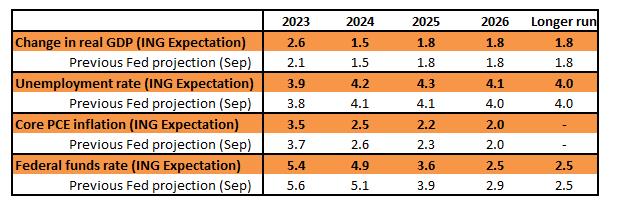

ING's expectations for what the Federal Reserve will predict

Federal Reserve, ING Fed to talk up prolonged restirctive stance

In that regard, the steep fall in Treasury yields in recent weeks is an easing of financial conditions on the economy and there is going to be some concern that this effectively unwinds some of the Fed rate hikes from earlier in the year. For example, mortgage rates have been swift to respond, with the 30Y fixed-rate mortgage dropping from a high of 7.90% in late October to 7.17% as of last week. With inflation still well above the 2% target despite recent encouraging MoM prints, we expect the Fed to be wary of anything that could be interpreted as offering an excuse to price in even deeper Fed rate cuts for next year and result in even lower longer-dated Treasury yields.

Consequently, we expect the Fed to retain a relatively upbeat economic assessment with the same 50bp of rate cuts in 2024 they signalled in their September forecasts, albeit from a lower level given the final 25bp December hike they forecasted last time is not going to happen Chair Jay Powell's assessment in a December 1st speech is likely to be the template for the tone of the press conference. There, he argued,“it would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease. We are prepared to tighten policy further if it becomes appropriate to do so”.

Similarly, NY Fed president John Williams expects“it will be appropriate to maintain a restrictive stance for quite some time”.

But the Fed will eventually turn dovishWe think the Fed will eventually shift to a more dovish stance, but this may not come until late in the first quarter of 2024. The US economy continues to perform well for now and the jobs market remains tight, but there is growing evidence that the Federal Reserve's interest rate increases and the associated tightening of credit conditions are starting to have the desired effect.

The consumer is key, and with real household disposable incomes flatlining, credit demand falling, and pandemic-era accrued savings being exhausted for many, we see a risk of a recession during 2024. Collapsing housing transactions and plunging homebuilder sentiment suggest residential investment will weaken, while softer durable goods orders point to a downturn in capital expenditure. If low gasoline prices are maintained, inflation could be at the 2% target in the second quarter of next year, which could open the door to lower interest rates from the Federal Reserve from May onwards – especially if hiring slows as we expect.

We look for 150bp of rate cuts in 2024, with a further 100bp in early 2025.

The Fed will try to keep the market rates impact to a minimumThere may be some interest from the press on money market conditions following the spikes seen in repo around the end of the month and reverberating into the early part of December. It comes against a backdrop where banks' reserves are ample, in the US$3 area. The last time the Fed engaged in quantitative tightening, bank reserves bottomed at a little under US$1 and there was a material effect felt on the money markets. It's unlikely that we'll get anywhere near that this time around. Bank reserves will certainly get below US$3tr and possibly down to US$2.

The Fed will want to get liquidity into better balance as a first port of call, but beyond that, it won't want to over-tighten liquidity conditions. Taking this into account, QT likely ends around the end of 2024. In the meantime, the clearest manifestation of quantitative tightening is to be seen in falling liquidity volumes going back to the Fed on the overnight reverse repo facility. This is now at US$825bn but will hit zero in the second half of 2024. Whether Chair Powell gets drawn into this will likely be down to whether the press wants him - they'll need to ask the question(s)!

In terms of expectations for market movements, we doubt there will be much. If, as we expect, the Fed sticks to the hawkish tilt and does not give the market too much to get excited about, then expect minimal impact. As it is, the structure of the curve, as telegraphed by the richness of the 5yr on the curve, is telling us that a rate cut is not yet in the 6-month countdown window. That will slowly change, and we'll morph towards a point where we are three months out from a cut and the 2yr yield really collapses lower.

It's unlikely the Fed will change that at this final meeting of 2023, though, and they won't want to.

Fed pushback could dent recent high-yield FX rallyAs mentioned above, a Fed pushback against market pricing of the easing cycle in 2024 should be mildly supportive of the dollar. Even though EUR/USD has performed poorly through the start of December and could get some mild support a day later from the ECB , this FOMC meeting could prompt losses to the 1.0650 area. We have had 1.07 as a year-end target for a few months now and expect the more powerful, dollar-led, EUR/USD rally to come through in 2Q when we expect those short-dated US yields to collapse.

Perhaps more vulnerable to a decent Fed pushback against lower rates might be what we call the 'growth' currencies, such as the high beta currencies in Scandinavia and the commodity sector (Australian and Canadian dollars). These currencies have had a good run through November on the lower US rate environment. However, as per our 2024 FX Outlook , these currencies are our top picks for next year and should meet good demand on pullbacks this month.

As to the wild ride that is USD/JPY, higher US yields could provide some temporary support. However, we doubt USD/JPY will sustain gains above the 146/147 area as traders re-adjust positions for a potential change in Bank of Japan (BoJ) policy on December 19th. We suspect that USD/JPY has peaked, however, and are happy with our call for USD/JPY to be trading close to 135 next summer after the BoJ starts to dismantle its ultra-dovish policy in the first half of next year.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment